On the 1-hour chart, XRP is doing its best impersonation of a sleepy housecat: it’s lounging just above $3.00 with very little motivation to pounce in either direction. Microstructure is showing a slow grind of higher lows, hinting at accumulation, but every attempt to rally past $3.05 gets smacked back down like an overeager intern at a crypto convention. Volume? Practically napping—low and inconsistent, which confirms the lack of serious commitment from either bulls or bears.

XRP/USD 1-hour chart on Sept. 16, 2025.

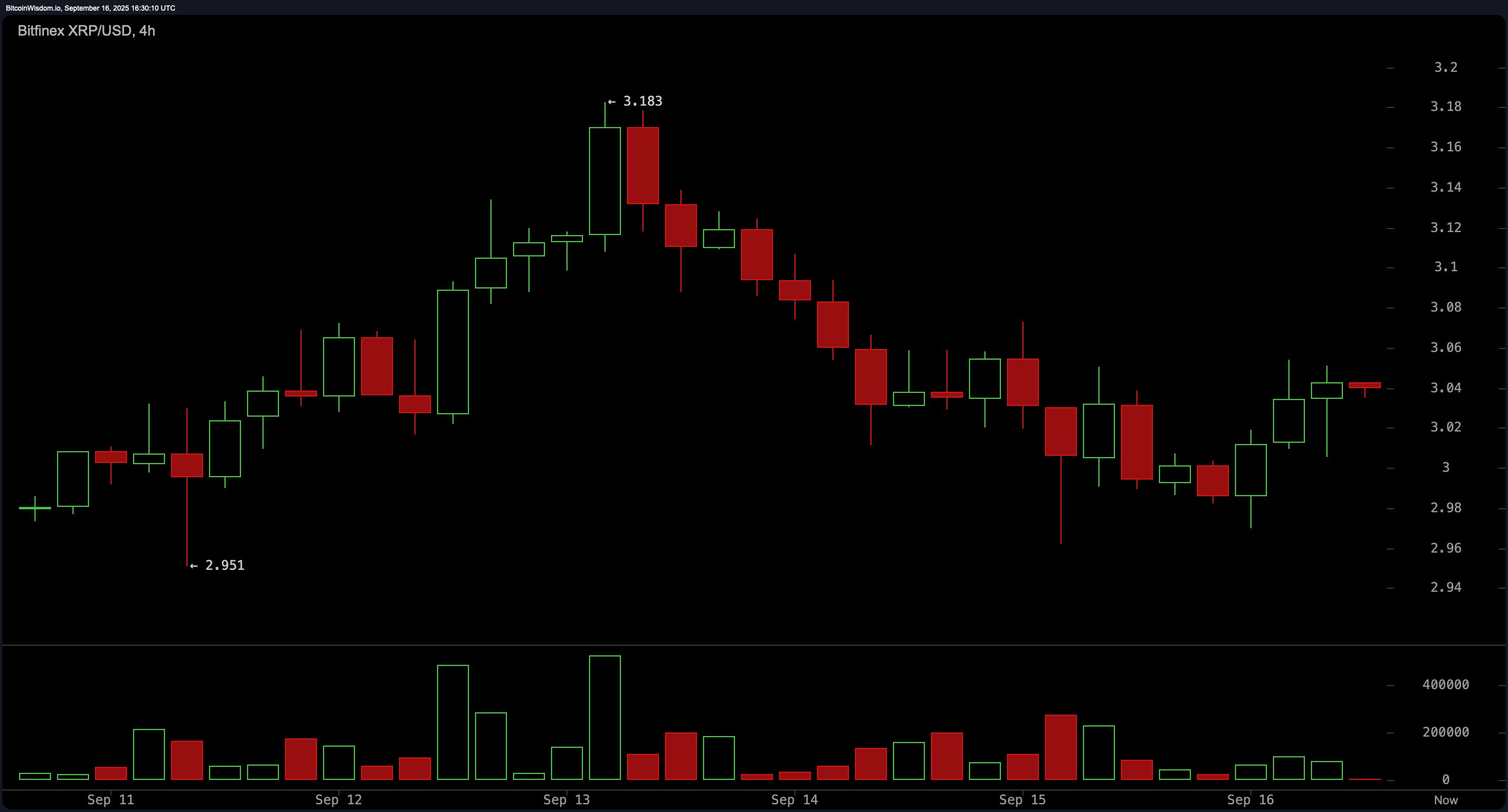

The 4-hour chart is giving off real “bear flag energy.” After a hard rejection at $3.18, XRP’s been carving out a sequence of lower highs with a slow drift toward the $3.00 support zone. The volume spike near the local top has been followed by a slow, deflating fade—textbook behavior for exhausted rallies. If XRP breaks below $3.00 on strong volume, a slide to $2.90 is likely. But if it manages a clean breakout above $3.07–$3.10, then we could see another run at $3.18, though it’ll need serious volume backup to make it stick.

XRP/USD 4-hour chart on Sept. 16, 2025.

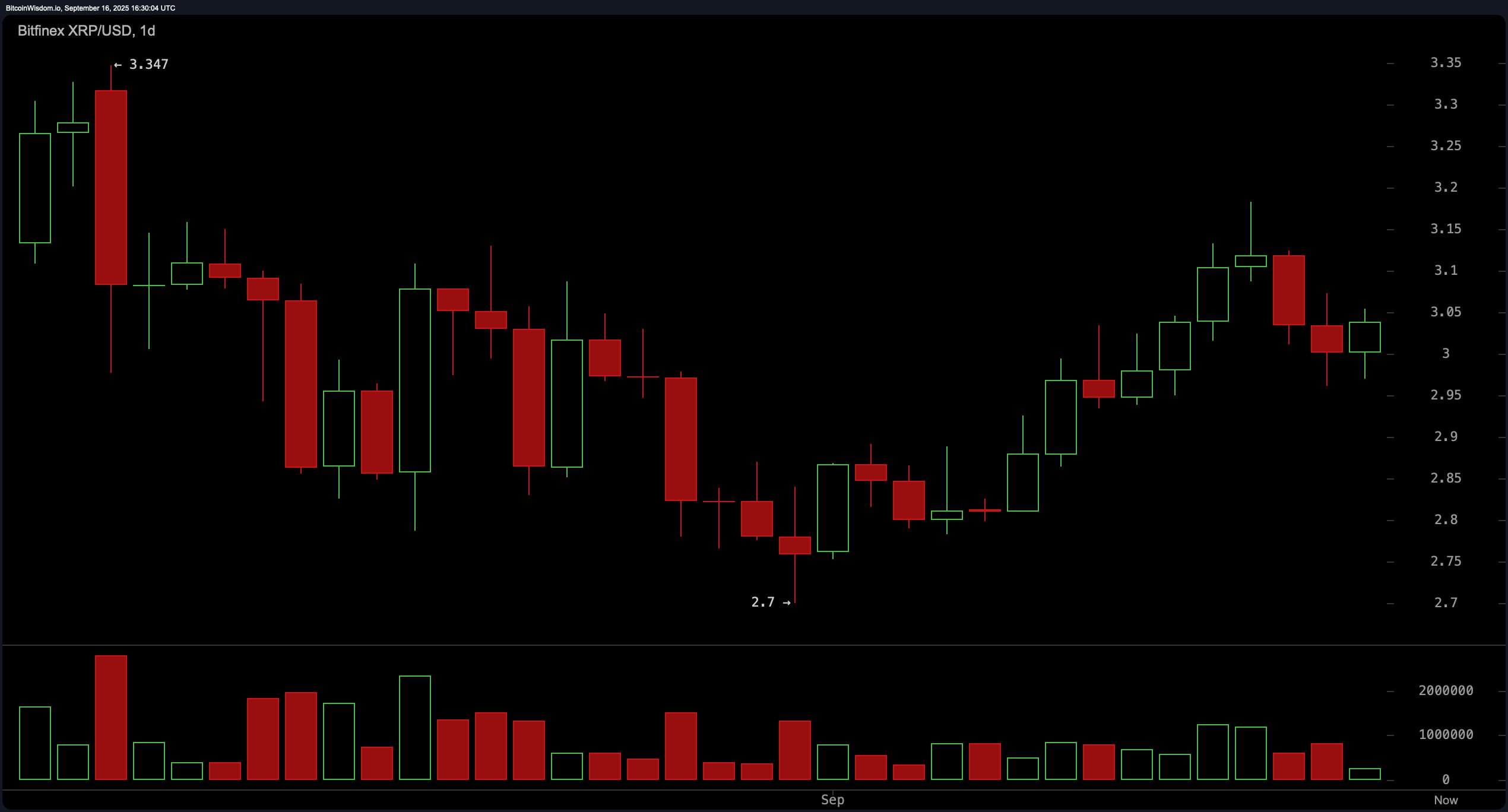

The daily chart is reading like a crypto romance novel: passionate highs followed by a sobering dose of reality. After bouncing from a low of $2.70 back up to just over $3.10, momentum is clearly losing steam. Candlestick bodies are shrinking, colors are mixed, and volume is retreating while price inches higher—a glaring bearish divergence if ever there was one. Add in a possible lower high and bearish engulfing pattern, and the setup is ripe for a pullback to the $2.85–$2.90 range. A breakdown there could mean even more pain, while a pop back above $3.15 might reignite the bulls.

XRP/USD daily chart on Sept. 16, 2025.

Oscillator readings are as diplomatic as a Swiss banker. At press time, the relative strength index (RSI) sits at 54.25, signaling neutrality, and the Stochastic oscillator is hovering at 62.42—again, noncommittal. The commodity channel index (CCI) at 65.43 and the average directional index (ADX) at 16.81 also wave the neutrality flag, while the Awesome oscillator (AO) says, “meh,” with a flat 0.10 reading. The momentum indicator at 0.22 is the only one pointing to a bullish flare, echoing the moving average convergence divergence (MACD) level of 0.022, which also flashes a positive signal. Bottom line: the oscillators aren’t hyped, but they’re not bailing either.

When it comes to moving averages (MAs), XRP is dressed to impress. Every major average—exponential moving averages (EMA) and simple moving averages (SMA) across the board from 10 to 200 periods—is flashing positivity. The EMA (10) at $3.00 and the SMA (10) at $3.01 both support short-term bullish bias, while longer-term support is rock-solid with the EMA (200) at $2.57 and the SMA (200) at $2.51. This kind of uniform alignment is rare and bullish—but caution is still warranted when oscillators aren’t fully on board.

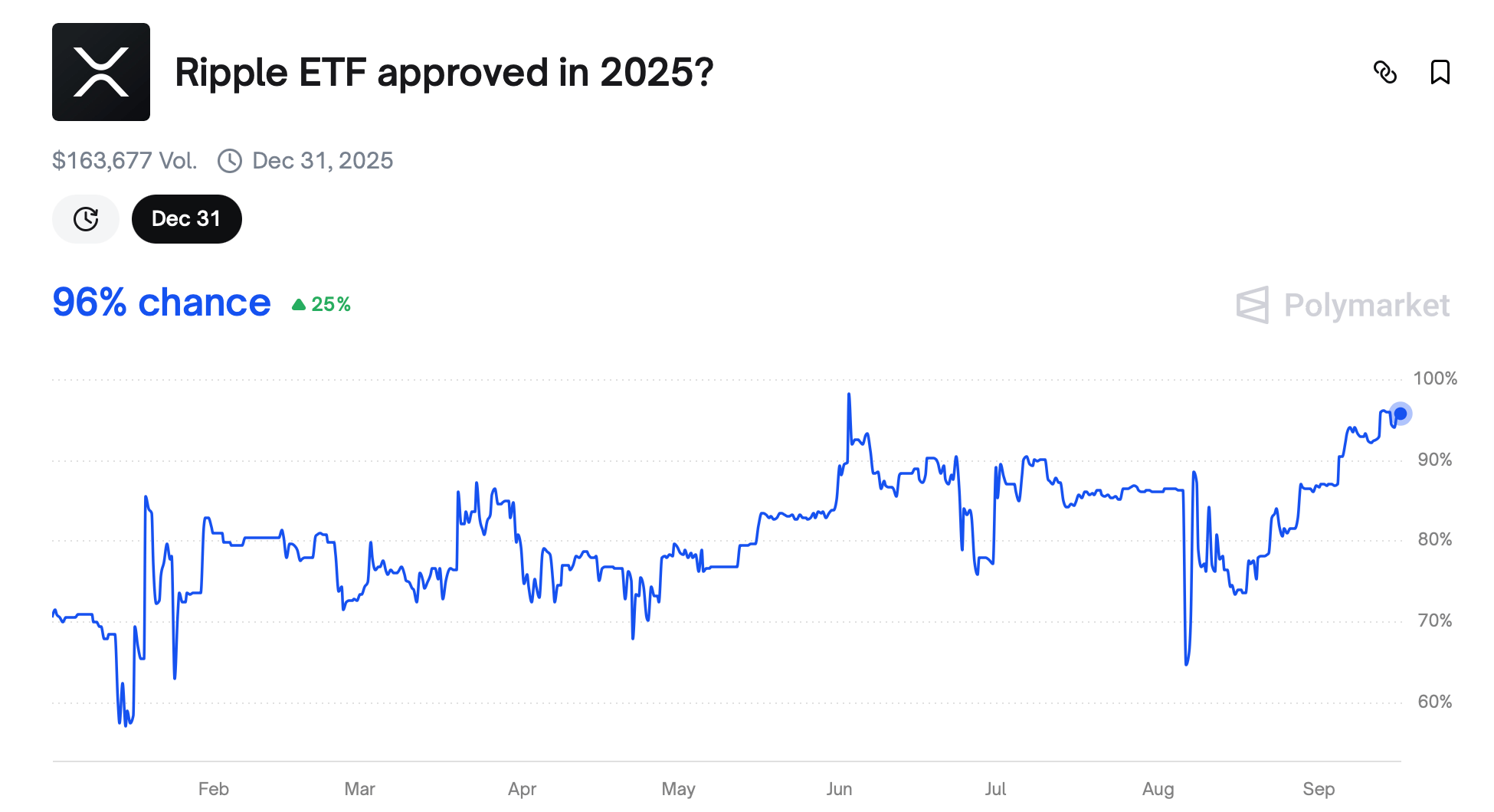

Alongside this, there’s the exchange-traded fund (ETF) elephant in the room. A spot XRP exchange-traded fund is still the stuff of dreams, but if it gets greenlit, it could kickstart a FOMO frenzy. The prediction marketplace Polymarket is giving a 96% chance of a spot XRP ETF being approved this year.

Polymarket bet on a XRP ETF approval on Sept. 16, 2025.

Institutional access, regulated inflows, and mainstream legitimacy could catapult XRP into the financial elite. Until then, this dance between resistance and support continues. Watch your levels, check your volume, and keep your eye on D.C.—because if the ETF bell rings true, XRP might just go from digital underdog to Wall Street darling.

Bull Verdict:

If XRP holds above $3.00 and pushes through $3.10 with real volume swagger, the aligned moving averages and underlying accumulation hint at a bullish breakout. A green light on an XRP spot ETF could turn this simmer into a full-on boil, sending price toward $3.35 and beyond.

Bear Verdict:

But if $3.00 cracks under pressure and momentum continues to limp, that weak rally on the daily chart and shrinking volume scream lower high trap. Without ETF fuel, XRP could easily slip back to $2.85—or worse, if bears smell blood.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。