Bitcoin ETFs Hit Record Institutional Demand With Rising Inflows

Bitcoin ETFs have posted another strong week, pulling in $2.34 billion in net inflows between September 8 and September 12, according to SoSoValue.

Source: Sosovalue

This is the third week in a row that spot Bitcoin ETFs have seen money flow in without a single outflow, showing growing confidence among big investors.

-

The largest inflow came from BlackRock’s iShares Bitcoin Trust (IBIT), which added $1.04 billion last week. That brings its total net inflow to nearly $59.8 billion.

-

Fidelity’s Wise Origin Bitcoin Fund (FBTC) followed with a cumulative $12.6 billion.

-

As of September 12, daily inflows hit $642 million

-

Trading volumes for the exchange traded funds reached almost $3.9 billion.

Impact of ETF Flows for Bitcoin Price

Every dollar that enters an ETF is paid for in actual crypto being bought up and stored, removing it from circulation on the exchanges. ETFs now hold over 6.5% of all BTC supply.

This increased demand could potentially be strong enough to price higher, especially at points in time when markets happen to be liquidity-constrained.

Historically, large ETF inflows have coincided with rallies in the price. Prior approvals have triggered increases of over 20% within weeks.

With record-level flows, many observers view this as an indicator that institutions are going all-in on this digital currency.

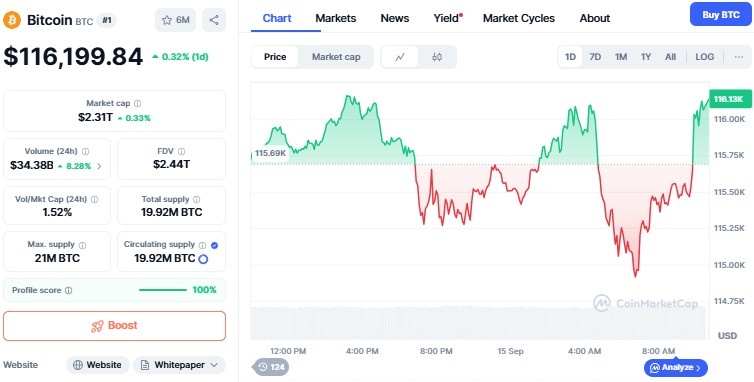

Source: CoinMarketCap

Currently the coin is trading at $116.199 with an increase of 0.33%, while trading volume has increased by 8.65% as per the CoinMarketCap .

Whale Moves and Market Risks

Large holders or whales are also in the spotlight. In August, wallets with at least 1,000 BTC added about 1,721 BTC ($196 million). They now control roughly 68% of BTC’s supply.

That kind of buying usually supports prices, but there’s a catch: some whales recently moved 12,000 BTC to exchanges, which could mean profit-taking.

If the crypto slips under $113,000, analysts warn it may fall to around $101,700, where the 200-day moving average sits.

Macro Factors: CPI and the Fed’s Next Move

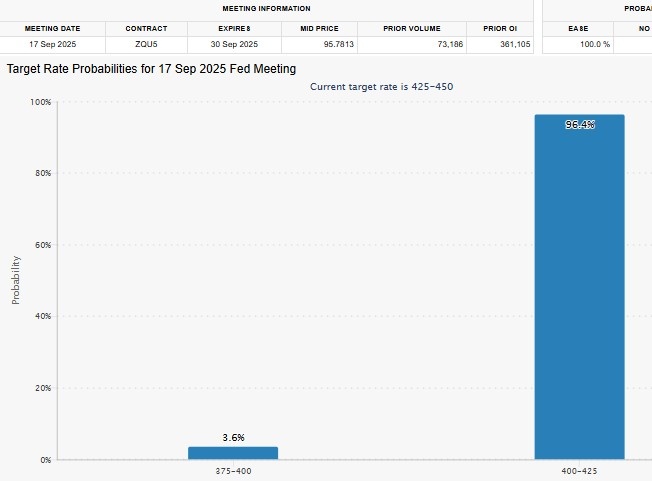

Outside of whales and ETFs, the larger economy is also a major mover. Everyone is waiting for September's CPI reading, which is estimated at around 2.9%. Predictions are depicting high probability of 96% for Fed rate cut in the upcoming FOMC meeting.  Source: Fed Watch Tool.

Source: Fed Watch Tool.

A softer number could pressure the Federal Reserve to reduce the rates, which has a tendency to boost this digital asset by weakening the dollar.

However, if inflation remains elevated, the Fed may hold back from cutting, which could put pressure on it's support at $110,000.

Final Thoughts

Bitcoin ETFs are reimagining the market narrative. With billions pouring in and institutions taking the lead, BTC is increasingly being included in mainstream finance portfolios. But the short-term risks persist, from profit-taking to Fed policy.

For the time being, the message is clear: Bitcoin ETFs are becoming one of the most powerful drivers shaping it's future.

Also read: Blockstream Sounds Alarm on Fake Phishing Email Scam免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。