Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

In the blink of an eye, it has been three months since the USD1 airdrop was distributed. Looking back at those 47 tokens, they seem more like a foreshadowing, quietly opening the curtain on the "family wealth script." Last week, the TGE of WLFI made a spectacular debut, with the token price halving at one point, allowing the Trump family to harvest a significant amount of traffic and funds.

However, for ordinary users, beyond just watching the excitement, what is more practical is how to increase the value of their wallets. If those 47 USD1 tokens had remained in the wallet, they might not even cover the miner fees; but if placed in CeFi or DeFi investment pools, they might have already hatched a few "golden eggs."

So the question arises: what are your 47 USD1 tokens doing right now? Are they quietly "lying flat," or are they working hard? Odaily Planet Daily has summarized the investment strategies for USD1 in CeFi, DeFi, and points systems for readers.

A Comprehensive View of USD1 Investment Opportunities from the "47" Airdrop

Through continuous observation and community research, USD1 has been fully deployed across mainstream public chains such as Ethereum, Solana, Tron, and BNB Chain, and has developed a variety of yield scenarios in both CeFi and DeFi, with annualized rates ranging from 1.7% to 45%, suitable for users with different risk preferences. Here’s a breakdown from several dimensions:

CeFi: The Most Suitable Principal Protection Channel for "Lazy People"

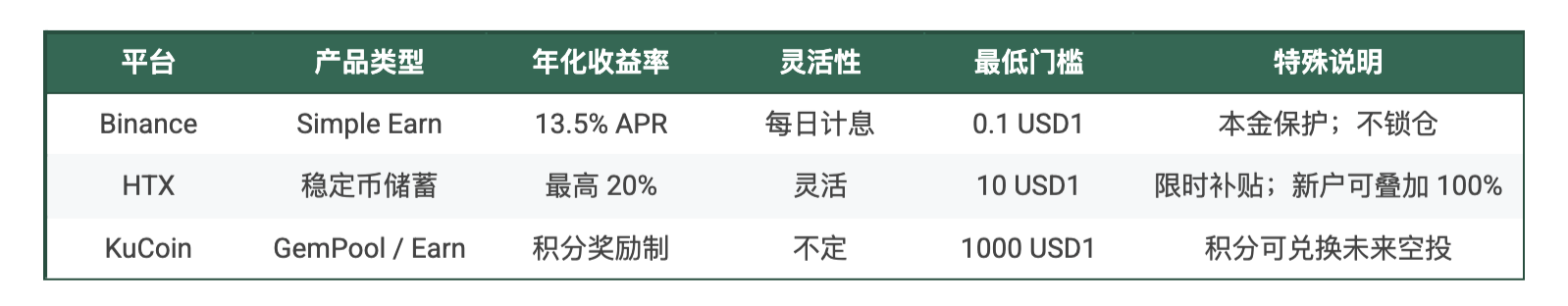

Note: Binance Simple Earn_ _APR fluctuates;_ HTX Activity has limits (20% APY for amounts below 500 USD1, new users can reach up to 100%).

In centralized platforms, Binance Simple Earn is the "standard configuration for lazy people." Starting from 0.1 USD1, it offers an annualized rate of about 13.5%, with no lock-up and daily interest calculation, plus occasional Yield Arena events, which is akin to "automatically leveling up."

HTX promotes "high interest," with annualized rates in the stablecoin section reaching up to 20%, but this is a subsidized behavior, suitable for short-term profit-taking and not advisable for long-term reliance.

Additionally, WLFI is advancing a comprehensive USD1 points system across platforms, covering exchanges like KuCoin, HTX, Bybit, LBank, etc. Holding, trading, or staking USD1 can accumulate points, which can be exchanged for airdrops, NFTs, or other benefits in the future.

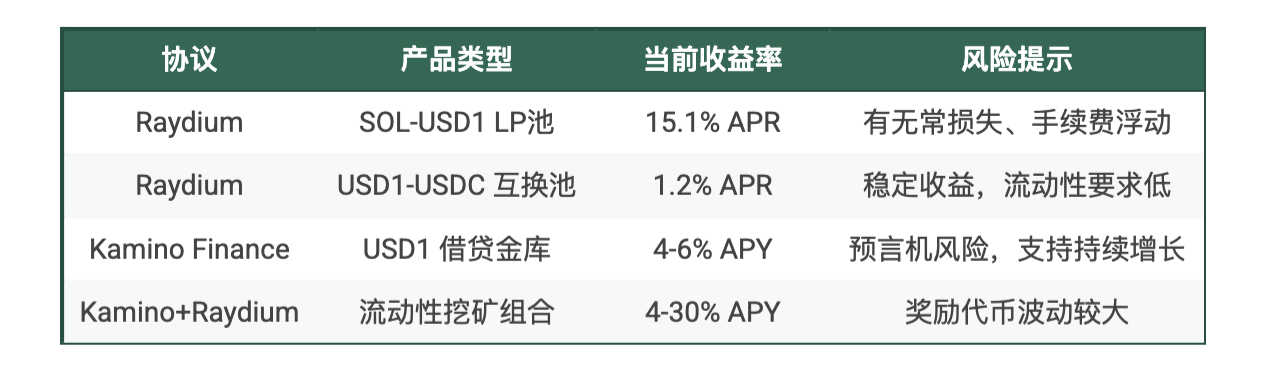

Solana Ecosystem: The Source of DeFi Liquidity

Solana is the ecosystem with the richest DeFi yields for USD1. Raydium USD1-USDC Pool: 1.2% annualized, with almost no price volatility, similar to "on-chain savings"; Raydium SOL-USD1 LP: 15.1% annualized, but requires bearing impermanent loss; Kamino Lending Vault: 4–6% annualized, no lock-up, suitable for stable holdings, and can also accumulate points; Raydium + Kamino Combination Pool: yield range of 4%–30%, highly dependent on the price of reward tokens, with significant volatility.

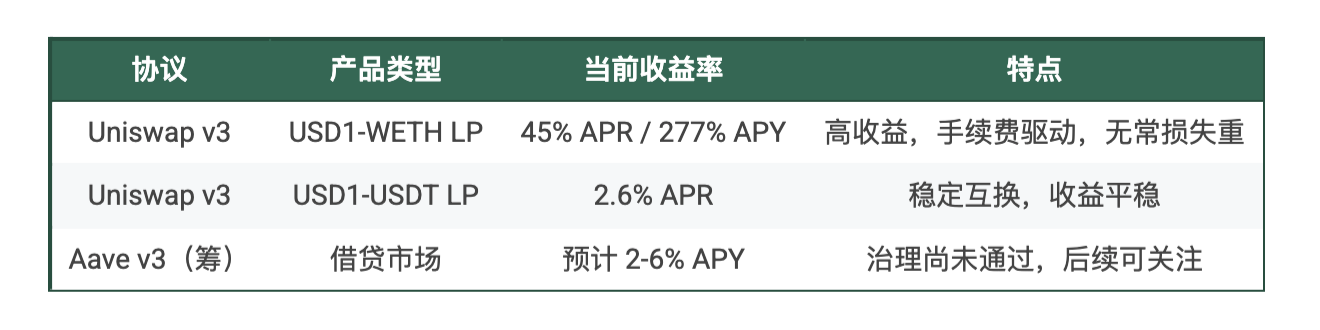

Ethereum: A Hotbed for High-Risk, High-Return Strategies

Ethereum has always been a paradise for DeFi players, but risks and rewards coexist.

- Uniswap v3 USD1-WETH LP: 45% APR / 277% compound APY, impressive returns, but requires bearing impermanent loss. When the market is good, transaction fees are substantial, but during a unilateral surge in ETH, it may only leave stablecoins.

- Uniswap v3 USD1-USDT LP: 2.6% APR, stablecoin pair, with almost no price risk, leaning towards a "retirement-type" investment.

- Aave v3 Lending Market (in preparation): expected 2%–6% annualized, overall risk is relatively controllable, more like a "serious financial product," suitable for conservative investors.

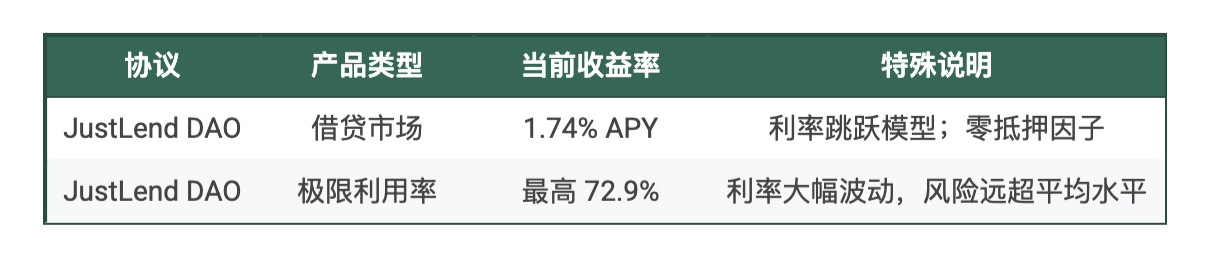

Tron: Hidden Risks of Interest Rate Jumps

Tron's JustLend DAO offers a more "extreme" gameplay. Regular Lending: approximately 1.74% annualized, low risk, but limited returns, similar to on-chain demand deposits; Extreme Utilization: when the pool is fully borrowed, annualized rates can soar to 72.9%. However, this state is highly unstable, and interest rates can drop suddenly. In the morning it might be 70%, but by the afternoon it could be in single digits, so caution is needed.

Tron's high yields completely rely on the "interest rate jump model," with fluctuations far greater than those in Solana and Ethereum. Conservative players may find it too stimulating, but short-term speculators who monitor closely may find their "thrill moments."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。