The cryptocurrency treasury sector is facing a moment of reckoning. David Bailey, CEO of the bitcoin treasury company Nakamoto Holdings, argues that the industry is being rightfully tested due to a chaotic mix of toxic financing and a proliferation of failed companies. He also criticizes what he calls “failed altcoins rebranded as DATs” (Digital Asset Treasuries), claiming this has created a confusing and misleading narrative around the concept of a crypto treasury company.

In a Sept. 14 post on X, Bailey suggested that the old model is collapsing and a new one is emerging: the bitcoin bank. He drew a direct parallel to the traditional financial (TradFi) world, where a company’s fiat treasury is managed by a bank.

“If you’re afraid of that term, call them bitcoin financial institutions,” Bailey explains. “The core strategy is to build and monetize your balance sheet. If you can do it well, you will grow your assets over time; if you do it poorly, you will trade at a discount and be consumed by someone who can do it better.”

Bailey warns those who are bearish on this new category of bitcoin banks against shorting these institutions. He argues that doing so is tantamount to “shorting bitcoin’s role as a primitive in our financial and monetary system.”

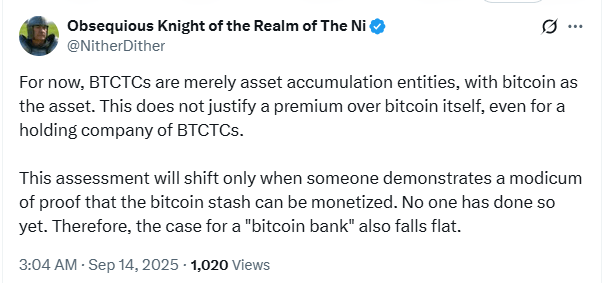

The Nakamoto Holdings CEO’s sharp criticism of failed companies and altcoins ignited a firestorm of backlash, particularly from opponents of bitcoin treasury strategies. Critics challenged the notion that BTC holdings could be effectively monetized, arguing that such claims lack substance and real-world viability.

“It’s not money, so this idea of BTC Treasury is lies built upon a mountain of lies. So many lies that almost everyone has been fooled,” an X user, John Makan, argues. “It is not money and not digital gold, so holding it does not make one a ‘bank.'”

Another user says he would “long BTC and short bitcoin treasury companies like Bailey’s Nakamoto Holdings,” calling it “probably the simplest trade of my life.”

However, Richard Byworth, a partner at the Swiss alternative asset manager Syz Capital, expressed support for Bailey while issuing an ominous warning. “Agree with this wholeheartedly,” Byworth states in his reply to Bailey’s post. “BTCTCs should be very careful about whose money they take. And DATs should be renamed STDs (Sh**coin Treasury Deals) for clarity.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。