Recently, the DeFi sector has been bustling once again. From the short-term surge of MYX, to AVNT's tenfold increase, and Aster's early airdrop returns exceeding ten times, this wave of market activity has almost plunged the entire market into a state of FOMO. As an observer, I feel that this is not just a short-term frenzy driven by market sentiment, but also reflects investors' sensitivity to innovative DeFi protocols and their ability to capture potential projects. While short-term prices attract attention, from a long-term value investment perspective, what truly deserves attention are projects with robust technology, reasonable ecological layout, and experienced teams.

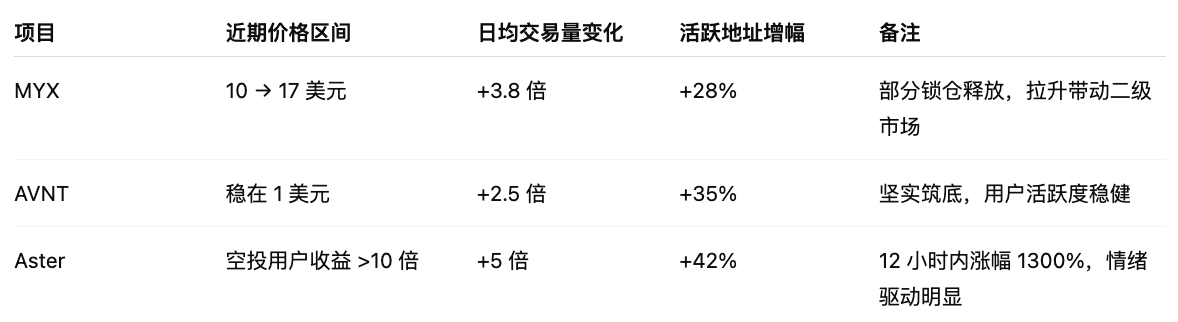

On-chain data is very intuitive: MYX surged from $10 to $17, with daily trading volume nearly quadrupling; AVNT stabilized at $1, with active addresses growing by 35% over the past week; Aster's early airdrop users saw returns exceeding ten times, with a price increase of over 1300% within 12 hours. It is evident that this wave of market activity has not only driven prices but also significantly boosted on-chain activity and user participation, creating a dual resonance of market sentiment and ecological vitality in the short term.

From the market dynamics, the impact of price surges on the sector is very clear. Aster's price spike directly drove early projects like MYX and AVNT to rise in tandem; at the same time, platforms like Lighter.xyz, EdgeX_exchange, and TradeParadex also have the opportunity to become the next focal points. The continuous expansion of the Base ecosystem provides investors with a clear direction—ecological dividends combined with technological advantages mean that in the heat of the sector, opportunities are always left for insightful planners. This also explains why Professor Su lamented in the morning report, "Everything that the secondary market can eat, I cannot eat," as the FOMO atmosphere drives not only prices but also market attention.

Upon closer observation of the entire DeFi sector, it can be found that investment logic is quietly changing. In the past, the market was almost entirely driven by sentiment: airdrops and short-term surges became the focus, and new coins were often abandoned after a brief spike. However, experienced investors are beginning to realize that to discover the next potential project amidst the frenzy, several key characteristics are necessary:

- Strong technology: Sufficient trading depth, efficient matching mechanisms, and excellent slippage control can accommodate large capital and institutional entry, while forming a natural moat in derivatives and liquidity management.

- Robust ecology: Early user and community participation is fundamental, but there must also be clear incentive mechanisms and ecological layouts to maintain activity amidst capital inflow and market expansion.

- Reasonable valuation: Popular coins in the sector can easily be pushed up by short-term surges; new projects aiming to become long-term winners need to demonstrate stability in FDV and lock-up ratios while leaving room for growth for long-term investors.

Taking BSX as an example, it received multiple rounds of investment from Base early on in the DEX sector, with lead investor Blockchain Capital being a well-established institution in crypto investment, indicating industry recognition of its technology and team. BSX's order book trading and matching capabilities are close to HyperliquidX, giving it a clear advantage in high-frequency trading and liquidity management. Although it does not have the short-term windfall like Aster, its robust technology and ecological layout provide low-risk investment opportunities for discerning investors. The expansion dividends of the Base ecosystem may also bring additional value. This indicates that projects with technological moats and ecological advantages often maintain steady growth after the market heat subsides.

Under this standard, Orderly's performance deserves special attention.

- Technology and trading model: Order book trading and high-frequency matching capabilities give the platform a natural advantage in derivatives and liquidity management, while its trading depth and slippage control perform excellently, supporting large capital inflows and institutional participation.

- Ecological layout: Orderly is advancing cooperation and community incentive measures, with platform activity and trading depth expected to steadily grow alongside the expansion of ecosystems like Base and EdgeX. Its multi-dimensional ecological strategy not only focuses on trading volume but also emphasizes community governance and long-term incentives, retaining value for capital and users.

- Valuation and potential: Compared to popular coins in the sector, Orderly's fully circulating market cap remains low, with significant potential. In terms of FDV and lock-up ratios, Orderly is relatively stable while providing a safety boundary for long-term investors.

- Financing background: Notably, Orderly has accumulated $25 million in financing since its establishment, with early investors including top global institutions like Pantera, Dragonfly, Jump, and Sequoia China. The backing of these leading capital firms also indirectly confirms its long-term potential and industry position.

Recently, everyone has been praising $AVNT, calling it "the Hyperliquid on Base," but data tells me that $ORDER is the severely undervalued perpetual contract opportunity. Orderly's model resembles the underlying engine of DeFi or the AWS of Web 3: a unified order book + full-chain liquidity, processing scales that rival centralized exchanges. Currently, it supports 58 builders, with liquidation amounts reaching billions of dollars, while the price of $ORDER remains at the low valuation of the early stage of the sector.

📊 Data comparison shows:

- In core metrics such as trading volume, TVL, and open interest (OI), Orderly is 2–6 times higher than AVNT.

- However, the market cap of $ORDER is only 1/7–1/8 that of AVNT.

This is not just undervaluation; it resembles a market pricing error. A simple valuation model indicates that the reasonable value of $ORDER should be above $2.5, while the current trading price has just surpassed $0.15. Once the market realizes its true value, the price may quickly correct rather than slowly return to a reasonable price, creating strong upward momentum.

It is important to emphasize that Orderly is not only competing with other perp DEXs; it is building a full-chain, full-ecosystem infrastructure, aiming directly at a CME-level clearing system. In other words, its value is not only reflected in short-term market activity but also in the foundation and long-term potential within the entire DeFi ecosystem.

Combining recent market dynamics, DeFi investment strategies can be divided into short-term arbitrage and long-term layout. Short-term arbitrage opportunities are evident: seizing surges and airdrop profits, quickly profiting like MYX, AVNT, and Aster. However, long-term layout requires vision; truly robust opportunities are often hidden in projects with deep technology, complete ecosystems, and experienced teams. Orderly is such a case: it may not be immediately fully recognized by the market, but as the DeFi sector matures, these undervalued tech projects typically undergo value reassessment.

From the investor's perspective, the DeFi boom is not just about chasing short-term windfalls but also a re-evaluation process of sector potential, technological innovation, and ecological layout. In this process, Orderly meets the three key dimensions of technology, ecology, and valuation, allowing it to avoid short-term noise while capturing long-term growth opportunities.

In summary, the DeFi boom brings not only price fluctuations but also a window for observing, understanding, and uncovering potential projects. Rational investors should remain calm amidst the frenzy, focusing on sector trends and core project values. As a technology-driven potential coin, Orderly undoubtedly deserves continued attention. In the coming months, as market capital flows back and ecological dividends are released, Orderly's performance will be an important window for observing the maturity of DeFi and the logic of potential investments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。