Exploring the fluctuations in the stablecoin sector under changing regulatory and interest rate environments.

Written by: Tanay Ved, Coin Metrics

Translated by: AididiaoJP, Foresight News

Key Points

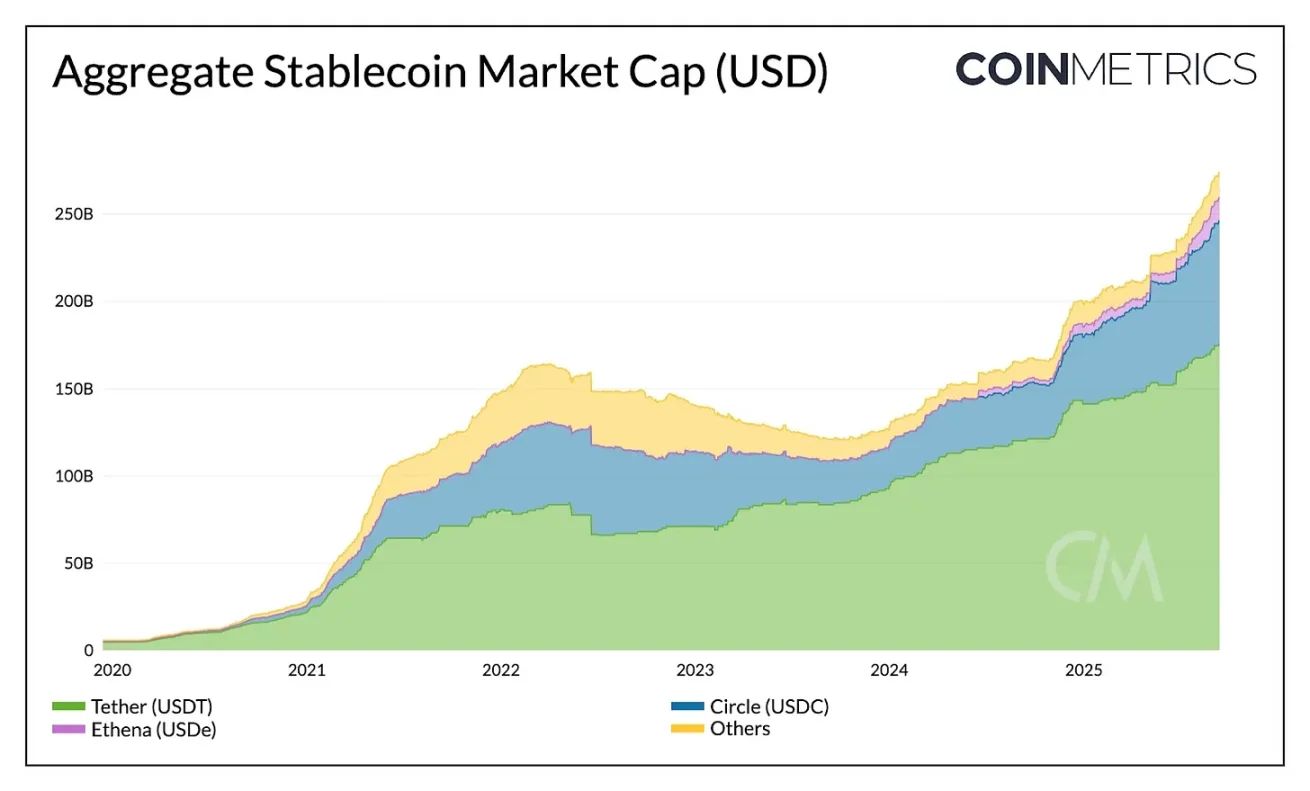

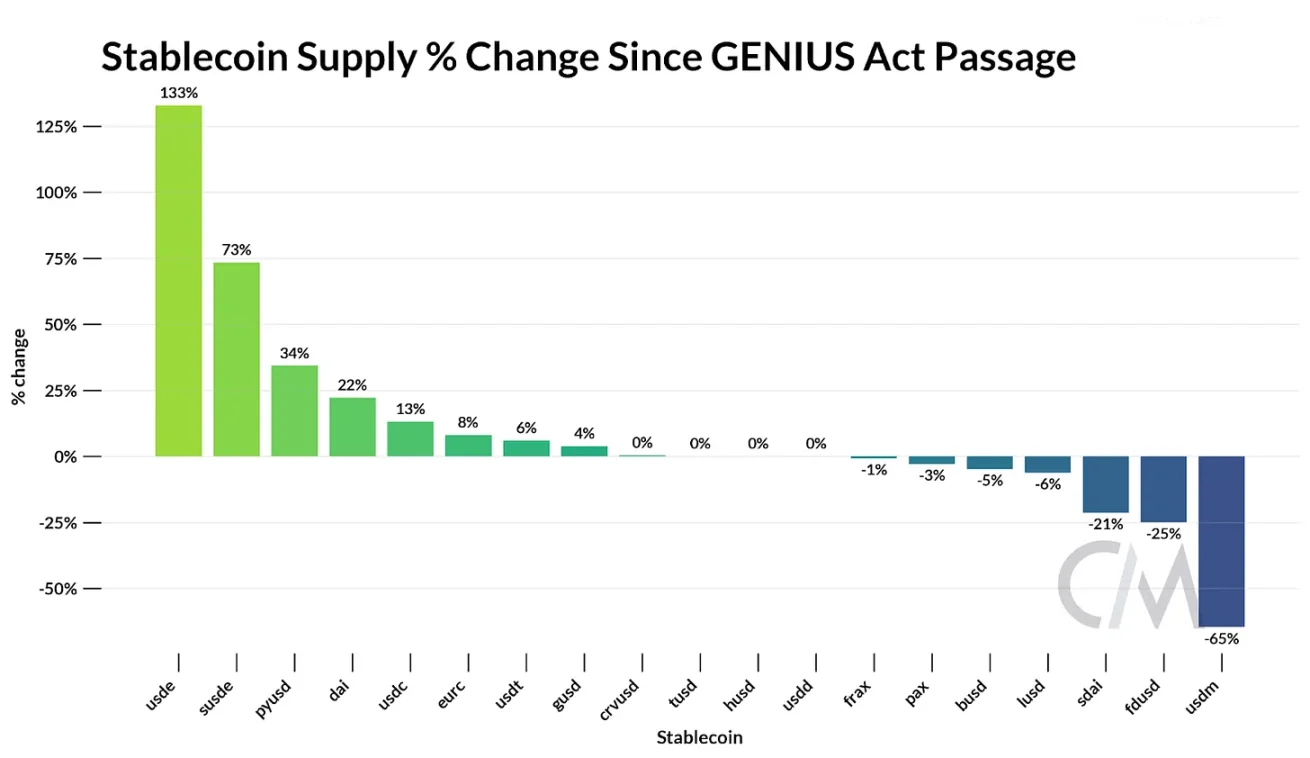

The total market capitalization of stablecoins has reached $280 billion, growing 40% year-to-date. USDT (64%) and USDC (25%) still hold the largest market shares, while USDe has expanded by 133% following the passage of the GENIUS Act, becoming the third-largest stablecoin.

The GENIUS Act standardizes reserve support with U.S. Treasury securities, shifting competitive differentiation towards distribution, ecosystem coverage, and the ability to expand market adoption.

Circle's revenue is driven by interest income from USDC reserves, primarily from Ethereum and Solana. However, most of the trading activity revenue from USDC goes to Coinbase (through sequential income on Base) and Ethereum and Solana (through fees and MEV).

These dynamics indicate the rise of application-specific stablecoins and chains focused on stablecoins, aiming to capture and internalize more value from the entire tech stack.

Introduction

The momentum in the stablecoin sector shows no signs of slowing down. In May, we analyzed various types of stablecoins, reserve models, and issuers across networks. In recent months, we have witnessed the U.S. implementing stablecoin regulatory policies through the GENIUS Act, while Circle's IPO has brought the stablecoin business model into the mainstream market. The competitive landscape is intensifying and appears to be in constant flux, with Tether announcing its entry into the U.S. market with USAT, a fierce battle for Hyperliquid's USDH code, and companies like Stripe and Circle launching a series of payment chain-focused releases.

In this context, this article explores the fluctuations in the stablecoin sector under changing regulatory and interest rate environments. As the GENIUS Act standardizes reserve support for payment stablecoins, competition increasingly shifts towards participants who master and capture distribution channels. We track Circle's revenue from USDC across different blockchains to understand the dynamics driving the emergence of proprietary stablecoins and dedicated networks.

Competitive Landscape: The Market After the GENIUS Act

Current Market Landscape

The GENIUS Act was signed into law on July 18, creating a regulatory framework for issuers of dollar-backed payment stablecoins. The main requirements of this legislation include 100% reserve support with safe, liquid assets (cash and short-term U.S. Treasury bills and money market funds) and a prohibition on issuers providing yields or interest on the stablecoins issued. This has created a new environment where the collateralization of stablecoins is more standardized among issuers.

Before considering its impact, it is necessary to take stock of the current market situation. The total market capitalization of stablecoins has now exceeded $275 billion, growing 40% year-to-date. Tether's USDT leads with a 64% market share ($177 billion), primarily distributed across Ethereum (50%) and Tron (47%), while Circle's USDC ranks second with a 25% market share ($71 billion), distributed across networks like Ethereum, Solana, and Arbitrum.

Source: Coin Metrics Network Data Pro

Tether's Entry into the U.S. Market

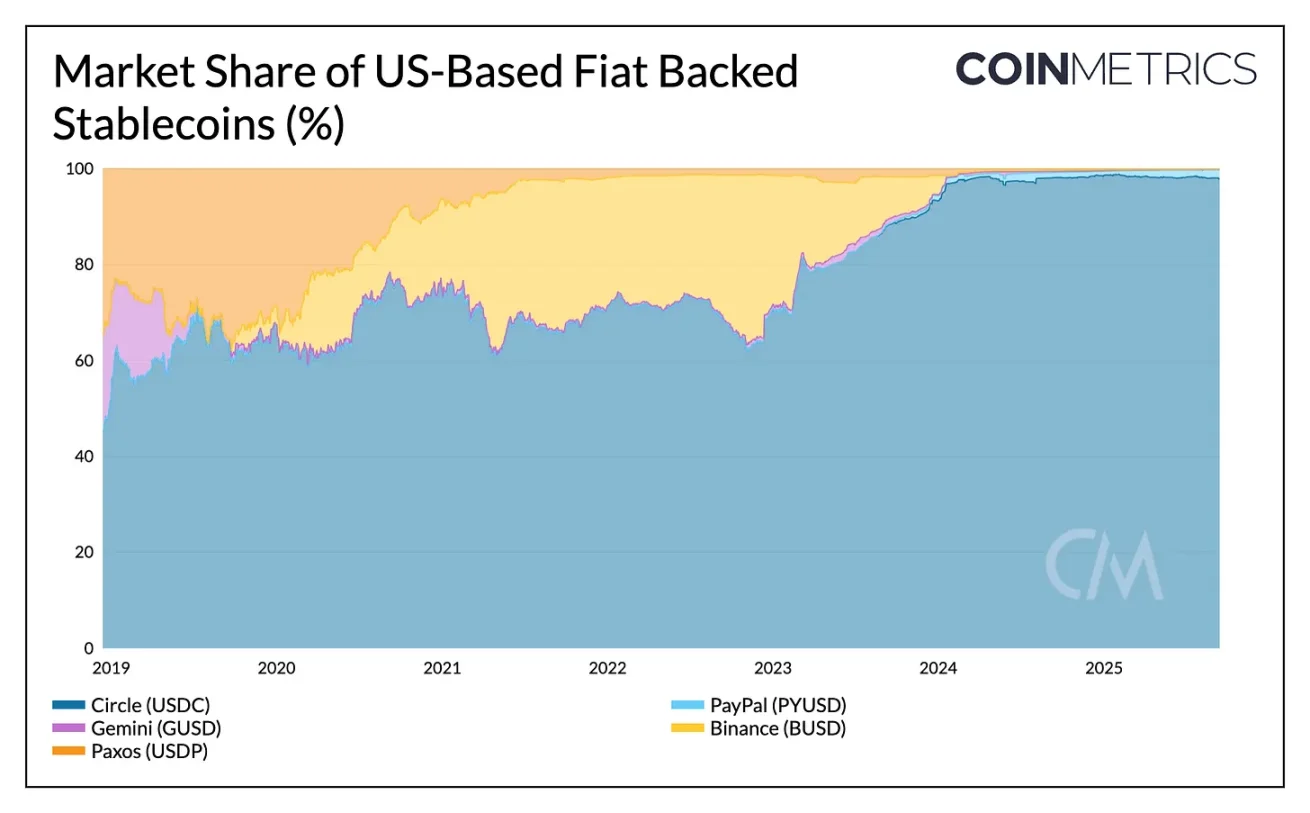

So far, Tether has operated as an offshore issuer based in El Salvador, with USDT primarily serving the demand in emerging markets. On the other hand, Circle's USDC benefits from a strong regulatory positioning in the onshore market, currently accounting for 97% of the U.S. domestic stablecoin supply.

By 2025, USDC's market share has grown by about 6%, while USDT has decreased by about 7%. However, Tether's launch of the U.S.-compliant stablecoin USAT could erode USDC's onshore dominance. Issued by Anchorage Digital and managed by Cantor Fitzgerald, USAT needs to penetrate the exchange listing and liquidity space to match USDC's multi-chain coverage and distribution achieved through partners like Coinbase.

Source: Coin Metrics Network Data Pro

Interest Rate and Yield Dynamics

The GENIUS Act's prohibition on yield payments and the changing interest rate environment may also significantly impact the competitive landscape. As stablecoin holders are prohibited from receiving direct compensation, the interest income from U.S. Treasury reserves continues to belong to the issuers. Tether and Circle have held over $145 billion in Treasury securities, with Tether retaining the earnings, while Coinbase indirectly passes on the interest from USDC reserves to holders.

This gap may make interest-bearing alternatives and on-chain yield sources generated through staking or lending more attractive. Since the passage of the GENIUS Act, Ethena's USDe has grown by 133%, while its staking version sUSDe has increased by 73%, making USDe the third-largest stablecoin with a market capitalization of $13.6 billion. By tokenizing basis trades using a delta-neutral strategy with staked ETH and perpetual futures, Ethena can offer competitive yields even as interest rates decline.

Source: Coin Metrics Network Data Pro

These dynamics collectively highlight how the competitive landscape is shifting from reserve models to distribution, yield, and ecosystem growth.

Tracking Circle's Revenue Across Blockchains

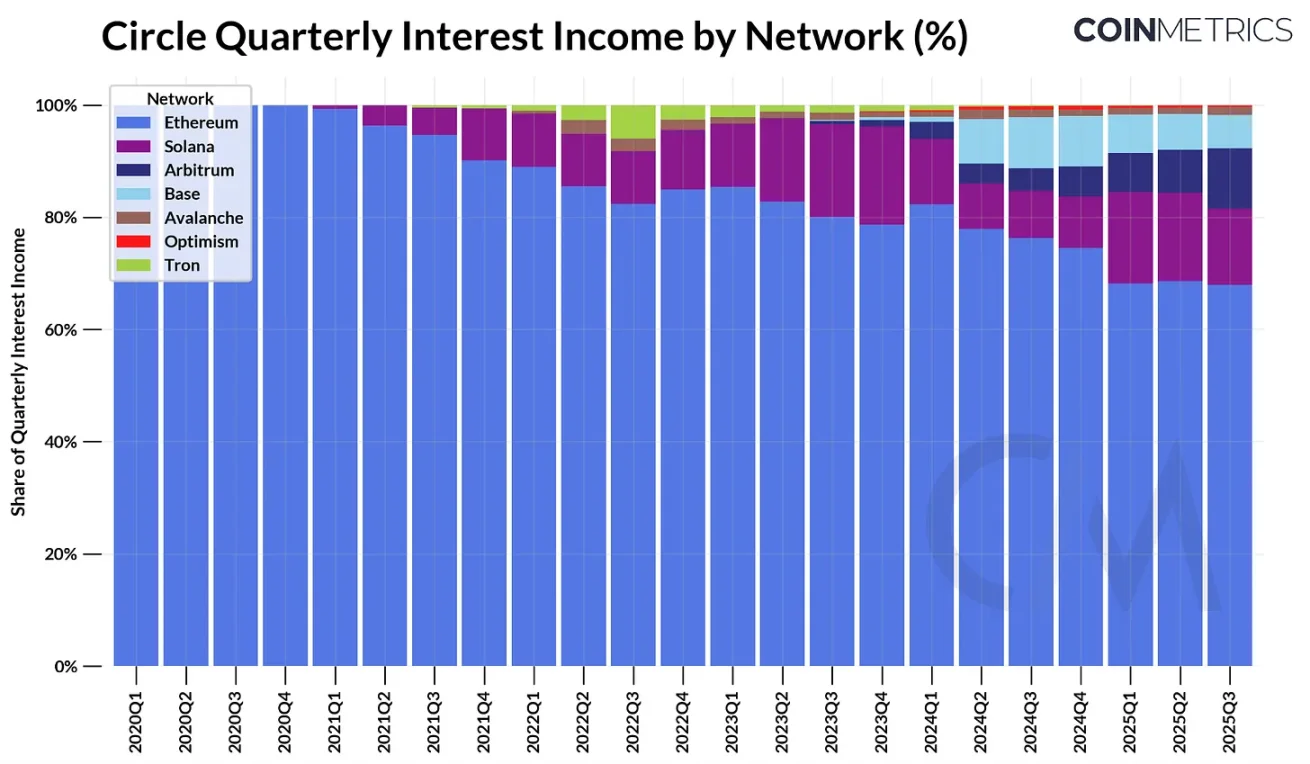

As a publicly traded company, Circle provides a clear blueprint for understanding the stablecoin business model. The primary driver of its current revenue is straightforward: interest income from reserves supporting the outstanding USDC supply.

In Q2 2025, Circle generated approximately $634 million in interest income, derived from its then approximately $61 billion USDC supply and the short-term U.S. Treasury yields supporting it. When broken down by chain, we can see that the largest contributors are Ethereum, generating $423 million (68%), and Solana, generating $97 million (15%), while Arbitrum has become the fastest-growing source of supply and revenue (growing 24% since Q1).

Source: Coin Metrics Network Data Pro

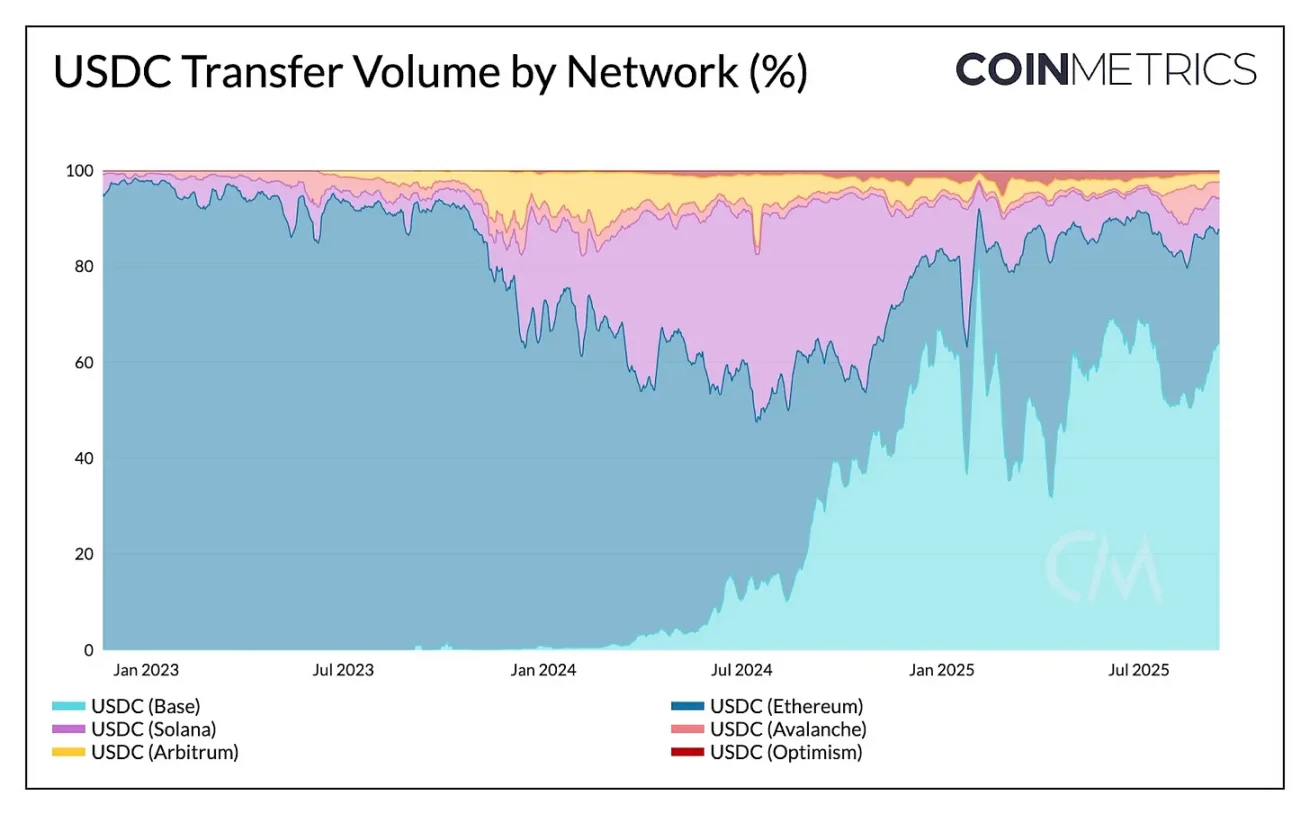

While the USDC supply generates interest income for Circle, the inter-chain transfers of USDC do not generate revenue. When analyzing the share of USDC transfer counts and volumes across networks, we see that Solana dominates in transfer frequency, while Base (64%) and Ethereum (23%) account for the majority of total transaction volume. Therefore, the revenue from these transaction activities of USDC goes to Coinbase (through sequential income on Base) and the validators of Ethereum and Solana, rather than Circle itself.

Source: Coin Metrics Network Data Pro

This emphasizes how Circle's revenue is tied to the outstanding USDC supply, while blockchains capture the value of transfer activities through sequencing, fees, and MEV. The emergence of application-specific stablecoins like Hyperliquid's USDH illustrates how platforms internalize reserve income within their ecosystems. Meanwhile, Circle's launch of its Layer-1 chain Arc indicates its efforts to capture transaction-based revenue from payment and forex-related use cases, which may not fully overlap with the types of activities occurring on current networks.

Launching Incentives to Control Distribution

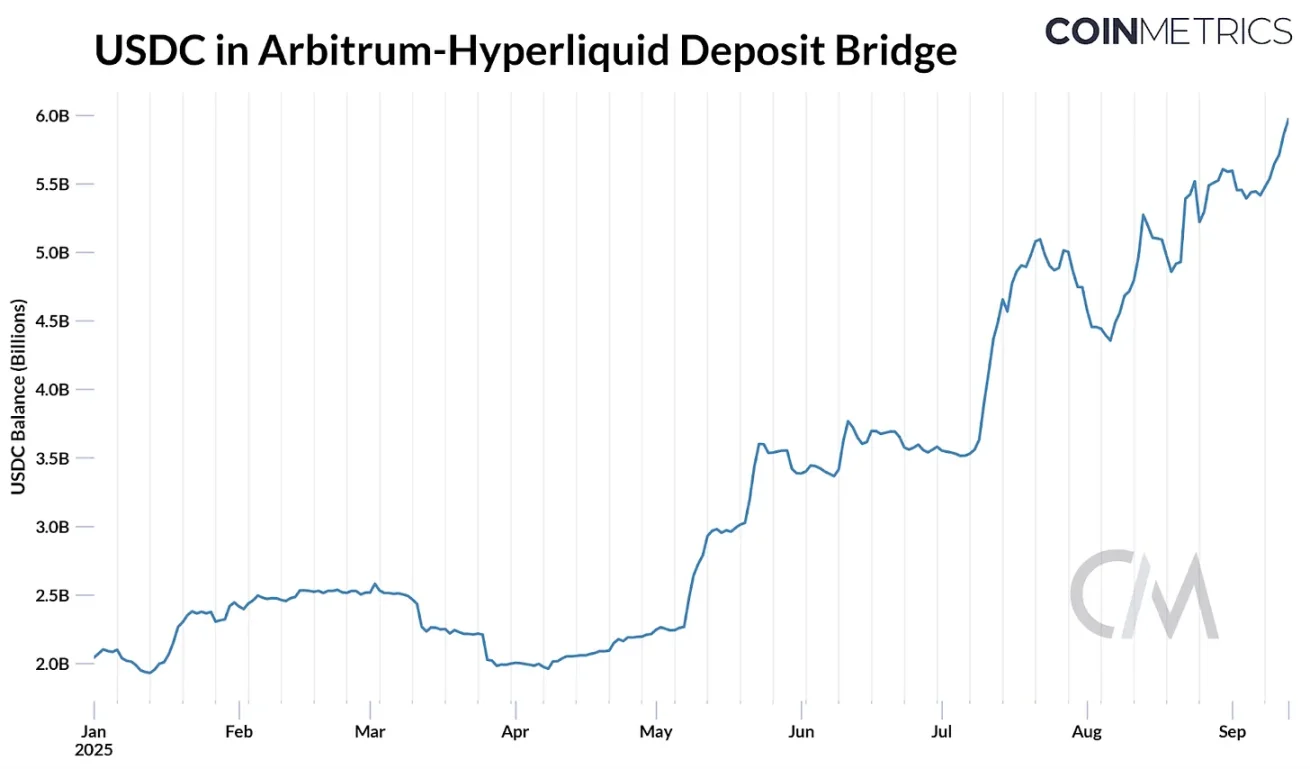

The recent battle for Hyperliquid's USDH code highlights why platforms want to reduce reliance on external sources and internalize economic benefits themselves. Last week, Hyperliquid initiated a governance vote to award the USDH code to an issuer that is "Hyperliquid-prioritized, aligned with Hyperliquid, and compliant." Approximately 8% of the total USDC supply (about $5.9 billion) is in Hyperliquid's Arbitrum bridge, which, at a 4.1% reserve return rate, represents about $247 million in interest income flowing to Circle (and through revenue-sharing agreements to Coinbase).

Source: Coin Metrics ATLAS

This has sparked a bidding war, attracting proposals from major issuers like Paxos, Ethena, Agora, and Sky, as well as newcomers like Native Markets. Issuers proposed terms that would make USDH attractive to the Hyperliquid ecosystem, suggesting returning up to 95% of interest income, offering appealing revenue-sharing models, or enhancing compliance consistency and distribution.

Ultimately, Native Markets secured the USDH code through on-chain voting. Native Markets' USDH will be fully backed by cash and U.S. Treasury equivalents, with off-chain reserves initially managed by BlackRock and on-chain reserves managed by Superstate through Stripe-owned Bridge. In response, Circle is also preparing to launch native USDC on Hyperliquid's HyperEVM, indicating that distribution on evolving platforms remains crucial for competing for stablecoin dominance.

Other recent stablecoin launches also demonstrate why applications, wallets, networks, and even states are moving in the same direction: issuing their own proprietary stablecoins to capture interest income and recycle it into ecosystem growth.

Conclusion

The stablecoin sector appears to be undergoing a simultaneous top-down and bottom-up restructuring phase. At a macro level, the GENIUS Act has standardized requirements, linking stablecoin reserves to U.S. Treasury securities and making distribution crucial. The competition between existing players Tether and Circle has entered a new phase, with USAT poised to challenge USDC in its home territory. As issuers are prohibited from passing on yields, declining interest rates may enhance the role of alternatives like Ethena's USDe, as the demand for yields persists. At a micro level, the economics of reserve income and transaction activities are driving platforms to internalize more value.

From the saga of Hyperliquid's USDH to Circle's Arc chain, this trend points towards controlling more of the tech stack, whether through internalizing reserve income or capturing transaction-based revenue. These efforts also reflect the aim of anchoring stablecoins in payments and settlements. However, the path forward raises important questions. Will the new wave of proprietary stablecoins dilute liquidity, or will distribution advantages concentrate demand around a few winners? As dedicated payment chains with more centralized architectures emerge, will they complement general-purpose L1s or compete with them? The evolution of this sector is far from over, and how these forces play out will define the next chapter of stablecoin adoption.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。