With bitcoin (BTC) stuck just above $110,000 and ether (ETH) consolidating after hitting fresh records, Solana (SOL) has emerged as a standout performer in the crypto market recently.

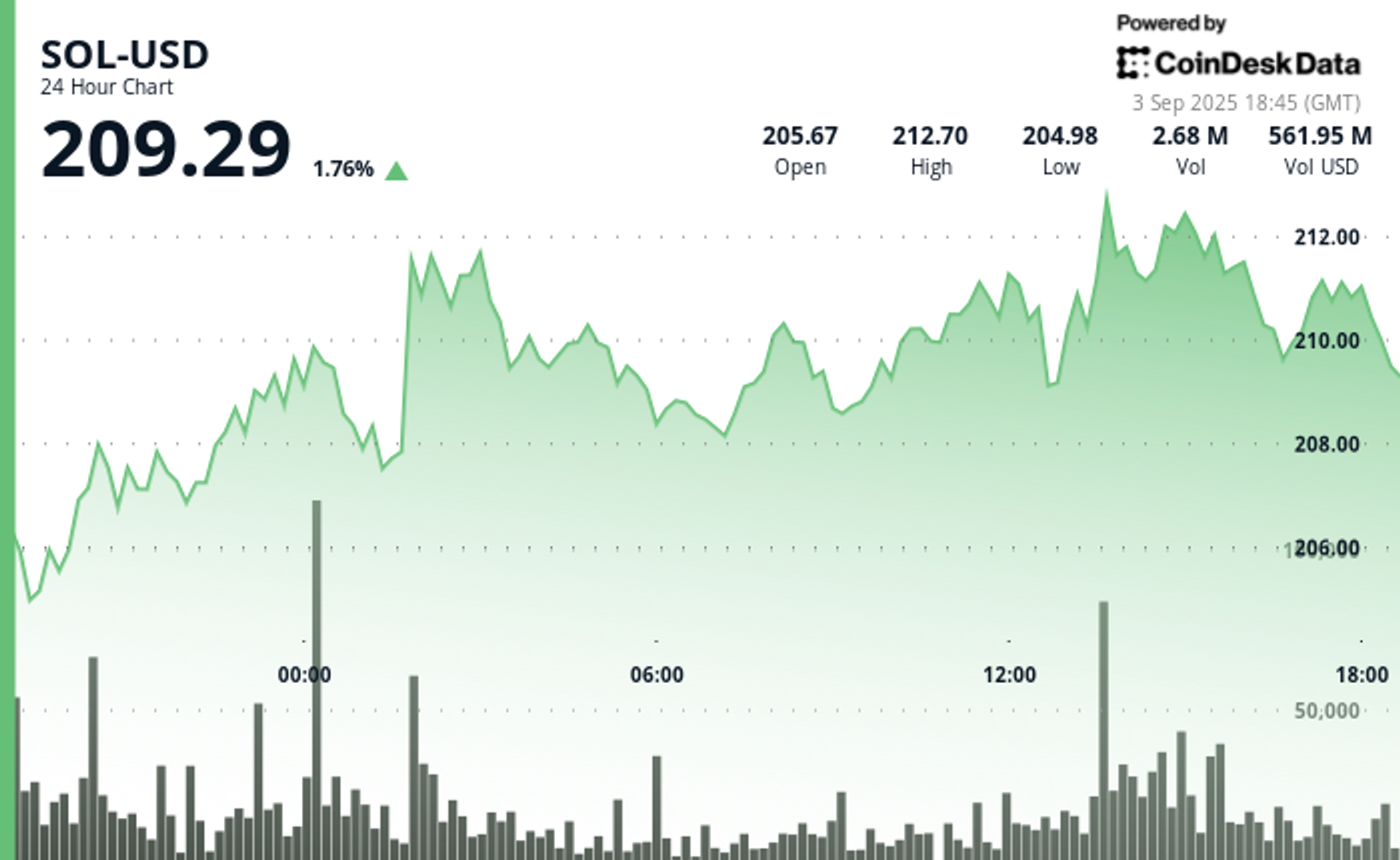

The token traded around $211 on Monday, up 33% from early August lows, making it one of the best performers in the CoinDesk 20 Index in the past month. Against bitcoin, SOL has gained 34% over the past month, and it has strengthened 14% versus ETH since mid-August.

The rally reflects a broader rotation into altcoins, analysts said.

"The season of profit redistribution among holders of cryptocurrencies continues,” Sergei Gorev, head of risk at YouHodler, said in a market note shared with CoinDesk. He said liquidity has been moving out of BTC into second-tier tokens, with "a noticeable increase in the positive dynamics in capital flows to SOL."

Such flows could be long-term as corporate investors look for large, liquid projects to hold, Gorev added, naming SOL alongside with XRP (XRP) as the "next interesting market ideas."

Jeff Dorman, chief investment officer at Arca, tipped SOL to replicate ether’s turnaround earlier this year. He pointed to Ethereum’s resurgence after stablecoin adoption, strong ETF inflows and the relentless bid from digital asset treasuries, or DATs, helped ETH rally nearly 200% since April.

"SOL appears poised to repeat the exact same playbook that ETH just executed in the coming months," Dorman wrote in a fresh report.

The first U.S.-listed Solana ETF launched in July, but it was futures-based. Several asset managers, including VanEck and Fidelity, have filed for spot products with decisions due later this year, Dorman said.

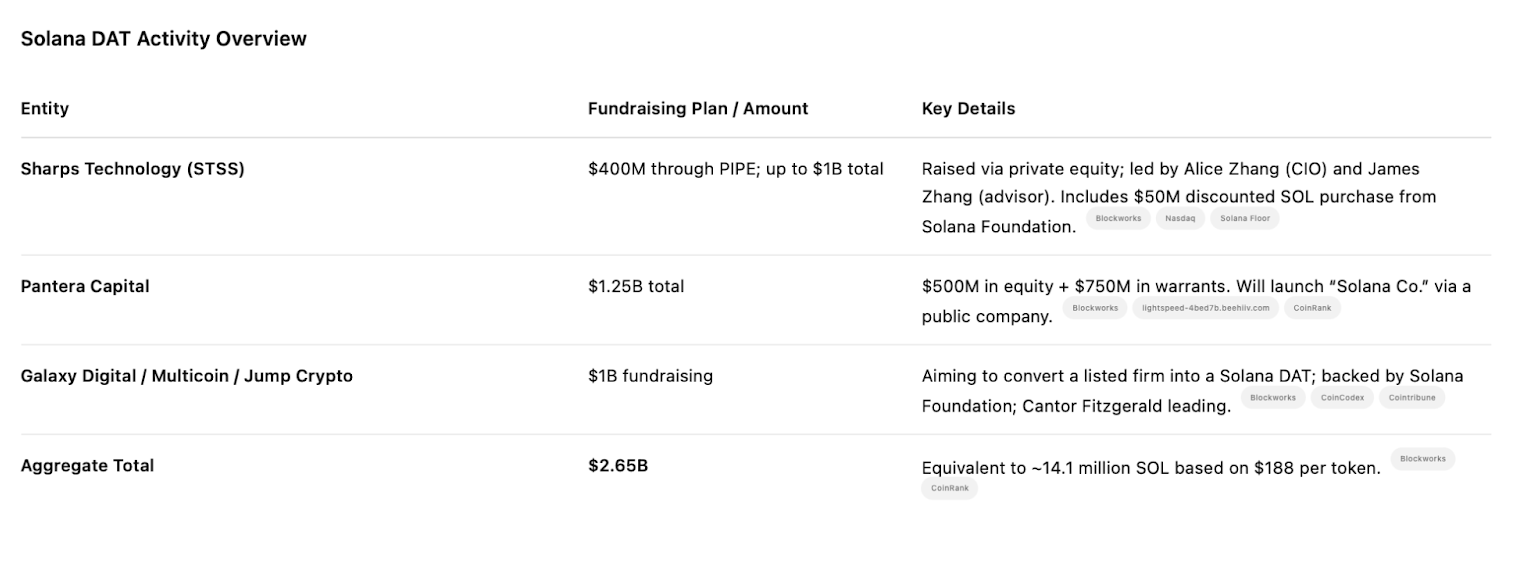

Meanwhile, at least three Solana-focused DATs are raising funds that could channel up to $2.65 billion into SOL over the next month, he added.

At only one-fifth of ETH's market capitalization, SOL's price could be even more reactive to the flows if they materialize.

"SOL might be the most obvious long right now," Dorman said. "If the price of ETH rose almost 200% on roughly $20 billion of new demand, what do you think happens to SOL on $2.5 billion or more of new demand?"

Recent news could also add to the momentum. Nasdaq-listed digital asset conglomerate Galaxy Digital tokenized its shares on Solana, while the approval of the Alpenglow upgrade promises to improve transaction speed and finality.

Read more: TRUMP, XRP, and SOL Options Signal a Potential Year-End Altcoin Season: PowerTrade

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。