BlackRock, Fidelity and ARK BTC Buys Amid US Treasury BuyBack $2B Debt

In a move that bridges traditional finance and the surging world of cryptocurrency, the U.S. Treasury has executed a significant debt buyback operation amid escalating national debt concerns.

According to official Treasury announcements and related market reactions, this development has sparked institutional interest in Bitcoin.

What's the News

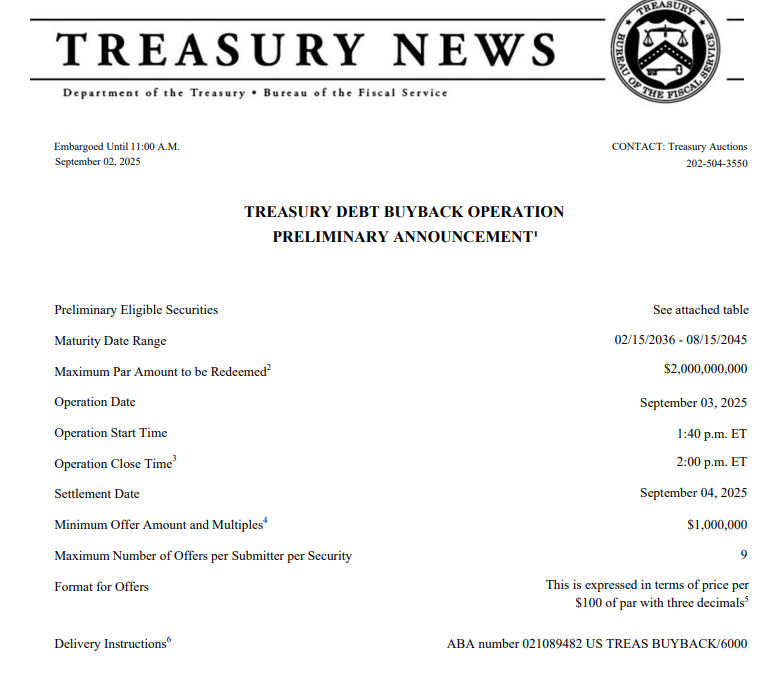

The core of this story revolves around the U.S. Treasury's announcement of a $2 billion debt buyback on September 3, 2025.

This activity will be oriented towards the qualified securities between 15 February 2036 and 15 August 2045, with a view to rationalizing the maturity structure of the financial and operational preparedness.

Concurrently, social media buzz on platforms like X highlights a ripple effect in crypto markets, where institutional investors responded by bolstering Bitcoin holdings, amid a volatile environment.

Source: Official Website of the US Treasury

US Treasury $2B Debt Buyback

The buyback involves redeeming up to $2 billion in par value from a list of 31 securities, including bonds with coupon rates ranging from 1.125% to 4.750%.

The operation, conducted via the Federal Reserve Bank of New York's FedTrade system on September 3, will have results published shortly after.

Eligible securities span maturities like the 1.125% bond due May 15, 2040, up to the 2.875% bond due August 15, 2045.

Treasury may accept less than the maximum, and offers will be prorated at the highest prices accepted. This move, governed by 31 CFR Part 375, reflects a proactive approach to financial management, supported by FAQs on TreasuryDirect.gov, and comes from a $100 billion auction context, signaling flexibility in fiscal strategy.

Crypto Investment at Rise

Alongside the buyback, major asset managers BlackRock, Fidelity, and ARK have jointly bought more than 2,500 Bitcoins, considering it a hedge against increasing U.S. debt.

On X, Posts connect this rush to the move of the Treasury and describe Bitcoin as insurance in the turbulent times. The institutional trust is increasing, and BlackRock IBIT ETF accumulated more than 250,000 BTC by March 2024, according to The Block data.

Source: X

This shift is driven by economic forecasts of the Congressional Budget Office (revised based on 2018 estimates) that indicate a debt of up to $40 trillion by 2028.

Peer-reviewed research by the National Bureau of Economic Research (2023) states that the volatility of Bitcoin may decrease when it becomes more popular, which makes it appealing in the context of traditional finance challenges.

Impacts

This repurchase would increase debt sustainability by improving the maturity structure, which would help reduce interest payments in the long term. Although, coupled with crypto market volatility, which undermines macroeconomic determinants of investor behavior.

With crypto, institutional Bitcoin purchases are indicative of maturation, and this could stabilise prices and encourage more adoption. The broader impacts are greater scrutiny of U.S. fiscal health, and studies have indicated that these operations put preparedness to conduct more economic operations into question. Since government interventions may have an indirect impact on the perceptions of digital assets.

Conclusion

This intersection of US Trump fiscal policy and digital finance has brought to light changing approaches to resilience in the economy, as financial burden looms large. Investors and policymakers will be interested in the long-term effects of this on markets and stability.

Also read: JOLTS Report Release Today: Will Crypto Market Fall or Rise?免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。