Original | Odaily Planet Daily (@OdailyChina)

On September 5, Cango Inc., the world's second-largest Bitcoin mining company, released its Q2 2025 financial report (as of June 30). This is Cango's first quarterly report after its strategic transformation from an internet car company to a Bitcoin mining company, attracting significant attention from the public.

The financial report shows that Cango's total revenue for Q2 2025 was 1 billion RMB (approximately 139.8 million USD), with revenue from Bitcoin mining operations amounting to 989.4 million RMB (approximately 138.1 million USD). In the second quarter, a total of 1,404.4 Bitcoins were mined, while revenue from traditional car trading business was 12.4 million RMB (1.7 million USD). From the composition of operating revenue, it can be seen that Cango's transformation over the past nine months has been successful.

However, Cango still reported an operating loss of 1.3 billion RMB (approximately 180.4 million USD) in Q2 2025, compared to an operating loss of 13 million RMB in the same period of 2024. The net loss for Q2 2025 reached 2.1 billion RMB (approximately 295.4 million USD), while the net profit for the same period in 2024 was 86 million RMB.

Although Cango's revenue has increased after the transformation, the operating loss has continued to expand compared to the same period in 2024, resulting in a significant net loss on the books. Is Cango's transformation merely superficial, potentially becoming another case of a Web 2 company failing in the crypto industry?

Growing Pains During Transformation

For publicly listed companies, whether investors are satisfied with their financial reports and the underlying operations is reflected in the stock price. On September 5, when the U.S. stock market opened, Cango (NYSE: CANG) saw its stock price rise to a high of 5.12 USD during the day. On the following Monday, CANG continued its upward trend, closing at 5.5 USD.

Cango's stock performance after the release of the Q2 2025 financial report (as of September 9)

From the stock price performance alone, investors believe that Cango has delivered a satisfactory report.

A closer look at the Q2 financial report reveals some insights. In Q2 2025, Cango's total operating costs and expenses amounted to 2.3 billion RMB (approximately 320.3 million USD). Excluding normal equipment depreciation and administrative expenses, the largest cost came from the impairment losses of mining machines (1.8 billion RMB).

In October 2024, Cango chose to acquire 18 E/s mining machines through equity settlement, with the corresponding issuance price at approximately 2 USD per ADS, totaling 144 million USD. However, as of June 30, 2025, Cango's stock price had risen above 4 USD, resulting in a book loss of 256.9 million USD (1.8 billion RMB) based on current fair value assessment.

Therefore, this 1.8 billion RMB is considered a "book loss" in accounting terms. According to the equity acquisition agreement, the acquisition of the 18 E/s mining machines was a private placement aimed at eight miners, not a public offering, and shareholders have a six-month lock-up period after issuance. Even if the stock price has doubled, the shares cannot be sold in the secondary market.

Additionally, another reason for the net loss in accounting terms comes from one-time losses incurred during the disposal of existing Chinese assets. During the process of divesting the original automotive business, Cango initially planned to sell all its Chinese operations for a contract price of 351.94 million USD. However, after evaluation by a third-party professional assessment agency, the fair value of the related assets was found to be lower than the original book value, resulting in a one-time impairment loss of 82.58 million USD.

It is evident that the net loss reported by Cango in Q2 2025 did not stem from poor performance in its mining operations, but rather from the "growing pains" encountered during its transformation. “We exchanged short-term accounting fluctuations for sustainable competitive advantages—scale effect leaps, extreme optimization of cost structure, and strategic focus on high-end computing. With a solid new foundation and a clear growth path, I have unprecedented confidence in Cango's future,” stated Cango CEO Paul Yu during the Q2 earnings call.

As of June 30, 2025, Cango's cash and cash equivalents stood at 843.8 million RMB (approximately 117.8 million USD), an increase of about 200 million RMB compared to the 660.1 million RMB disclosed at the end of 2024. Although there was a net financial loss for the quarter, the ample cash reserves have instilled real confidence in investors regarding Cango's future business expansion.

Nine Months into Transformation, Cango Becomes a "Growth Beast"

Cango's mining business revenue in Q2 2025 was 989 million RMB (approximately 138.1 million USD), accounting for over 98% of total revenue. After excluding the impairment losses of mining machines and one-time losses from the terminated Chinese business, the adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) for the second quarter was 710.1 million RMB (approximately 99.1 million USD), compared to 5.4 million RMB in the same period of 2024, representing an increase of over 130 times.

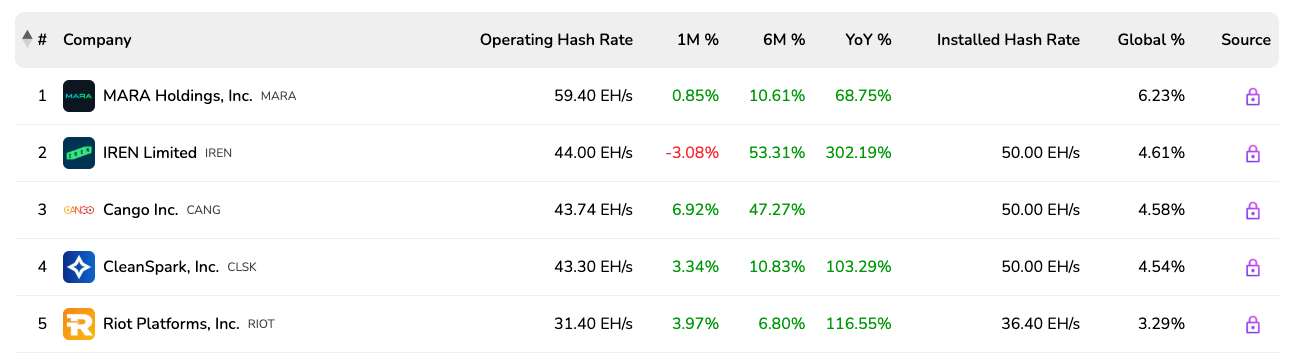

The EBITDA profit margin reached 71.01%, and the strong potential profitability has turned Cango into a "business growth beast." “In just nine months, we have successfully positioned ourselves as one of the largest Bitcoin miners in the world,” summarized CEO Paul Yu during the Q2 earnings call. This is not mere self-praise; according to BitcoinMiningStock data, Cango's hash rate has grown to 50 EH/s, making it one of the second-largest mining companies globally, with a hash rate accounting for 4.58% of the global total and an actual operating hash rate of 43.74 EH/s, ranking third.

Global ranking of Bitcoin mining companies by hash rate

In July, after the launch of the 50 EH/s hash rate, the company's Bitcoin production increased by 44%, reaching 650.5 Bitcoins. Meanwhile, Cango is still expanding its business; in August, Cango completed the acquisition of a 50-megawatt mining facility in Georgia, USA. This acquisition will effectively reduce electricity procurement costs and enhance operational stability.

DAT Cools Down, "Cango Model" to Be Valued

Cango is not only a Bitcoin mining company but also a new type of DAT (Digital Asset Treasury Company), executing a "mine and hold" strategy. Although it does not create Bitcoin buy orders in the public market, it reduces market selling pressure from the "supply side." In Q2 2025, Cango mined a total of 1,404.4 Bitcoins, valued at over 158 million USD, with an average comprehensive cost of 98,636 USD per Bitcoin, indicating that Cango "stockpiled" 1,404.4 Bitcoins in Q2 2025.

The DAT concept began to gain popularity among U.S. publicly listed companies in 2025. According to data from consulting firm Architect Partners, since January of this year, 154 publicly listed companies in the U.S. have announced fundraising to purchase cryptocurrencies. However, on September 4, a regulatory announcement from Nasdaq suddenly cooled the DAT craze. Nasdaq is reportedly strengthening its scrutiny of publicly listed companies holding cryptocurrencies, focusing on those attempting to raise funds to purchase and stockpile cryptocurrencies to inflate their stock prices.

Although specific measures have not yet been disclosed, the stock prices of DAT concepts in the U.S. immediately plummeted, with MSTR falling over 5.3%, MARA over 3.5%, RIOT over 5.6%, and SBET over 10.1% on that day.

Nasdaq's intention is clear: to crack down on the phenomenon of crypto companies transforming through "shell companies" in the U.S. stock market and to increase the difficulty of financing for existing publicly listed crypto treasury companies. The "stockpiling coins - financing - re-stockpiling coins - re-financing" DAT model, which has been popular in the capital circle, may shrink due to increased regulation, and after the bubble bursts, those new DATs that genuinely conduct compliant crypto business and stockpile cryptocurrencies will be valued.

Perhaps value discovery has already occurred, with Cango representing the new type of DAT. Since September 4, Cango's (NYSE: CANG) stock price has continued to rise. Although there was a slight pullback in stock price on Tuesday of this week, it still stands out among all DAT concept stocks. Most DATs in the market are "shell companies"; they raise funds to buy coins to enhance the value of each share of cryptocurrency, but Cango raises funds to conduct real crypto business—enhancing its mining capabilities.

In terms of operations, Cango adheres to a light asset operation strategy centered on "prioritizing strategic procurement of second-hand mining machines," achieving rapid and low-cost expansion and scaling of hash rate. On one hand, it expands its hash rate scale through financing methods such as medium to long-term loans secured by Bitcoin, achieving "hash rate leverage"; on the other hand, it optimizes capital utilization efficiency through reasonable debt in daily operations, achieving "operational leverage."

The dual leverage amplification effect is superior to directly financing the purchase of Bitcoin. Cango does not need to cover coin purchases and operational expenses through traditional DAT "issuing new shares," avoiding dilution of existing shareholders' equity and maximizing the benefits brought by the rise in Bitcoin prices.

One of Cango's mining facilities

Cango CEO Paul Yu explained during the Q2 earnings call, “The light asset operation model gives us a unique advantage. By procuring plug-and-play mining equipment, we can rapidly scale up with minimal upfront investment costs, making us more cost-effective compared to vertically integrated competitors. Our capital efficiency ensures excellent return on capital employed (ROCE) and maintains operational resilience across different market cycles, avoiding the heavy burden of equipment financing.”

Cango's model is also spreading among other mining companies, with American Bitcoin, a Bitcoin mining company backed by the Trump family, being one of them. American Bitcoin initially chose to accumulate Bitcoin at a low cost through mining, rather than directly financing to stockpile Bitcoin, distinguishing it from traditional DATs. (Related reading: Trump family raises $1.5 billion, the business behind Bitcoin mining company American Bitcoin)

The regulatory news from Nasdaq may be a signal that while Bitcoin treasury companies have been a key innovation in this round of the crypto bull market in the U.S., the excess returns are now diminishing. In the next phase of the crypto bull market, DATs with real crypto businesses will take center stage.

Seeking Breakthroughs, the Second Growth Curve Emerges

The competitive landscape of Bitcoin mining is quite fierce, with competition over electricity costs and equipment becoming the norm. To stand out in this competition, Hut8 has even invited the son of the U.S. president to help launch American Bitcoin.

Although it has only been nine months since the transformation, Cango has already grown into one of the leading mining companies. According to the "Corporate Lifecycle Theory" proposed by renowned British management scholar Charles Handy, if leading companies in the industry want to avoid falling into a "Nokia-style dilemma," they must find a "second growth curve." After entering the first maturity phase, the ability to choose new business objectives and build new growth logic is key to a company's success.

Cango's second growth curve is already beginning to take shape.

"This quarter's significant growth highlights the robust progress of our business transformation and its tangible positive impact on operations. With this solid foundation, we are ready to further expand our Bitcoin mining business and enhance our future energy and high-performance computing (HPC) capabilities," said Cango's Chief Financial Officer Michael Zhang during the Q2 earnings call.

CEO Paul Yu elaborated on Cango's future plans during the call. In the short term, the focus will be on fully utilizing the existing 50 EH/s hash rate and replicating the low-cost operational model of the Georgia mining facility to maximize value; in the medium term, plans include piloting renewable energy storage projects to achieve near-zero-cost mining operations while retrofitting some facilities to support high-performance computing applications; the long-term goal is to build a dynamic computing platform, transitioning to "energy + HPC," enabling real-time intelligent switching between Bitcoin mining and AI inference training, expected to be implemented in the first half of 2026, maximizing the value of each kilowatt-hour.

Cango's chosen "energy + HPC" strategy is not merely about renting out space and electricity to AI large model companies, as traditional mining companies might do, but rather focuses more on the energy itself. This strategic positioning suggests that even if the DAT concept cools down in the future and the mining industry faces a downturn, Cango will remain highly viable.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。