Written by: Baheet

Translated by: Glendon, Techub News

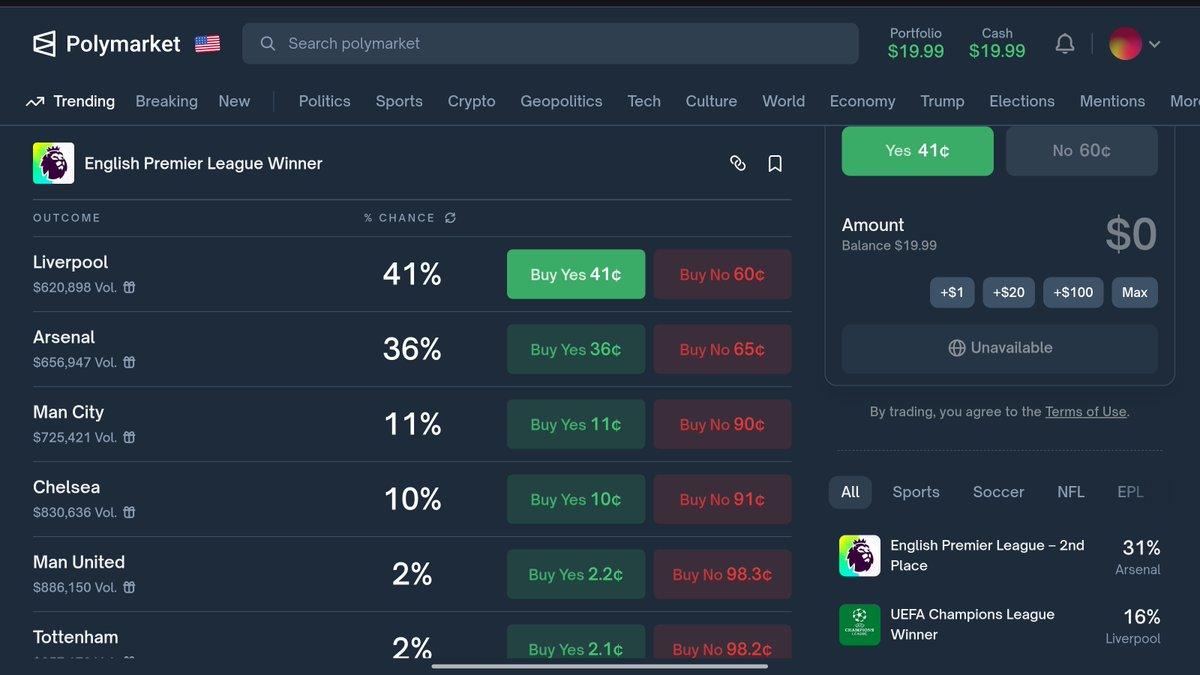

The concept of prediction markets existed long before the blockchain era, and it was the emergence of Polymarket that truly brought prediction markets into the mainstream.

Since its launch in 2020, Polymarket's on-chain model has demonstrated the power of combining decentralized infrastructure with a convenient user experience, attracting significant trading volumes for high-profile events such as the U.S. presidential election. Its success not only provides strong evidence for the potential of decentralized prediction markets but also drives a new wave of innovation and competition in the prediction market space.

However, not all prediction markets are created equal.

The rise of Polymarket has also given birth to a diverse and complex array of design choices behind prediction platforms. While they all share the common goal of aggregating collective intelligence, different platforms have taken different paths. They differ significantly in their operational mechanisms—from the underlying supporting technologies to the mechanisms that determine the "truth" of the market.

This article aims to provide a comprehensive classification system for prediction markets, based on real project cases, covering established platforms like Kalshi and Polymarket, as well as emerging markets like Limitless, XO Market, and MYRIAD. The goal is to help users and developers navigate the ecological diversity, including the risks and potentials of prediction markets, by analyzing the technical choices of projects and their impacts.

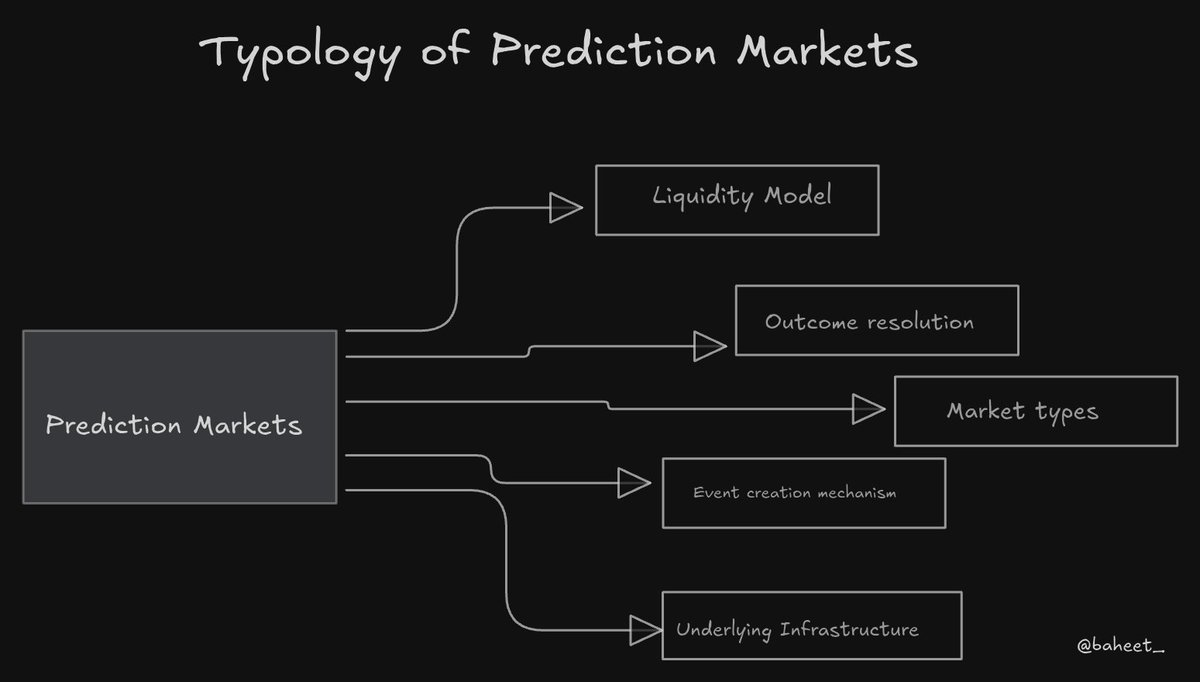

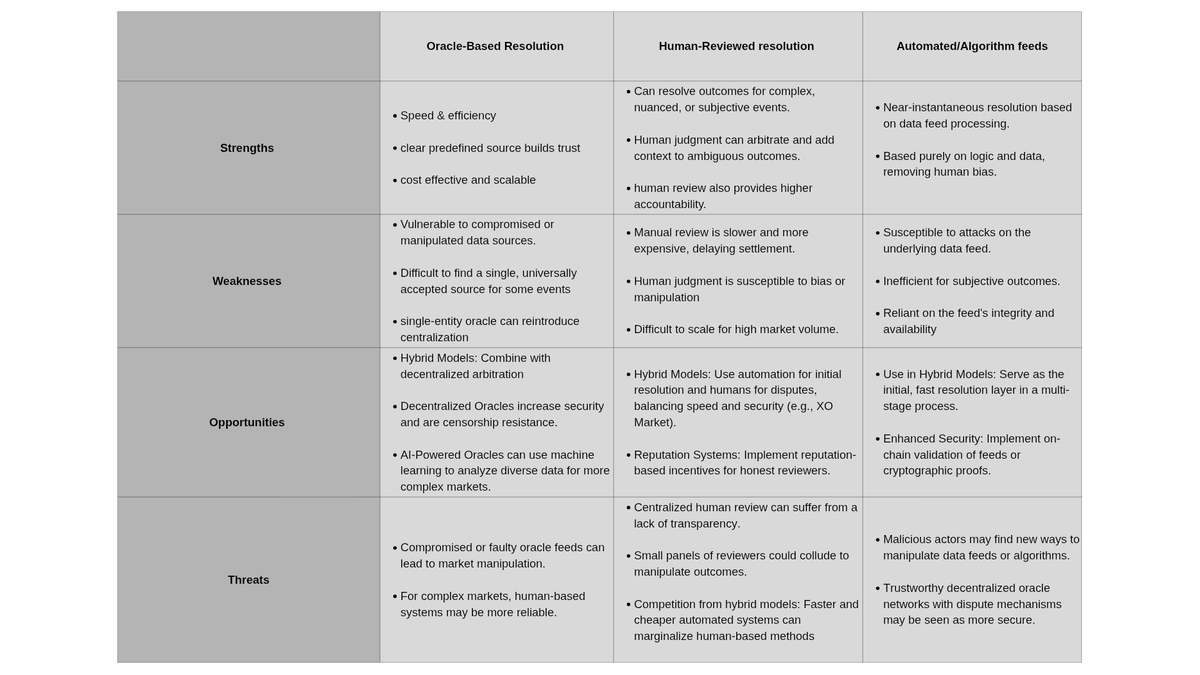

Outcome Resolution Mechanisms

In prediction markets, the outcome resolution mechanism determines how market results are verified and settled, which is crucial for trust and finality.

There are differences among projects in this regard—they rely on external data sources, human judgment, or automated processes, each bringing unique technical challenges. New projects often attempt hybrid solutions to balance speed and reliability.

Oracle-Based Resolution Mechanisms

These projects obtain and verify off-chain data (such as results, prices, scores) through decentralized or centralized oracles to achieve on-chain settlement and resolution.

Examples

Polymarket: A hybrid prediction market that uses UMA Optimistic oracles for arbitration and dispute resolution.

Myriad: An on-chain prediction market that submits proofs through oracles and resolves disputes.

Limitless: Based on the Base chain, it uses price data from PythNetwork's oracles to resolve price action markets while employing a custom resolution mechanism, particularly suitable for user-generated markets.

OpinionLabs (coming soon): Built on Monad, primarily relying on oracle mechanisms to obtain external data through a decentralized oracle network to resolve market outcomes.

Human Resolution Mechanisms

In this mechanism, market outcomes are determined by community voting, expert committees, or specially designated administrators from the platform. This resolution method is suitable for subjective or ambiguous events and often still relies on external oracle data sources.

Human resolution excels at handling subtle differences but sacrifices execution speed and carries centralization risks, making its scalability in high-traffic, objective events weaker than oracle solutions. New projects may adopt this mechanism in early stages for community building but will face scalability challenges as they grow. Therefore, a hybrid approach is often the best choice.

Examples

Kalshi: A prediction platform regulated by the U.S. CFTC, equipped with a human oversight team. Its market group thoroughly reviews the market and determines outcomes when resolution conditions are met, ensuring process compliance.

Augur: An early Ethereum-based project that employs a community reporter resolution mechanism.

XO Market (coming soon): Although it emphasizes a permissionless mechanism, its resolution process is automatically handled by the AI agent MODRA (developed by XO Market) for simple markets. If there is a dispute over the outcome, it escalates to a human jury court, introducing a human review step for ambiguous resolutions.

Automated/Algorithmic Data Sources

Such markets process information from predefined data sources directly through algorithms, achieving automated resolution. Outcomes are deterministically generated from input data, requiring no human intervention unless there is a dispute or error with the data source itself.

The issue is that automation prioritizes efficiency over flexibility, sacrificing the ability to handle ambiguity in exchange for faster payment and resolution speeds. It is suitable for cryptocurrency or price markets but struggles with subjective topics like politics.

Examples

Kalshi: A typical representative. Their system automatically settles based on data provided by their official sources (essentially pre-selected feedback).

Polymarket: Also relies on automated information flows from integrated oracles (such as Chainlink), providing data from various sources (e.g., news API event results). Resolution is triggered once specified data points are met.

Limitless: As mentioned, it uses decentralized oracles to aggregate multi-source data, with market outcomes driven by automated data flows.

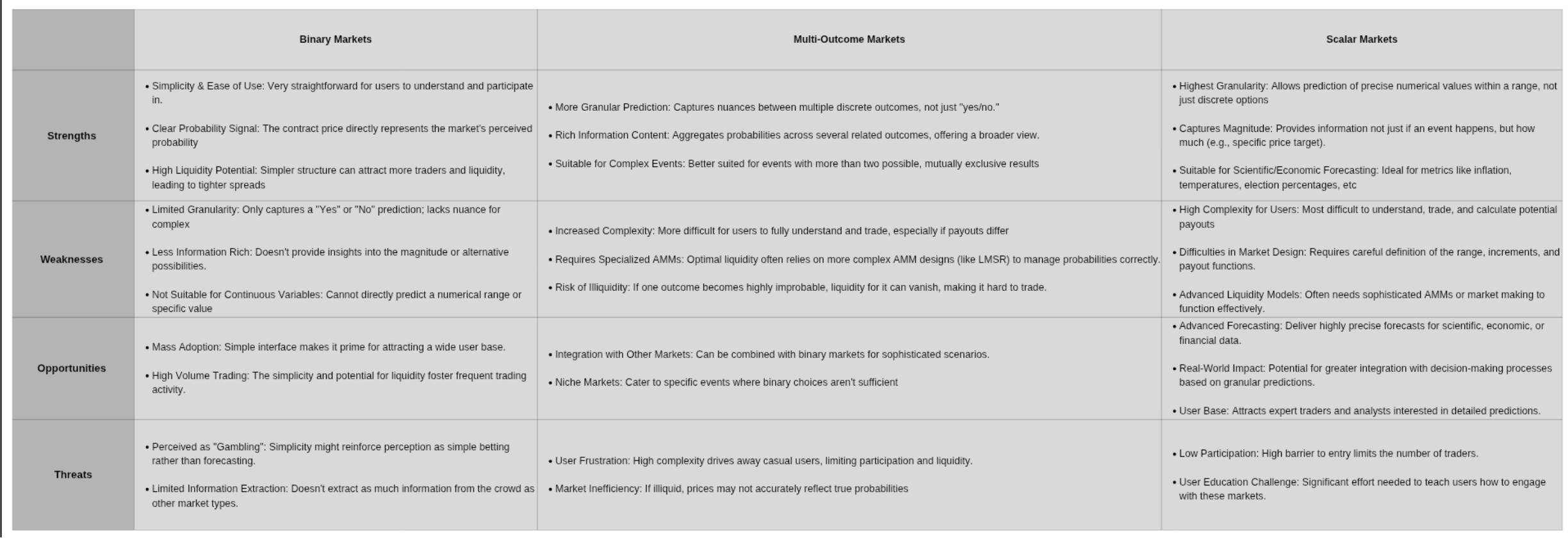

SWOT analysis of various outcome resolution methods in prediction markets

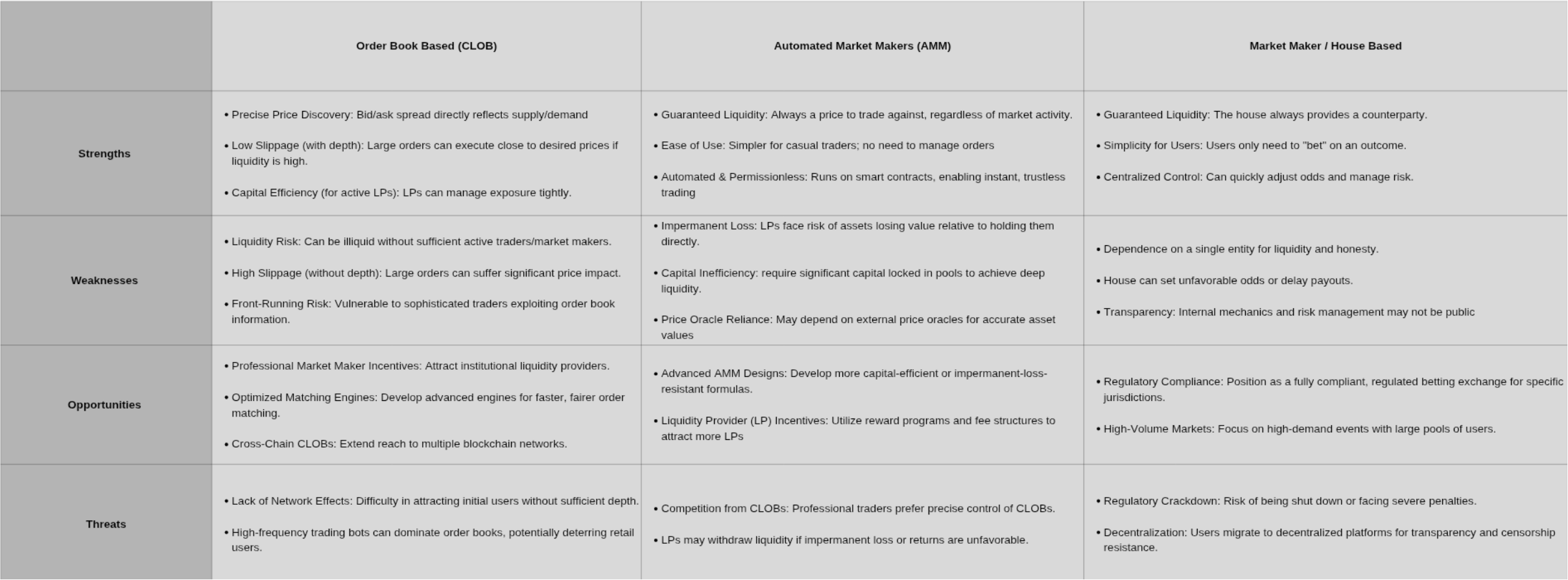

Liquidity Models

Liquidity determines how easily users can enter and exit positions without price slippage. The liquidity model adopted by prediction platforms directly affects trading efficiency and capital requirements.

High liquidity ensures that individual trades have minimal impact on prices, allowing market prices to change smoothly and predictably as new information emerges, accurately reflecting the public's evolving predictions.

Low liquidity can lead to severe price fluctuations, as a single large order can cause disproportionate price movements. New projects often innovate in this area to kickstart liquidity in the early stages.

Automated Market Makers (AMM)

This method relies on algorithm-driven mathematical formulas to provide constant liquidity without the need to match buyers and sellers. Users trade with liquidity pools, and the prices of assets in the pool continuously adjust.

Automated market makers ensure that new markets always have liquidity, but in simplifying operations, they prioritize trading precision, which differs from order books that can provide better prices at scale. A typical case is the Logarithmic Market Scoring Rule (LMSR), which provides continuous liquidity and incentivizes information-based trading.

Prediction markets often start in the form of AMM and then migrate to models like Polymarket.

Examples

XO Market: Uses an LS-LMSR type AMM optimized for prediction markets.

Augur: Utilizes AMM (especially order books mimicking AMM behavior) to ensure liquidity.

Myriad: Myriad uses vAMM to provide deep, continuous liquidity for its prediction market.

Order Book/Centralized Limit Order Book (CLOB)

This is the model used by traditional financial exchanges: buyers and sellers submit limit orders (buying or selling at a specified price) or market orders (executing at the best price immediately), and the platform matches these orders.

This model requires active users or professional market makers to maintain deep liquidity; otherwise, the market will lack liquidity and be difficult to trade. CLOB offers better capital efficiency for professionals but requires more initial liquidity than AMM, making it harder to use for smaller projects.

Examples

Polymarket: Initially used an automated market maker but now operates in the form of an order book, allowing users to place limit orders to buy and sell "outcome shares" at specific prices, achieving price discovery through supply and demand.

Limitless: Uses CLOB to trade outcome shares, suitable for its social and creator-configured markets.

SX Network: Operates a customized EVM chain, achieving on-chain settlement through order matching.

Market Maker/Broker Model

A centralized entity (the "broker" or platform operator) acts as the counterparty to all bets. It sets the odds (prices) and takes the opposite position to users.

The "broker" always provides liquidity, allowing users to place bets at any time. This is very common in traditional sports betting.

Example

Divvy.Bet: A decentralized sports betting platform on Solana that allows anyone to act as a broker.

SWOT analysis of prediction market liquidity models

Hybrid Models

This model combines the strengths of two or more of the above models to mitigate weaknesses, aiming for optimal liquidity, price discovery, and capital efficiency.

Kalshi adopts a hybrid model centered on CLOB, supported by an internal trading team and third-party professional market makers. This model ensures deep liquidity across the market, a key feature of any regulated financial exchange.

Kalshi's approach is closest to a hybrid model but emphasizes the market maker/internal agency and order book components. It differs significantly from AMM-based models, as it does not solely rely on algorithms and liquidity pools provided by the general user base.

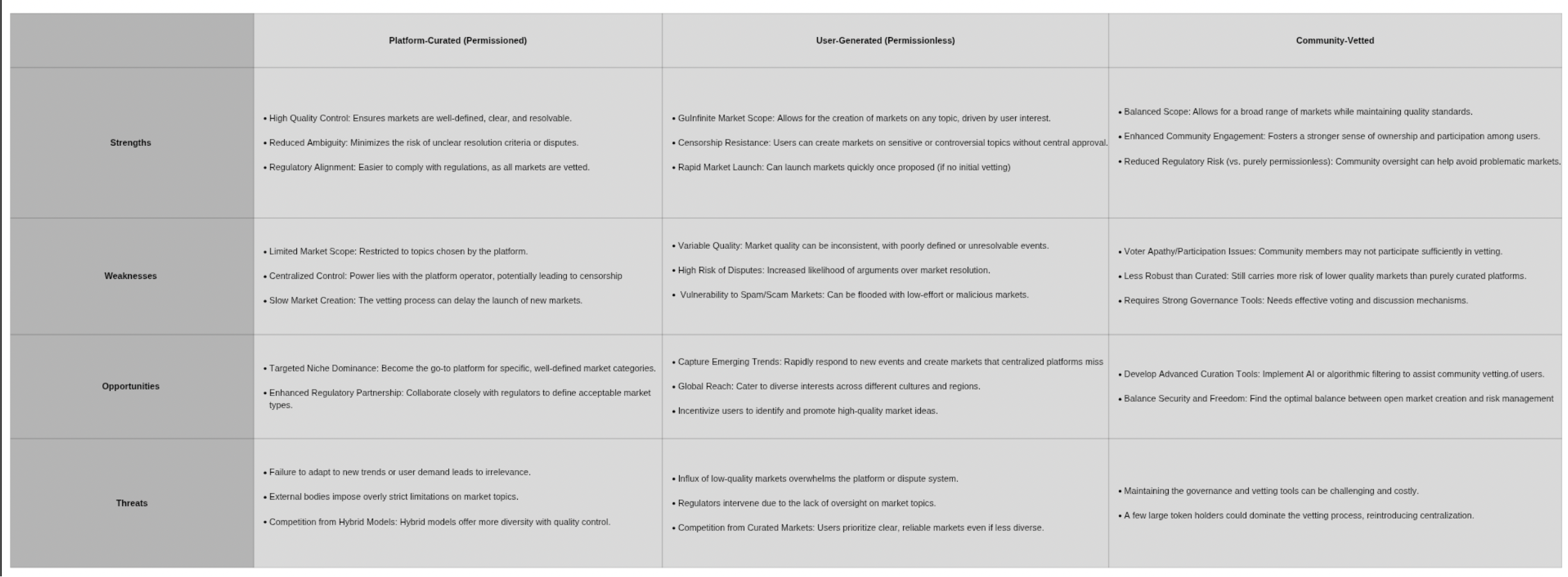

Event Creation Mechanisms

Prediction markets can also be classified based on their event creation mechanisms, which determine how markets are proposed, reviewed, and launched.

This process is a key factor in distinguishing platforms, as it directly affects market diversity, quality, and overall philosophy (centralized vs. decentralized).

Platform Review System (Permissioned)

Platform operators or a central team fully control which events are offered to users. The platform acts as a gatekeeper, and users can only trade events selected and launched by the platform. This model is favored by regulated platforms as it allows for better control over event legality and compliance.

Examples

Kalshi: Kalshi manages all its markets, which are reviewed to ensure clarity and regulatory compliance.

PredictIt: Historically, this platform has managed all political markets to ensure they comply with its regulatory framework.

User-Generated (Permissionless)

In this mechanism, any user can propose and create their own markets as long as they adhere to the platform's rules and deposit the necessary collateral.

This model is often adopted by decentralized platforms running on blockchain. Permissionless platforms typically require additional mechanisms, such as curation markets, to handle low-quality or fraudulent events.

Examples

Augur: One of the pioneers of permissionless market creation, allowing anyone to propose market suggestions;

XO Market: Adopts user-generated, permissionless market creation;

Zeitgeist: Allows the creation of permissionless markets on its Polkadot parachain.

Community Review System

This is a hybrid approach where users can propose market suggestions, but the final decision to launch a market is made through a community-based governance process or a multi-stage voting system. This provides a balance between free creation and quality control through platform review.

Example

Polymarket: Users can suggest, discuss, and review new markets through a channel, thereby influencing which markets the Polymarket team ultimately launches. This is a centralized review process based on community sentiment.

SWOT analysis of prediction market event creation mechanisms

Market Types

Market types refer to the different structures or formats used by prediction markets to express probabilities and facilitate outcome trading.

They determine how probabilities are presented, how contracts are designed, and how payouts are distributed. A single platform can offer multiple market types.

Binary Markets

This is the simplest type of prediction market. There are only two possible outcomes, usually presented in the form of "yes" or "no."

The probability of market settlement is either 0% or 100%. The price of a "yes" contract directly represents the market's expected probability of that outcome (for example, a "yes" contract trading at $0.70 implies a 70% likelihood).

Multiple Outcome Markets

This type involves more than two possible discrete outcomes, but only one outcome can be true. For example, who will win the election among candidates A, B, and C?

This type typically benefits from AMM designs (such as LMSR), which can manage the relationships between multiple outcome probabilities.

Example: Which team will win the World Cup? Listing the outcomes for each major competitor.

If there are 8 teams left in the tournament, there will be 8 separate "outcome tokens";

The price of each token will fluctuate based on trading, reflecting the market's probability of that team winning;

The market aggregates these different probabilities to predict the most likely winner.

Scalar Markets

Scalar markets involve predicting a numerical value or range (e.g., "What will the price of Bitcoin be on date X?"), with payouts based on the proximity of the prediction to the actual result, settled linearly or in brackets.

Technically, it employs a quadratic scoring rule, resolving through quantifiable data feeds (such as price oracles) to achieve precise data-driven settlements.

For example, if the market inquires about the closing price of a stock (e.g., between $100 and $150). If participants believe the closing price will be $125, they will establish positions based on that belief. If the stock closes at $120, they will receive payouts proportional to how close $120 is to their predicted $125, reflecting the rewards of precise trading.

Example

Trepa (in testing): A prediction platform focused on accuracy and precision rather than binary outcomes, rewarding traders based on the proximity of their predictions to actual results.

SWOT analysis of prediction market types

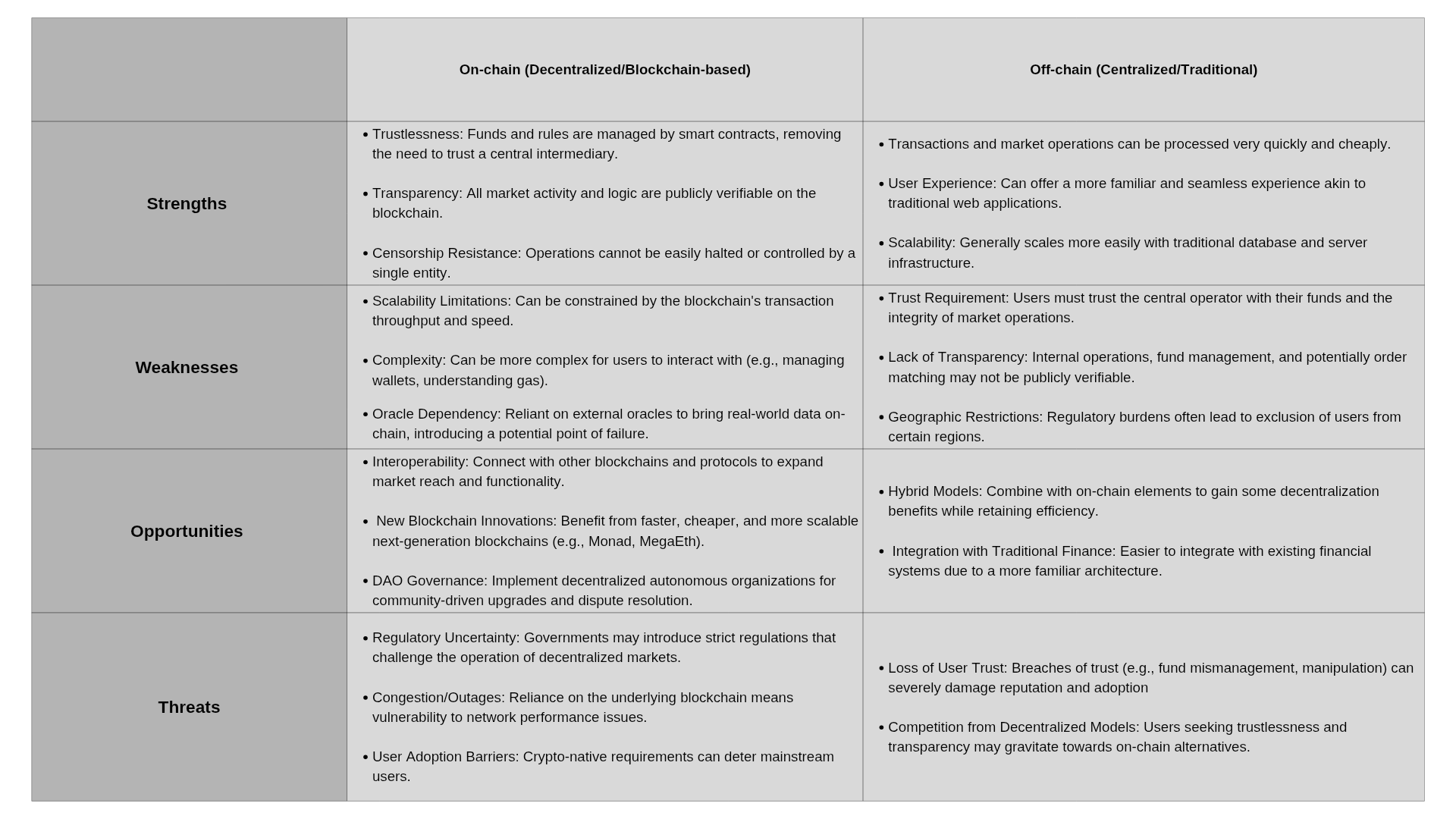

Underlying Infrastructure

The underlying infrastructure of prediction markets significantly impacts their performance, security, and user experience.

This infrastructure determines how trades are processed, data storage mechanisms, and the level of trust users have in the system.

Off-Chain Infrastructure

The core operations of prediction markets, including market creation, order matching, user account management, and fund custody, run on servers controlled by a single entity.

The use of public blockchains may be minimal or nonexistent, serving only as an audit ledger in specific cases (if at all).

On-Chain Infrastructure

The fundamental components of prediction markets, such as market creation, trading, outcome resolution logic, and fund management, are executed and recorded through smart contracts on the blockchain. User funds are retained in their wallets (non-custodial) or controlled by smart contracts, rather than held by a centralized entity.

SWOT analysis of prediction market underlying infrastructure

Hybrid Prediction Markets

This type combines the advantages of on-chain and off-chain systems, such as the security and transparency of on-chain settlement and the speed and efficiency of off-chain processing.

Example: The Clearing Company: Developing a regulated on-chain prediction platform that integrates on-chain efficiency with compliance frameworks.

Conclusion

From the classifications above, we can see the wide range of decentralization levels in prediction markets. On one end, centralized platforms like Kalshi prioritize regulatory compliance and institutional liquidity depth; on the other end are fully on-chain protocols that achieve censorship resistance and trustlessness through cryptocurrency economic incentives and governance mechanisms. Hybrid platforms in the middle demonstrate the ability to leverage the advantages of both: using off-chain speed for order matching while retaining the security of on-chain settlement.

Overall, the architecture of prediction markets is essentially a dynamic balancing act among the three core elements of efficiency, regulatory compliance, and decentralization.

Moreover, the exploration of the perfect liquidity model is far from over. While CLOB dominates, AMM should not be overlooked. Projects like XO Market further optimize capital efficiency and market depth through customized AMM algorithms (LS-LMSR), driving the trend of AMM development.

It is foreseeable that the success of prediction markets often depends on their ability to solve liquidity issues, and the competition to find the most efficient, scalable model is a major driving force for innovation in this field.

Ultimately, there will be no single "best" design for prediction markets. The ideal architecture entirely depends on the target audience, use cases, and tolerance for trade-offs. Regulated prediction markets and censorship-resistant platforms serve different purposes. For example, platforms like Trepa focus on incentivizing precise predictions, while others provide binary predictions.

As technology and ecosystems expand, we expect to see a richer array of design choices. In summary, the next chapter will be written by those platforms that can most effectively balance core elements such as liquidity, settlement, and user engagement to create markets that genuinely help predict the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。