Written by: Ethan, Planet Daily

In the world of DeFi, TVL is a key metric—it symbolizes the strength of a protocol and serves as a barometer of user trust. However, a controversy surrounding the falsification of metrics for $12 billion in RWA assets has quickly shattered user trust.

On September 10, Figure co-founder Mike Cagney took to the X platform to publicly accuse the on-chain data platform DefiLlama of refusing to display its RWA TVL solely due to "insufficient social media followers," questioning the fairness of its "decentralization standards."

A few days later, DefiLlama co-founder 0xngmi published a lengthy article titled "The Problem in RWA Metrics" in response, revealing data anomalies behind Figure's claimed $12 billion scale, pointing out that its on-chain data is unverifiable, assets lack real transfer paths, and there are even suspicions of evading due diligence.

Thus, a battle for trust over "on-chain verifiability" versus "off-chain mapping logic" erupted.

Timeline of Events: Figure Takes Initiative, DefiLlama Responds Firmly

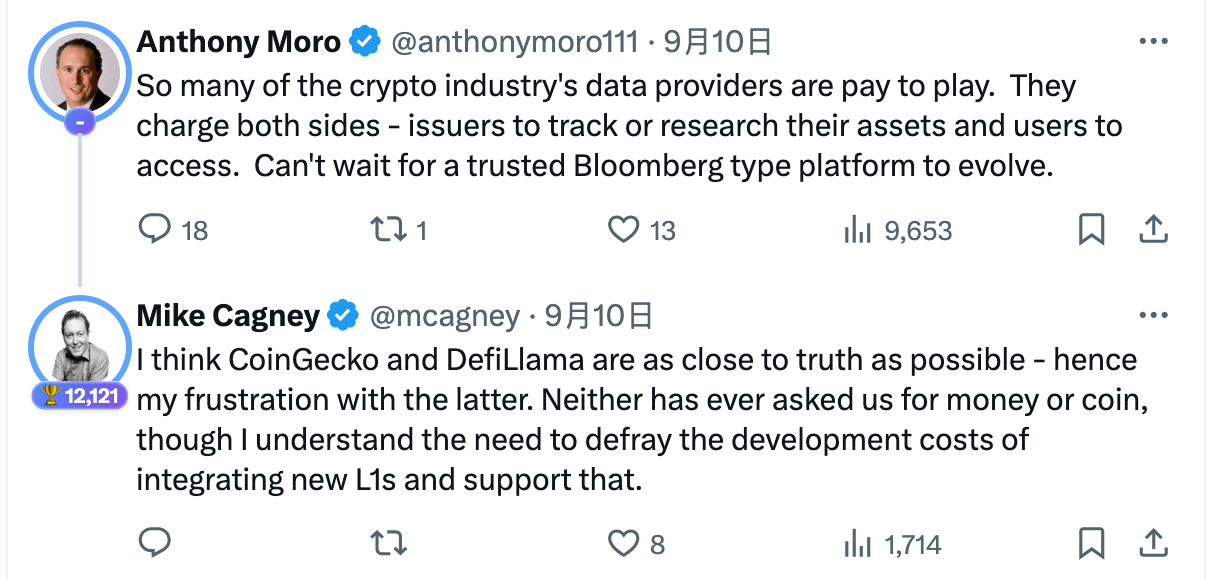

The spark for this controversy came from a tweet by Figure co-founder Mike Cagney.

On September 10, he announced on the X platform that Figure's home equity line of credit (HELOCs) had successfully landed on CoinGecko, while simultaneously accusing DefiLlama of refusing to display Figure's $13 billion TVL on the Provenance chain. He directly targeted DefiLlama's "review logic," even stating that they rejected his listing on the grounds of "insufficient X followers." (Note: Here, Mike Cagney mentions $13 billion, which is inconsistent with the $12 billion mentioned later in 0xngmi's response.)

Shortly after, about an hour later, Provenance Blockchain CEO Anthony Moro (who seemed to have intervened without grasping the full context) commented on the same post, expressing strong distrust towards the industry data platform DefiLlama:

Subsequently, Figure co-founder Mike Cagney added that he understood the development costs of integrating a new L1, but also stated that CoinGecko and DefiLlama had never asked Figure for fees or tokens, clarifying the implication of "paying for listing."

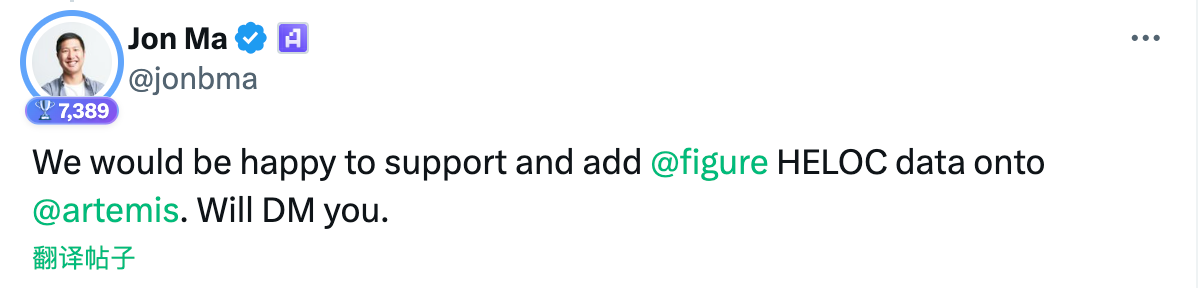

On September 12, Jon Ma, co-founder and CEO of the L1 data dashboard Artemis (who also appeared to be unaware of the controversy's details), publicly extended an olive branch.

During this period, public sentiment seemed to lean heavily towards Figure—many observers pointed their fingers at DefiLlama's "credibility and neutrality."

It wasn't until September 13 that DefiLlama co-founder 0xngmi published the lengthy article "The Problem in RWA Metrics," systematically disclosing their due diligence findings and four points of questioning, which began to shift the narrative; soon after, opinion leaders like ZachXBT shared their support, emphasizing that "these metrics are not 100% verifiable on-chain," and DefiLlama's position gained broader backing.

DefiLlama's Investigation Results: Data Doesn't Match

In the lengthy article "The Problem in RWA Metrics," 0xngmi published the results of DefiLlama's due diligence on Figure, listing multiple anomalies:

The on-chain asset scale is severely inconsistent with the claimed scale.

Figure claims that its on-chain issued RWA scale reaches $12 billion, but the actual verifiable assets on-chain are only about $5 million in BTC and $4 million in ETH. The 24-hour trading volume of BTC is even only $2,000.

Insufficient stablecoin supply.

Figure's own issued stablecoin YLDS has a total supply of only $20 million, theoretically all RWA transactions should be based on this, but the supply is far from sufficient to support a $12 billion trading scale.

Suspicious asset transfer patterns.

Most RWA asset transfer transactions are not initiated by the actual asset holders but are operated through other accounts. Many addresses have almost no on-chain interactions, suspected to be mere database mirrors.

Lack of on-chain payment traces.

The vast majority of Figure's loan processes are still completed through fiat currency, with almost no corresponding payment and repayment records found on-chain.

0xngmi added: "We are unsure how Figure's $12 billion asset scale formed transactions. Most holders seem not to have transferred these assets using their own keys—are they just mapping their internal database onto the chain?"

Community Response: DefiLlama Receives Overwhelming Support

As the controversy spread, community sentiment overwhelmingly supported DefiLlama, but during this process, some differing perspectives emerged.

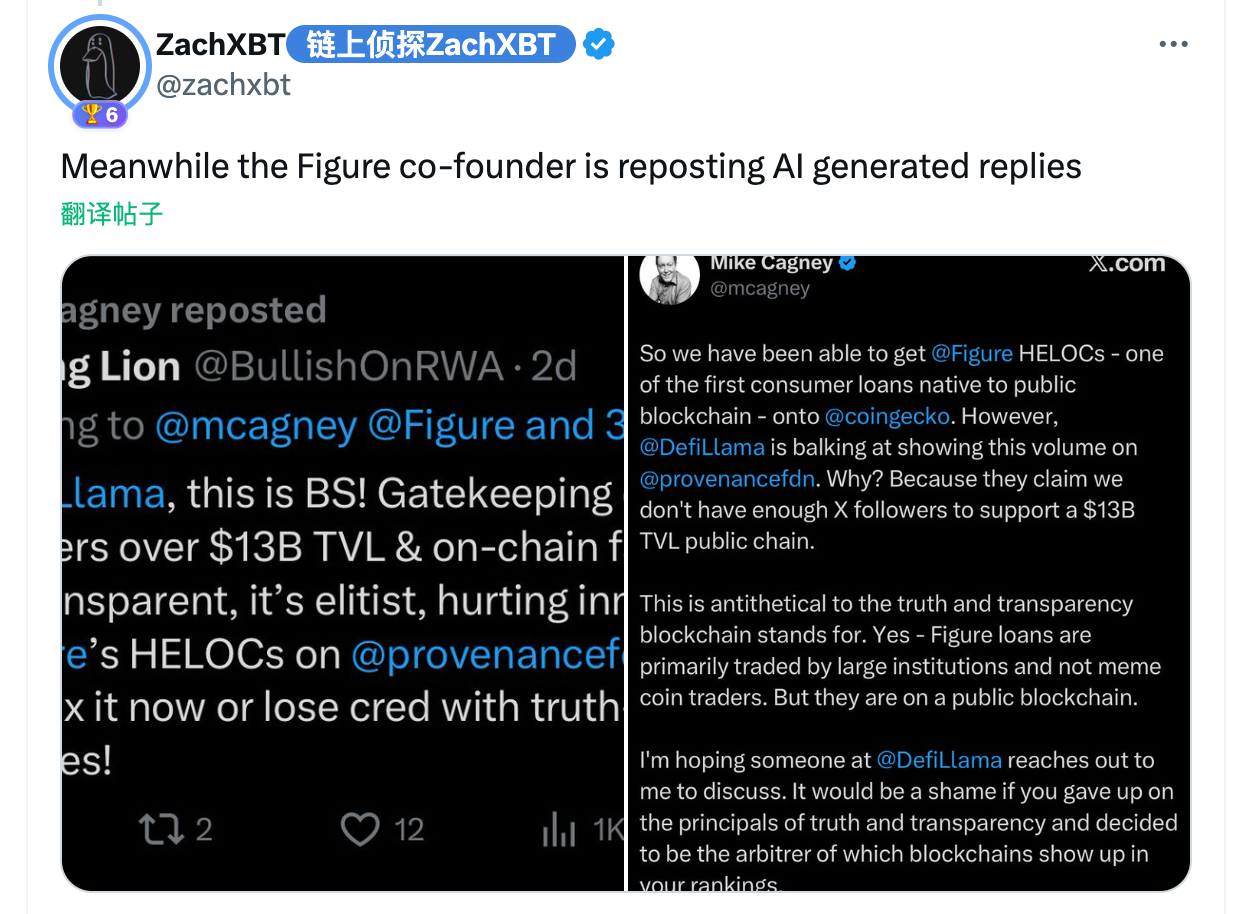

ZachXBT (on-chain detective):

Stated that Figure's actions amounted to "blatant pressure," clearly pointing out: "No, your company is trying to publicly pressure verified participants like DefiLlama with metrics that are not 100% verifiable on-chain."

Conor Grogan (Coinbase board member):

Directed his criticism at those who, while the controversy was still unclear, were lobbied by Figure and privately questioned DefiLlama. He wrote: "I have received many private messages from people at large cryptocurrency institutions and venture capital firms contacting defillama and our partners. Each of these individuals needs to be named in person and asked how they can work in this industry if they can't even verify things themselves."

Conor's statement echoed the sentiments of many: if basic on-chain verification cannot be independently completed, then these institutions' credibility in the RWA and DeFi space will be significantly undermined.

Ian Kane (Head of Partnerships at Midnight Network):

Proposed a more technical suggestion, believing that DefiLlama could add a new metric called "active TVL" in addition to the existing TVL tracking, to show the actual transfer speed of RWA over a certain period. He provided an example: "Example: Two DApps each minted $100 billion in TVL (totaling $200 billion). DApp 1 has $100 billion just sitting there, possibly with only 2% of funds flowing, generating $2 billion in active locked value, while DApp 2 has 30% of funds flowing, generating $30 billion in active locked value (15 times that of DApp 1)."

In his view, this dimension can show the total scale while avoiding "stagnant or showy TVL."

Meanwhile, ZachXBT also noted that Figure co-founder Mike Cagney was continuously retweeting some seemingly AI-generated "supportive comments," publicly pointing this out, further inciting resentment towards Figure's public relations manipulation.

Conclusion: The Cost of Trust is Just Beginning to Show

The dispute between Figure and DefiLlama appears to be a ranking controversy, but it actually strikes at the core vulnerability of the RWA space—what exactly constitutes "on-chain assets."

The core contradiction of this controversy is, in fact, on-chain fundamentalism vs off-chain mapping logic.

DefiLlama's insistence: Only counting TVL that can be verified on-chain, adhering to an open-source adapter logic, and refusing to accept asset data that fails to meet transparency.

Figure's model: Assets may genuinely exist, but the business logic relies more on traditional financial systems, with the on-chain part merely being a database echo. In other words, users cannot prove the flow of assets through on-chain transactions, which conflicts with the "verifiability" standard of DeFi natives.

The so-called $12 billion, if it cannot be verified on-chain, is equivalent to 0.

In an industry where transparency and verifiability are the baseline, any attempt to bypass on-chain verification and use database numbers to impersonate on-chain TVL will ultimately backfire on user and market trust.

This controversy may just be the beginning. In the future, as more RWA protocols emerge, similar issues will continue to arise. The industry urgently needs to establish clear and unified verification standards; otherwise, "virtual TVL" will continue to inflate, becoming the next bombshell that undermines trust.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。