Grayscale CoinDesk Crypto 5 ETF Launches with XRP, BTC, ETH, SOL & ADA

The investment environment will also undergo a significant change when the GDLC Fund, currently renamed as the Grayscale CoinDesk Crypto 5 ETF, officially becomes available tomorrow. The ETF will comprise Bitcoin, Ethereum, XRP, Solana, and Cardano, noting the growing institutionalization under the changing SEC rules.

Grayscale Digital Large Cap (GDLC) Fund Adds XRP

It stated that the GDLC Fund has assets under management. XRP will now make up 5.72% of the portfolio, alongside Bitcoin (77.5%) and Ethereum (12.42%). Such a distribution is an indication of a strategic move towards diversification in non-Bitcoin and non-Ethernet digital assets.

Source: JackTheRippler X

Barry Silbert, chairman of Grayscale, reposted the analyst Nate Geraci's update on social media, amplifying market attention to the ETFs going live tomorrow.

Source: X

From GDLC to CoinDesk Crypto 5 ETF

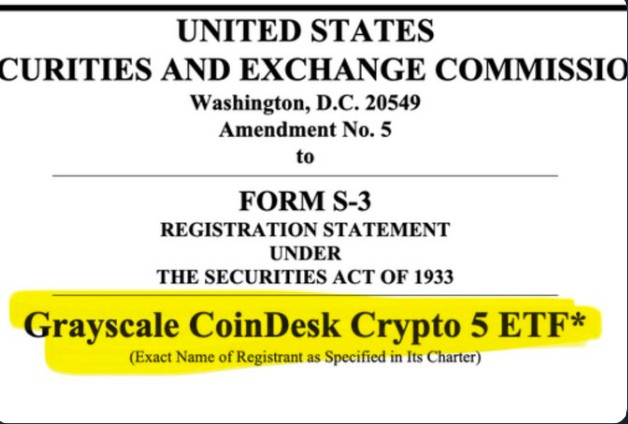

The GDLC fund will now trade as the Grayscale CoinDesk Crypto 5 ETF , providing diversified exposure to five major cryptocurrencies. According to official announcement on X (formerly Twitter):

“SEC APPROVES $GDLC TO TRADE AS AN ETP. FUND PROVIDES EXPOSURE TO $BTC, $ETH, $XRP, $SOL, AND $ADA.”

This rapid rebranding was highlighted by BankXRP, which wrote:

“Grayscale’s Digital Large Cap Fund ($GDLC) is now the Grayscale CoinDesk Crypto 5 ETF, and it’s launching TOMORROW! … hitting the market within 24 hours of SEC approval, a lightning-fast pivot from the usual 3–6 month slog.”

SEC’s Regulatory Shift Enables Faster Approval

The launch comes just one day after the SEC approved generic listing standards on September 18, 2025, allowing spot crypto ETFs to bypass lengthy individual reviews. Historically, ETF approvals could take up to six months, but the new framework enabled the company to hit the market within 24 hours.

According to a September 18 Reuters report, the new rules put forward by the SEC allow the time taken to approve ETFs to be cut to a mere 75 days, which will enable easier access to crypto products. This is in contrast to the agency being cautious in its approach, as observed in the delayed approval on the Bitwise Dogecoin ETF and the Grayscale Hedera ETF , both awaiting approval till November 2025.

XRP’s Inclusion and Market Context

It is also important that XRP was included in spite of its controversial legal background. The SEC’s 2020 lawsuit against Ripple partly concluded in 2023 when a judge ruled that sales to retail investors were not securities. After the decision, the XRP price today shot up suddenly and is now trading at $3.04, down by 1.87% with trading volume $6.21 billion and market cap. $181.88 billion in the last 24 hours.

Source: CoinMarketCap

The XRP Ledger, known for its 1,500 transactions per second and carbon-neutral design, strengthens its appeal for institutional investors seeking scalable, sustainable blockchain assets.

Increasing Institutional Demand.

Surveys of the market indicate that crypto ETFs are in high demand. In a study of 500 financial advisors, conducted by Nasdaq in 2022, 72% indicated they would allocate to cryptocurrency if spot ETFs existed, and 86% of current users indicated they would allocate more in the next year. These numbers confirm the fact that Nate Geraci is expecting a huge demand for index-based crypto ETFs.

Conclusion

The rebranding, featuring Ripple alongside Bitcoin, Ethereum, Solana, and Cardano, underscores a transformative moment for institutional cryptocurrency adoption. Supported by a regulatory change by the SEC and the increasing investor interest, this will be the first move towards a wider diversification of the digital asset market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。