Yesterday we mentioned that it was the day of the air force's counterattack, and the market moved as we predicted with a pullback. We also provided support levels for the market, which held today. Overall, the air force has counterattacked, but the bulls have also managed to defend, so the market has once again reached a critical point.

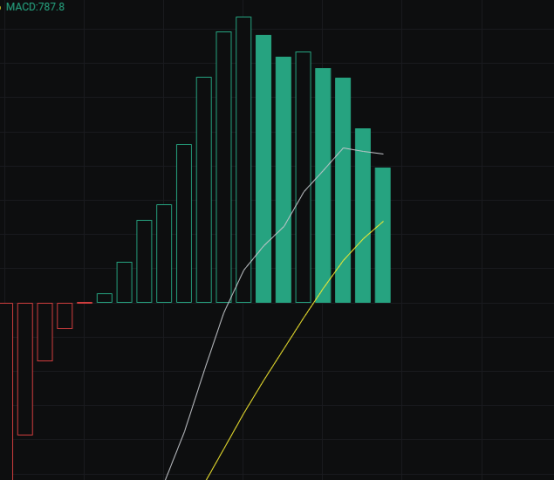

From the MACD perspective, the energy bars continue to decline, and the fast line has changed from an upward trend to a flat line, which is unfavorable for the bulls. We will see if a larger bullish candle can emerge to change the trend.

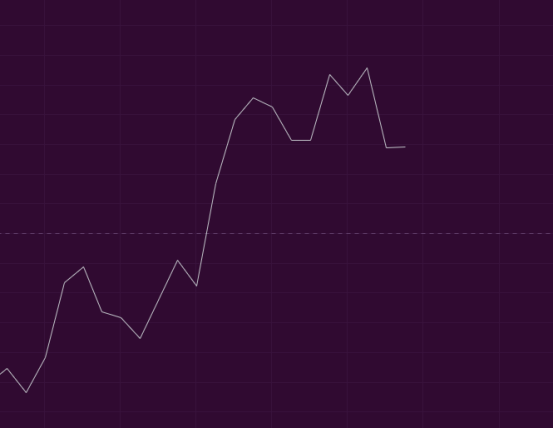

From the CCI perspective, it is currently around 30, also in a neutral range, with potential for both upward and downward movement. We will continue to observe.

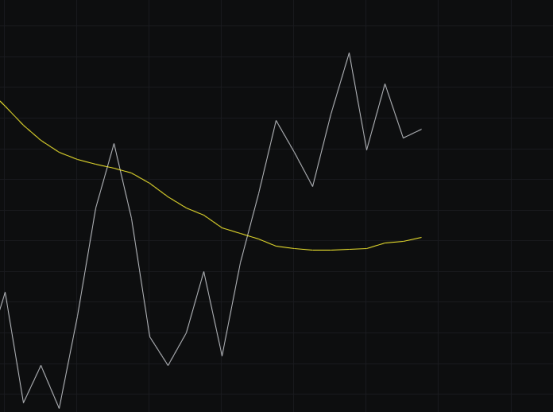

From the OBV perspective, with yesterday's decline, the OBV has seen some pullback, but it has not fallen below the previous low, which is still acceptable. As long as there are no consecutive bearish candles, the OBV will not see significant outflows.

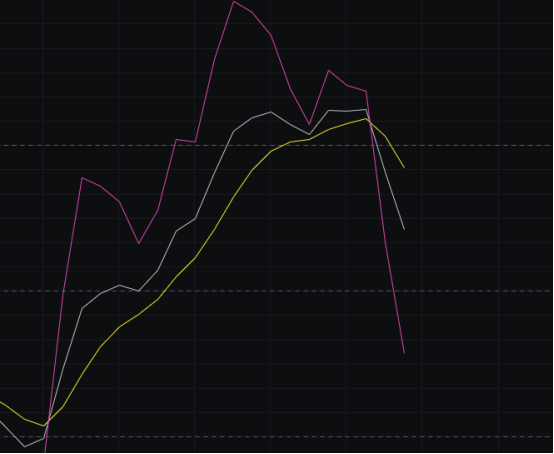

From the KDJ perspective, with yesterday's bearish candle, the KDJ death cross has completed, entering a downward trend. To fully release the downward momentum, the KDJ needs to continue declining, so there won't be significant gains in the next couple of days. For the bulls, a small bullish candle would be satisfactory.

From the MFI and RSI perspective, the MFI is still in the overbought zone, indicating sustained enthusiasm from the bulls, while the RSI has returned to a neutral range. For the RSI to perform well, there should be no bearish candles in the next couple of days.

From the moving averages perspective, yesterday's market found support at the level we requested, which aligns with our expectations. The 30-line continues to rise, meeting the bulls' requirements, but yesterday's bearish engulfing candle means we need to see a breakout above 107,000 next week; otherwise, there is a possibility of downward movement.

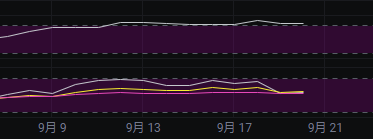

From the Bollinger Bands perspective, we did not see the desired 0.5% bullish candle yesterday, which disrupted the upward channel. Currently, the upper band has flattened, indicating a wide range of fluctuations. For the bulls, the best scenario here is to see a small bullish candle in the next couple of days, then wait for the lower band to continue rising. If the market does not perform well next week, it will enter a narrow range and then choose a direction. If it performs well, we could see a large bullish candle or consecutive bullish candles that directly expand the Bollinger Bands, returning to an upward channel.

In summary: With yesterday's decline, the upward pattern has been broken, and the market has once again reached a critical point. For the bulls, it would be best to see a small bullish candle in the next couple of days to facilitate further upward movement next week. Today's target is ideally to stand above 116,000, with support at 115,200-113,600 and resistance at 117,000-118,500.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。