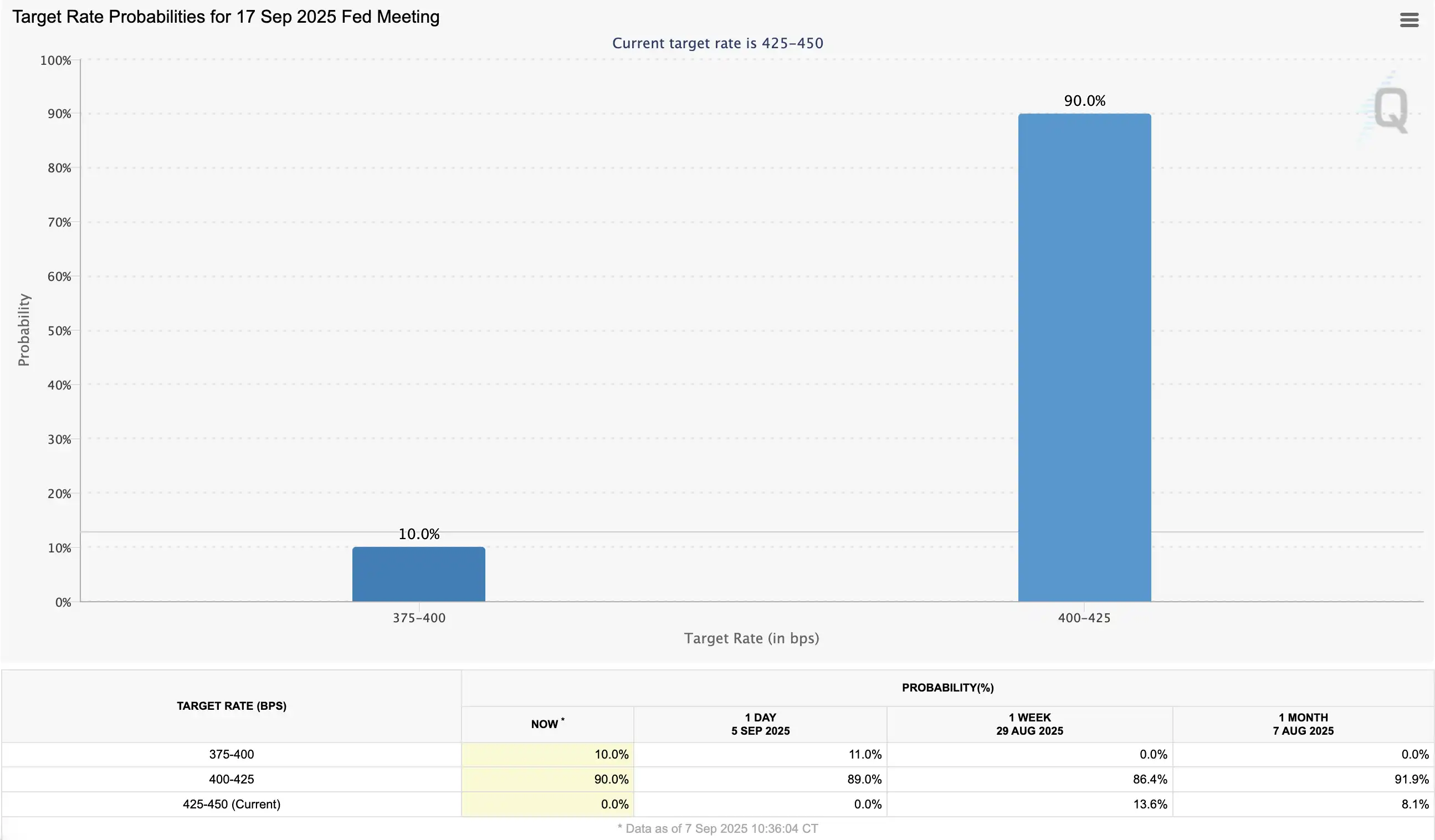

On September 5, the U.S. Department of Labor released the non-farm employment data for August, which once again disappointed the market—only 22,000 new jobs were added, far below the expected 75,000. This marks the fourth consecutive month of weak non-farm data, pulling the average new jobs added over the past four months down to just 27,000. The weak data has directly prompted a repricing of market expectations regarding the Federal Reserve's policy path: expectations for consecutive rate cuts in September, October, and December have surged. According to CME data, the probability of a rate cut by the Federal Reserve skyrocketed from 86.4% before the announcement to 100%, with 90% betting on a 25 basis point cut and 10% even betting on a 50 basis point cut.

However, the positive policy expectations have not boosted risk appetite, as U.S. stocks experienced a slight decline, indicating that traders are more concerned about the recession risks brought about by slowing economic momentum. The "rate cut bullishness" is being overshadowed by "recession trading."

Next, Rhythm BlockBeats has compiled traders' views on the upcoming market situation to provide some directional references for trading this week.

@fundstrat

Bitmine CEO Tom Lee expects the Federal Reserve to begin cutting rates in September, similar to the situations in 1998 and 2024. In both of these historical contexts, the market subsequently experienced a strong rebound, especially in the performance leading up to the end of the year. Therefore, Tom Lee offers a "contrarian" judgment that is contrary to the general market view: a bullish trend may emerge in September 2025.

@0xENAS

Traders were briefly bullish on SOL last Thursday but stopped out on Friday. They noted that BTC successfully reclaimed $110,000, making it the strongest mainstream currency at the moment. Meanwhile, ETH has lost momentum, and mNAV has shrunk (BMNR 1.1, SBET 1), leading to expectations that the market will shift towards newer, lower-positioned coins. If BTC falls below $110,000, the strategy will fail.

@qinbafrank

Companies are producing more orders with fewer people, and the logic of worrying about recession before gradually regaining confidence is repeating itself after a month. The non-farm data significantly underperformed expectations, raising initial recession concerns, but in a few days, people may realize that the economy is actually fine.

Looking back, the logic from a month ago still applies. In addition to the previously mentioned logic, two new points emerged this week: 1. The manufacturing and services PMI released this week were quite good, and notably, the manufacturing and services order indices significantly exceeded expectations. The chart below shows services on top and manufacturing below; the substantial outperformance in industrial orders does not indicate recession. However, companies are reducing their workforce—how can this be explained? It can only be said that the structural changes in the labor market brought about by technological transformation are becoming a reality. Productivity is improving, and companies are achieving more output with fewer employees. This could be the norm in the AI era, where labor productivity increases and companies will employ fewer people.

@Phyrex_Ni

Both instances are similar to the last Jackson Hole annual meeting; although the likelihood of rate cuts has increased, the cost is an economic downturn. The market tends to be excited first and then calm down, and the impact of the economy will weigh more heavily. While bad data can be treated as good data ("celebrating a funeral"), bad data is still bad data, and economic issues are likely pointing towards recession. If it occurs, it will be the "last drop," and if it doesn't, it will likely be a gradual decline.

Thus, economic issues will be more serious than the rate cuts themselves. In simple terms, rate cuts are not always positive; they must be viewed in conjunction with the economy. If rate cuts are due to economic concerns, they may not be beneficial. Rate cuts are just one factor; the key is the policy response after an economic downturn. Historically, the recession in 2020 lasted only two months, and the S&P 500 recovered its losses within six months and reached a new high in seven months, indicating that a recession does not necessarily lead to a long-term decline.

My personal strategy remains unchanged: I plan to reduce holdings in small coins, retain mainstream coins, and hold cash to wait for bottom-fishing opportunities. If the market declines, I will selectively increase positions; otherwise, I will continue to enjoy the gains from mainstream coins. From the data, the turnover rate of BTC has significantly decreased, indicating that most investors are choosing to wait and see. Until the situation between Trump and the Federal Reserve becomes clearer, more investors will remain on the sidelines.

@Cato_CryptoM

Although the unemployment rate in this employment data did not rise significantly, the non-farm employment data for August saw a substantial decline. As I mentioned in my previous analysis, this is due to a decrease in the supply side of the labor market.

Currently, the situation is that the weakness in employment is not only due to a decline in demand but also a significant reduction in the supply side from companies, indicating cautious expansion by businesses. This situation reflects a lack of confidence in the economy.

After the data was released, Trump reiterated that the Federal Reserve needs to cut rates, while Bessenet stated that the Federal Reserve's ability to manage the economy has failed. The market interpreted this situation as a deterioration in employment, suggesting that the Federal Reserve's management of employment has already failed.

This is the situation I was previously concerned about. Once there is a lack of confidence in the economy, a 25 basis point rate cut, or even a more aggressive 50 basis point cut, becomes "poison." If there are expectations of economic risks, such as stagflation or recession, then the more aggressive the rate cuts in September or this year, the more it indicates a lack of confidence from the Federal Reserve in the economy, and panic expectations will gradually spread.

At this point, the probability of a 50 basis point rate cut in September has risen again to 11.8%. Although this is a slight increase compared to the employment data release, if confidence in the economy cannot be restored and market concerns about a potential economic crisis are not alleviated, a higher rate cut of 50 basis points may have a more negative effect.

However, from the current situation, short-term expectations of concern have emerged, but panic has not yet set in; we will see how the sentiment develops next week.

@biupa

Altcoins are currently still in a state of fluctuation without a significant drop, mainly because Ethereum has not experienced a breakdown, allowing it to maintain a range between 280-310 billion.

This fluctuation is somewhat similar to September and October 2024. Overall, there isn't much long-term content worth analyzing; short-term trading is about profiting through fluctuations within the range.

Yesterday's non-farm data significantly lowered expectations for a rate cut in September, which should be a positive sign; however, I believe the risk of recession is still relatively small (the unemployment rate has not risen significantly). Nevertheless, there is an expectation of an overall adjustment in U.S. stocks in September (statistically, this is unrelated to recession), so there may be a situation where Bitcoin adjusts alongside U.S. stocks. If such a situation occurs and falls below $100,000, I still believe the major bottom will appear between $93,000 and $98,000.

If there is no adjustment in U.S. stocks or it does not lead to a significant drop in Bitcoin, then $107 may have already hit the bottom. Technically, the short-term focus is on the $110,000 area.

Given the widespread expectation of several consecutive rate cuts in the future, the market in October and November should be favorable, aligning with our prediction that something significant will occur between October and November.

@Rachael Lucas

BTC Markets analyst Rachael Lucas stated that the weak U.S. employment report has indeed triggered expectations that the Federal Reserve will adopt a more dovish stance, which typically supports risk assets like Bitcoin. However, the market has already priced in a certain degree of policy easing. Meanwhile, we see institutional investors taking profits, while ETF fund flows remain relatively stable. Bitcoin's resistance level is at $113,400, with further resistance at $115,400 and $117,100. Breaking through these resistance levels indicates that the market has absorbed recent selling pressure and is preparing to retest the highs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。