Original Title: "Crypto’s Distribution Playbook: Or, the DeFi Mullet"

Translated by: Luiza, ChainCatcher

Every few years, cryptocurrency experiences its own moment in the spotlight. For most of its life, these moments follow a predictable four-year cycle: prices soar (often to ridiculous heights), people flock in, most lose their investments, and a few stick around. Cryptocurrency has grown through this cycle of "boom and bust," leaving behind true believers after each shake-up.

Traditional institutions seem to be playing the same game—they allocate Bitcoin to their balance sheets, launch ETF funds, or allow clients to trade cryptocurrencies. Each time such moves occur, they are hailed as turning points. However, institutional entry often marks the peak of the market rather than the beginning of a new growth cycle. "The institutions are here" has even become a meme. They have never brought in a billion new users because they have never truly embraced cryptocurrency; they merely dipped their toes in.

But this time is different, as institutions are no longer just testing the waters. They need cryptocurrency. This is the first time in history they are going all in because it is the choice that aligns best with their interests.

It is quite ironic that the original birth of cryptocurrency was a form of "rebellion" against traditional institutions. Its core intention was to build a new system outside the existing financial framework. However, since entering the crypto space, there has always been a desire to gain recognition from established authorities—despite the fact that these authorities are precisely what it sought to "rebel" against. Where does this desire come from? Perhaps it stems from the gradual realization that replacing the entire financial system is unrealistic. The current system is built on decades of accumulated trust, and regardless of its flaws, most people still believe it can serve them.

Therefore, a more realistic goal is not to replace but to penetrate. To encourage traditional institutions to gradually abandon outdated models—those inefficient black-box operations that are incompatible with a highly interconnected, natively internet-driven global world.

Until recently, this seemed like wishful thinking. But in this cycle, the transformation is no longer coming from marginal startups but from top-level design.

The current rhetoric from the U.S. government surprisingly aligns with the cryptocurrency industry's long-standing claims. To maintain the dollar's status as the world's reserve currency, all levers must be pulled, and cryptocurrency is one of the most powerful levers. Stablecoins pegged to the dollar (like USDT and USDC) have already dominated the on-chain space. The U.S. government has not resisted this trend; instead, it has embraced it—stablecoins have transitioned from being a "novelty" to a policy tool, becoming central to economic strategy during the Trump administration.

The GENIUS Act (full name: "Cryptocurrency Asset Transparency and Regulatory Certainty Act," aimed at regulating stablecoin issuance) requires stablecoin issuers to purchase U.S. Treasury bonds, creating a new category of buyers for U.S. debt financing. Why is this important? Because buying Treasury bonds is not just "funding the government," but it is the cornerstone of the entire financial system. U.S. Treasury bonds are viewed as the safest assets globally: for the government, stable demand for bonds can maintain low interest rates and a strong dollar; for institutions, bonds provide predictable returns backed by the U.S. government's credit—undoubtedly the most reliable borrowing entity in contemporary history.

This creates a win-win-win scenario: stablecoin issuers gain scalable, interest-bearing, high-liquidity assets to back their tokens; institutions gain access to a market that is both safe and large; and the U.S. government acquires new capital channels to finance spending without raising interest rates. To this day, this has become a national strategy.

The incentive effects are astonishing: large banks, holding trillions in customer deposits, now have reasons to convert reserves into stablecoins, as the latter is inherently more efficient. Arthur Hayes (former CEO of BitMEX) estimates this will bring over $10 trillion in new purchasing power to U.S. government debt.

Where will this liquidity flow? Not all will remain in the Treasury market. Some funds will spill over into risk assets, flowing into the cryptocurrency space, thus forming a cycle: stablecoin growth → Treasury bonds receive funding → liquidity spills over → crypto market rises → stablecoins grow again.

For this reason, institutions are no longer just dipping their toes in but are deeply binding themselves.

This is why this moment in the spotlight could truly become a turning point: not because cryptocurrency has convinced the world to betray traditional institutions, but because traditional institutions are beginning to turn to cryptocurrency.

We have never encountered a situation like this: a warming government attitude, active institutional involvement, a clear regulatory framework, and improved infrastructure with cross-chain interoperability solutions. Now that we have reached the long-awaited breakthrough, how should crypto teams seize the opportunity? The answer lies in the DeFi Mullet model.

The DeFi Mullet

All successful new technologies achieve widespread adoption by hiding complexity. The internet is a prime example: early on, it required dial-up modems, obscure commands, and patience to endure slow connections; even in the 90s and early 2000s, going online still meant expensive computers, clunky browsers, or visiting internet cafes. For residents of third-world countries like me, these were still luxuries until the early 2010s. For nearly thirty years, the internet was practical but hard to popularize, primarily due to limitations in distribution channels.

Until the advent of smartphones. The internet transformed from a place you had to "go to" into a tool you could carry with you—ranging from full-keyboard BlackBerrys and durable Nokias to the smooth-touch iPhones and Android phones, the internet became an always-on, readily available presence. This shift not only broke down access barriers but also created entirely new demand: billions of people who had never thought they needed the internet suddenly found it indispensable. Without smartphones, the internet might have remained at a million-user scale forever.

Artificial intelligence also experienced its "ChatGPT moment" a few years ago. Previously, AI mainly existed in research papers, GitHub code repositories, and APIs called by developers. However, when a user-friendly chat interface became available, generative AI instantly reached millions of users, and people began using it to write emails and code for daily tasks. This marked the mainstream leap of AI: from a niche tool to a global phenomenon.

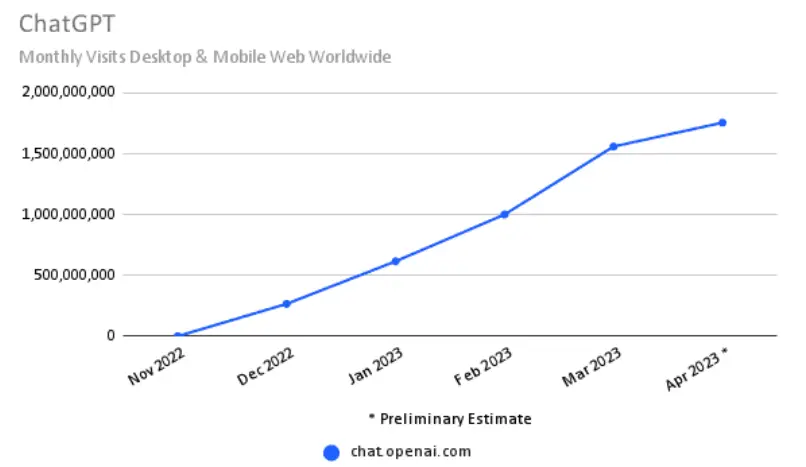

Two data points illustrate everything:

Record-breaking user adoption speed. After its launch at the end of 2022, ChatGPT reached over 100 million monthly active users in just two months, while TikTok took nine months to achieve this milestone, and Instagram took over two years.

Viral user engagement: OpenAI's website traffic skyrocketed from 152.7 million visits in November 2022 to 1.6 billion visits in March 2023, growing more than tenfold in four months.

Source: similarweb Blog

Cryptocurrency is also waiting for its own "ChatGPT moment." The technology is mature, the infrastructure is in place, but it lacks a popularization channel. The internet needed smartphones, AI needed ChatGPT, and cryptocurrency needs its own interactive interface revolution.

You cannot expect billions of people to use decentralized exchanges or manage self-custody wallets—my parents will never learn. But if their banking app suddenly offers stablecoin payments or crypto yield features, they would give it a try. This is the most realistic path to achieving a billion-user scale.

I call it the "Grandma Test." Cryptocurrency has yet to pass this test: you cannot expect Grandma to navigate a DeFi interface to manage wallets, gas fees, or slippage issues. But if PayPal supports her with an on-chain yield mechanism in the background, only showing her a "savings account with 5% yield" in the front end, she would just need to click confirm to participate—this is something she could completely accept.

This is the "Mullet model": the front end is traditional fintech, while the back end is decentralized finance. Smartphones completed this transformation for the internet, ChatGPT achieved this breakthrough for AI, and the Mullet strategy will undoubtedly bring transformation to cryptocurrency.

For users, all they see are loan or yield products offered by banks, PayPal, or Coinbase; meanwhile, transactions are executed on-chain through censorship-resistant protocols in the background. Users do not need to see the complexity or understand the intricacies.

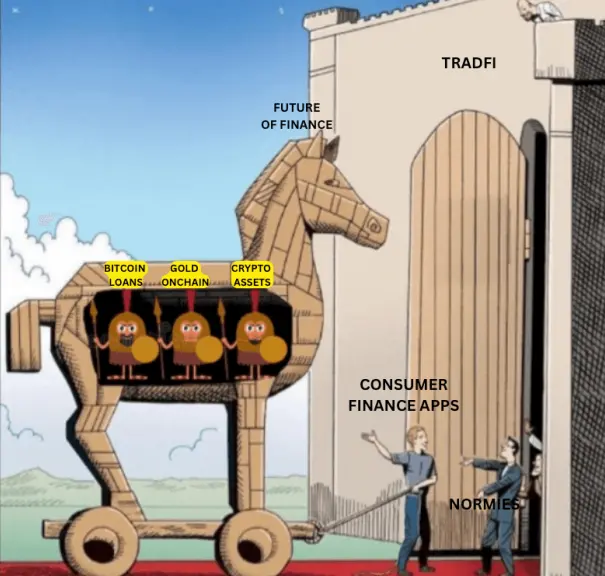

The Trojan Horse in the Castle of Traditional Finance

The DeFi Mullet strategy is no longer theoretical; it has become a Trojan horse for invading the castle of traditional finance.

The most typical case is the collaboration between Coinbase and Morpho. From the user's perspective, this is just a standard Coinbase feature: a clear button offering Bitcoin collateralized loan services. But when the button is pressed, the loan actually comes from Morpho's on-chain lending market. Users do not see DeFi; they only see the word "loan."

This completely overturns the previous operational model of cryptocurrency. In the past, we always expected users to actively adapt to the crypto world—learning to use wallets, cross-chain, pay gas fees, bridge assets, and operate decentralized exchanges. We stubbornly believed that "the product is good enough," "the yield is attractive enough," and "self-custody is crucial," so knowledgeable users would naturally embrace DeFi! This mindset, while showcasing a commitment to the crypto punk spirit, naively assumes that the whole world is willing to follow the same set of rules. Claiming "we don't need those users" may seem principled, but in reality, it is self-imposed confinement—like losing business opportunities due to refusing to improve packaging.

The DeFi Mullet model completely shifts the narrative back on track: providing services in users' existing scenarios (exchanges, banking portals, consumer finance applications). We offer consistent core products—lending, exchanging, earning—while hiding the technical details that users fundamentally do not care about, eliminating the cognitive barriers we previously forced them to cross.

Taking Coinbase and Morpho as an example, the only core action presented to users is: stake Bitcoin to earn dollars. All other complex steps are pushed to the background, returning to where they should exist.

Early data strongly supports the feasibility of the Mullet strategy.

The path to scaling cryptocurrency is clear: meet users in familiar scenarios. Today, the number of cases adopting the "Mullet model" continues to grow:

- Kraken x Ink x Aave: institution-level on-chain DeFi loans distributed through retail channels

- Coinbase x Velodrome: on-chain liquidity behind consumer interfaces

- ZeroHash x Mastercard x Chainlink: credit card-supported tokens + DEX crypto payments

- SharpLinkGaming x Ethereum: a Nasdaq-listed company obtaining DeFi yields through digital asset tokens (DAT)

If the DeFi Mullet model continues to be effective, a billion users will unknowingly use DeFi in the future.

Skeptics dismiss it as "hollow narrative," but that is precisely where its power lies—the narrative is how humans understand new technologies. "Bitcoin as a store of value" is also a narrative. Wall Street does not care about the Bitcoin network or blockchain technology; they only want to buy BTC as a hedge against inflation and a store of value. The Mullet model follows the same logic: compressing the difficult-to-explain technical details into perceivable simple concepts.

More importantly, the Mullet model represents a paradigm shift in product building and distribution. Developing products for DeFi users familiar with crypto technology is one thing, but the vast majority outside the circle only care about the results: dollars, yields, credit, tokens.

The Mullet model provides a new perspective for entrepreneurs, investors, and regulators in product development and promotion: you do not need to drag a billion users into DeFi; you just need to quietly embed DeFi into the applications they are already using.

Now is a Historic Opportunity

Traditional finance is no longer just dipping its toes in. Once pilot projects and tentative collaborations have been replaced by comprehensive embrace strategies. Institutions like Robinhood, Stripe, Coinbase, and Circle are building blockchains, acquiring companies, and integrating crypto technology into their core architectures. Giants in asset management like Franklin Templeton and BlackRock are moving core money markets on-chain. These traditional financial behemoths are investing real money into their cryptocurrency businesses, formulating specialized strategies, and building distribution channels. Even more noteworthy is that the U.S. Securities and Exchange Commission (SEC) has launched "Project Crypto," which hints at "opening on-chain business channels for the entire financial industry."

For banks and fintech companies, the "Mullet model" is the optimal solution. Building DeFi infrastructure from scratch is both time-consuming and expensive, requiring a mature team proficient in crypto markets and technology. Instead of spending years developing infrastructure, it is better to tap into existing ecosystems—in a fast-paced market, time is the biggest cost. Embracing the DeFi Mullet model is clearly more economical, agile, and wise.

Simply calling for "institutions to use the technology we develop" is far from enough. It is like telling others in 1995 that "they should do business on the internet because the TCP/IP protocol is mature"—technological maturity does not equate to user adoption. DeFi teams must actively approach institutions. This does not mean abandoning decentralization or self-custody principles, but rather packaging existing technology into forms that institutions can directly use.

Institutions are most concerned with three core aspects:

Compliance: They must never cross regulatory red lines. If DeFi teams do not build comprehensive KYC, reporting, and risk management interfaces, institutions will not even consider integration;

Reliability: For seasoned crypto users who "seek solutions on Discord when things go wrong," occasional protocol fluctuations may be acceptable; but institutions need "certainty guarantees." This includes service availability (Uptime) agreements, penetration testing reports, and clear problem resolution processes. For DeFi developers, wrappers, software development kits (SDKs), and service agreements may seem "not cool enough," but these tools are what will allow institutions to use them with peace of mind.

Looking at the big picture, most obstacles are not the protocols themselves but the last-mile problem. This may seem tedious and laborious for some DeFi users and builders, but it is now necessary to let go of obsessions and develop tools that can truly bring cryptocurrency to the masses.

Today, the "DeFi Mullet model" is widely known, but what is the "Cross-Chain Interoperability Mullet"? As you may already know, the "cross-chain interoperability" issue in cryptocurrency has been resolved, and relevant tools are ready—this means fintech companies and institutions can smoothly enter the on-chain world and fully unleash the potential of the crypto internet capital market.

The core of the DeFi Mullet model is "abstracting the application layer of cryptocurrency" (for example, hiding the Morpho protocol under a button on Coinbase);

The Cross-Chain Interoperability Mullet focuses on "abstracting the infrastructure layer of cryptocurrency"—for instance, hiding the cross-chain bridges, blockchain networks, decentralized exchanges that the LI.FI protocol relies on when executing transactions, or hiding the cross-chain interoperability protocols and their proprietary token standards that support stablecoin issuance technology. It is like "another layer of Mullet beneath the Mullet model," serving as the underlying technical support.

Interoperability: The Mullet Beneath the Mullet

If we view the DeFi Mullet as the ultimate solution to the challenges of crypto applications, it is akin to believing that improving car comfort can solve traffic congestion. The real problem lies beneath the vehicle—the roads themselves are key.

The beauty of the crypto ecosystem is that it is not a unified value internet but a multiverse composed of hundreds of chains, each embodying builders' unique insights into scalable blockchains. This fragmentation is both a source of charm and a barrier to mass adoption, and interoperability is the key to breaking through.

The Interoperability Mullet, like the DeFi Mullet, can also accelerate the process for institutions to launch crypto products, with the following two cases being particularly representative:

Stablecoin Issuance: Nowadays, various parties are eager to launch their own stablecoins, including cryptocurrency companies, fintech firms, banks, and even local governments. By 2025, "whether to issue stablecoins" will no longer be the question; "when to issue" will be key. As countries like the U.S. "accelerate the promotion of cryptocurrency adoption to facilitate the circulation of their currencies through crypto infrastructure," everyone is eager to join this "stablecoin gold rush." In the current cryptocurrency ecosystem, the best (and perhaps only legitimate) way to launch a "future-proof" stablecoin is to adopt "cross-chain interoperability token standards." Such standards can significantly shorten the time to issue stablecoins and reduce technical and operational costs during the issuance process, while issuers can still retain control over the token contracts, ensure security, and charge related fees, achieving a "win-win for all parties."

Asset Exchange (same chain, cross-chain, cross-chain bridge exchange)

In the cryptocurrency space, the demand for asset exchange has never disappeared. This means that exchanges, wallets, deposit channels, custodians, and other businesses always need to provide "asset exchange" services for themselves or their users.

Conclusion

The long-standing core challenge in the crypto space has been technological breakthroughs: scalability, consensus mechanisms, interoperability. The top talents have basically solved these problems, and the infrastructure is already in place.

The core challenge has now shifted: it is no longer about building the engine but about creating cars that people genuinely want to drive. The Mullet model is the blueprint for this car.

With an idealistic optimism to build a better world, the crypto industry has created a $40 trillion economy; in the next phase of the journey, pragmatism will become the winning strategy. The Mullet model embodies this pragmatism—it acknowledges that the traditional financial world possesses what crypto needs most: distribution channels. This is the most direct path to making cryptocurrency accessible to everyone. Builders who understand this will ultimately shape the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。