Stephen Miran Joins Fed 1 Day Before Rate Cut Meeting: Why Too Timely?

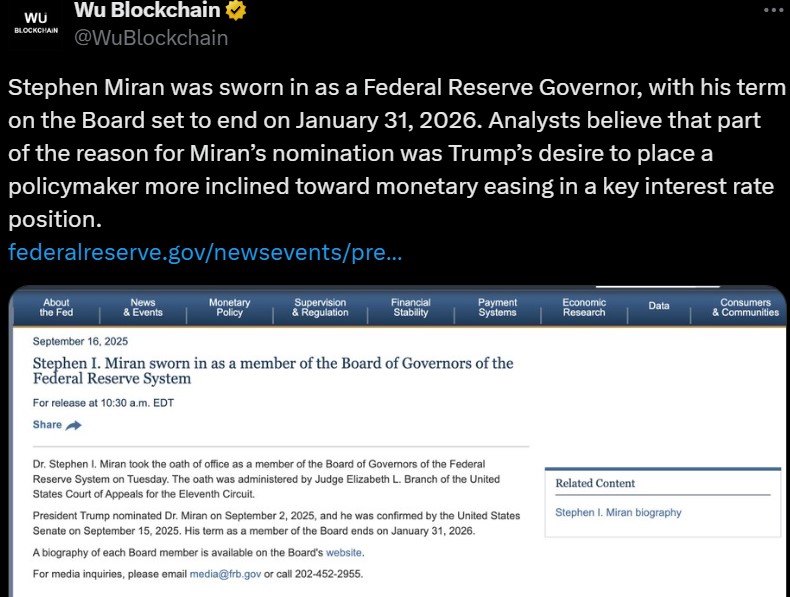

The Federal Reserve has welcomed a new voice to its Board of Governors at a critical moment for U.S. monetary policy. On Tuesday, Dr. Stephen Miran officially took the oath of office as a Federal Reserve Governor, sworn in by Judge Elizabeth L. Branch of the U.S. Court of Appeals for the Eleventh Circuit.

His appointment comes just one day before the September 17 FOMC meeting, when markets expect a decisive move on interest rates.

Stephen Miran appointed Fed governor because President Donald Trump nominated him on September 2, 2025, and the U.S. Senate confirmed him on September 15.

His term is set to end on January 31, 2026, giving him just over four months to leave his mark on monetary policy.

Why Stephen Miran Was Appointed to the Federal Reserve

According to analysts and data shared by Wu Blockchain , Trump’s decision to push Miran’s nomination was strategic. The aim: to place a policymaker more inclined toward monetary easing into a key interest rate role.

For years, the president has openly advocated for lower borrowing costs, often clashing with the Fed’s cautious stance.

With Miran now seated, many believe his influence could tilt the Federal Reserve further toward rate cuts—aligning closely with Trump’s pro-growth agenda.

This raises critical questions about whether political pressure is reshaping the traditionally independent Federal reserve at a time of mounting economic uncertainty.

Fed Meeting Date September 17 , Rate Cut Odds Soar to 96%

The stage is set for a dramatic FOMC meeting which is just 1 day away. The two-day gathering, running from September 16 to September 17, will conclude with a policy statement and press conference at 2:00 p.m. ET tomorrow.

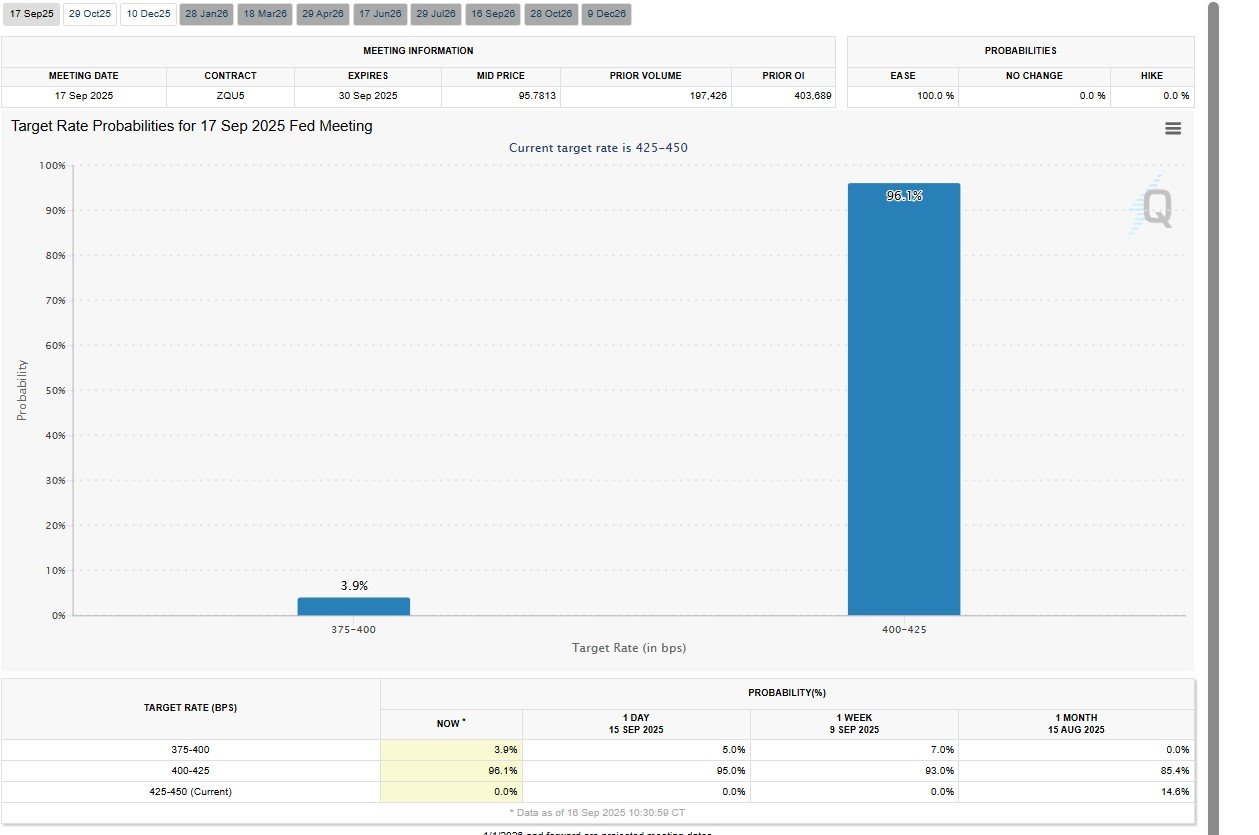

According to the CME FedWatch Tool , the probability of a Fed rate cut tomorrow has soared to 96%, with markets fully pricing in a new target range of 4.25%–4.50%.

That leaves 0% odds for no change or hikes, underscoring the market’s absolute conviction to the question; will fed lower rates tomorrow or not.

This marks a pivotal moment: a 100% implied chance of easing reflects the strongest consensus in recent history and highlights how much pressure is on the Federal reserve to act decisively.

Stephen Miran Federal Reserve First Test Comes Immediately

For Miran, his first day on the job coincides with the Fed’s most consequential meeting of the year. His views on monetary easing and interest rates will be closely scrutinized.

As per Fed rate cut latest news , Will he back a cut tomorrow in line with Trump’s agenda, or will he prioritize institutional independence?

With such high stakes, his vote and influence could be a defining moment, not only for his short term as Governor but also for how the meeting is perceived globally.

All Eyes on Rate Cut Meeting Tomorrow: What Does This Means?

Tomorrow’s Fed meeting time is set at 2 p.m. ET is being watched worldwide. Equities, bonds, and even cryptocurrency markets are already pricing in the cut , with analysts predicting a wave of volatility once the decision is announced.

If they deliver on expectations, the move could support risk assets in the short term but also reignite debates over inflation, independence, and long-term stability. For now, the rate cut probability of 96% leaves little doubt: markets believe they will choose easing over restraint.

A Defining Week for the Federal Reserve

The combination of Stephen Miran’s appointment, Trump’s strategic influence, and a near-certain Fed rate cut tomorrow makes this one of the most defining weeks for the U.S. central bank in years.

As investors and analysts count down to September 17 at 2 p.m., all eyes are on the Federal Reserve—not only for the policy outcome but also for the role its newest Governor will play in shaping it.

Also read: BlockDAG Presale Hits $405M—Will It Affect $BDAG Price Oct Launch免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。