When "interest rate cuts" become a high-frequency term in the global financial market, many investors still feel confused about its impact logic and market reactions.

==================================

💎

💎

From the current market pricing and institutional forecasts, it is highly likely that the Federal Reserve will take the first step towards an interest rate cut in tonight's meeting, with an expected reduction of 25 basis points. On one hand, recent inflation data in the U.S. is gradually approaching the 2% target, and the year-on-year growth rate of the core PCE price index continues to decline, providing space for a shift in monetary policy; on the other hand, although the labor market remains resilient, the marginal growth of employment is slowing down, coupled with fluctuations in consumer confidence indices, the policy layer needs to provide moderate easing to "safeguard" economic growth. More importantly, the market generally expects that in the interest rate meetings in October and December 2025, the Federal Reserve may further cut rates by 25 basis points each time, with a total expected reduction of 75 basis points for the year. This pace reflects the policy layer's recognition of economic resilience and anticipatory response to potential downside risks, representing a typical path of "gradual easing."

==================================

💎

💎

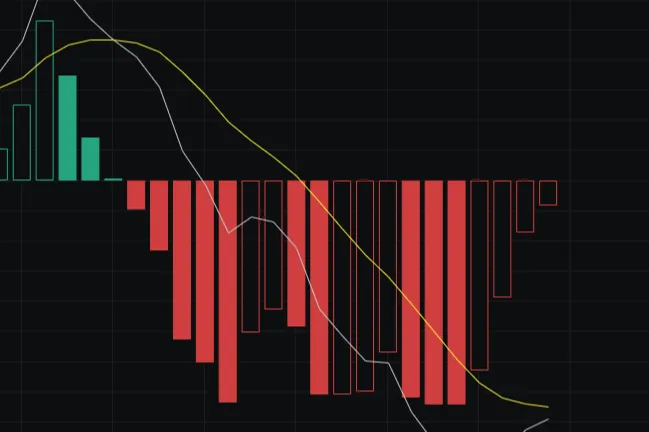

In the face of clear expectations for an interest rate cut, the market's reaction is often "forward-looking"—not waiting for the policy to be implemented on the day itself, but gradually completing pricing during the formation of expectations. This pattern is particularly evident in the recent performance of Bitcoin and Ethereum. Over the past month, the prices of these two major cryptocurrencies have continued to rise, with cumulative increases exceeding 15%. This round of increase is not driven by a single event but is a preemptive digestion of the market's expectation of "the Federal Reserve cutting rates by 25 basis points." From a technical perspective, the current price is close to previous resistance levels, while trading volume shows a gradual decline, indicating that the momentum driving the rise is weakening. Based on this signal, caution is warranted regarding short-term market trends. When "a 25 basis point cut" becomes a consensus, it means that this positive news has been fully factored into the price; if there is no subsequent unexpected positive support, the market is likely to experience a correction after the "good news is fully priced in." Historical data shows that during the Federal Reserve's rate-cutting cycles in 2019 and 2020, there were instances of "price increases during the expectation speculation period, followed by declines after the policy was implemented," and this time may be no exception.

==================================

💎

💎

A 25 basis point cut is the market consensus, but what truly determines the subsequent market direction is the dot plot released during tonight's meeting and the speech by Federal Reserve Chairman Powell. These two elements will directly reveal the policy layer's true attitude towards the future pace of interest rate cuts, becoming the core basis for the market's judgment of "dovish space." The dot plot is a summary of the predictions of the future interest rate path by the 19 members of the Federal Reserve, with each point representing the view of one member. Through the dot plot, the market can clearly see: do the members believe that further rate cuts are needed in 2025? What is the target interest rate range for 2026? If the dot plot shows that the cumulative rate cut in 2025 exceeds 75 basis points, or if there are still plans for rate cuts in 2026, it indicates that the policy layer's easing attitude exceeds expectations, and the market may initiate a new round of "dovish expectation speculation," pushing the prices of risk assets higher; conversely, if the dot plot indicates a slowdown in the pace of future rate cuts, or even suggests that this round of rate-cutting cycle is about to end, it means that the dovish space is narrowing, and market sentiment may quickly turn cautious.

==================================

💎

💎

The Federal Reserve's interest rate cuts are not simply "good news" or "bad news"; their impact on the market depends on the "difference between expectations and reality" as well as the "future direction of policy." The current market has digested the expectation of "a 25 basis point cut," and the meeting on September 18 will become a "watershed" for the market. For market operations, rather than getting entangled in "whether to cut rates," it is better to focus on the signals revealed by the dot plot and Powell's speech, adjusting strategies based on actual conditions—rational responses are essential to seize opportunities in a volatile market. For specific layouts, let's discuss together in the live broadcast room.

=================================

💎

💎

==================================

If you are feeling lost—unable to understand technology, unsure how to read the market, not knowing when to enter, unable to set stop losses, unclear about taking profits, randomly increasing positions, getting stuck while trying to bottom out, unable to hold onto profits, missing market opportunities… these are common issues for retail investors. But don't worry, I can help you establish the right trading mindset. A single profitable trade speaks louder than a thousand words, and finding the right direction is better than repeatedly facing defeats. Instead of frequent operations, it is better to strike precisely, making each trade more valuable. If you need real-time guidance, you can scan the QR code below the article to follow my public account. Market conditions change rapidly, and due to the timeliness of reviews, subsequent trends will be based on real-time layouts. I look forward to moving steadily forward in the market with you.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。