Author: Dappradar

Compiled by: Felix, PANews

Summer has passed, and September often marks a new beginning, not only in daily life but also in the market. This summer saw a mid-cycle bull market, and the industry has clearly entered a new growth phase.

On-chain activity in August may have slightly cooled, but the situation beneath the surface is quite different. DeFi TVL reached an all-time high, institutions entered the market in large numbers, NFT activity heated up again, and AI dapps developed rapidly, even as the hype cycle shifted. Meanwhile, security incidents serve as a reminder that the industry is still evolving.

The data clearly indicates one thing: Web3 has not stagnated. As we enter autumn, the momentum of this bull market is becoming increasingly evident. This is reflected not only in speculative behavior but also in adoption rates, innovation, and real capital flowing onto the chain.

Key Points

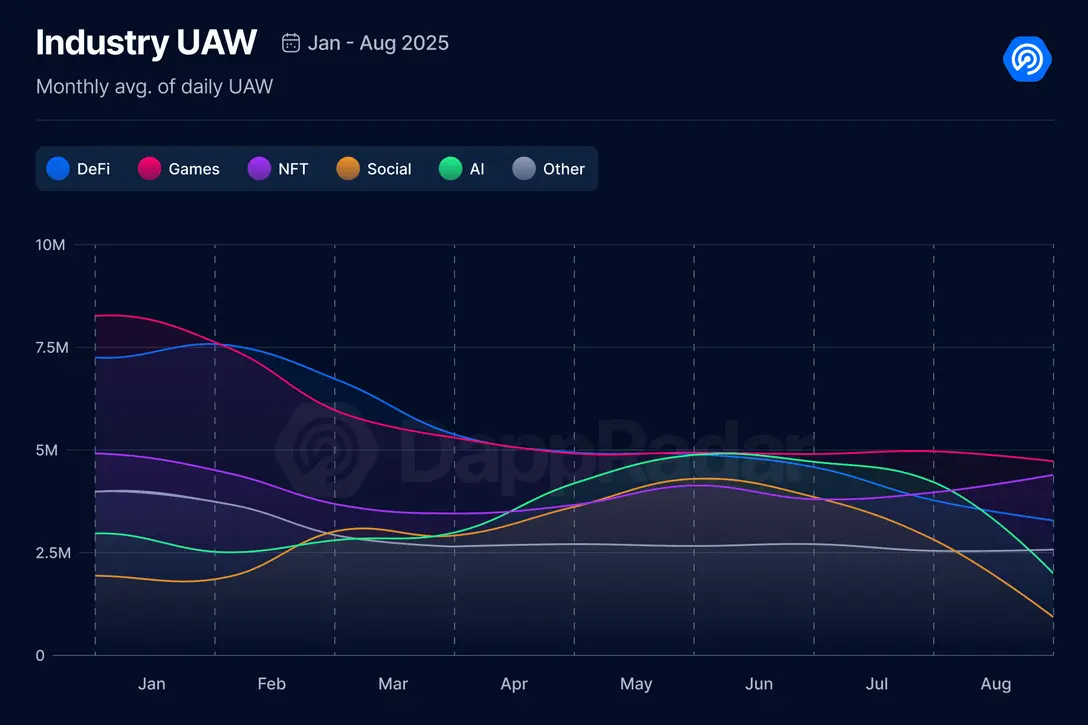

- The number of daily active unique wallets (dUAW) in August decreased by 18%, falling to 17 million, indicating a cooling of on-chain activity during the summer.

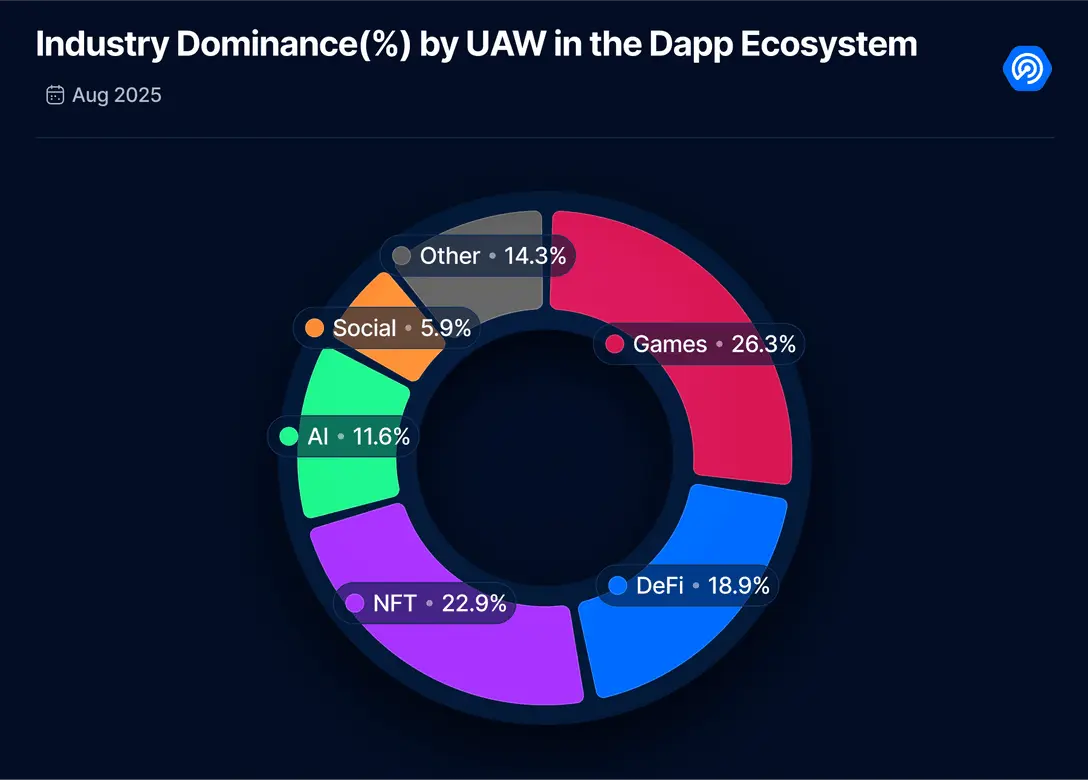

- Although activity in gaming DApps slightly declined by 4%, it still dominated the market, while NFT activity increased by 7%, and social DApps fell by 63%.

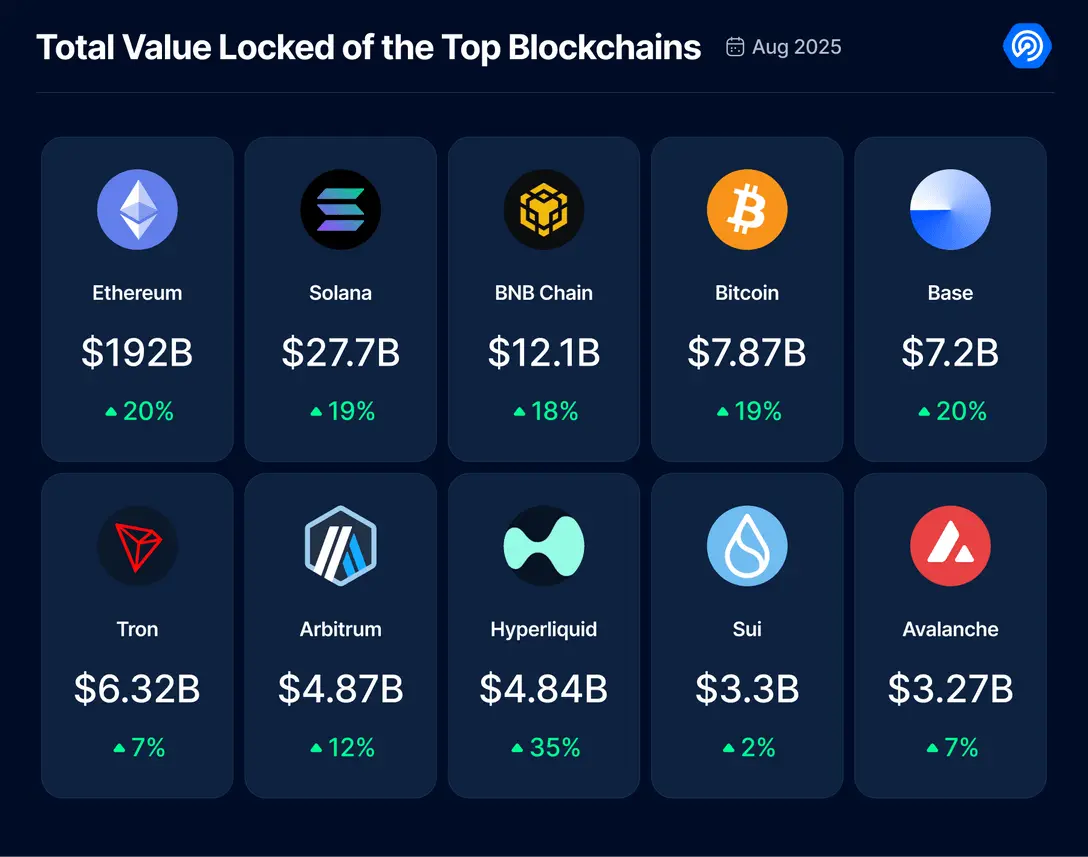

- Driven by Ethereum's strong performance, DeFi TVL reached an all-time high of $292 billion in August, a 13% increase from July.

- Cryptocurrency market capitalization reached new highs: total market cap hit $3.82 trillion, with non-BTC assets reaching $1.59 trillion, surpassing the peak in 2021.

- The supply of USDe from Ethena grew by 42% to $12.4 billion, with revenue reaching $61 million, solidifying its position as the most profitable stablecoin in DeFi.

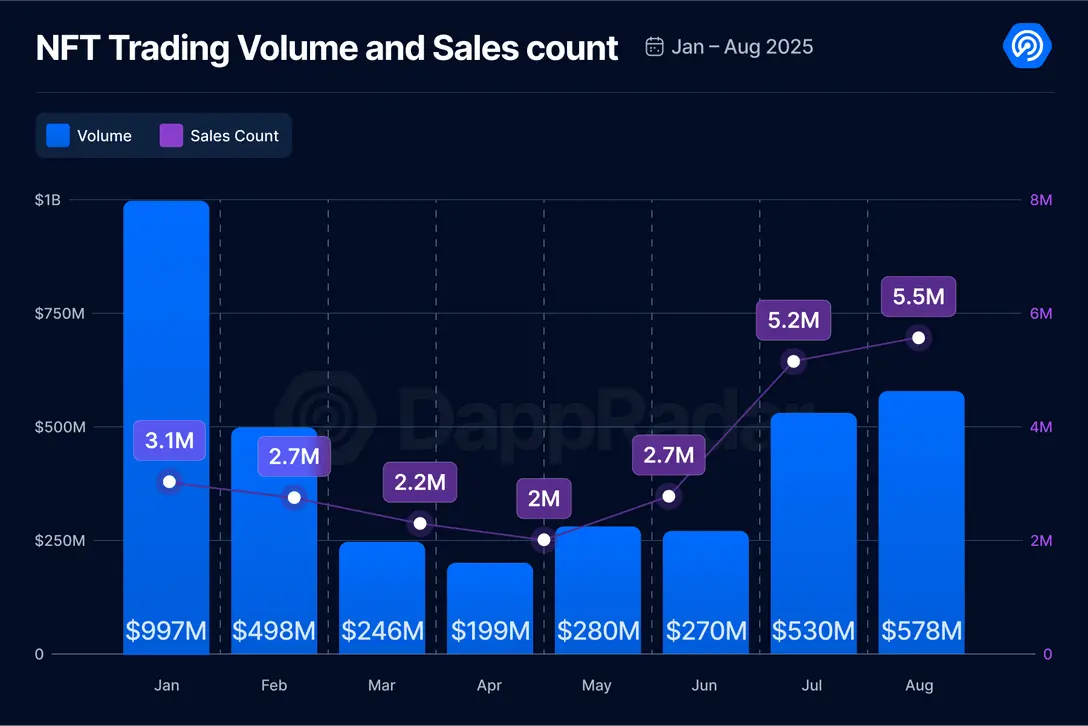

- NFT trading volume increased by 9%, with Courtyard surpassing Ethereum blue-chip projects to lead all series.

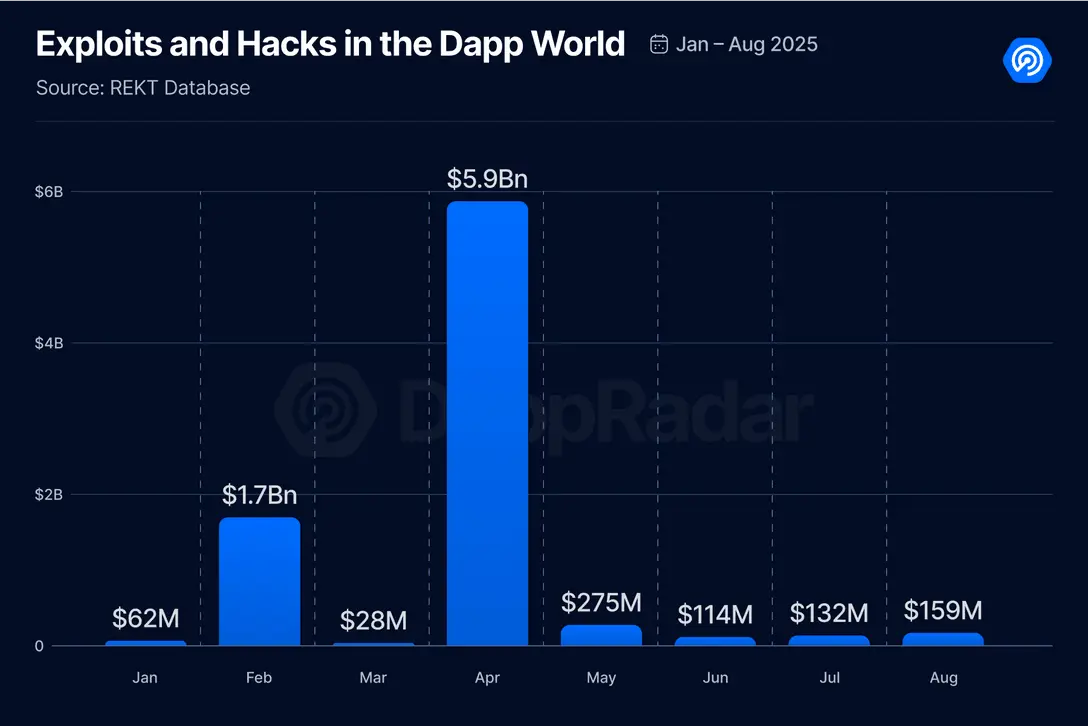

- August saw losses of $159 million due to vulnerabilities, a 20% increase from July, with one phishing attack causing losses of $91 million.

Dapp Cooling in August

In August, on-chain activity clearly cooled. The number of daily active unique wallets (dUAW) in the Dapp industry fell by 18%, down to 17 million.

Two areas were hit hardest: social applications fell by 63%, and AI applications dropped by 49%. While this decline is surprising, it aligns with natural cycles. Both areas experienced months of rapid growth and heavy promotion, but maintaining that momentum and engagement is a significant challenge. The vision for these two product categories remains exciting. In the long run, they may reshape the entire industry, but for now, this decline indicates that their development is still in the early stages.

On the other hand, other categories saw growth. NFT activity increased by 7%, reclaiming the second position in industry dominance. Given the market slowdown earlier this year, this rebound is surprising. Despite a slight decline (4%) in gaming DApp activity, it re-emerged as the most active sector, demonstrating strong resilience as a pillar of on-chain participation.

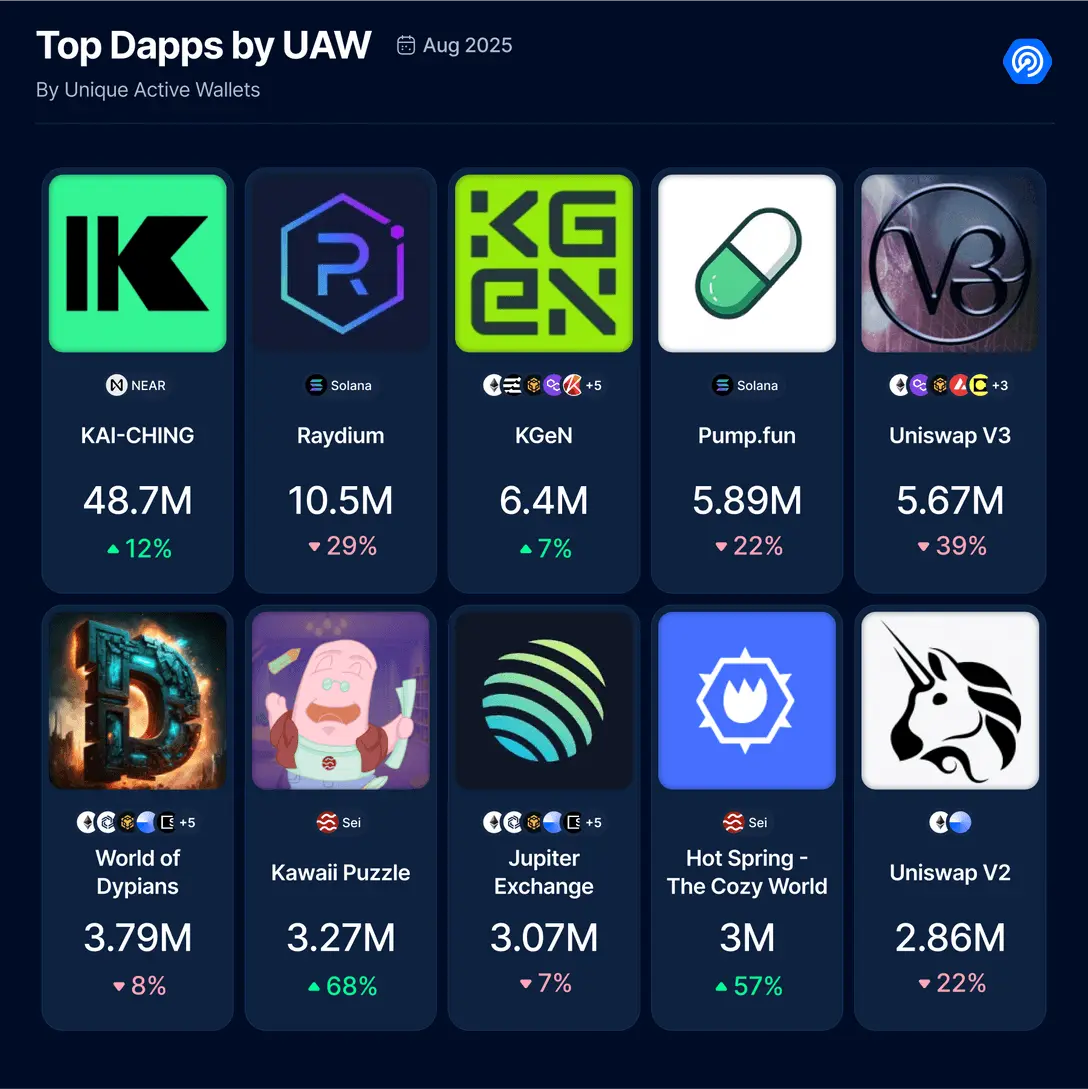

Looking at the most active Dapps in August, they spanned DeFi, gaming, social, and AI sectors, but no single category could fully dominate. This highlights the current state of the industry: a diverse yet balanced ecosystem, with each sector exploring its unique advantages.

DeFi TVL Hits New Highs, Institutions Enter the Market

In August, DeFi's performance confirmed many previous speculations. TVL reached $292 billion, a 13% increase from July, primarily driven by Ethereum's strong performance. Both DeFi TVL and ETH prices hit all-time highs in August, underscoring the strong growth momentum in the industry.

Across the entire cryptocurrency market, the overall market also showed strong momentum:

- The total market capitalization of cryptocurrencies, including BTC, rose by 4% in 30 days, reaching $3.82 trillion, setting a new all-time high.

- The total market capitalization of cryptocurrencies, excluding BTC, increased by 15%, reaching $1.59 trillion, slightly above the peak set in November 2021.

- The total market capitalization of cryptocurrencies, excluding BTC and ETH, rose by 9.41%, reaching $1.05 trillion, also a new high.

What is the conclusion? Ethereum continues to maintain super-fast growth, while altcoins remain largely subdued. However, since the beginning of this year, the market cap of altcoins has only increased by 12%, suggesting that we may be in the mid-cycle of a bull market, just before altcoins typically begin to accelerate.

In addition to market data, August also welcomed a series of product and institutional milestones:

- Protocol Innovations: Uniswap's Unichain enabled Flashblocks, achieving 200 milliseconds of block confirmation, comparable to CEX speeds, and has MEV resistance. Base and other OP Stack chains have also adopted this upgrade through Flashbots. Additionally, Pendle Finance launched Boros on Arbitrum, allowing users to trade perpetual funding rates directly on-chain. Finally, Synthetix announced its return to the Ethereum mainnet and launched a new perpetual contract exchange, indicating that the L1-L2 hybrid experiment is far from over.

- Institutional Adoption: Aave Labs launched Horizon, an institutional lending platform that provides institutions with access to tokenized government bonds and RWA. Aave Horizon has attracted institutions such as VanEck, WisdomTree, Hamilton Lane, Circle, and Ethena. Additionally, Ripple's RLUSD stablecoin has joined Horizon's risk asset market, expanding the range of collateral options. Meanwhile, Chainlink further solidified its position as the core data layer for cryptocurrencies by integrating foreign exchange and precious metals data from the Intercontinental Exchange (ICE), connecting TradFi-level data with DeFi infrastructure.

- Stablecoins and Yields: Ethena's USDe supply surged by 42% to $12.4 billion, with protocol revenue reaching a new high of $61 million in August. Its rapid growth solidifies USDe's position as one of the most profitable and controversial stablecoin models in DeFi, sparking ongoing discussions about sustainability and fee acquisition.

This bull market feels different. Unlike past cycles, institutions are now shaping market narratives and infrastructure. Market growth is no longer dominated by retail investors but led by innovative financial products, investment funds, and governments embracing the technology.

AI DApp Activity Cools in August

AI has become one of the most transformative forces today, reshaping not only technology but also daily life. However, in the blockchain space, August saw a slowdown in development. As mentioned in the industry overview, AI DApp activity dropped by 49%, indicating that even the hottest areas are not immune to cycles. Nevertheless, top AI projects still rank highly, and new entrants continue to expand the possible boundaries.

New AI protocols introduced this month include:

Vibely: An AI companion designed to alleviate loneliness and anxiety.

Calories Cash: A Telegram-based AI agent that allows users to take a photo of their food to receive calorie estimates and earn token rewards.

However, the headline news this month comes from Numerai, a decentralized hedge fund built entirely on machine learning models contributed by thousands of data scientists. Numerai secured $500 million in funding from JPMorgan Asset Management, nearly doubling its assets under management and causing its NMR token to soar over 100% in just a few days. The fund's performance is driven by AI models staked with NMR, meaning JPMorgan's support is not just a capital influx but also a validation of AI-driven asset management coordinated through blockchain incentives.

On the infrastructure front, Render Network is entering the AI space by introducing high-end GPUs to support decentralized machine learning through trials in the U.S. This expansion from graphic rendering to other fields positions Render as a strong competitor to cloud giants, with node operators receiving RNDR rewards. Similarly, Bittensor launched a new governance module (dTAO), giving token holders more control over upgrades and strengthening TAO's coordinating role in the decentralized AI ecosystem.

The Artificial Superintelligence (ASI) alliance, composed of Fetch.ai, SingularityNET, and Ocean Protocol, focuses on developer engagement. August's hackathon showcased AI agent use cases ranging from DeFi automation to decentralized data sharing. While the FET token remains stable, the ecosystem's $50 million buyback plan and collaborative governance framework lay a solid foundation for long-term growth.

In summary: even though the heat of usage has cooled, AI in the crypto space is still developing rapidly. Institutional capital, decentralized infrastructure, and an active community are now driving the evolution of this field, indicating that this is not just hype but a sustained phase of building decentralized AI.

NFT Momentum Strong, Courtyard Makes History

In August, the momentum in the NFT market continued to strengthen. Trading volume increased by 9%, despite a 4% decline in the number of NFT sales, indicating that while the number of assets traded decreased, collectors were paying higher prices for each transaction.

This made July and August the two strongest months for NFT trading volume and sales since February 2025. Various signs indicate that people are returning to the NFT space. This revival is partly due to mainstream adoption. In Ibiza, the world-renowned nightclub Hi partnered with The Night League and London's W1 Curates to open the first permanent NFT art gallery within the club. The works of renowned crypto artists such as Beeple, Mad Dog Jones, WhIsBe, and KidEight were showcased through immersive digital installations, marking a breakthrough for NFTs beyond the Web3 circle.

Another driving factor is Base, whose low minting costs and speculation surrounding upcoming airdrops have spurred NFT activity. Base has now risen to become the third-largest chain by trading volume, highlighting how scaling solutions impact NFT adoption.

Ethereum remains strong, dominating the NFT industry with a 61% share. In August, developers launched the ERC-8004 "Trustless Agent," a proposed standard that uses NFTs as the unique on-chain identifier for autonomous programs. This will enable AI systems and dApps to securely use NFT-based IDs and reputation layers for mutual recognition and interaction.

In other developments, Solana made progress in scalability, successfully conducting stress tests with over 100,000 transactions per second, ten times the previous average. This initiative positions Solana as a strong competitor for hosting large-scale NFT and gaming markets. On the product front, the Solana wallet Phantom acquired the NFT analytics platform Solsniper, planning to integrate its wallet tracking and sniping tools into the Phantom app.

In the market, Blur surpassed OpenSea, capturing 22% of total NFT trading volume, thanks to its aggressive rollout of new features and liquidity incentives. Meanwhile, OpenSea launched a beta version of its Model Context Protocol (MCP) server, an open standard that provides real-time NFT and wallet data to AI applications across more than 20 chains, placing it at the intersection of NFTs and AI.

In collectibles, the biggest surprise came from Courtyard, which became the highest trading volume NFT collection, even surpassing Ethereum's blue-chip projects. Courtyard's momentum was bolstered by a $30 million Series A funding round at the end of July, aimed at expanding its model of bringing real-world collectibles on-chain and providing instant liquidity and verifiable provenance. The rise of Courtyard and platforms like Phygitals on Solana indicates that RWAs will become a dominant trend in NFTs in the second half of 2025.

Collaborations among blue-chip projects also made headlines. Azuki partnered with Swiss watchmaker H. Moser & Cie to launch "Elements of Time," a series of luxury watches connected to Ethereum. Each watch is equipped with a physical-backed token (PBT) based on NFT technology to verify its authenticity and ownership.

Generative art also reached a milestone. Art Blocks announced the upcoming launch of its 500th project, celebrating its fifth anniversary. The "Art Blocks 500" series, set to launch in November, will cover all six of its categories and mark the end of its Curated series, signaling the conclusion of the first era of on-chain generative art.

The conclusion? The NFT market is heating up again.

August Sees 20% Increase in Web3 Attack Incidents

August was another tough month for Web3 security. According to the REKT database, losses from hacks and exploits reached $159 million, a 20% increase from July. However, the data for August is not particularly striking compared to previous months.

The most notable incident in August was a large-scale phishing attack, accounting for 57% of total losses. Victims lost 783 bitcoins (approximately $91 million) in a complex social engineering scam where attackers impersonated customer service representatives from exchanges and hardware wallets. This theft occurred a year after the Genesis creditor exploit, which resulted in a loss of $243 million, and the stolen funds have been laundered through privacy-focused mixers like Wasabi Wallet.

The second major incident occurred at the Turkish exchange BtcTurk, which reportedly suffered a hack resulting in losses of approximately $48 million to $50 million. The stolen assets came from the platform's hot wallet. During the investigation, while deposits and withdrawals were paused, local fiat operations and trading services remained normal.

Another notable attack targeted Odin.fun, a meme coin issuance and trading platform based on Bitcoin. Attackers manipulated liquidity in its automated market-making tool, stealing 58.2 bitcoins (approximately $700,000).

This month once again highlighted the importance of security awareness in Web3. From phishing to hot wallet thefts, attackers are continuously improving their methods. It is essential to protect assets, verify communication sources carefully, and use secure storage methods.

Conclusion

August highlighted that the DApp industry remains vibrant. While overall activity has cooled, DeFi TVL soared to an all-time high, NFTs regained growth momentum, and despite a decline in usage, AI dApps continue to attract institutional attention. Meanwhile, security incidents serve as a warning, making vigilance more important than ever.

However, it is worth noting that this cycle is "different." Institutions are no longer sitting on the sidelines but are actively shaping the market through capital, partnerships, and infrastructure. As we enter the final quarter of 2025, the interplay between retail trends, institutional adoption, and technological breakthroughs will determine the future direction of the industry.

One thing is clear: on-chain innovation has not slowed down.

Related articles: July Dapp Report: Overall Activity Cools, DeFi TVL Hits New High, Chain Games Show Resilience

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。