Source: Grayscale; Compiled by AIMan, Golden Finance

Key Points of This Article

- Credibility is crucial for fiat currency. Today, due to high public debt, rising bond yields, and uncontrolled deficit spending, the U.S. government's commitment to maintaining low inflation may no longer be entirely credible. We believe that strategies for managing the national debt burden will at least involve moderate high inflation, a possibility that is increasingly likely. If holders of dollar-denominated assets believe this, they may seek other means of value storage.

- Cryptocurrencies like Bitcoin and Ethereum may achieve this goal. They are alternative monetary assets based on new technology. As a means of value storage, their most important features are programmatic, transparent supply, and autonomy not controlled by any individual or institution. Like physical gold, their utility partly stems from their immutable nature and independence from political systems.

- As long as public debt continues to grow uncontrollably, the government cannot credibly commit to maintaining low inflation, and investors may question the viability of fiat currency as a means of value storage. In this environment, macro demand for crypto assets may continue to rise. However, if policymakers take steps to enhance long-term confidence in fiat currency, macro demand for crypto assets may decline.

Investing in the crypto asset class means investing in blockchain technology: a network of computers running open-source software to maintain a public transaction database. This technology is changing the way valuable items (money and assets) flow on the internet. Grayscale believes that blockchain will fundamentally change digital commerce and have a profound impact on our payment systems and capital market infrastructure.

But the value of this technology—the utility it provides to users—lies not only in the efficiency of financial intermediation. Bitcoin and Ethereum are both payment systems and monetary assets. These cryptocurrencies have certain design features that can serve as a refuge from traditional fiat currency when needed. To understand how blockchain works, one needs to grasp computer science and cryptography. But to understand the value of crypto assets, one must understand fiat currency and macroeconomic imbalances.

Fiat Currency, Trust, and Credibility

Almost all modern economies use fiat currency systems: paper money (and its digital representation) has no intrinsic value. Surprisingly, the foundation of most of the world's wealth rests on worthless paper. Of course, the true meaning of fiat currency is not the paper itself, but the institutions surrounding it.

For these systems to function, expectations about the money supply need to be based on some foundation—without any commitment to limit supply, no one would use paper money. Therefore, the government commits not to excessively increase the money supply, while the public judges the credibility of these commitments. This is a trust-based system.

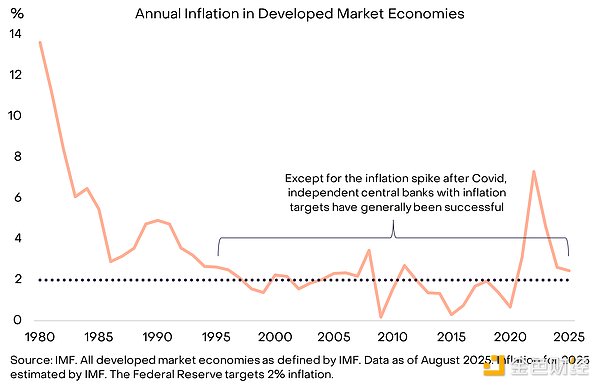

However, history is filled with examples of governments violating this trust: policymakers sometimes increase the money supply (leading to inflation) because it is expedient at the time. As a result, currency holders naturally become skeptical of vague commitments to limit the supply of fiat currency. To make commitments more credible, governments often adopt some institutional framework. These frameworks vary by time and country, but the most common strategy today is to delegate the responsibility of managing the money supply to independent central banks, which explicitly set specific inflation targets. This structure has been the norm since around the mid-1990s and has been largely effective in achieving low inflation (Figure 1).

Figure 1: Inflation targets and central bank independence help build trust

When Currency Fails

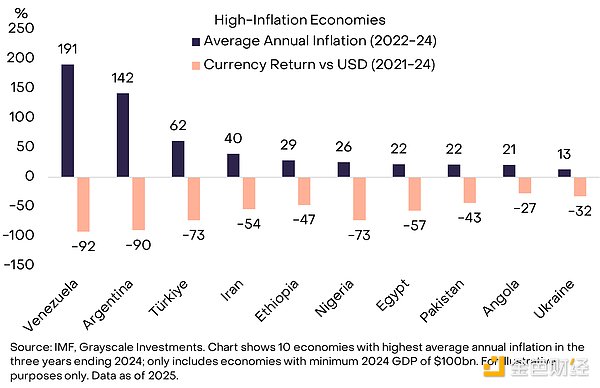

When fiat currency has high credibility, the public does not care about this issue. That is the goal. For citizens of countries with historically low and stable inflation rates, the significance of holding a currency that cannot be used for everyday payments or debt repayment may be difficult to understand. But there are many places in the world that clearly need better currency (Figure 2). No one questions why citizens of Venezuela or Argentina would want to hold part of their assets in foreign currency or certain crypto assets—they clearly need a better means of value storage.

Figure 2: Governments occasionally mismanage currency supply

The ten countries in the above chart have a total population of about 1 billion, many of which have turned to cryptocurrencies as a monetary lifeline. This includes Bitcoin and other cryptocurrencies, as well as blockchain-based stablecoins like Tether (USDT), which is pegged to the U.S. dollar. The adoption of Tether and other stablecoins is merely another form of dollarization—replacing local fiat currency with the U.S. dollar—a practice that has been common in emerging markets for decades.

The World Runs on the Dollar

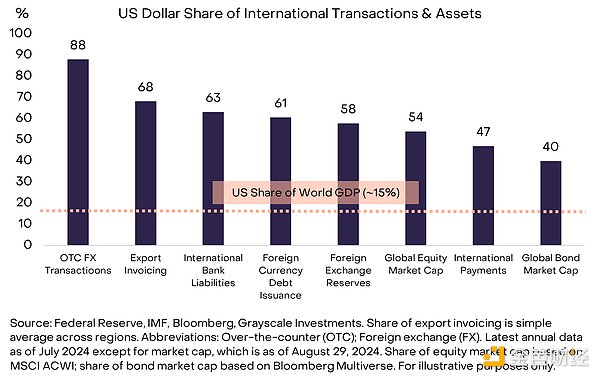

But what if the problem lies with the dollar itself? If you are a multinational corporation, a high-net-worth individual, or a nation-state, you cannot escape the influence of the dollar. The dollar is both the U.S. domestic currency and the dominant international currency today. The Federal Reserve estimates that the dollar accounts for about 60%-70% of international currency usage, while the euro accounts for only 20%-25%, and the renminbi less than 5% (see Figure 3).

Figure 3: The dollar is the dominant international currency today

It is important to clarify that, compared to the emerging market economies in Figure 2, the U.S. does not face issues of mismanagement of its currency. However, any threat to the dollar's robustness is critical because it affects almost all asset holders—not just U.S. residents who use dollars for everyday transactions. The risks faced by the dollar (rather than the Argentine peso or the Venezuelan bolívar) are the real reasons that the largest pools of capital seek alternative assets like gold and cryptocurrencies. While the potential challenges to U.S. monetary stability may not be the most severe compared to other countries, they are the most significant.

The Core Issue is Debt

Fiat currency is built on commitments, trust, and credibility. We believe that the dollar is facing an emerging credibility issue, as it becomes increasingly difficult for the U.S. government to make a convincing commitment to low inflation. The root cause of this credibility gap lies in unsustainable federal government deficits and debt.

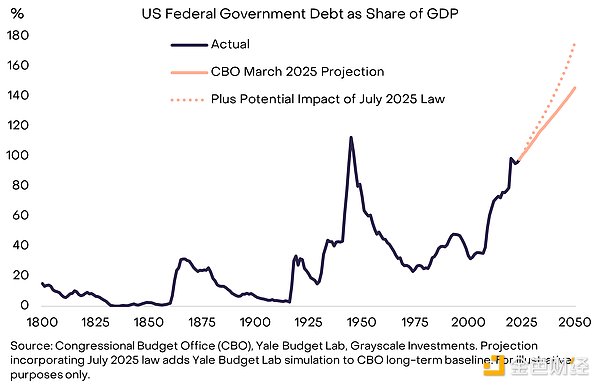

This imbalance began with the 2008 financial crisis. In 2007, the U.S. deficit was only 1% of GDP, and total debt was 35% of GDP. Since then, the federal government has averaged an annual deficit of about 6% of GDP. Currently, U.S. national debt is about $30 trillion, equivalent to 100% of GDP—almost at the level of the last year of World War II—and is expected to continue to grow significantly (Figure 4).

Figure 4: U.S. public debt is on an unsustainable upward trajectory

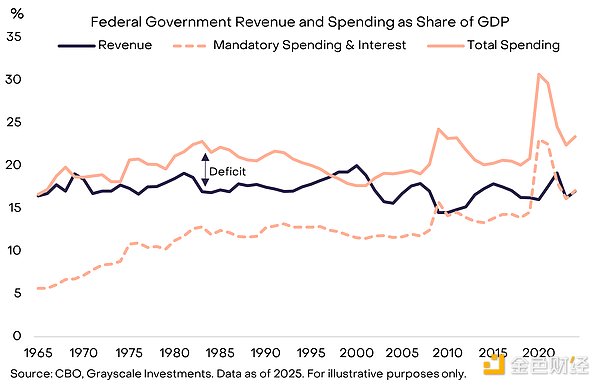

The massive deficit has been a concern for both parties, even in times of relatively low unemployment. One reason modern deficits are difficult to address is that revenues now only cover rigid expenditures (such as Social Security and Medicare) and interest payments (see Figure 5). Therefore, balancing the budget may require politically painful cuts in spending and/or tax increases.

Figure 5: Government revenue only covers mandatory spending plus interest

Interest Payments: A Tight Constraint

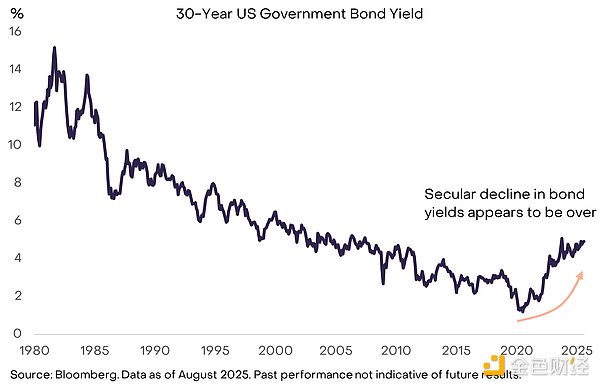

Economic theory cannot tell us how much government debt is too much. Any borrower knows that what matters is not the amount of debt, but the cost of financing. If the U.S. government can still borrow at extremely low rates, debt growth may continue without significantly impacting institutional credibility and financial markets. In fact, some prominent economists have been optimistic about the rise in debt levels in recent years precisely because low interest rates have made financing easier. However, the decades-long trend of declining bond yields now seems to have ended, and the limits of debt growth are beginning to show (Figure 6).

Figure 6: Rising bond yields mean the limits of debt growth are starting to take effect

Like other prices, bond yields ultimately depend on supply and demand. The U.S. government continues to issue more bonds, and at some point in the past few years, it seems to have satisfied the demand for these bonds (low yields/high prices).

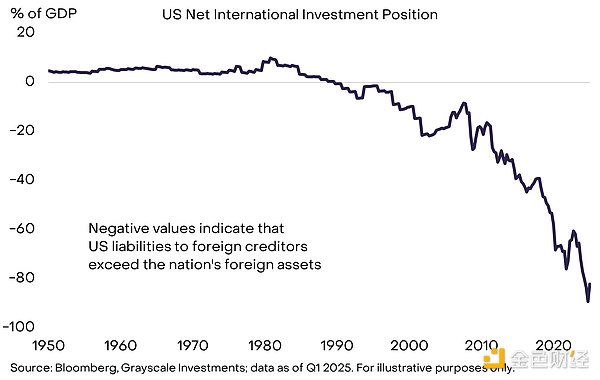

There are many reasons for this, but the key is that the U.S. government borrows both from domestic savers and from abroad. Domestic savings in the U.S. are far from sufficient to absorb all borrowing and investment needs of the U.S. economy. Therefore, there is a significant amount of public debt stock and a large net debt position in the U.S. international accounts (Figure 7). A series of changes in foreign economies over the past few years has led to a decrease in international market demand for low-yield U.S. Treasury bonds. These changes include a slowdown in the accumulation of official reserves in emerging markets and the end of deflation in Japan. Adjustments in the geopolitical landscape may also weaken the structural demand from foreign investors for U.S. Treasury bonds.

Figure 7: The U.S. relies on foreign savings to finance borrowing

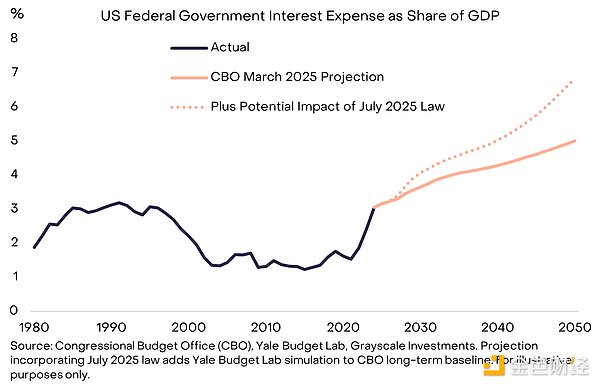

As the U.S. government refinances its debt at higher interest rates, a larger proportion of spending is allocated to interest payments (Figure 8). Low bond yields allowed the debt stock to grow rapidly over nearly 15 years, without significantly impacting the government's interest payments. But that situation has now ended, making the debt issue more urgent.

Figure 8: Higher interest payments are a constraint on debt growth

Why Debt Snowballs

To control the debt burden, lawmakers need to: (1) balance the primary deficit (i.e., the budget balance excluding interest payments); (2) hope that interest costs remain low relative to economic growth rates. The U.S. has a persistent primary deficit (about 3% of GDP), so even if interest rates are manageable, the debt stock will continue to rise. Unfortunately, the latter issue—sometimes referred to by economists as the "snowball effect"—is also becoming increasingly challenging.

Assuming the primary deficit is balanced, the following conditions must be met:

If the average interest rate on debt is lower than the nominal growth rate of the economy, the debt burden (defined as the ratio of public debt to GDP) will decrease.

If the average interest rate on debt is higher than the nominal growth rate of the economy, the debt burden will increase.

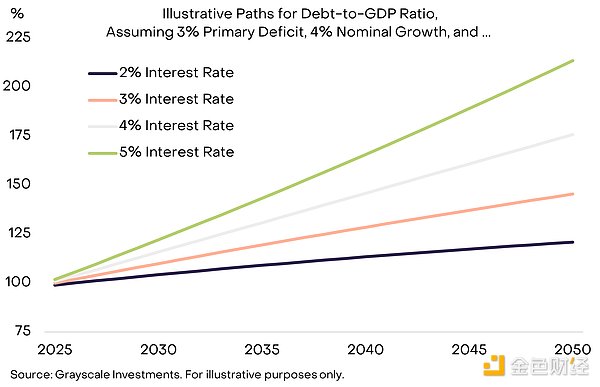

To illustrate the importance of this, Figure 9 shows the hypothetical path of U.S. public debt as a percentage of GDP, assuming a primary deficit remains at 3% of GDP and nominal GDP growth can be maintained at 4%. The conclusion is that when interest rates are relatively high compared to nominal growth rates, the debt burden will increase more rapidly.

Figure 9: Rising interest rates may lead to a snowballing debt burden

In addition to rising bond yields, many forecasters now expect structural GDP growth to slow due to an aging workforce and reduced immigration: the Congressional Budget Office (CBO) predicts that by 2035, the potential labor force growth rate will slow from the current approximately 1% per year to about 0.3%. Assuming the Federal Reserve can achieve its 2% inflation target—which remains an open question—declining real growth rates will mean lower nominal growth rates and accelerated growth of the debt stock.

What is the Conclusion of the Story

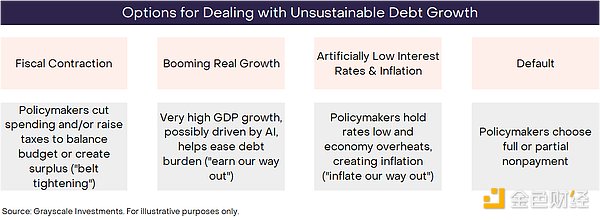

By definition, unsustainable trends cannot continue indefinitely. The unchecked growth of U.S. federal government debt will eventually come to an end, but no one can pinpoint the exact timing. As always, investors need to consider all possible outcomes and weigh their likelihood based on data, policymakers' actions, and historical lessons. Essentially, there are four possible outcomes, which are not necessarily mutually exclusive (Figure 10).

Figure 10: Investors need to consider outcomes and weigh their probabilities

The likelihood of default is extremely low because U.S. debt is denominated in dollars, and inflation is generally less painful than the consequences of not repaying debt. Fiscal tightening may occur in the future—and could ultimately be part of the solution—but the U.S. Congress has just enacted the "Big Beautiful Act," which keeps fiscal policy in a high-deficit state for the next decade. At least for now, reducing the deficit through tax increases and/or spending cuts seems unlikely. Robust economic growth would be the ideal outcome, but growth is currently sluggish, and potential growth is expected to slow. While current data has yet to show this, a significant boost in productivity driven by AI technology will undoubtedly help manage the debt burden.

This leads to artificially low interest rates and inflation. For example, if the U.S. can maintain an interest rate of about 3%, a real GDP growth rate of about 2%, and an inflation rate of about 4%, it could theoretically stabilize the debt stock at current levels without reducing the primary deficit. The structure of the Federal Reserve operates independently to insulate monetary policy from short-term political pressures. However, recent debates and policymakers' actions have raised concerns among some observers that this independence may be at risk. In any case, it may be unrealistic for the Federal Reserve to completely ignore the nation's fiscal policy issues. History shows that in critical moments, monetary policy yields to fiscal policy, and the path of least resistance may be to escape through inflation.

Given the various possible outcomes, the severity of the issues, and the actions policymakers have taken so far, we believe that long-term strategies for managing the national debt burden will increasingly likely result in average inflation rates exceeding the Federal Reserve's 2% target.

Back to Cryptocurrency

In summary, due to the massive scale of debt, rising interest rates, and the lack of other viable coping mechanisms, the U.S. government's commitment to controlling the growth of the money supply and inflation may no longer be entirely credible. The value of fiat currency ultimately depends on the credible commitment of the government not to increase the money supply. Therefore, if there are reasons to doubt this commitment, all investors in dollar-denominated assets may need to consider what this means for their portfolios. If they begin to believe that the reliability of the dollar as a means of value storage is diminishing, they may seek other options.

Cryptocurrencies are digital commodities based on blockchain technology. There is a wide variety of cryptocurrencies, and their uses are often unrelated to "value storage" currencies. For example, public chain applications span a wide range of areas, including payments, video games, and artificial intelligence. Grayscale uses a framework developed in collaboration with FTSE Russell to classify crypto assets based on their primary uses.

We believe that a small portion of these digital assets can be viewed as viable means of value storage due to their wide applications, high decentralization, and limited supply growth. This includes the two largest cryptocurrencies by market capitalization—Bitcoin and Ethereum. Like fiat currencies, they are not "backed" by other assets that confer value. Instead, their utility/value stems from the fact that they allow users to make peer-to-peer digital payments without the risk of censorship, and they make credible commitments not to increase supply.

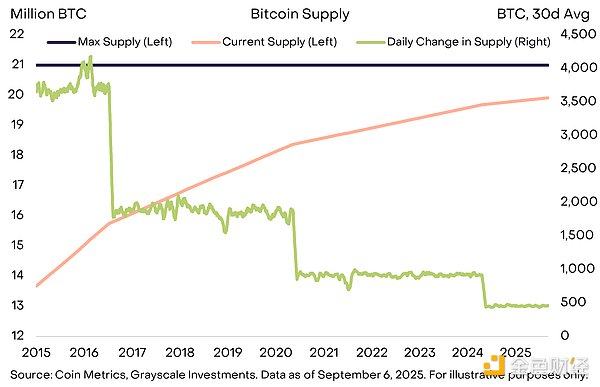

For example, Bitcoin has a supply cap of 21 million coins, with the current supply growing at a rate of 450 coins per day, and the new supply is halved every four years (Figure 11). This is clearly articulated in the open-source code, and any changes cannot be made without consensus from the Bitcoin community. Furthermore, Bitcoin is not subject to any external institutions (such as fiscal authorities that need to repay debt) that might interfere with its low and predictable supply growth targets. A transparent, predictable, and ultimately limited supply is a simple yet powerful concept that has helped Bitcoin's market capitalization grow to over $2 trillion.

Figure 11: Bitcoin provides a predictable and transparent monetary supply

Like gold, Bitcoin itself does not earn interest and is (currently) not widely used for everyday payments. The utility of these assets lies in what they do not do. Most importantly, their supply does not increase because the government needs to repay debt—no government or any other institution can control their supply.

Today's investors must navigate an environment of severe macroeconomic imbalances, the most significant of which is the unsustainable growth of public debt and its impact on the credibility and stability of fiat currency. Holding alternative monetary assets in a portfolio aims to hedge against the risk of fiat currency depreciation. As long as these risks continue to grow, the value of assets that can hedge against this outcome should be higher.

What Could Turn the Tide

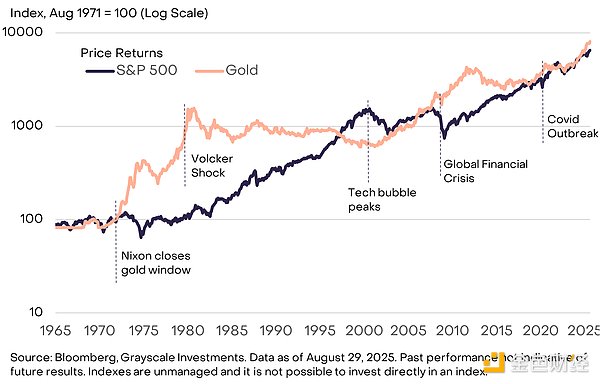

Investing in the crypto asset class involves various risks that are beyond the scope of this report. However, from a macro perspective, a key risk facing the long-term value proposition of certain crypto assets may be that the government strengthens its commitment to managing the supply of fiat currency to restore public confidence. These measures may include stabilizing and reducing the ratio of government debt to GDP, reaffirming support for central bank inflation targets, and taking steps to consolidate the independence of central banks. Government-issued fiat currency is already a convenient medium of exchange. If the government can ensure that it also becomes an effective means of value storage, the demand for cryptocurrencies and other alternative means of value storage may decline. For example, when U.S. institutional credibility was questioned in the 1970s, gold performed well, but in the 1980s and 1990s, as the Federal Reserve controlled inflation, gold performed poorly (Figure 12).

Figure 12: In the 1980s and 1990s, gold performed poorly as inflation declined

Public chains have brought innovation to digital currencies and digital finance. The highest market capitalization blockchain applications are those digital currency systems that provide functions distinct from fiat currency—demand for which is closely related to modern macroeconomic imbalances (such as high public sector debt). Over time, we believe that the growth of the crypto asset class will be driven by these macro factors as well as the adoption of other public chain-based innovative technologies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。