AVAX Price Prediction and Market Outlook After Avalanche Treasury Plan

The Avalanche Foundation is preparing a major fundraising plan to boost its AVAX reserves . As reported by the Financial Times, the non-profit group wants to raise $1 billion through two US-based digital asset treasury companies.

Source: X (previously Twitter)

The goal is to move millions of avalanche tokens into corporate treasuries at discounted prices, giving the network more strategic support.

Two Treasury Deals in Progress

The first deal is being led by web3 investment firm Hivemind Capital. It is aiming to raise up to $500 million, with money expected to come from Nasdaq-listed companies.

Former White House Press Secretary and crypto investor Anthony Scaramucci is advising the project. Insiders believe this deal could be finalized by the end of the month.

The second deal will be run by a special purpose acquisition company (SPAC) backed by Dragonfly Capital.

It also has a target of $500 million and is set to close in October 2025.

Similar to the first transaction, it will purchase AVAX coin directly from the foundation at discounted prices.

Together, both transactions are aimed at establishing a stronger AVAX treasury and boosting adoption among corporate participants.

Why It Matters for Avalanche Investors

This is timely as crypto treasury businesses are under pressure. Companies like Japan’s Metaplanet and Michael Saylor’s Strategy (microstrategy), which deal primarily in Bitcoin, have seen share prices decline recently.

Despite this, corporate crypto treasuries are still in demand.

Avalanche's fundraising can help AVAX receive more attention among major investors seeking large on-chain exposure.

Avalanche's C-Chain also received more than $30 million in inflows during the last month, showing that there is still demand for the ecosystem.

Though the coin continues to lag behind Solana (SOL) and the top altcoins, these treasury flows can help give the necessary push and support from long-term investors.

AVAX Price and Market Outlook

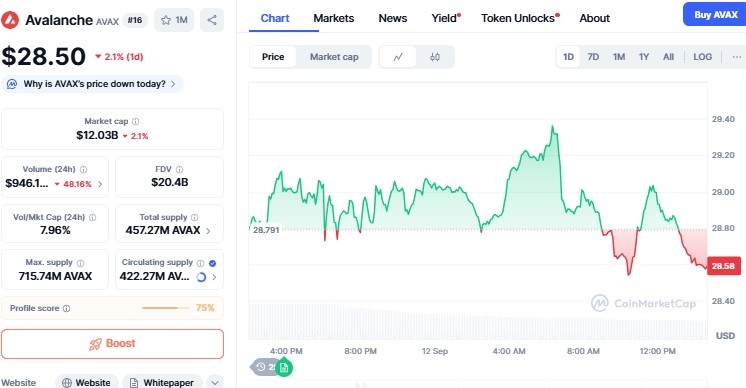

In the previous 24 hours, it fell 0.74% to $28.50, while the total crypto market added 1.14%.

Source: CoinMarketCap

-

The decline was largely due to profit-taking after a robust avalanche price jump of more than 15% in one week.

-

The token's RSI reached 80.16, indicating overbought levels that tend to prompt minor corrections.

-

The cryptocurrency also encountered technical resistance near $29.82 and $28.04.

-

Meanwhile, volume declined 47% to $962 million, indicating diminishing momentum.

Traders are now monitoring important levels at $26.05 (50% Fib retracement) and the 30-day SMA at $24.66 to determine if the bulls can hold them.

AVAX Price Prediction

-

Short Term: It is at $28.60 may retest $26 support. If it holds, a rebound toward $30 is possible.

-

Mid Term: A breakout above $30 could push it toward $34–$38. As long as it stays above $24.60, the trend remains bullish into late 2025.

-

Long Term: With the $1 billion treasury plan, it could climb toward $45–$50 in 2026. If support at $24.60 fails, the price could revisit $20.

Conclusion

The $1 billion treasury plan by Avalanche Foundation is a wake-up call to strengthen the altcoin and increase its presence in corporate treasuries.

As the AVAX price struggles with short-term corrections, the long-term is bright since adoption expands and more institutions take interest.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。