Written by: Will A-Wang

The cryptocurrency ecosystem in Latin America is no longer a "new phenomenon," but an irreversible force that is rewriting financial rules. The triple resonance of economic turmoil, regulatory vacuum, and innovative vitality has made this continent the most dramatic and experimental battlefield in the global crypto landscape. Argentina, Brazil, Colombia, and Mexico are the first to break through, each staging a live drama of "on-chain capital redistribution"—old wealth is being repriced here, and new investment opportunities are growing wildly.

I am honored to discuss the "Latin American scene" of stablecoin payments with Jane Luo, CMO of VelaFi, and Hongyi Tang, VP for Latin America. In their eyes, this continent is not a unified market but a series of isolated "economic islands": Argentina uses stablecoins to hedge against triple-digit inflation, Mexico hesitates under geopolitical circumstances, and Brazil treats on-chain dollars as a "digital dollar savings jar." VelaFi's cross-border payment network builds floating bridges between these severed veins, allowing "liquidity" to freely navigate the blood vessels of the Latin American continent, while also finding tailored exits for each isolated pain point.

VelaFi is a cross-border financial infrastructure platform centered on stablecoins, designed specifically for emerging market enterprises, with operations covering Latin America, the United States, and Asia, and is continuously expanding into more global markets. Currently, VelaFi has provided hundreds of enterprises with full-link financial services such as cross-border payments, fund management, clearing, and settlement, supporting multi-currency and multi-channel fiat and digital asset inflows and outflows. Its clients include various emerging industries such as cross-border e-commerce, international trade, fintech, and Web3. VelaFi's mission is to build a foundational financial system that supports enterprises in achieving frictionless growth amid global financial transformation, accelerating the integration of emerging markets into the global digital economy.

(www.velafi.com)

1. The Real Demand for Stablecoins in the Latin American Market

Will:

In a previous interview, Tether CEO Paolo did not hide his desire for the Latin American market. Latin America is both a testing ground for cryptocurrencies, especially in countries affected by inflation or currency instability (such as Argentina and Venezuela), and a significant point for serving the unbanked population. According to the 2022 Latin America report, 70% of the region's population still lacks a bank account. At the same time, Latin America is a cradle of global agriculture and energy, both of which require global circulation. Therefore, we can see that both individuals and enterprises are eager for convenient financial services.

As a stablecoin payment infrastructure deeply rooted in the Latin American market, how do you view the rigid demand for stablecoins in this region and its underlying logic?

1.1 Rigid Demand Caused by the Macroeconomic Environment

VelaFi:

In general, whether it is B2B trade or B2C consumption, the core reason why people use stablecoins in Latin America is directly related to the macroeconomic environment:

A. Foreign Exchange Controls

Many Latin American countries have varying degrees of foreign exchange controls; once the macroeconomic situation worsens and dollar reserves are insufficient, individuals/enterprises will face limits, queues, or even be unable to obtain foreign exchange quotas, directly suppressing the demand for imports and cross-border payments.

B. Extreme Exchange Rate Risks

Although some countries do not have foreign exchange control issues, the depreciation of the local currency is also a fundamental factor driving people towards stablecoins. Argentina is a typical example: the local currency has depreciated significantly, and the government has choked off foreign exchange channels, leading the entire society to want to escape the local currency, thus naturally creating a demand for stablecoins to complete payments and preserve value.

C. Heavy Tax Burden + Banking Service Desert

In countries like Mexico and Brazil, which nominally have no foreign exchange controls, the complex tax system, difficulty in opening bank accounts, and fragmented foreign exchange counter services often prevent importers from opening accounts or exchanging currency, and even if they can, they have to accept poor exchange rates and experiences.

It is precisely these combined macro factors and regional characteristics that have forcibly compressed the normal demand for financial services into a rigid demand for "stablecoins."

1.2 Underlying Logic—Transaction Medium

Will:

The macro environment has created a rigid demand for stablecoins, which directly corresponds to a specific example Paolo mentioned in a previous interview: stores in Santa Cruz, Bolivia, and other towns have begun to label prices in USDT. From your perspective as a stablecoin payment company, do you think the value of stablecoins as "currency preservation" is greater, or is their value as a "transaction medium" more significant?

VelaFi:

In our view, many so-called research reports or narratives romanticize the story of stablecoins in Latin America too much. There will certainly be street vendors accepting stablecoins, but not every street vendor will do so.

The application of stablecoins on the consumer side (C-end) is still in its early stages; it is not common for consumers to use stablecoins for daily payments, and more often it is sporadic pilot projects or attempts in specific scenarios. Overall, it has not formed large-scale penetration. Despite narratives about stablecoin services for the unbanked population, there are still last-mile challenges in practical applications. In fact, the acceptance of stablecoins on the C-end still highly depends on regional and scenario adaptability.

Moreover, while the popularity of stablecoin wallets can reach the unbanked population, how to achieve direct circulation of stablecoins in the local economy remains a key obstacle. For example, in tax-strict regions like Brazil, the use of stablecoins is more common in B-end scenarios, especially in enterprise businesses such as import and export trade. Enterprises typically choose stablecoins for settlement to optimize cross-border fund structures, reduce exchange complexity, and minimize tax friction, anchoring transaction value to the dollar and improving overall fund flow efficiency. In contrast, the popularization of C-end scenarios requires more complete infrastructure and regulatory support.

In these scenarios, stablecoins still primarily serve as a medium for cross-border payments, rather than an endpoint. Therefore, the degree of popularization of stablecoins in C-end consumption scenarios remains limited, with current stablecoin applications more concentrated in the efficient flow of B-end enterprise funds, especially in high-frequency demand scenarios like cross-border payments. How many cross-border payments do you think an individual will make in their lifetime? In contrast, B-end enterprises, in such a globalized economy, are making cross-border payments every day.

Will:

Indeed, based on the characteristics of blockchain and stablecoins, they can fully leverage their advantages in cross-border scenarios. The United States is one of the markets with the highest efficiency in capital flow globally, with financial channel efficiency reaching 90%. If stablecoins were introduced in the U.S., efficiency might improve by 5%, which offers very limited premium space. In contrast, in other parts of the world, such as Nigeria, Argentina, or Turkey, the efficiency of financial channels may only be around 10% to 20%. After introducing stablecoins, efficiency is expected to rise to 50%, meaning an improvement of 30% to 40%. Therefore, for these countries, the significance of stablecoins is much greater.

1.3 The Last Mile

Will:

When we previously launched a C-end stablecoin payment application, we targeted regions like Chiang Mai, Bali, and Singapore, where Web3 communities are concentrated. Outside of these places, there is rarely a demand for stablecoins for payments, or people simply do not hold stablecoins. So the question arises, as you mentioned earlier: "Stablecoins in these scenarios still primarily serve as a medium for cross-border payments, rather than an endpoint."

Where is the endpoint for stablecoins? From which perspective can we see stablecoins ultimately achieving the last mile?

VelaFi:

Currently, even if B-end enterprises have received payments through stablecoins, the payee usually still needs to convert stablecoins into local fiat currency for actual living expenses. This process still relies on inflow and outflow channels or currency exchange solutions like VelaFi. At the same time, the application of stablecoins on the C-end relies on inflow and outflow channels (such as currency exchange services or U-card solutions), and the coverage and convenience of such infrastructure have not yet fully addressed the liquidity needs of end users.

In the future, the promotion of stablecoins on the C-end needs to overcome two major bottlenecks: first, expanding the coverage of payment scenarios (such as retail, in-game purchases, etc.), and second, optimizing the convenience of fiat currency exchange. Currently, there are some positive attempts in the industry, such as Hong Kong promoting compliance through the "Stablecoin Regulation," companies like JD.com testing the application of stablecoins in e-commerce payments, and the gaming industry exploring stablecoins as cross-platform value media. However, regulatory uncertainties (such as some countries incorporating Play-to-Earn models into financial regulation) and technical barriers (such as the complexity of blockchain integration) remain major constraints.

2. Main Use Cases for Stablecoin Payments

We have previously outlined the rigid demand for stablecoins in Latin America caused by the macroeconomic environment, the role of stablecoins as a transaction medium in cross-border payments, and the solutions needed to bridge the last mile. Now, we see many companies planning to expand their business in Latin America. The essence of expansion is that there is a commercial demand behind it. Let's explore the sources of commercial demand for expansion in Latin America.

2.1 Cost Accounting for Import and Export Trade

Will:

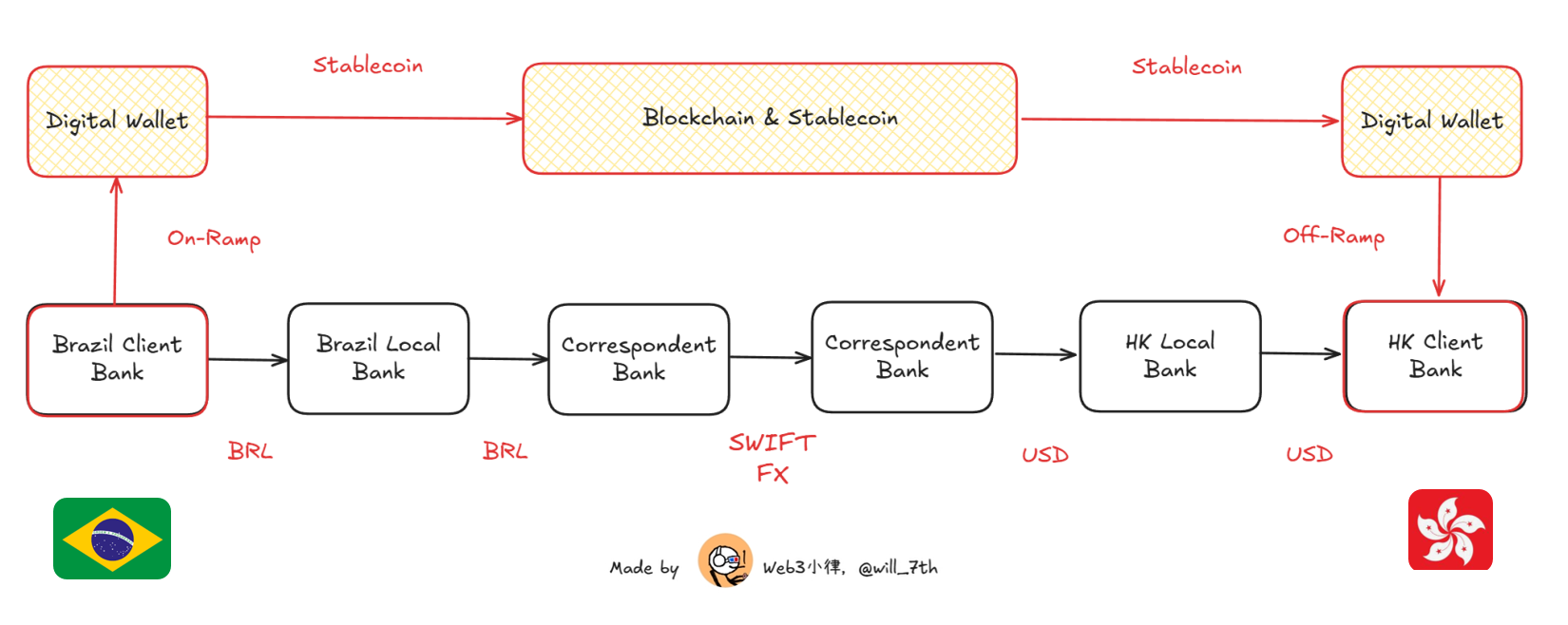

In our previous article "Stablecoin Payments and Global Capital Flow Models," we also mentioned that stablecoin applications for enterprises mostly adopt a "stablecoin sandwich" structure, which means using blockchain to replace traditional payment channels for horizontal value/fund transmission, while still relying on the outdated financial payment system at both ends. Although this design brings significant improvements, it also limits the full release of blockchain advantages. Clearly, there will be exchange costs at both ends.

So for companies in Latin America, is it more advantageous to use stablecoin payments in the field of goods trade, or is it better to directly use small currency collections offered by traditional cross-border payment companies?

VelaFi:

Before answering this question, we need to trace its source—fiat currency. Imagine a complete trade chain: a Brazilian importer imports daily necessities from a Hong Kong exporter. Once the goods arrive in Brazil, they are distributed through local distributors and eventually enter the Brazilian retail market. In this chain, the final consumer still uses fiat currency, so the source must be fiat currency. Now, if we look at it from the perspectives of different participants, their considerations will differ.

For the Hong Kong exporter, they will directly require the Brazilian importer to pay in stablecoins. They won't care how the distribution happens locally in Brazil; as long as stablecoins are paid, that’s the end of it—efficient and convenient.

For the Brazilian exporter, an unavoidable question is: how do I convert Brazilian currency into stablecoins? Although the entire chain can be long—factory, exporter, importer, distributor, retail consumer—there are essentially only two ends: the starting point is the real, and the endpoint is the dollar.

Stablecoins are merely the "thinnest and fastest" segment in the middle. Whether to use them ultimately comes down to a single account:

Brazilian currency → Discount on stablecoins + Outbound fee rates in places like Hong Kong/Singapore/Dubai

Traditional path: Brazilian bank fees + SWIFT transfer fees + 3–5 days of capital occupation + 0.38%–1.5% IOF exit tax

Who bears the currency exchange cost depends on the contract terms. If the contract states "only accept stablecoins," for the exporter, the exchange loss is "invisible" on the surface, and all costs are pushed onto the importer. If the contract states "settlement in Brazilian currency," then the exporter must find a local currency exchange or trading platform to convert Brazilian reais into stablecoins, and then into the final fiat currency. What truly determines whether to go through the stablecoin channel is the "comprehensive landed cost" of the two paths.

In other words, costs are not merely numerical figures; specific solutions must depend on the client's stage and core demands: if the pursuit is for absolute low cost, trading with "fellow countrymen" is undoubtedly the most convenient. However, this is only the superficial "optimal" solution; the cost of such trading lies in compliance gaps, unstable channels, and the inability to guarantee "always responsive" and timely matching of demands.

If clients have demands for timeliness, compliance, and relatively reasonable costs, stablecoin solutions can address their pain points to some extent. For leading enterprises like BYD, banks have already provided a full suite of customized services, making it difficult for stablecoins to replace them in the short term. Therefore, stablecoins remain a growing tool, and enterprises must weigh different needs, paying a premium for compliance, efficiency, and certainty to ultimately reach an acceptable balance.

2.2 Underestimated Service Trade

Will:

So what specific scenarios exist for service trade? We often encounter many digital platforms, such as gaming and live streaming, expanding into Latin America. Could you elaborate on this?

VelaFi:

In addition to traditional goods trade, VelaFi also serves a large number of service trade clients. Goods trade at least has small currency collection solutions provided by traditional cross-border payment companies, which are relatively convenient. However, for service trade enterprises, exchanging currency and opening accounts is even more challenging, so they account for a significant portion of our business—they belong to a group completely overlooked by the mainstream financial system.

Service trade scenarios mainly focus on the following categories:

MCN and influencer platforms: The capital pool is usually in dollars, requiring quick conversion to local Latin American currencies.

Gaming and live streaming companies: They have income in Brazilian reais locally but cannot open foreign exchange accounts with banks, making it impossible to remit income back to their Hong Kong parent company.

Overseas lending platforms: They lend in Latin America, but the recovered reais also face challenges in account opening and currency exchange, preventing smooth repatriation.

The overall chain of service trade is: VelaFi instantly converts the client's local currency into stablecoins, then settles through the stablecoin network to their Hong Kong (or other regions) accounts, completing the cross-border capital flow loop from local currency → stablecoin → dollar.

Will:

A common issue we encounter is that many service trade clients are marked as "high-risk" by traditional financial institutions, which directly leads to their difficulty in obtaining traditional payment channels. Even if they do access traditional payment channels, the fees are often very high.

So, in your view at VelaFi, is this a reason that drives them to turn to stablecoins? Or have Latin American users already become accustomed to using stablecoins for consumption in these scenarios? How do you understand this demand?

VelaFi:

The core difference between "directly accepting small currencies" and "accepting stablecoins" is not the fee rates, but that traditional solutions fundamentally "do not exist":

Even if service trade enterprises register a company in Hong Kong, it can take six months to ten months to open an account, often falling into a "must operate to open an account, must open an account to operate" vicious cycle; if this is the case in Hong Kong, it is even more unattainable with Latin American banks.

The operational entities for large currency collections in Hong Kong face similar challenges, let alone those needing to collect small currencies across the broad Latin American region. Many enterprises have never been covered by traditional financial services, making stablecoins the only available payment channel.

A very typical example is for overseas gaming companies, where the typical characteristic of gaming products is "not localized"—a game launched in Spanish can cover dozens of Latin American countries simultaneously, making it impossible to open bank accounts and complete local currency exchanges in every country. Thus, they naturally lack a "small currency → dollar" channel and must rely on payment companies to solve this.

Although the mainstream collection channels for gaming platforms are still fiat currencies, there are indeed a few companies starting to directly accept users' stablecoins, but overall, it is still in a "developing" state and far from widespread. However, the trend of adopting stablecoin payments is changing:

Currently, overseas digital platforms primarily use "fiat currency collection," and the accumulated funds are then settled cross-border using stablecoins—this is the most common model.

As stablecoin payment service providers like VelaFi simplify the inflow and outflow processes, enterprises no longer need to "go abroad" and can directly hold and use stablecoins.

In some data industries (gaming, lending, SaaS, etc.), a "stablecoin-based" self-circulation has emerged: advertisers, cloud service providers, and SMS platforms can all accept stablecoins and issue invoices, allowing enterprises to pay each other using stablecoins. The internal ecosystem has already established a stablecoin circulation.

We expect that in the coming years, this "stablecoin-based internal circulation" will spread to more industries; at that time, overseas digital platforms will generate a demand for "directly accepting stablecoins."

The next biggest variable is "directly using stablecoins for collection"—VelaFi will soon launch such products. The logic behind this is simple: when the inflow and outflow chain for stablecoins is smooth enough, enterprises no longer need to "go abroad" and can keep their assets on-chain, completing a full cycle of collection, payment, storage, and investment.

3. The Fragmented Latin American Market

Will:

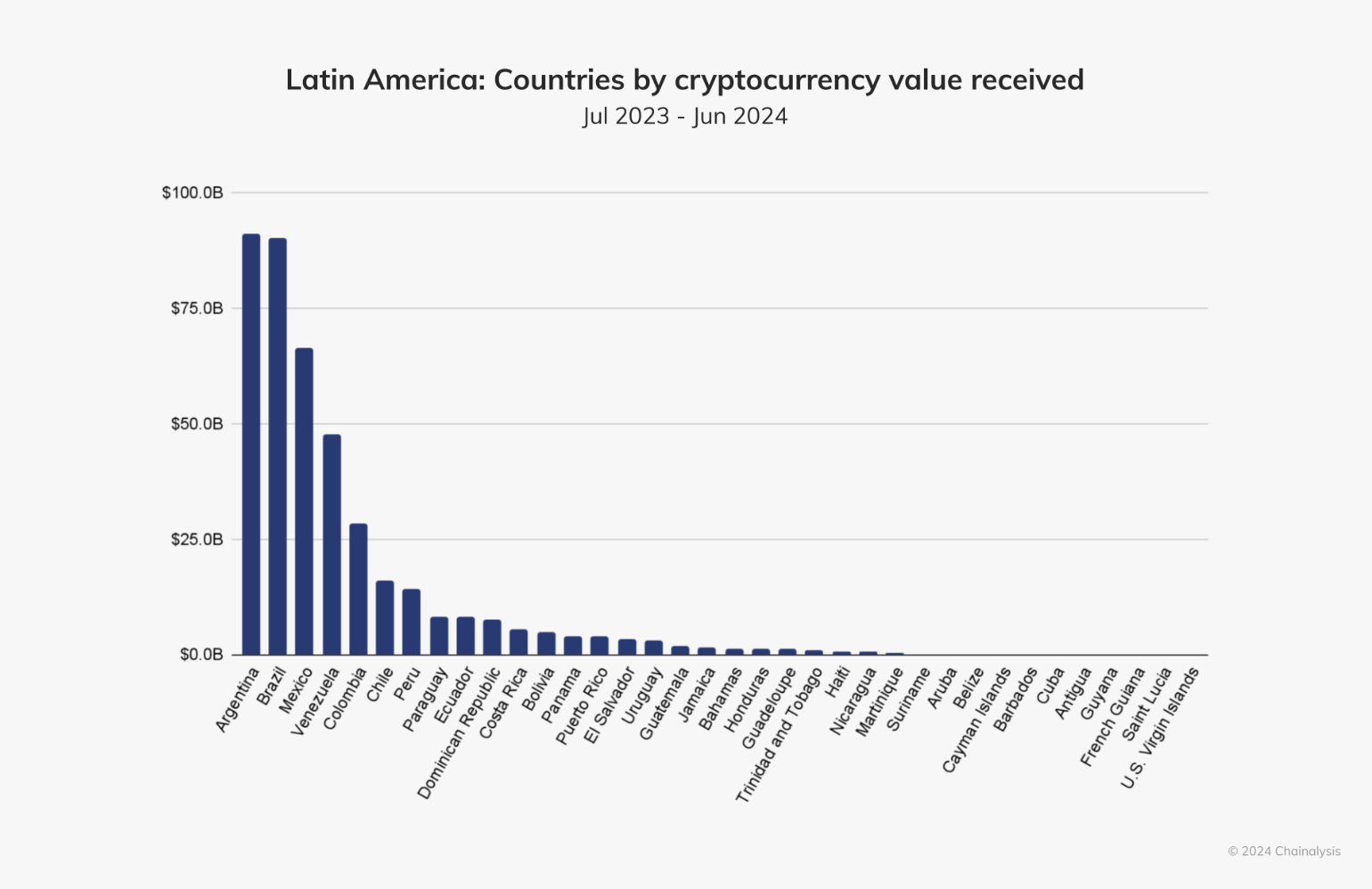

The Chainalysis 2024 Latin America report states:

Latin America is the second fastest-growing region for cryptocurrency globally, with a year-on-year growth rate of about 42.5%. This growth is largely driven by strong yet diverse cryptocurrency markets in countries like Venezuela, Argentina, and Brazil.

Among the top 20 countries in the global adoption index, four are located in Latin America: Brazil (9th), Mexico (13th), Venezuela (14th), and Argentina (15th). Remittances based on stablecoins are becoming increasingly popular in these countries and throughout Latin America.

Clearly, the Latin American market is a very attractive market from both cryptocurrency and overseas expansion perspectives.

(Chainalysis, Latin America’s Search for Economic Stability: The Rise of Stablecoins Amid Volatility)

3.1 Relatively Mature Brazilian Market

Will:

We consider the Brazilian market to be relatively mature. From Dune's report, we see that traditional financial players have launched their own stablecoins and are actively building their stablecoin ecosystems and scenarios. Additionally, major global exchanges like OKX and Coinbase, as well as Circle (officially launching in Brazil in May 2024), are also actively expanding locally. The Drex pilot program—a hybrid CBDC/smart contract platform being developed by the Brazilian central bank—also encourages TradFi banks to be more forward-looking in their digital asset strategies.

These factors collectively drive the adoption of stablecoins. Therefore, we are currently encountering many stablecoin payment scenarios focused on Brazil. Can you share the situation regarding stablecoin adoption in Brazil?

VelaFi:

We have also noticed that many of our clients are concentrated in Brazil, possibly because:

Brazil is the largest economy in Latin America, with the highest population and GDP;

It is a BRICS country with intensive trade with China;

Geopolitically, it is closer to China. Although Mexico also has a significant economic scale, it leans towards North America, and the pace of client acquisition is slower, resulting in fewer cases at present.

We all know that Brazil has a multitude of taxes, especially when converting Brazilian currency to foreign currency for outbound transactions, which involves two actual costs commonly referred to in the industry as "exit taxes." This means that when money "leaves the country," it is usually first deducted by 0.38% IOF, and then subject to withholding income tax of 15% (or 25%) based on its nature, before finally being converted into dollars/euros, etc. Both of these are mandatory, and unless specific exemption clauses are met, they cannot be avoided.

Therefore, the tax burden is one of the biggest motivations for many people to use stablecoins for imports and exports in Brazil. The tax burden in Brazil is already harsh, and stablecoins are legally regarded as "on-chain assets," which are not subject to the same regulatory scrutiny as dollars, lacking the concept of "cross-border" and only distinguishing between on-chain and off-chain, thus circumventing exit taxes. At the same time, they are anchored to the dollar, ensuring that the value of invoice amounts does not depreciate, so enterprises are willing to take the route of "Brazilian currency → stablecoin → foreign currency."

From our perspective, using stablecoins for goods trade is a "rapidly growing" but still small-scale sector. This pain point is very real: for Chinese exporters, the payment ultimately needs to be converted into RMB to return to China, which involves regulatory issues in China.

Will:

Indeed, as the regulatory legislation for stablecoins becomes clearer and as awareness of stablecoins increases, we believe that players in the frontline market will gradually accept the existence of stablecoins. We are also actively discussing the legal and compliant application of stablecoin payments in foreign trade import and export processes with partners. This indeed, as you mentioned earlier, is not just a matter of stablecoins as a transaction medium; it also involves transaction rates, cross-border transaction structures, tax planning, compliance of capital repatriation, and other legal issues.

3.2 Mexico's Political Hesitation

VelaFi:

The market size in Mexico is comparable to that of Brazil, but the pain points are quite different.

It does not have the "exit tax" that Brazil has, so tax avoidance is not a pressing need; the real trouble is geopolitical—with the US-China trade war, Mexico finds itself caught in the power struggle between the two giants. The banking system feels the chill first: any SWIFT transaction that ends in China must pass through a major US bank, and as soon as they see the recipient's address, they "technically" delay it for two days, turning what should be a 1–2 day payment into 4–5 days, which is the issue clients face.

As a result, Mexican banks, traditional financial institutions, and leading import-export companies are collectively seeking stablecoin solutions: funds arrive on-chain in 10 minutes, without needing any approval from US banks, completely bypassing "intermediary bank scrutiny."

We already have Mexican import-export clients piloting this, but the scale is still smaller than in Brazil. One reason is that Mexico has a high degree of economic openness, and its foreign exchange services are relatively mature, offering many alternative solutions; another reason is that client acquisition is slow, and the market is still in the education phase. However, the logic remains the same: as long as importers need to quickly and tax-efficiently convert their local currency into dollars for outbound transactions, stablecoins will have room to grow. It’s just a matter of time before the volume increases.

3.3 The Turmoil and Stability of Argentina

Will:

This is very interesting: Brazil's pain point is "tax," while Mexico's is "geopolitics." Apart from these two largest Latin American countries, the next one might be Argentina. Can you elaborate on that?

VelaFi:

While Latin America is often viewed as a whole, the pain points in each country are significantly different. Argentina is a completely different story.

Argentina has been struggling with inflation and the devaluation of the Argentine peso (ARS) for decades, leading to multiple currency collapses (with inflation rates exceeding 200%). The official supply of dollars has dried up, and import-export companies cannot obtain sufficient foreign exchange through formal channels, forcing many citizens to seek alternatives to protect their savings and ensure a more stable economic future.

The core contradiction in Argentina is the "three exchange rates coexisting," with the three rates often differing by more than 30%:

Official exchange rate (ARS/USD)

Financial market rate (MEP)

Black market rate (Blue Chip Swap)

Importers cannot buy dollars at the official rate, and the cost at the MEP rate is too high, so they simply adopt stablecoins like USDT/USDC:

The price is close to the black market, more expensive than the official rate but cheaper than MEP;

Transactions are available 24/7, without needing central bank approval for quotas;

Funds can be paid to Hong Kong exporters within 10 minutes after arriving on-chain.

Comparing the monthly stablecoin trading volume of the Argentine peso (ARS) on Latin American exchanges, we find that the depreciation of the peso is directly proportional to the trading of stablecoins.

Thus, over 90% of our B2B trade clients in Argentina are using stablecoins to "bypass foreign exchange controls and multiple exchange rate discrepancies," making stablecoins their de facto "parallel dollars." Although the volume is not as large as Brazil's, the average transaction size is high, and the frequency is also high, making it hard to abandon once adopted.

3.4 Other Latin American Markets

Will:

What about other markets in Latin America? Do smaller countries face issues of poor liquidity and dispersed demand, making them commercially unviable?

VelaFi:

Colombia has foreign exchange controls: domestic enterprises and individuals are not allowed to open any form of dollar accounts, and the demand for dollar exchange and preservation has long been suppressed, making stablecoins an alternative solution. In absolute terms, Colombia and Peru are certainly smaller than Mexico and Brazil, but they are roughly on the same scale as Argentina. The economic size and population of these three countries are similar, and their demand structures are also alike, so we categorize them as "second-tier" core markets.

For other countries, liquidity is indeed a challenge, but the pain points in smaller countries are equally sharp. For example, Bolivia is experiencing a tightening of the dollar system similar to Argentina, with enterprises unable to exchange currency, leading to a rapid growth in demand for stablecoins.

A typical feature of Latin America is the "long tail effect": apart from the two major hubs of Mexico and Brazil, countries like Bolivia, Paraguay, Uruguay, and Ecuador have fragmented demand, but collectively they can still form a considerable business volume. For institutions with cross-border liquidity and compliance capabilities, these "long tail" markets actually provide differentiated competitive space.

Four, VelaFi—A Chinese Team Deeply Engaged in the Latin American Market

4.1 Localization and Licensing

Will:

Earlier, we outlined the essence of stablecoin adoption in major Latin American countries: on the surface, they all use stablecoins, but the underlying drivers are different. This is something only frontline practitioners can see, and it’s the most interesting part.

We noticed that most teams working on stablecoin payments in Latin America are local teams, and you should be the only Chinese team that has been deeply engaged for many years and has obtained local licenses. I’d like to ask why you chose this track initially and your subsequent licensing strategy.

VelaFi:

Our starting point is a typical "pain point-driven" approach combined with "geopolitical convenience." Additionally, we have always been involved in Fintech and Web 3. Team members have long lived overseas: I am in Mexico, while other colleagues are mostly in Texas or California, which gives us a natural advantage due to the proximity to Latin America. More importantly, we observed early on the multiple pain points in the Latin American financial system—lack of inclusive finance, high inflation, severe exchange rate fluctuations, and limited dollar supply.

As mentioned earlier, Latin America is one of the fastest-growing scenarios. Compared to markets like Europe and the US, where traditional financial infrastructure has become saturated, the financial industry in Latin America has not yet fully developed its "skill tree"—banking services are lacking, exchange rate fluctuations are severe, and foreign exchange controls are frequent, leading to traditional systems frequently "breaking down." These pain points provide ample space for stablecoin finance, making emerging markets like Latin America and Africa the most promising growth poles for stablecoin payment solutions.

Although early stablecoins have not yet become widespread, we believe that blockchain-based digital currencies can provide solutions to these pain points. As technology matures and the regulatory environment gradually clarifies, stablecoins will ultimately be validated as the best tool to meet Latin American needs.

Regarding licensing, Brazil's regulatory framework is still in the final sprint phase. Authorities plan to launch a special license for "Virtual Asset Service Providers (VASPs)" by the end of 2024, and the industry is preparing for compliance according to this standard, but licenses have not yet been officially issued. At this stage, we are focusing on markets with clear legislation—Mexico, Peru, and Argentina have all obtained or are about to obtain local licenses; using these compliance qualifications as a lever, we aim to extend our reach to regions like Colombia and Brazil where licenses are still pending, forming a path of "compliance first + regional replication."

4.2 Current Product Forms

VelaFi:

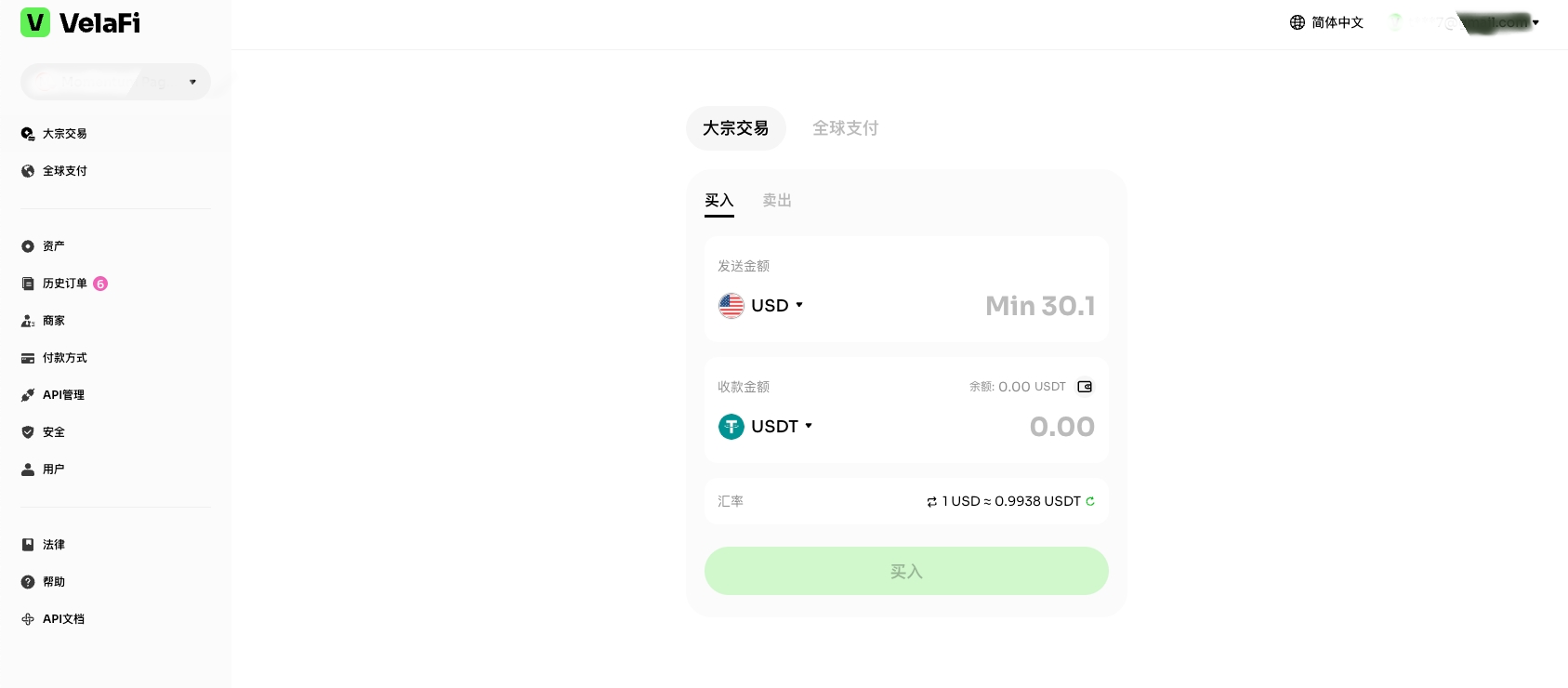

Our current products focus on the capabilities of "stablecoin ⇄ fiat currency" digital currency exchange and local fiat currency payments, which is the deepest know-how our team has accumulated in the Latin American market:

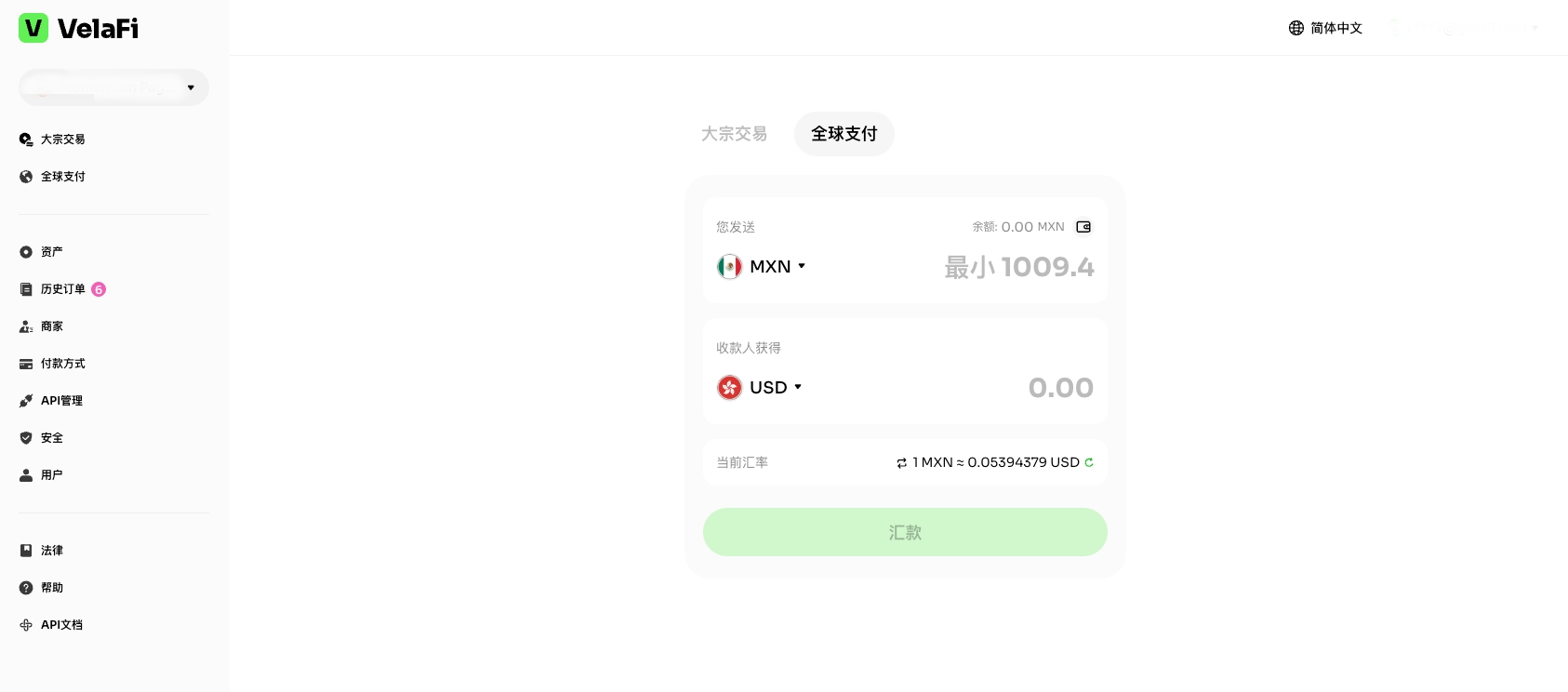

- Bulk trading: Mainly completes instant exchanges between local fiat currency and stablecoins. Users input the amount, and the system provides real-time exchange rates, allowing for one-click buying or selling, making it very user-friendly for beginners.

(www.velafi.com)

- Global payments: Supports exchanges between different fiat currencies, providing payment channels for various scenarios, such as collecting payments for trade merchants or making bulk payments to influencers. For example, if you input "from Colombian pesos to Mexican pesos," the system will immediately display the amount the recipient will receive, and after confirmation, you can click "remit," completing the entire process automatically without manual intervention.

(www.velafi.com)

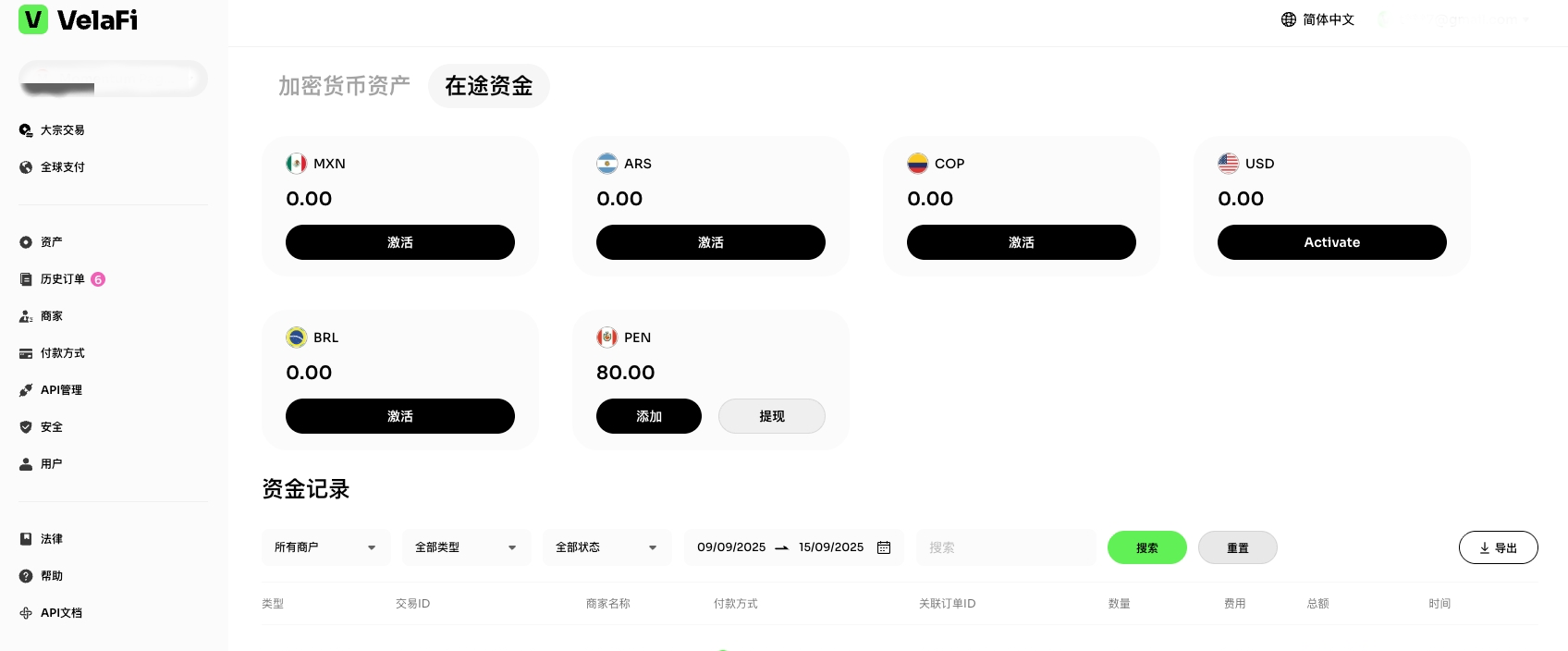

- The asset page splits the balance into "digital currency assets" and "fiat currency assets." We have integrated six fiat currency channels, allowing users to bind their bank accounts (such as a Mexican account) at any time to recharge pesos onto the platform, withdraw back to their bank accounts, or exchange in real-time with digital currencies.

After completing KYB, users can also add multiple merchants at the sub-account level, facilitating unified management of payments and collections for factory-type enterprises. Additionally, the backend provides API key management, supporting automated payments and collections.

(www.velafi.com)

4.3 Launching New Products to Fit the Market

VelaFi:

The new direction we aim to expand into in the next phase is "pure on-chain stablecoin payments." Specifically, this means providing direct stablecoin collection for e-commerce, gaming, and other entertainment industries; if the platform needs to lend to users later, it can also directly issue stablecoins.

The logic of this evolution is: as global stablecoin inflows and outflows become smoother, enterprises and individuals will be more willing to hold stablecoins long-term rather than frequently converting back to fiat, thereby reducing friction and lowering exchange costs. In such a rapidly approaching economic state, providing enterprises with direct payment capabilities in stablecoins will be very important, whether for receiving or making payments (Last Mile), as this will represent a future payment state. By positioning ourselves in advance for this payment form, we can seize the next wave of incremental market opportunities.

Another key direction is AI payments. With the proliferation of AI Agents, there is a need for instant, borderless micro-payment channels between machines, and stablecoins are currently the only programmable, globally accessible assets that can settle 24/7. We are simultaneously developing payment interfaces for AI, allowing Agents to automatically invoke on-chain transfers without penetrating various national banking systems.

Will:

The AI payment scenario seems to be limited at the moment; is it too early to lay the groundwork? We understand your advantage lies in the local clearing network in Latin America, while AI is purely on-chain. How will these two aspects collaborate?

VelaFi:

The scenarios have indeed not yet exploded, but enterprises must position themselves in advance. Just like laying the groundwork for stablecoin inflows and outflows in 2020—waiting for the market to heat up before entering would be too late. Products also need time to iterate: compliance frameworks, risk control models, and interface standards must grow alongside the industry. The core issue is not "is there a transaction today," but rather "this is a direction that is certain to happen," and entrepreneurs should lay the groundwork early.

The point of collaboration is the "global stablecoin clearing layer." Our local capabilities in Latin America are our first step, and in the future, they can be replicated in Africa, Southeast Asia, Europe, and the US, forming a cross-regional network for stablecoin inflows and outflows. At that time, clients will only need one API to achieve:

On-chain collection → Off-chain local outflow;

Off-chain local collection → On-chain payment to the global market;

AI Agents can also directly invoke on-chain interfaces to complete cross-border settlements.

Through an integrated "on-chain + off-chain" solution, we can help enterprises facilitate capital flows in any country and direction, with AI being just one new invocation method for on-chain payments.

Five, In Conclusion

In "The Dissected Veins of Latin America," Galeano wrote of five hundred years of blood loss: silver mines, sugarcane, oil—each pipe inserted into the continent's veins, wealth flowing northward, leaving behind stitches of poverty and violence. Today, Bitcoin, stablecoins, and DeFi are re-welding that severed vein. An Argentine youth exchanges pesos for USDC to fend off inflation, a Colombian coffee farmer sells green beans to Northern Hemisphere investors using NFTs, and the payment codes of Brazilian street vendors pulse with sats.

Cryptographic algorithms are not new colonizers but rather the self-stitching thread: nodes run on solar panels at the edge of the rainforest, private keys held in the hands that once wove blankets. Latin America no longer waits for the IMF's prescriptions; it issues its own time, labor, and trust on-chain, rewriting five hundred years of outward shock into an inward heartbeat—this time, the blood flowing through the veins is not someone else's but the future it has forged itself.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。