Abstract

Since the birth of Bitcoin's genesis block in 2009, the Web 3 public chain sector has undergone explosive evolution from single-value settlement to Turing-complete smart contracts, and then to the coexistence of multiple chains. Ethereum has long held the top position in total locked value (TVL) due to its first-mover advantage and robust DeFi ecosystem. However, starting in the second half of 2023, high-performance public chains represented by Solana have launched a strong challenge in terms of user experience, creating a new pattern of "funds in Ethereum, traffic alternating." At the same time, public chains like Tron, which focus on specific scenarios (stablecoin settlement), have also carved out an important niche market in specific areas.

This report will analyze the changing logic of public chain "mainstream rankings" by reviewing the growth paths of mainstream public chains and combining the two core indicators of TVL and on-chain transaction volume. We believe that as market attention shifts from generalized DeFi applications to more specific, real-world integrated stablecoin payments and RWA (real-world assets), the shortcomings of traditional public chains in performance, interoperability, compliance, and privacy are gradually being exposed. This presents structural development opportunities for a new generation of high-performance public chains designed specifically for these scenarios (such as BenFen).

Table of Contents

1. Overview of Mainstream Public Chains

•1.1 Inventory of Mainstream Public Chains: Who are they, what are their "key skills," and how did they grow?

•1.2 How the "mainstream ranking" of public chains has changed: A composite perspective using TVL + transaction volume

•1.3 The "common formula" for successful public chains

2. Why Hot Stablecoins and RWAs are "Absent" on Traditional Public Chains

•2.1 Overview of currently popular stablecoins and RWAs, their trends, and the role of Web 3 in driving them

•2.2 Shortcomings of mainstream public chains regarding stablecoins and RWAs

○2.2.1 Scalability and performance bottlenecks

○2.2.2 Insufficient cross-chain interoperability

○2.2.3 Difficulties in compliance and regulatory adaptation

○2.2.4 Data privacy and security needs

○2.2.5 Incomplete asset onboarding processes and infrastructure

3. How BenFen Public Chain Fills the Infrastructure Gap for Stablecoins and RWAs

•3.1 Move language - a secure and flexible foundation for smart contract development

•3.2 One-click issuance of stablecoins and RWA assets

•3.3 Support for multiple stablecoins and a multi-asset coexistence ecosystem

•3.4 Stablecoins directly pay Gas fees, optimizing user experience

•3.5 Compliance and privacy support of BenFen public chain

•3.6 Ecological outlook: A bridge connecting traditional finance and Web 3

4. Conclusion

5. References

1. Overview of Mainstream Public Chains

1.1 Inventory of Mainstream Public Chains: Who are they, what are their "key skills," and how did they grow?

To understand the future of the public chain landscape, we must first review the "giants" that have defined the past and present. Each has seized market opportunities at different times with their unique "key skills," collectively shaping today's Web 3 world.

Bitcoin (2009–): Digital Gold and Final Settlement Layer

As the source of value for all crypto assets, Bitcoin's core positioning has always been decentralized store of value (SoV) and final settlement network. Its limited scripting capability (Script) is a deliberate design choice aimed at maximizing network security and stability, which also determines that DeFi is not its main battlefield. Although its programmability has been expanded through methods like the Lightning Network and Taproot activation, most of its on-chain financial activities have "overflowed" to other smart contract chains in forms like wBTC. The industry's statistics on total locked value (TVL) generally do not include it in the mainstream DeFi competitive landscape, with major smart contract chains long dominating the TVL leaderboard[1].

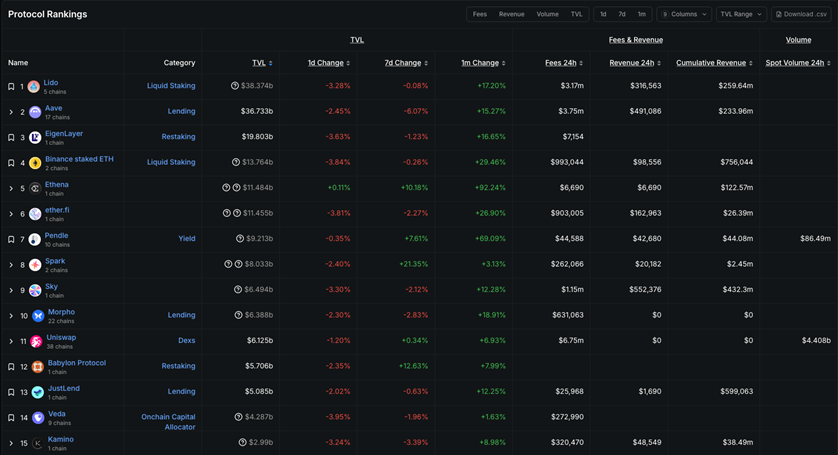

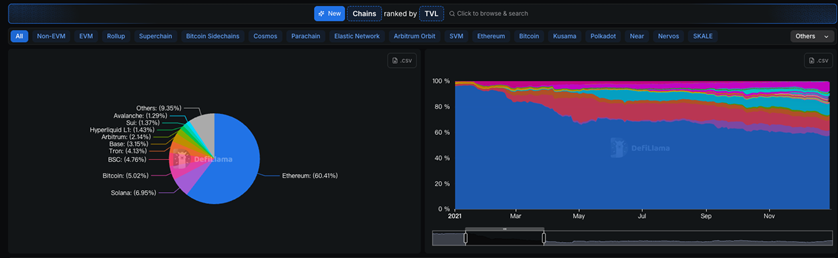

[Chart 1.1: Overview of Mainstream Smart Contract Chains' TVL]

(Source: DeFiLlama)

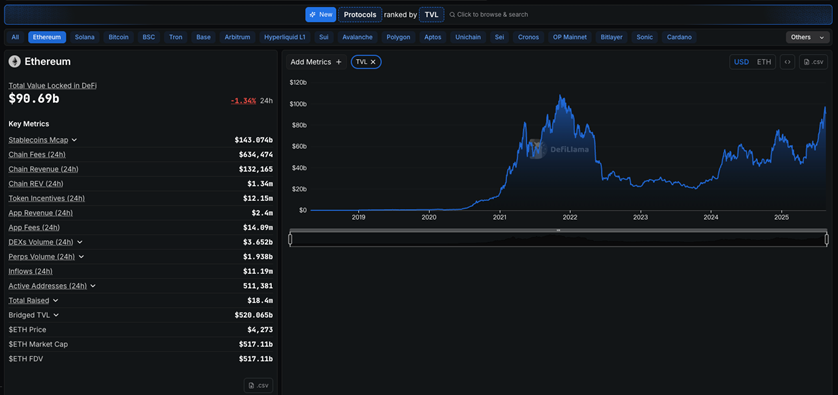

Ethereum (2015–): The Absolute Core of the DeFi World

Ethereum is the undisputed king of general-purpose smart contract platforms and the "ancestor" of the DeFi ecosystem, hailed as the "world computer." From the ICO frenzy of 2017 to the "DeFi Summer" of 2020, and the historic "The Merge" consensus transition in 2022, Ethereum has always been a hub for innovation and capital in the Web 3 world. Even facing fierce competition from L2 ecosystems and high-performance L1s in 2024-2025, its TVL share has consistently maintained the top position across the network[2], making it the "asset pricing center" of the crypto world.

[Chart 1.2: Historical TVL Trend of Ethereum]

(Source: DeFiLlama)

BNB Chain / BSC (2020–): The Inclusive Pioneer of EVM Compatibility

BNB Chain (formerly BSC) rapidly rose in the spring and summer of 2021 due to its low Gas fees, complete EVM compatibility, and close ties to the Binance ecosystem. It significantly lowered the participation threshold for new users and projects, becoming the first stop for "yield farmers" and long-tail assets, with its TVL market share peaking at nearly 20% in May 2021[3]. However, as the multi-chain ecosystems of Solana, Terra (pre-collapse), Avalanche, and others flourished, its traffic and funds were gradually diverted, stabilizing its market share.

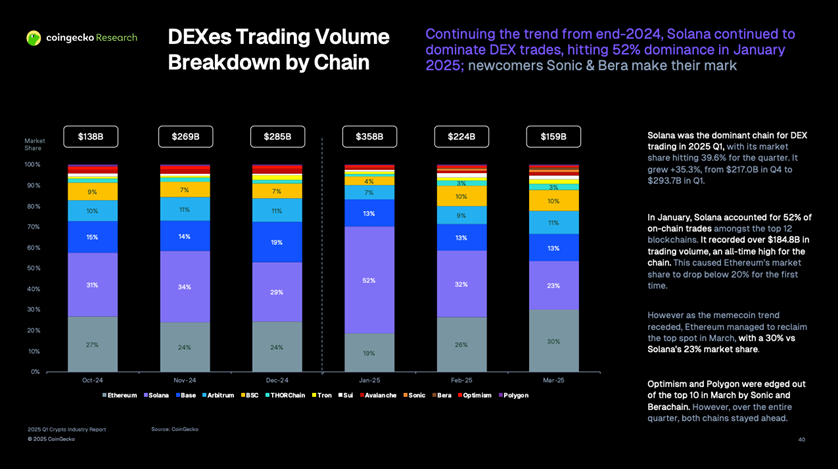

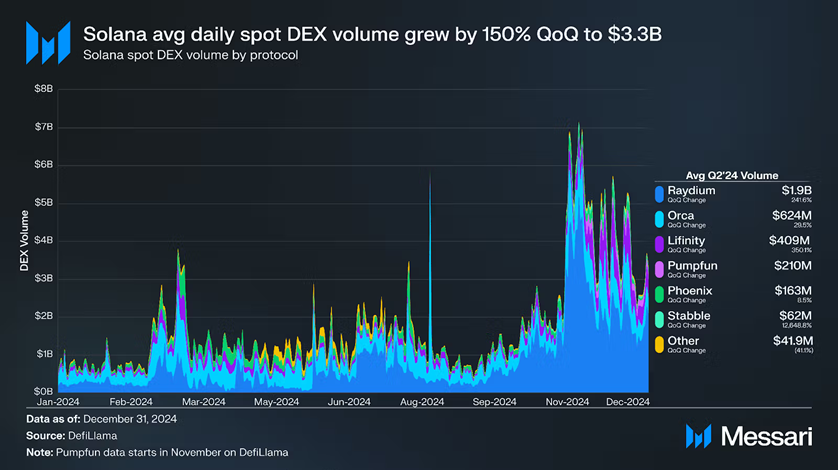

Solana (2020–): The "Transaction Hotness King" Winning with Performance

Solana took a different path—winning with extreme performance. Its high throughput (TPS) and low transaction costs make it very friendly to high-frequency trading, DEX, and meme coins, which have high performance requirements. This advantage began to explode in the second half of 2023, with data from research firm Kaiko showing that during 2024, the daily trading volume of Solana's on-chain DEX briefly surpassed that of Ethereum multiple times[4]. Messari further confirmed this trend in its "State of Solana Q4 2024" report, noting that Solana's TVL soared 486% in that quarter, reaching $8.6 billion[5]. Entering 2025, according to CoinGecko, Solana's share of on-chain transactions reached an astonishing 52% in January, and although Ethereum reclaimed the monthly crown in March due to its deep liquidity, Solana has solidified its position as the "transaction hotness king"[6].

[Chart 1.3: Q1 2025 Major Public Chain DEX Trading Volume Share]

(Source: CoinGecko 2025 Q1 Crypto Industry Report)

Tron (2018–): The "Stablecoin Settlement King"

Amid the clamor of DeFi and meme competition, Tron has quietly occupied a crucial ecological niche: stablecoins, particularly the global retail and cross-border settlement network for USDT. With its extremely low transfer fees, Tron has become the preferred mainstay for small stablecoin payments and remittances worldwide. According to CoinDesk Data, by the first half of 2025, the monthly stablecoin transfer volume on the Tron network had stabilized above $600 billion, with over 60% of transaction volumes below $1,000, fully reflecting its dominance in the retail payment sector[7].

Other Representatives: New Forces and L2 Ecosystems

• Next-Generation Public Chains: Represented by Aptos, Sui, Sei, etc., also focusing on high-performance narratives, their ecological TVL began to grow rapidly in 2025, entering a "germination phase"[8].

• Ethereum L2: Layer 2 solutions like Arbitrum, Optimism, Base, etc., as a core strategy for Ethereum's scalability, have taken on a large volume of transactions and TVL, forming a continuous tug-of-war with Solana in terms of "transaction activity" level[6].

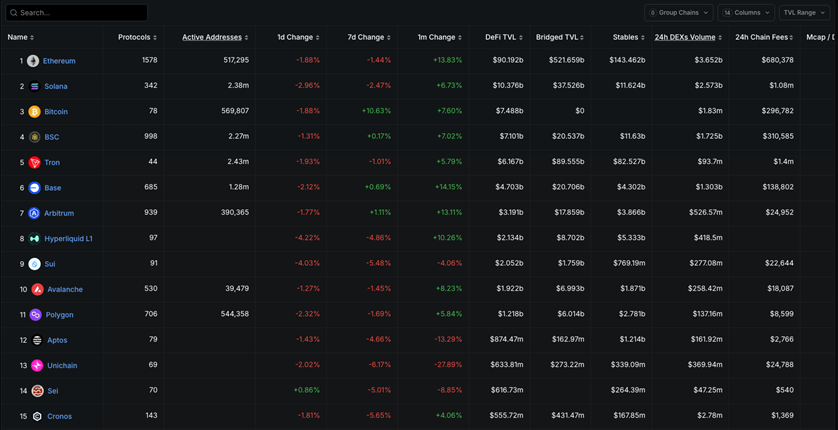

1.2 How the "Mainstream Ranking" of Public Chains has Changed: A Composite Perspective Using TVL + Transaction Volume

A single TVL metric is no longer sufficient to comprehensively measure the health of a public chain ecosystem. Especially after the DeFi Summer of 2020, with the explosion of multi-chain ecosystems, TVL (total locked value) as a measure of "fund weight" and on-chain transaction volume as a measure of "usage heat" together form a dual-track perspective for observing the competitive landscape of public chains. This section will focus on the dynamic changes in the mainstream rankings of public chains after 2020 through these two core indicators.

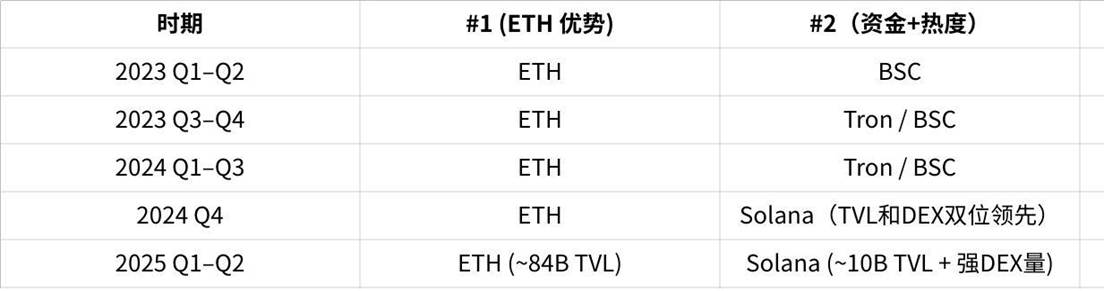

[Chart 1.4: Overview of Changes in Mainstream Public Chain Rankings (Q1 2023 - Q2 2025)]

A. Milestones (2017–2022): Several Waves that Established the Landscape

• 2017–2019: Establishment of Ethereum Standards: Ethereum became the core platform for the explosion of ICOs and early DeFi protocols due to its Turing-complete smart contract capabilities, effectively establishing the technical standards and ecological paradigm for smart contract public chains.

• 2020: DeFi Summer: Core applications within the Ethereum ecosystem, such as lending (Compound, Aave) and trading (Uniswap), experienced explosive growth, and the concept of TVL became deeply ingrained. According to DappRadar data, the total industry TVL reached $189 billion in 2021, a year-on-year increase of 767%, with Ethereum long occupying an absolute dominant position[9].

• 2021: The Year of Multi-Chain and the Highlight Moment of BSC BNB Chain (BSC) successfully captured the massive long-tail assets and user demand that overflowed from Ethereum due to its low fees and EVM compatibility, with its TVL market share approaching 20% at one point during the year. By the end of the year, Terra surpassed BSC in TVL, becoming the second-largest public chain at the time, thanks to its algorithmic stablecoin UST and the Anchor protocol's nearly 20% annual savings interest rate, showcasing the capital narrative's ability to attract funds[10].

• 2022: Reshaping the Landscape Ethereum successfully completed "The Merge" consensus transition, officially entering the PoS era. In the market void left by Terra's collapse, Tron rapidly rose due to its large stablecoin settlement volume. According to Messari, its value settlement volume consistently ranked second across the network that year[11].

B. Recent Trends (2023–2025): Dual-Track Game and Tug-of-War

Entering 2023, the focus of public chain competition became increasingly clear: Ethereum's TVL throne is hard to shake, but the battle for "second/third place" is exceptionally fierce; at the same time, in terms of transaction volume, which represents "usage intensity," Solana launched a strong challenge, weakening Ethereum's absolute advantage.

• Mid-2023 to 2024 (Rotating Period): In terms of TVL, Tron and BNB Chain alternated in occupying the second and third positions, while Solana began a strong recovery after experiencing a low point. In terms of transaction volume, Solana has repeatedly surpassed Ethereum on daily/monthly dimensions. For example, on May 10, 2024, its single-day DEX trading volume reached $1.3 billion, slightly higher than Ethereum's $1.29 billion, achieving a daily "overtake"[4, 12].

• Q4 2024 (Solana's Explosive Period): This was the period of the most dramatic changes in the landscape. Messari pointed out that Solana's TVL surged to approximately $8.6 billion in that quarter, surpassing Tron in November to become the second-largest TVL public chain across the network[5]. The transaction volume was even more astonishing; according to data cited by Binance Square, Solana's daily DEX trading volume in that quarter reached nearly $3.98 billion, exceeding the combined total of Ethereum ($1.71 billion) and Base ($1.21 billion)[13].

• First Half of 2025 (Tug-of-War Phenomenon): Solana's trading heat continued, but Ethereum demonstrated its ecological resilience. According to CoinGecko, although Solana occupied 52% of the on-chain transaction share in January, Ethereum regained the lead in March with a monthly DEX trading volume of $63 billion—its first time since September 2024[6, 15].

• Parallel Trend (Tron): Beyond the fierce competition in TVL and DEX trading volume, Tron's position as a "payment settlement chain" continued to solidify. By the first half of 2025, its monthly stablecoin transfer volume stabilized above $600 billion, becoming one of the de facto standard chains for global retail and cross-border stablecoin payments[7, 8].

Key Points Summary:

• Fund Weight (TVL): ETH was almost always first, with the second place in Q4 2024–2025 more often rotating among Solana/Tron/BSC;

• Usage Intensity (Transaction Volume/DEX): Solana has overtaken Ethereum in multiple time windows, significantly enhancing its dominance in "activity and availability";

• Payment Settlement (Stablecoins): Tron dominates in global retail/cross-border stablecoin transfers, becoming the infrastructure oriented towards "payments."\u0007

Key Data and Case Supplement

• Solana Trading Volume Explosion: In Q4 2024, Solana's single-day DEX trading volume peaked at approximately $3.98 billion, surpassing the combined total of Ethereum ($1.71 billion) and Base ($1.21 billion)[13]. For the entire year, according to Coinspeaker, Solana's average monthly DEX trading volume reached about $258 billion, far exceeding Ethereum's $86 billion[14].

• Short-Term Overtake: As early as May 10, 2024, Solana's single-day DEX trading volume reached $1.3 billion, slightly higher than Ethereum's $1.29 billion, achieving a daily "overtake"[12].

• Tron Stablecoin Ledger Home Court: By the first half of 2025, the monthly stablecoin transfer volume on the Tron network continued to exceed $600 billion, solidifying its position as the core ledger for global stablecoin circulation[8].

Driving Analysis: Why the Changes in Ranking Over Time?

The competition in the public chain space superficially appears to be a contest of technology and data, but behind it lies a multidimensional comprehensive game of user experience, scenario positioning, capital narratives, and ecological vitality.

A. User Experience Drives Traffic

Network performance and transaction costs are the most intuitive feelings for users and the most direct driving force for traffic migration. Solana's ability to challenge Ethereum in trading heat is largely due to its transaction fees as low as approximately $0.00025, which greatly satisfies the needs of high-frequency trading and meme coin cycle users[16]. Similarly, BSC's early rise and Tron's success in the stablecoin payment field are both inseparable from their low-cost trading experiences.

B. Differentiated Scenario Positioning

As the market matures, general-purpose public chains begin to differentiate into specific advantageous areas, forming differentiated user mindsets:

• Ethereum: The "financial center" and "cultural layer" of DeFi and NFTs, expanding its versatile positioning through the L2 ecosystem.

• Solana: The "performance engine" for high-frequency trading and meme coin cycles, specializing in scenarios that demand extreme speed and cost efficiency.

• Tron: The "global payment network" for stablecoins, building a strong moat in the field of small, high-frequency cross-border payments and retail settlements.

C. Capital Orientation and "Explosive Stories"

Capital and users always chase the most attractive stories. In 2021, BSC captured 20% of the TVL share during its peak due to the long-tail asset boom that "everyone could participate in." In the same year, Terra's 20% annualized yield from the Anchor protocol served as an "explosive story," attracting massive funds in a short time and climbing to the second position in TVL, with its subsequent collapse leaving a profound lesson for the market. From 2024 to 2025, Solana successfully drove its trading heat curve with the story of "high performance carrying meme hotspots."

D. Ecological Vitality and Head Adhesion

The long-term value of a public chain is ultimately determined by the quality and vitality of its ecological applications. Ethereum's moat is composed of a series of well-tested DeFi infrastructures like Uniswap, Aave, and Lido. Solana's traffic is more driven by emerging, smoother DEXs and aggregators like Jupiter. While Tron's ecosystem may not be as rich as the first two, its large stablecoin liquidity pool itself constitutes the strongest application scenario, attracting all demand related to stablecoin settlements.

E. Data Transparency Provides Traceability for Competition

The rise of third-party data and research platforms like Messari, DeFiLlama, and CoinGecko has made competition among public chains unprecedentedly transparent. Core indicators such as TVL, transaction volume, and active addresses are quantified and tracked in real-time, providing communities and users with decision-making tools to assess the strengths and weaknesses of each chain, which in turn intensifies the "involution" of public chains in data performance.

1.3 The "Common Formula" for Successful Public Chains

By reviewing the rise and fall of the aforementioned mainstream public chains, we can find that although their "explosive stories" differ, those that can stand out in fierce competition and maintain mainstream rankings often follow a common "formula" for success.

1. Low Fees + High Throughput: The Hard Prerequisite for Trading Activity

In the era of multi-chain competition, network performance and transaction costs are the fundamental prerequisites that determine users' "foot voting."

The astonishing explosion of Solana's DEX trading volume in multiple time windows from 2024 to 2025 directly confirms this[4, 6, 12]. When a network can provide a sufficiently low-cost (almost zero-cost) and efficient (second-level confirmation) trading experience, it possesses the hard conditions to accommodate the market's highest frequency, most speculative, and most vibrant trading demands (such as meme coin trading).

2. Clear "Main Battlefield" Mindset: Differentiated Positioning

As the market matures, general-purpose public chains that attempt to be "all-encompassing" find it difficult to compete with highly focused "specialized" public chains without absolute first-mover advantages. Successful public chains often have an extremely clear and deeply ingrained differentiated positioning.

• Ethereum: The value sediment layer of general smart contracts and the L2 ecosystem.

• Solana: The high-frequency trading chain driven by extreme performance[4].

• Tron: The global stablecoin settlement chain[7].

3. Strong Ecological Hooks: High Proportion of Leading Applications

The prosperity of a public chain relies on the ability to continuously attract and lock in users through leading "hook" applications. These applications not only contribute the majority of on-chain activity but also constitute the ecological moat.

[Chart 1.5: Distribution of Solana Ecosystem DEX Trading Volume]

(Source: Messari "State of Solana Q4 2024" report)

Ethereum's Uniswap, Aave, Lido, and other "DeFi fundamentals" are the cornerstone of its large TVL; Solana's rise heavily relies on the efficient integration and traffic distribution of DEX aggregators like Jupiter. Messari's report indicates that Jupiter alone accounted for approximately 38% of Solana's ecosystem's spot DEX trading volume in Q4 2024[5].

4. Resonance Time Windows of Narratives and Capital

The accumulation of technology and ecology is the foundation, but igniting the market often requires a powerful "narrative" to attract the resonance of capital and users within a specific time window.

[Chart 1.6: Changes in Public Chain TVL Market Share in 2021]

(Source: DeFiLlama)

In 2021, BSC rapidly increased its market share to nearly 20% with the narrative of "low-fee long-tail assets" [3]; by the end of the year, Terra attracted massive amounts of capital in a short time relying on the extreme narrative of "Anchor 20% yield," but also quickly collapsed due to overheated narratives, revealing the risks [10]. From 2024 to 2025, Solana successfully seized the narrative window of "high-performance trading + Meme," while Ethereum demonstrated stronger resilience during market hot switches with its robust narrative of "deep liquidity and diversified applications" [6, 15].

5. Institutional Research and Transparent Data Endorsement

In the current crypto market, the competition among public chains is no longer merely a contest of community volume. Third-party research institutions and data platforms, represented by Messari, Kaiko, CoinGecko, and DeFiLlama, provide institutionalized and traceable competitive benchmarks for the market through continuously updated chain-level research reports and open-source data panels.

[Chart 1.7: DeFiLlama Public Chain TVL Ranking]

(Source: DeFiLlama)

The data from these platforms has become a core decision-making tool for projects, institutions, and deep users to assess the strengths and weaknesses of chain ecosystems and identify "ranking changes," which in turn encourages public chains to pay more attention to the real on-chain data performance.

II. Why Hot Stablecoins and RWA Are "Absent" on Traditional Public Chains

In the first part, we observed that the competition among mainstream public chains mainly revolves around DeFi's TVL and on-chain trading heat. However, since 2023, the narrative focus of Web 3 has quietly shifted. The payment applications of stablecoins and the tokenization of RWA (real-world assets) are becoming the core engines driving the industry into the next phase. Yet, when we examine the existing public chain infrastructure, we find that they were not adequately prepared to accommodate these two major trends from the outset, leading to a noticeable phenomenon of "infrastructure absence."

2.1 Overview of Current Hot Stablecoins and RWA, Their Major Trends, and Web 3's Driving Role

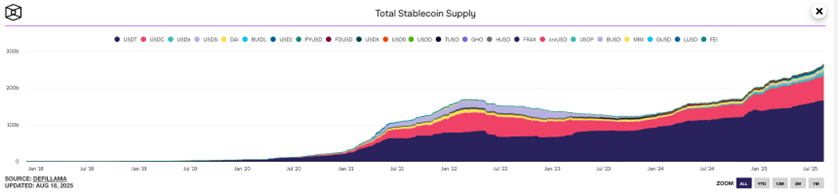

Stablecoins (represented by USDT and USDC) and RWA (tokenization of real-world assets, such as real estate and bonds) are not new concepts, but they have recently shown unprecedented growth momentum. The fundamental reason lies in their ability to address the key issues for Web 3 to go mainstream: value anchoring and asset expansion.

Why are stablecoins and RWA major trends?

• Stablecoins serve as the "dollar" of the crypto world, providing a reliable measure of value and medium of exchange for a highly volatile market. Meanwhile, RWA fundamentally broadens the asset categories and market depth of Web 3 by bringing large-scale traditional assets on-chain. Data shows that the global stablecoin market cap exceeded $180 billion in 2023, and according to a Consensys report, the locked value of RWA-related DeFi protocols also surpassed $7 billion during the same period [17].

[Chart 2.1: Global Stablecoin Total Market Cap TVL Growth Trend]

(Source: The Block Data)

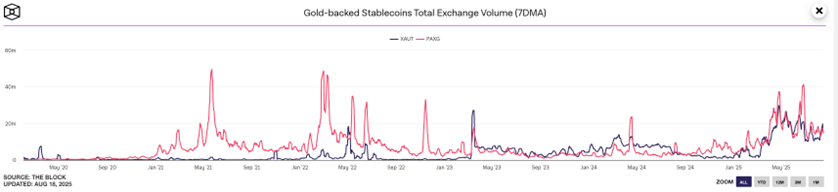

[Chart 2.2: Total Trading Volume of Gold-Backed Stablecoins]

(Source: The Block Data)

Driving Role for Web 3

• The combination of these two trends is pushing Web 3 from a purely endogenous digital asset game to a broader financial ecosystem capable of interacting with the real world in terms of value. The proliferation of stablecoins has significantly reduced the cost and time of cross-border payments, while RWA paves the way for applications closer to traditional finance, such as asset securitization and decentralized lending, collectively accelerating the mainstreaming of blockchain technology and the expansion of user scale.

2.2 Deficiencies of Mainstream Public Chains Regarding Stablecoins and RWA

Although existing public chains are powerful, they are generally designed to be "general-purpose" and have not been natively optimized for scenarios requiring high frequency, high compliance, and high privacy, such as stablecoin payments and RWA. This has exposed the following five core deficiencies when facing the new wave:

2.2.1 Scalability and Performance Bottlenecks

Large-scale payments and asset transactions require networks to have extremely high processing capabilities and very low costs. First, the average transaction confirmation time of traditional public chains like Ethereum mainnet is about 15 seconds, and it can extend to several minutes during network congestion, which cannot meet the immediacy requirements of payment scenarios. Second, high and unstable Gas fees are another major obstacle; during the market peak from 2021 to 2022, network congestion repeatedly caused Gas fees to exceed 200 Gwei, making the cost of a single stablecoin transfer exceed $50, which is unacceptable for small payments and high-frequency trading scenarios [18]. Finally, according to Etherscan data, Ethereum's daily average transaction volume stabilized at about 1.2 million in 2023, close to its theoretical TPS limit, indicating that its network capacity is basically saturated and cannot support the massive transaction demands brought by large-scale stablecoin and RWA applications in the future.

2.2.2 Insufficient Cross-Chain Interoperability

The value transfer of stablecoins and RWA inevitably involves a multi-chain environment, but the current cross-chain bridge infrastructure remains a hotspot for security risks. The 2021 Poly Network cross-chain bridge hack, which resulted in losses exceeding $600 million, exposed the vulnerabilities of cross-chain asset security [19]. At the same time, the multi-chain ecosystem has led to severe asset fragmentation issues, where users often need to perform cumbersome operations across at least 3-5 different chains, resulting in a poor experience and significantly increasing the risk of user attrition. According to Chainalysis data, losses caused by cross-chain bridge scams and security incidents accounted for over 50% of all DeFi security incidents in 2023, which severely undermined users' confidence in conducting large asset cross-chain transactions [20].

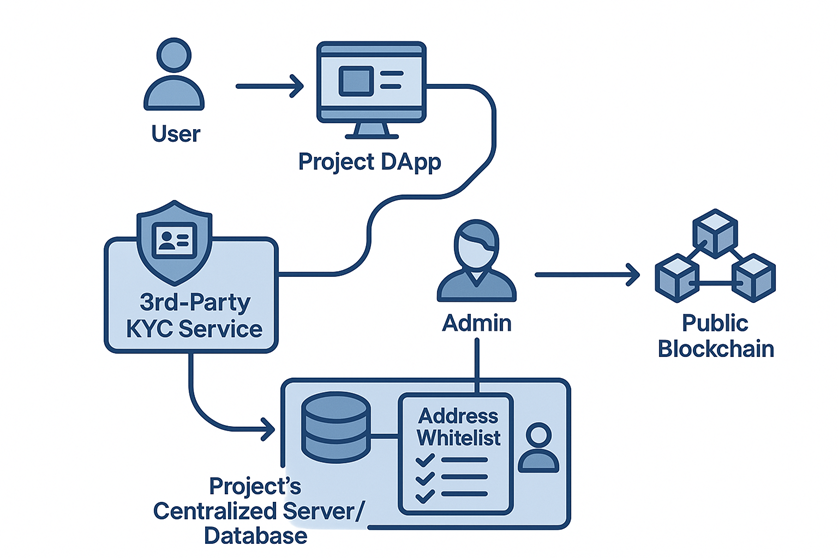

2.2.3 Compliance and Regulatory Adaptation Difficulties

Stablecoins and RWA are closely linked to real-world assets and inevitably face strict financial regulation. Regulatory agencies like the SEC have strengthened oversight of stablecoin issuers in 2023, requiring them to meet KYC/AML compliance [21]. However, most existing public chains lack native on-chain identity verification modules, forcing project parties to rely on piecemeal, poorly experienced third-party solutions to achieve compliance, resulting in high compliance costs. As the International Monetary Fund (IMF) pointed out, compliance for RWA on-chain is one of the main obstacles to its large-scale application.

[Chart 2.3: Schematic Diagram of "Patchwork" Architecture for Asset Compliance on Traditional Public Chains]

(Source: Author's own creation)

2.2.4 Data Privacy and Security Needs

The completely public and transparent transaction data of traditional public chains poses a significant barrier for business and financial scenarios that require privacy protection, as no real-world enterprise is willing to disclose its complete supply chain payment records or details of RWA asset portfolios involving sensitive information. Market demand is driving technological change; according to Gartner's prediction, within the next three years, 75% of blockchain applications will need to introduce privacy protection technologies to meet corporate compliance needs [22]. Although existing public chains can integrate privacy technologies like zero-knowledge proofs (zk-SNARKs), these typically exist as independent L2 or application layer solutions, facing performance and usability bottlenecks, which also exacerbates the fragmentation of the ecosystem.

2.2.5 Incomplete Asset On-Chain Processes and Infrastructure

The tokenization of RWA is not just a technical issue; it also involves a series of complex off-chain processes such as asset proof, credit endorsement, legal rights confirmation, custody, and auditing, while the industry currently lacks unified and efficient standards and infrastructure. For current DeFi, the proportion of RWA-related smart contracts is less than 5%, clearly indicating that the relevant infrastructure is still in a very early stage of development. A ConsenSys report also clearly pointed out that one of the biggest challenges facing the RWA market in 2024 is the lack of a well-established on-chain asset custody and compliance auditing mechanism [17]. Existing public chains, as purely technical platforms, have not provided native tools or frameworks to address these "off-chain" challenges.

III. How BenFen Public Chain Can Fill the Infrastructure Gap for Stablecoins and RWA

In the second part, we analyzed the multiple shortcomings of traditional general-purpose public chains when facing stablecoin payments and RWA (real-world assets) in this new wave of Web 3, including performance, security, compliance, and usability. These shortcomings cannot be simply remedied by technical iterations; they stem from the underlying design "genes" that were not born for such scenarios.

This chapter will detail how BenFen, as a new generation of high-performance stablecoin public chain, systematically fills these gaps through a series of native, dedicated infrastructure designs, aiming to become the core platform for accommodating the next round of value growth in Web 3.

3.1 Move Language—A Secure and Flexible Foundation for Smart Contract Development

For high-value stablecoins and RWA assets representing real-world rights, the security of smart contracts is an insurmountable bottom line. The massive losses of funds due to contract vulnerabilities on traditional public chains (like Ethereum) have repeatedly proven this point. From day one, BenFen has prioritized security, and its core decision has been to choose Move language as the sole smart contract development language.

The Move language was designed by the Meta (formerly Facebook) team for the Diem project. Its core "Resource Type" system treats digital assets (such as tokens) as a special type, prohibiting the arbitrary duplication of assets (to prevent inflation vulnerabilities) or accidental destruction (to prevent asset loss) at the language level. This means that the Move language is fundamentally immune to a series of fatal vulnerabilities commonly found in Solidity contracts, such as integer overflow and reentrancy attacks. Additionally, its modular smart contract design facilitates developers in constructing and auditing complex financial logic, making it very suitable for the complex business needs of stablecoins and RWA. By adopting the Move language, BenFen significantly reduces the security risks and development costs for developers when issuing and managing high-value assets.

3.2 One-Click Issuance of Stablecoins and RWA Assets

Issuing assets on traditional public chains, especially complex RWA, involves cumbersome processes and high technical barriers, which is a significant reason hindering their scalable development. To address this pain point, BenFen provides a standardized tool for "one-click issuance," encapsulating complex on-chain operations into a simple front-end interface.

This feature is based on BenFen's advanced object-centric model, treating each token as an independent "object" and unifying asset issuance standards through a built-in official coin core module. Project parties or institutions do not need to engage in complex smart contract coding; they can complete compliant and transparent on-chain asset issuance simply by filling in the core parameters of the asset (such as name, symbol, total supply, etc.) through a configurable interface. This not only greatly improves the efficiency of asset onboarding but also provides native support for the entire lifecycle management of assets (issuance, transfer, redemption, etc.), laying the foundation for rapid ecosystem expansion.

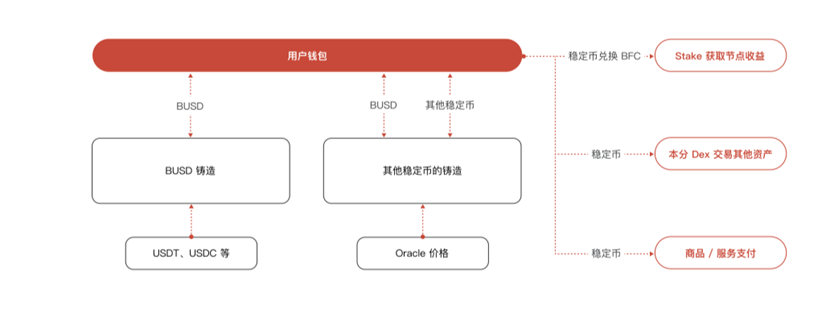

[Chart 3.1: Stablecoin Creation Flowchart]

(Source: BenFen Public Chain White Paper)

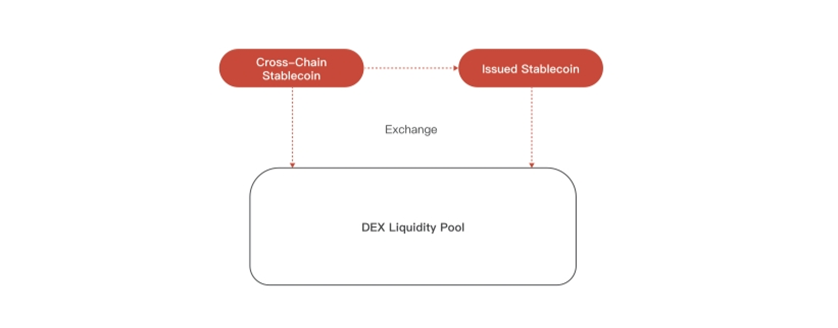

3.3 Support for Multiple Stablecoins and Multi-Asset Coexistence Ecosystem

To address the over-centralization of US dollar stablecoins and the limitations of a single currency, BenFen natively supports a multi-currency stablecoin system at the protocol layer. This system uses the core stablecoin BUSD (which is 1:1 pegged to mainstream US dollar stablecoins through cross-chain bridges) as a reserve and exchange medium, obtaining real-time foreign exchange prices through on-chain native oracle services, thereby supporting the efficient and low-cost issuance and circulation of stablecoins pegged to different national fiat currencies (such as BJPY, BEUR, etc.) within the ecosystem.

This multi-currency coexistence mechanism not only meets the localized payment and settlement needs of different regions globally (such as cross-border e-commerce and local payments) but also allows for more complex cross-asset interactions and transactions, providing the necessary underlying support for diversified financial scenarios such as consumer payments, lending, and wealth management, helping to build a more inclusive global financial network.

[Chart 3.2: Stablecoin Circulation Diagram within the BenFen Ecosystem]

(Source: BenFen Public Chain White Paper)

3.4 Stablecoins Directly Pay Gas Fees, Optimizing User Experience

Traditional public chains require users to hold their native tokens (such as ETH) to perform any on-chain operations, creating significant friction and barriers for new users. As the first public chain to natively support stablecoin payment of gas fees, BenFen fundamentally resolves this issue.

Users conducting any transactions within the BenFen ecosystem can directly use mainstream stablecoins like BUSD to pay gas fees, without needing to purchase and hold the volatile native token BFC in advance. This mechanism separates the "transaction initiator" from the "gas fee payer" at the protocol level, even allowing project parties to directly cover gas fees for users through a transaction sponsorship feature. This makes the user payment experience more aligned with real-world habits, significantly enhancing the usability of stablecoins in payment scenarios, and is a key step towards bringing Web 3 applications into the mainstream.

3.5 Compliance and Privacy Support of BenFen Public Chain

BenFen directly addresses the rigid demands for compliance and privacy in stablecoins and RWA through natively integrated functional modules.

• Native Compliance Framework: In response to the KYC/AML compliance requirements for assets like RWA, the BenFen ecosystem has built-in the BenFen KYC on-chain identity verification system. This system adopts W3C's DID and VC standards, allowing project parties to verify investor identities at the protocol level, achieving standardized and efficient compliance processes while ensuring that users' KYC information is controlled by the users themselves.

• Native Privacy Support: To address the need for sensitive information protection for assets like RWA, BenFen supports privacy accounts and privacy payments at the virtual machine level. Once assets are deposited into a privacy account, their actual balance is hidden on-chain. Payments made between two privacy accounts only reveal an encrypted interaction record to the outside world, without disclosing the specific amount. This provides the necessary privacy protection for large-scale compliant commercial applications on-chain.

3.6 Ecological Outlook: A Bridge Connecting Traditional Finance and Web 3

In summary, BenFen is not a simple copy or performance iteration of existing public chains; rather, it systematically addresses the core shortcomings of traditional public chains in accommodating stablecoin and RWA businesses through a series of native, dedicated infrastructures. By providing a "safer (Move language), easier to use (stablecoin gas, one-click issuance), and more compliant (native KYC/privacy)" infrastructure, BenFen aims to build a complete ecosystem of stablecoins and RWA that connects traditional finance with Web 3.

Its ultimate goal is to open up the circulation channels between on-chain and off-chain assets, helping trillions of traditional financial assets complete their digitization and securitization, and to introduce quality partners and institutions to jointly create a multi-win financial ecosystem that truly serves the value transfer of the real world.

IV. Conclusion

The development of public chains is at a new historical turning point. If the core competition of the previous cycle was the Lego-style combination of "general-purpose" DeFi protocols, then the traffic in the next three years will belong to those "dedicated" infrastructures that can truly connect the real world and accommodate large-scale payments and compliant assets.

This report points out through analysis that while traditional public chains like Ethereum have a solid foundation, they struggle to natively support the core needs of stablecoin payments and RWA in terms of performance, cost, compliance, and privacy, revealing a clear "infrastructure gap."

BenFen has emerged in this structural gap. It is not another general chain attempting to compete in all areas, but rather, through a series of focused designs—such as the asset security brought by the Move language, the low threshold of one-click issuance, the ultimate user experience provided by stablecoin gas, and the native compliance and privacy modules—it has tailored a complete, efficient, and reliable underlying infrastructure for the explosion of PayFi and RWA.

We believe that the next chapter of public chains will be written by those platforms that can truly serve the real economy and reduce friction in value transfer. BenFen, with its clear positioning and dedicated technology stack, is already prepared for this.

V. References

1. DeFiLlama. (2025). Cryptocurrency Market Cap & DeFi TVL. Retrieved August 18, 2025, from https://defillama.com/

2. DeFiLlama. (2025). Ethereum Chain TVL. Retrieved August 18, 2025, from https://defillama.com/chain/Ethereum

3. Mint Ventures. (2021). Multi-angle Analysis of Pancake. Medium. Retrieved from https://medium.com/@mint-ventures/multi-angle-analysis-of-pancake-business-is-back-to-a-new-high-what-is-its-project-valuation-6a98dfb213c8

4. Kaiko Research. (2025). Kaiko's Top 10 Charts of 2024. Retrieved from https://research.kaiko.com/insights/kaikos-top-10-charts-of-2024

5. Messari. (2025). State of Solana Q4 2024. Retrieved from https://messari.io/report/state-of-solana-q4-2024

6. CoinGecko. (2025). 2025 Q1 Crypto Industry Report. Retrieved from https://assets.coingecko.com/reports/2025/CoinGecko-2025-Q1-Crypto-Industry-Report.pdf

7. CryptoSlate. (2025). CoinDesk data: Tron surpasses $600 B in monthly stablecoin transfers. Retrieved from https://cryptoslate.com/coindesk-data-tron-surpasses-600b-in-monthly-stablecoin-transfers/

8. BlockchainReporter. (2025). Chains With Top TVL Growth. Retrieved from https://blockchainreporter.net/chains-with-top-tvl-growth-ethereum-dominates-defi-solana-bitcoin-bsc-tron-and-others-among-top-10/

9. DappRadar. (2022). 2021 Dapp Industry Report. Retrieved from https://dappradar.com/blog/2021-dapp-industry-report

10. TabInsights. (2021). Ethereum dominates DeFi market while Terra overtakes BSC. Retrieved from https://tabinsights.com/article/ethereum-dominates-defi-market-while-terra-overtakes-bsc-as-the-second-largest-defi-blockchain

11. Messari. (2023). State of Tron Q4 2022. Retrieved from https://messari.io/report/state-of-tron-q4-2022

12. DailyCoin. (2024). Solana Overtakes Ethereum in DEX Volume. Retrieved from https://dailycoin.com/solana-overtakes-ethereum-dex-volume-is-ethereum-slipping/

13. Binance Square. (2025). Solana's DEX Trading Volume Surpasses Ethereum and Base Combined. Retrieved from https://www.binance.com/en/square/post/01-07-2025-solana-s-dex-trading-volume-surpasses-ethereum-and-base-combined-18594004884034

14. Coinspeaker. (2025). Solana Outshines Ethereum Again as DEX Volume Surges. Retrieved from https://www.coinspeaker.com/solana-outshines-ethereum-again-as-dex-volume-surges/

15. The Defiant. (2025). Ethereum Surpasses Solana to Lead DEX Volume. Retrieved from https://thedefiant.io/news/defi/ethereum-surpasses-solana-to-lead-dex-volume-63-billion-march-2025-despite-8-18-eca38b52

16. The Currency Analytics. (2024). Solana DEX Volume Overtakes Ethereum and BNB. Retrieved from https://thecurrencyanalytics.com/altcoins/solana-dex-volume-overtakes-ethereum-and-bnb-in-major-defi-shift-186094

17. ConsenSys. (2023). The State of Web 3 perception around the world. Retrieved from https://consensys.io/insight-report/web-3-and-crypto-global-survey-2023

18. YCharts. Average Ethereum Gas Price Data. Retrieved from https://ycharts.com/indicators/ethereumaveragegas_price

19. CNBC. (2021). Suspected hacker behind $600 million Poly Network crypto heist did it ‘for fun’. Retrieved from https://www.cnbc.com/2021/08/12/poly-network-hacker-behind-600-million-crypto-heist-did-it-for-fun.html?qsearchterm=Poly%20Network

20. Chainalysis. (2024). The 2024 Crypto Crime Report. Retrieved from https://www.chainalysis.com/blog/2024-crypto-crime-report-introduction/

21. Solidus Labs. (2023). 2023 Crypto Enforcement Trends. Retrieved from https://www.soliduslabs.com/research/2023-crypto-enforcement-trends

22. Gartner. (2024). Gartner Identifies the Top Cybersecurity Trends for 2024. Retrieved from https://www.gartner.com/en/newsroom/press-releases/2024-02-22-gartner-identifies-top-cybersecurity-trends-for-2024

Disclaimer

This report is for reference only and does not constitute any investment, legal, accounting, or tax advice, nor does it constitute an offer or invitation to sell or purchase any tokens or securities.

The information in this report is sourced from publicly available materials and interviews. While Bixin Ventures and the BenFen team strive for accuracy and reliability, they make no guarantees regarding the accuracy and completeness of this information. The views, analyses, and forecasts in the report represent the authors' judgments as of the date of publication and are subject to change without notice.

This report contains certain forward-looking statements that are subject to risks, uncertainties, and assumptions, which may ultimately prove to be incorrect. The cryptocurrency market is highly volatile and risky, and past performance should not be used as a basis for future results.

Under no circumstances shall the authors or publishers of this report be liable for any loss incurred by any person as a result of using any content in this report. Investors should conduct independent due diligence and consult professional financial advisors before making any investment decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。