Original | Odaily Planet Daily (@OdailyChina)

Pump.fun has successfully transformed, and overnight, no one considers it an "industry vampire" anymore; instead, it has become another hope for blockchain's mass adoption. “Pump.fun is essentially a social product; we never intended to be a Meme coin platform, but rather a platform where all content can be traded,” said Pump.fun's anonymous co-founder Noah in a recent interview.

Two months ago, Pump.fun issued tokens with a valuation of $4 billion, and the market generally believed it would become the tombstone of the Meme era, with only a small number of people believing it could be reborn (_Related reading: _ Which of the two scenarios after PUMP's launch do you believe?). After the launch, the price of PUMP fell sharply, with the market cap hitting a low of $2 billion, revenues declining, and the Meme graduation rate being surpassed by LetsBonk, leading to doubts about the token buyback, and Pump.fun was once declared "sentenced to death" in the public opinion environment. However, two months later, Pump.fun's reputation experienced a dramatic turnaround, with Upbit and Binance successively listing PUMP, and Pump.fun's market cap exceeding $8 billion, completely silencing the players who once spread FUD.

Setting aside Pump.fun's genius operational strategies and timely "vision dissemination," what changes have occurred in Pump.fun's fundamentals over the past month? Is the rise of "live streaming coins" just a flash in the pan? Can the concept of a "super social application" grow into a new moat for it, or will it only become a hollow narrative to temporarily boost Pump.fun's valuation?

The Great Comeback of Pump.fun After Dark Times

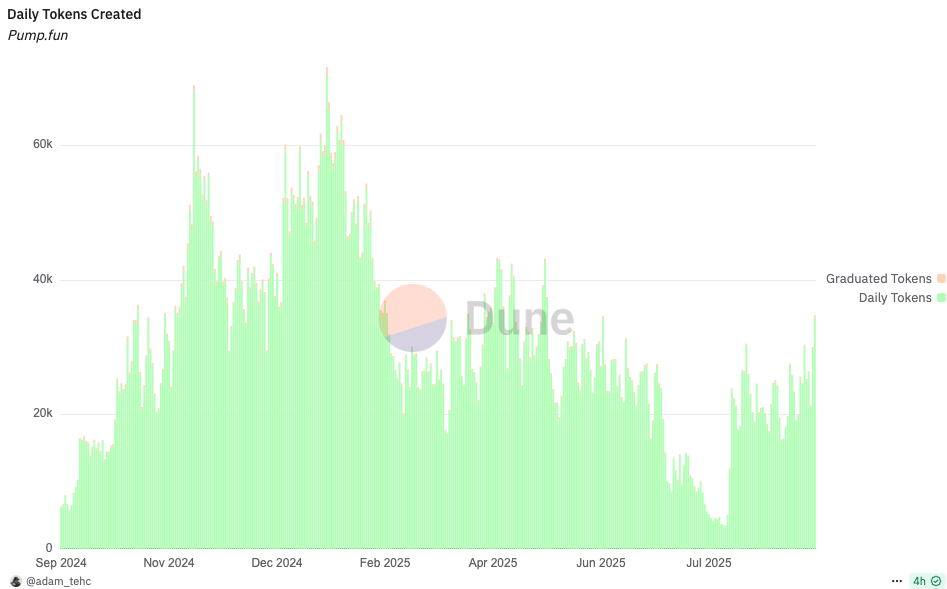

July may have been the darkest moment for Pump.fun this year, reflected not only in the massive negative public opinion and the decline in token prices after issuance but also in various data dimensions. According to Dune data, in July, the number of tokens created on the Pump.fun platform was less than 10,000 daily, and the weekly graduation rate for tokens fell to a new low of 0.58%. Pump.fun's revenue was also declining, with August 2 marking the lowest daily revenue since May 2024, at $251,788. The price of PUMP also hit a low of $0.0022 at the end of July, halving its original $4 billion valuation to $2 billion.

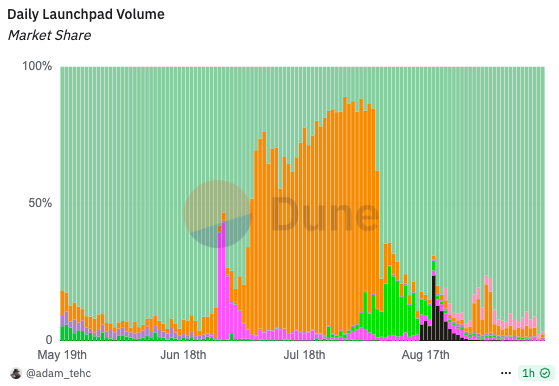

LetsBonk quickly rose in competition, surpassing Pump.fun in user activity and token trading volume in July to become the number one Meme issuance platform.

LetsBonk led the market in trading volume share in July

Just when the market thought Pump.fun was powerless, it began its comeback in August. On August 5, the number of tokens created and trading volume on the Pump.fun platform suddenly surged, and the token graduation rate also began to rise. Although it cannot be compared to the disruptive period in January 2025, the on-chain address activity has returned to the level before the token issuance in July, and it quickly regained the number one position in the Meme issuance platform.

The number of tokens created on Pump.fun surged in August

Why did Pump.fun's platform performance "skyrocket" in August and reclaim the share taken by LetsBonk? Explaining this is difficult; after all, on August 2, Pump.fun's daily revenue had just hit a new low since May 2024, and just two days later, the platform data suddenly improved, which seemed "abrupt." At the beginning of August, there were no significant hot topics in the Meme market, and Pump.fun did not propose any meaningful creator incentive activities.

Regarding LetsBonk's market share decline, Solayer's core developer Chaofan Shou believes that it was mainly due to the CPMM program upgrade causing bot programs to become paralyzed. However, this explanation does not hold up, as the LetsBonk upgrade occurred at the end of August, while Pump.fun had already regained the lead over LetsBonk at the beginning of August.

So, the warming of platform data may be attributed to Pump.fun's "great operation."

Perhaps due to the fact that Pump.fun itself is a breeding ground for "PVP and fraud" and the founder's "questionable character," any action by Pump.fun is prone to a trust crisis, including the token buyback plan launched in mid-July. The market was concerned about the authenticity of Pump.fun's token buyback and the subsequent fate of the tokens, as well as the distortion of the "100% buyback of daily revenue" promise, leading to the token buyback in July not having a significant positive effect on Pump.fun.

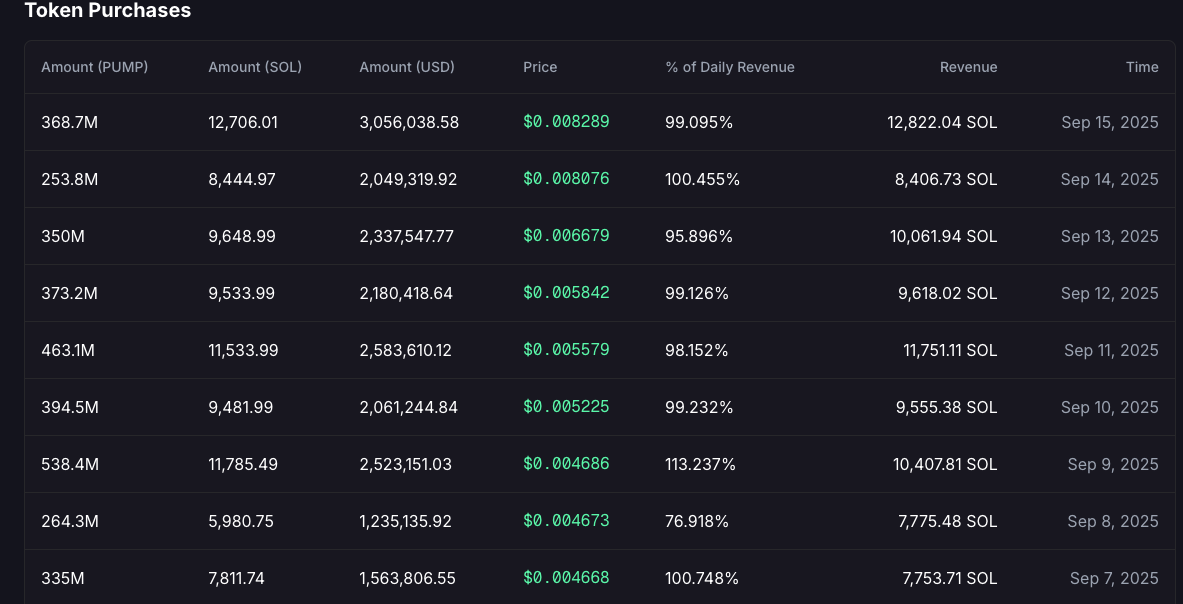

Therefore, on August 5, Pump.fun launched an income dashboard to track Pump.fun's daily revenue and the number of PUMP purchases in real-time. Coincidentally, the launch of the income dashboard almost coincided with the recovery of Pump.fun's platform activity and the warming of fee income. Pump.fun's buyback funds rely on continuous fee income, which in turn depends on the large trading volume of the platform's Meme coins. Thus, the speculation that the Pump.fun team created false trading volume to generate false fee income, thereby creating a false sense of prosperity for the platform, spread in the market.

Pump.fun daily token buyback

However, from the results, whether it was a deliberately created illusion or a perfect coincidence, regaining the number one ranking in the Meme issuance platform and impressive buyback data allowed Pump.fun to reclaim the high ground in terms of token price and public opinion.

Dynamic Fee Model: Leveraging Project Fundamental Innovation

The unreasonable creator revenue-sharing mechanism was also a point of criticism for Pump.fun from the community, and many competitors have entered the competition by innovating incentive mechanisms and enhancing the sustainability of Memes. In May, Pump.fun announced a 0.05% share of PumpSwap fees for token creators, which was far less than the 1% trading fee share offered to creators by LetsBonk during the same period, thus failing to attract creators sufficiently.

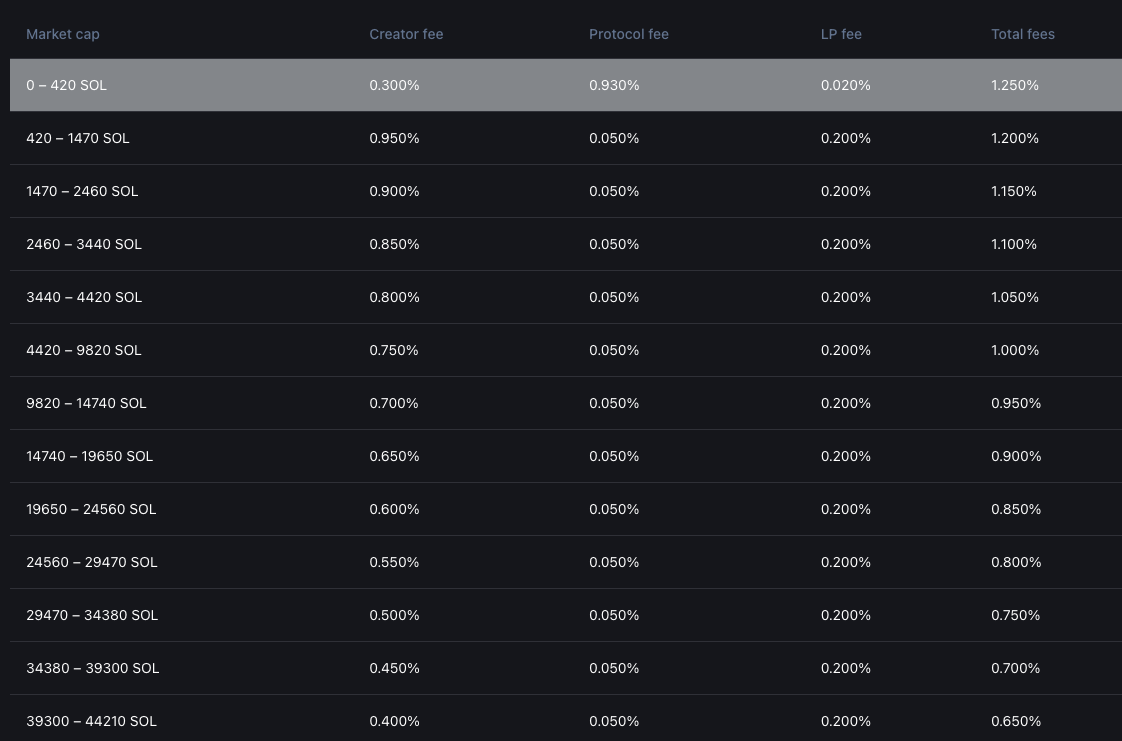

It wasn't until September that Pump.fun released a dynamic fee model, which was considered a change in the project's fundamentals. The core of Project Ascend is to tier the creator fees based on market capitalization; the higher the token's market cap, the lower the creator fee percentage. This means that many newly issued, low market cap token creators will receive extremely high returns, with creators able to earn a 0.3% share of trading volume during the "pre-binding phase," gradually decreasing to 0.05% as the token's market cap grows.

Project Ascend

The update of the creator fee model also laid the groundwork for the subsequent rise of live streaming concept coins. For any content/platform, one of the moats is a continuous influx of creators, and creators are inherently profit-driven. To attract or retain them, the platform must design a competitive revenue-sharing mechanism. “Our current logic is that if streamers can earn significantly more money on Pump.fun than on other platforms, they will attract fans or friends to consume content on Pump.fun, and the network effect will begin to kick in,” said Pump.fun's anonymous co-founder Noah.

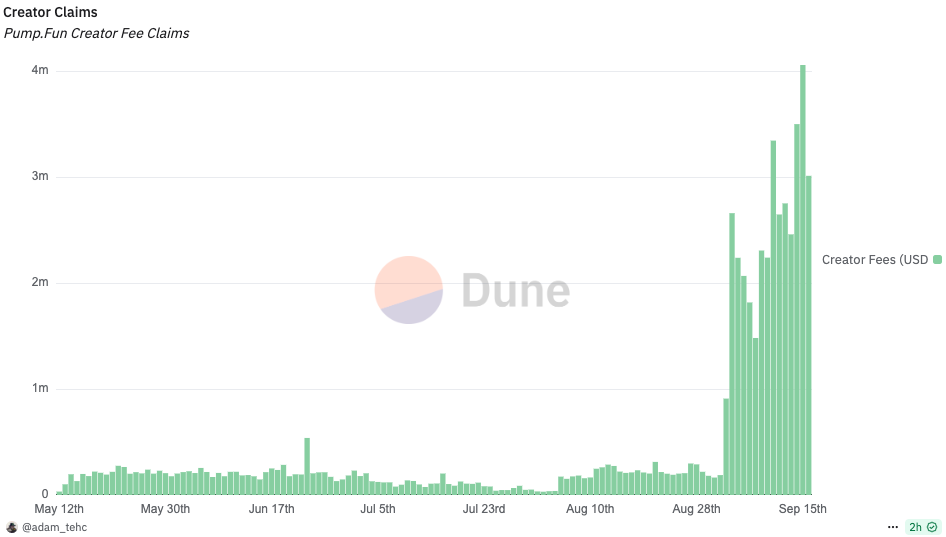

This straightforward logic has indeed brought significant growth to Pump.fun. Since September 3, Pump.fun has been sharing millions of dollars daily with creators, and with the flywheel of "increased new creator revenue ➡️ more creators joining ➡️ overall creator revenue increasing" starting, on September 15, it even set a record of $4 million in a single day for creator revenue. Pump.fun co-founder Alon stated that the average number of concurrent live streams on the Pump.fun platform once surpassed Rumble, approaching about 1% of Twitch's market share, reaching about 10% of Kick's market share.

From an industry perspective, on September 15, in the market share ranking of Solana issuance platforms within nearly 24 hours, Pump.fun ranked first with 90.6%, LetsBonk ranked second with 5.18%, and Believe ranked third with 1.66%.

Pump.fun creator revenue-sharing fees

The explosive growth of the live streaming sector has led Solana co-founder Toly to exclaim that Pump.fun has the opportunity to develop into a global streaming platform. However, Pump.fun did not choose to spend a large sum of money to directly sign big streamers from Instagram or TikTok to create content; instead, it opted to cultivate micro-influencers. To support these micro-influencers, Pump.fun spent about $500,000 to procure a batch of "streamer starter kits," which include cameras, monitors, keyboards, mice, and other equipment to help newcomers start live streaming.

The new creator revenue-sharing mechanism indeed lowers the monetization threshold for small influencers and creators, making investors feel that Pump.fun's vision of "taking down Facebook and TikTok" is no longer just empty talk. The fundamental narrative of Pump.fun has successfully transitioned from a token issuance tool to a socially innovative entertainment platform, redefining the relationships between the platform, creators, and audiences.

Pump.fun's Live Streaming Boom May Not Be Sustainable

With the update of the fee model and the activation of the live streaming network flywheel, Pump.fun itself has become the biggest beneficiary, with its daily fee income surpassing Hyperliquid, making it the highest-earning application in the cryptocurrency field, second only to stablecoin issuers like Tether and Circle. Pump.fun has successfully rescued itself, escaping the quagmire of competition with other Meme coin issuance platforms.

But is live streaming truly sustainable and capable of becoming a solid moat for Pump.fun?

Essentially, no matter how Pump.fun redefines itself, live streaming is merely a different way to attract attention and issue Meme coins; the players watching the streams are still primarily seeking profit. Since Pump.fun shut down its live streaming feature last November for restructuring, it gradually restarted in April 2025, with the key difference being the introduction of stricter content review and rules, but the underlying PVP nature on the Pump.fun platform remains unchanged.

“We want to blend TikTok, Robinhood, Twitch, and Pump.fun into a super app, allowing Gen Z users to trade while creating and consuming content here.” This is Pump.fun's ambitious vision, but in traditional entertainment live streaming platforms, users are consumers, while on Pump.fun, users are investors.

In traditional entertainment live streaming platforms, viewers mostly seek emotional value and are willing to "tip" streamers for it, but on Pump.fun, viewers, like creators, are profit-driven, caring not about whether they like the streamer's content but whether the streamer can create market buzz that drives up token prices. Such a distorted starting point naturally leads to even more distorted streamer behavior. An ordinary artist cannot attract attention by live streaming their creative process on Pump.fun, but someone who walks into a gym to steal a hat and gets slapped on the spot or leaks an unreleased song by a rapper will certainly draw attention.

True creators are overlooked, while streamers who engage in distorted behavior capture significant revenue shares. In such an unhealthy platform model, Pump.fun not only struggles to cultivate genuinely high-quality creators, but creators from other platforms are also unlikely to sacrifice their reputations to migrate to Pump.fun.

The product logic emphasized by Pump.fun still focuses on the financialization of content, a logic that does not allow viewers to "slack off," meaning that in this ecosystem, not only must the platform and creators make money, but even viewers must think about making money. “I have actually deleted all social media from my phone because I really don't like those things; they drain your energy. Those who endlessly scroll are, in my view, in the worst state. If you really have to do that, you might as well make it bring some economic return instead of purely wasting your life.” Pump.fun's anonymous co-founder Noah mentioned his views on social media and Pump.fun's product logic in a Delphi Digital podcast.

Noah's statement is akin to blaming those who spend time scrolling through "low-fat" videos for not spending that time on learning and self-improvement. However, it is precisely because of those willing to "waste their lives" on social media that a rich and diverse content ecosystem has emerged. Perhaps more than the losses incurred in the Meme coin game, what Pump.fun fails to understand is why some people willingly "tip" streamers without seeking economic returns.

If Pump.fun continues to adhere to this product logic, it cannot become a platform that surpasses traditional social entertainment; it will still only serve as a token issuance platform for speculating on Memes. The internet is another self of humanity, and social entertainment platforms are a "utopia" where people indulge themselves. A user who has been watching Pump.fun live trading for hours may still choose to open TikTok before bed to watch their favorite streamer for relaxation.

Viewers come for profit and will leave when they incur losses. Live streaming influencers are merely one of the attention-grabbing gimmicks on Pump.fun to attract players for PVP, fundamentally no different from community Memes, AI Agents, or celebrity coins. Moreover, as market conditions change, the PVP cycle will accelerate. According to OKX Wallet data, on September 17, only 9 live streaming concept coins on Pump.fun had a market cap exceeding $1 million, down from 39 just two days prior.

Of course, if you, like Pump.fun's die-hard bulls Crypto Weituo, believe that "zero-sum," "PVP," and the world heading towards chaos are the fundamentals for this generation of young people, then you should bet on Pump.fun.

Related Reading

After PumpFun's crazy live streaming goes viral again, Alon's first interview

Going long on Pump, shorting human nature: A debate on Pump Fun's $8B market cap

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。