The company said on Wednesday that the purchase was executed through Anchorage Digital Bank N.A. and follows an Aug. 5 communication outlining its plan to add bitcoin to corporate reserves. Robin Energy stated the allocation is part of a board-approved policy and will be managed within the parameters of its treasury framework.

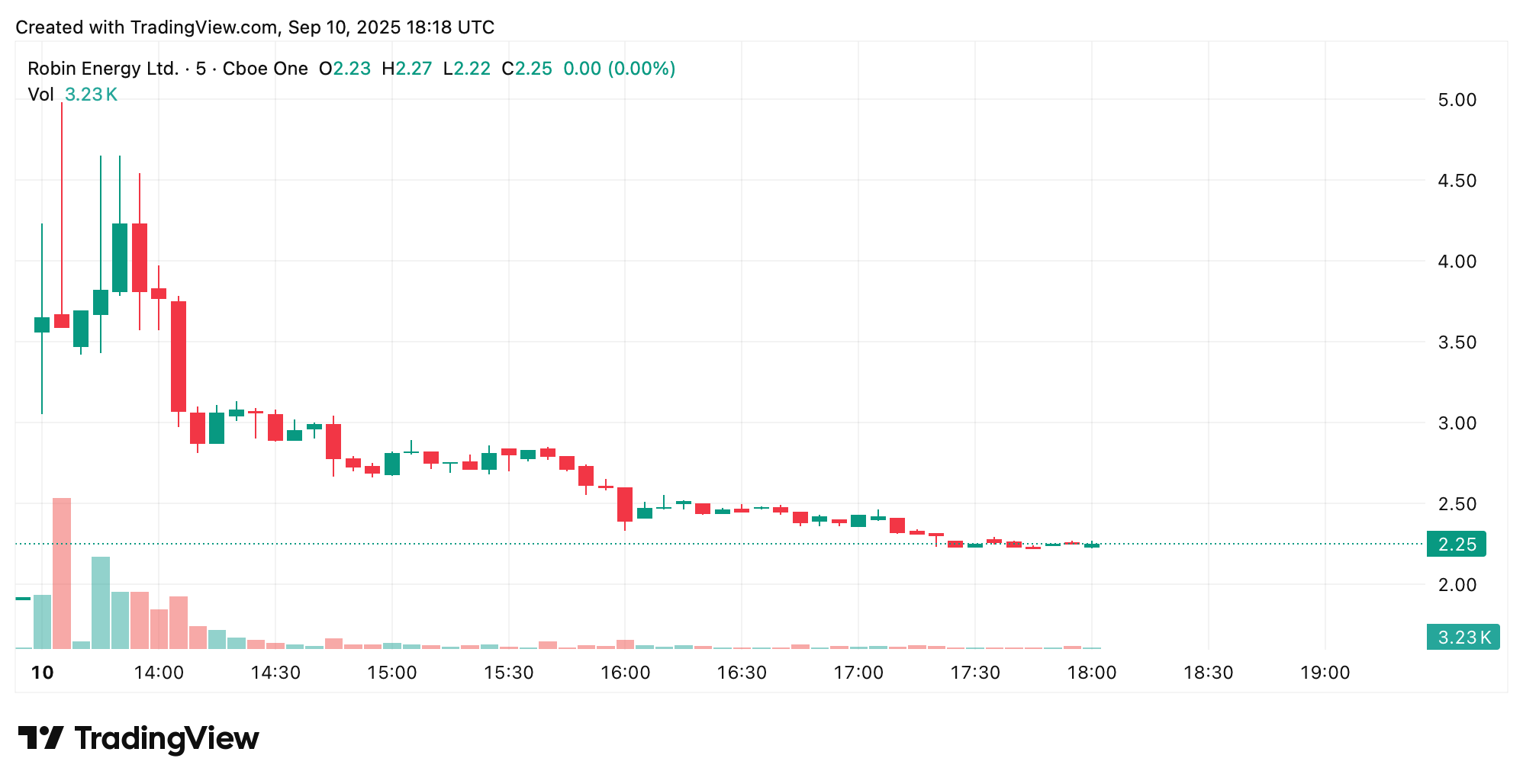

Nasdaq: RBNE on Sept. 10, 2025.

Unlike several BTC treasury firms, the company did not specify the execution window or the average purchase price for the BTC acquired, and it said the transaction aligns with its board-approved capital policy and longer-term liquidity management objectives.

“We are pleased to have completed the allocation of $5 million to bitcoin in accordance with our board-approved strategy. We believe in bitcoin’s unique characteristics as a scarce digital asset and see it as an integral component of our long-term strategy to grow our company further and drive shareholder value,” the firm’s Chairman and Chief Executive Officer, Petros Panagiotidis, remarked in a statement.

Robin Energy also noted it will keep a close eye on shifting market conditions and could tweak its bitcoin allocation as part of a treasury strategy meant to juggle market swings with day-to-day efficiency. The move coincides with a milestone moment as bitcoin treasury firms collectively now hold more than 1 million BTC.

Based in Cyprus and traded on Nasdaq under the ticker RBNE, Robin Energy operates globally as an energy transportation provider. Shares climbed more than 18% as of 2 p.m. Eastern time on Wednesday afternoon, according to Tradingview stats. The company owns one Handysize tanker vessel and one liquefied petroleum gas (LPG) carrier that transport petrochemical gases and refined petroleum products worldwide.

Robin Energy kept quiet on the finer points—no word yet on custody setup, rebalancing triggers, or when the next bitcoin buy might drop beyond the already finished $5 million move. In 2025, corporations from biotechs to retail game shops have been diving headfirst into the crypto balance sheet craze. Whether these wagers will look brilliant or short-sighted in hindsight remains to be seen, but for now, the bandwagon keeps rolling, and nobody wants to be the one chasing it from the sidewalk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。