Chainlink ETF Price Impact: Will Grayscale Trigger $LINK Rise or Fall?

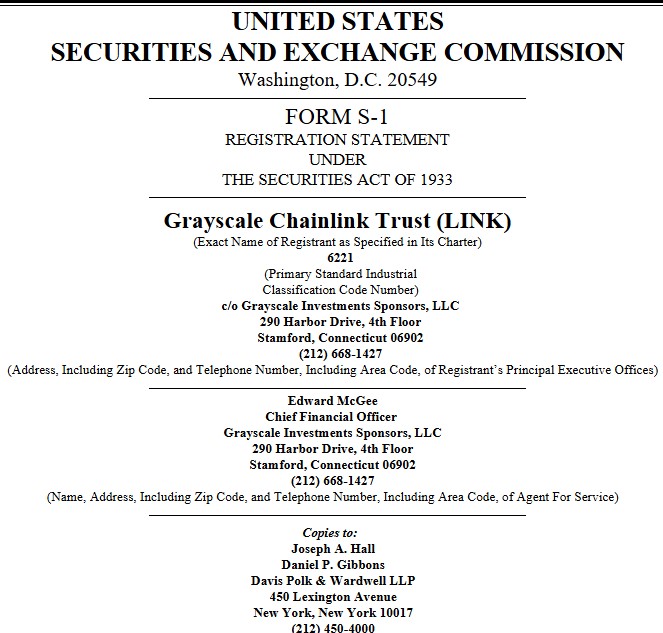

Breaking Chainlink ETF news has shaken the crypto world today: Grayscale has submitted an S-1 filing to the SEC for a spot $LINK exchange traded fund, officially named the Grayscale Link Trust.

If approved, it will trade under the ticker $GLINK, making the token one of the very few altcoins to achieve digital asset fund status.

But here’s the big question: Will this move fuel a major Chainlink ETF price impact, or could SEC delays cool down the momentum?

Why This Digital Asset Fund Filing Is a Game-Changer?

Grayscale Chainlink ETF filing is more than just another filing. It would give institutional investors a regulated way to buy the token, just like Bitcoin and Ethereum.

According to Wu Blockchain ’s latest X data, it will start with a cash-based mechanism, and later could support physical redemption, meaning direct access to real tokens in the future.

If approved, this would:

-

Boost mainstream adoption – Token would join the exclusive list of altcoins with exchange traded funds recognition.

-

Open liquidity floodgates – Wall Street capital could pour in, lifting trading activity.

-

Strengthen credibility – $LINK price analysis would gain higher status, no longer seen as “just another token fall or rise.”

Chainlink Price Surge Today , But Why and What Next?

The announcement has already created excitement around the cryptocurrency community, so now let’s get to some price surge reasons and facts:

-

Price at $23.17: Up nearly 5% today since the filing news.

-

Trading volume $749M: A massive 49.7% surge in 24 hours.

-

Its Reserve added 43,937 tokens: Raising holdings to 237,014 LINK.

-

Ecosystem adoption: 7 new integrations this week across Ethereum, Solana, Arbitrum, Base, BNB Chain, and BOB.

So, now what will be the Chainlink ETF price impact after this announcement driving the headlines today?

What Does The Technical Chart Suggest: Fall Or Rise?

LINK price analysis as per TradingView chart , traders are closely watching these levels:

-

RSI 51.48: Neutral, not overheated.

-

MACD momentum: Showing bearish signals are decreasing, reversal possible.

-

Support at $22: Holding above this shows strength.

-

Resistance at $25: Breaking it could trigger a rally toward $27–$30.

In simple words: The price movement looks balanced, and this grayscale latest news may give it the push needed to break higher.

Will SEC Approve Gayescale $LINK ETF? Price Scenarios Here

-

If Approved

-

It could retest $25–$27 soon.

-

The current breakout continuation may take it beyond $30+.

-

If Delayed or Rejected

-

Short-term dip back to $20–$22 as traders sell hype.

This means the chainlink price prediction could be sharp in the short term , but long-term adoption trends remain bullish regardless.

Conclusion: What Traders Should Watch Now

The crypto market has been waiting for a new spark. With this latest announcment, many traders believe this could mark the start of an altseason.

-

$22 Must hold this support to stay bullish.

-

$25 resistance is the breakout zone.

-

SEC updates are the biggest driver of sentiment.

The token is steady now, with momentum building around Chainlink ETF price impact. If SEC approval comes, $LINK could easily aim for $30

Traders should keep an eye on the security exchange commission’s decision because that will decide the real price move in the coming weeks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。