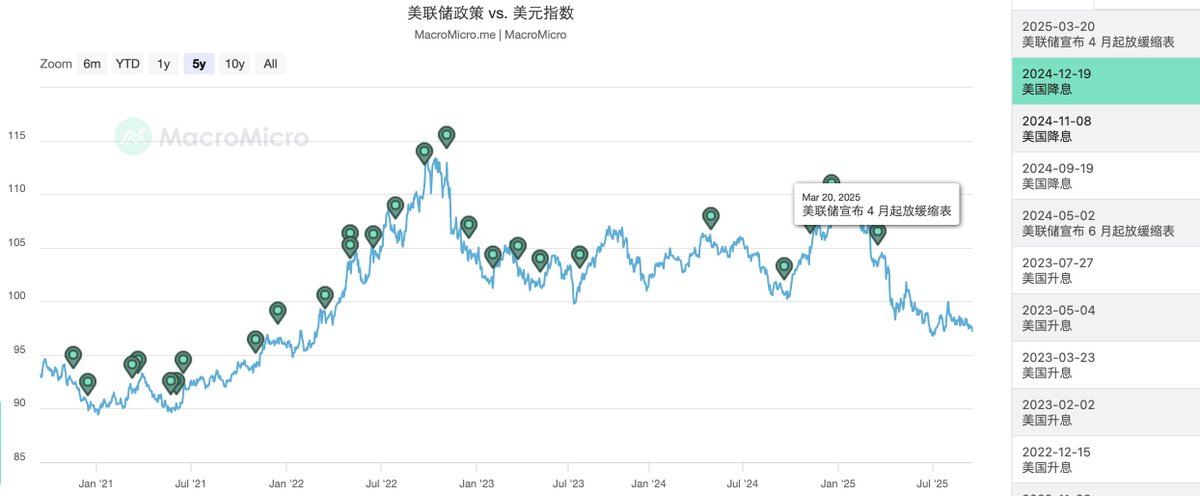

⚡️Trump recently revealed: A significant interest rate cut is expected this week!

I have been observing the movements of large institutions recently and found an interesting phenomenon: top funds like Bridgewater and Renaissance have been aggressively engaging in "rate cut trades" over the past six months.

Let's take a look at what these large institutions are doing, mainly in three categories:

1⃣ Interest Rate Options (Hedging Insurance): Last month, Bridgewater significantly increased its position in put options on interest rates, betting that the Federal Reserve will be forced to cut rates in September, leading to a downward shift in short-term rates.

If the rate cut materializes, it will be profitable; if not, the options provide a safety net, limiting losses.

2⃣ Treasury Futures: Whenever a rate cut window opens, Treasury yields tend to decline. Renaissance has repeatedly increased its positions in 10-year Treasury futures significantly, with rapid adjustments.

3⃣ Gold ETFs: Since the first quarter, Bridgewater has been building a substantial position in gold ETFs, adhering to the principle of risk aversion—when the Federal Reserve injects liquidity, money becomes cheaper, risk aversion rises, and gold prices increase.

The operational logic of top funds is not particularly complex, and I believe there are several ideas worth considering as investment philosophy:

1) First, look at the overall trend, then choose the tools. Macro trend: U.S. fiscal pressure → Federal Reserve forced to cut rates → Interest rate center moves down. Once the direction is set, use tools to amplify returns.

2) In an uncertain environment, first control the downside with position and tools, then pursue the upside. First, ensure survival, then seek profit.

3) In a market with frequent volatility, if one must take risks, it is essential to set clear expectations, take profits when the expected difference is achieved, and avoid getting too attached to the battle.

4) Institutions will not put all their chips on one asset; even if one logic fails, the overall portfolio can still outperform.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。