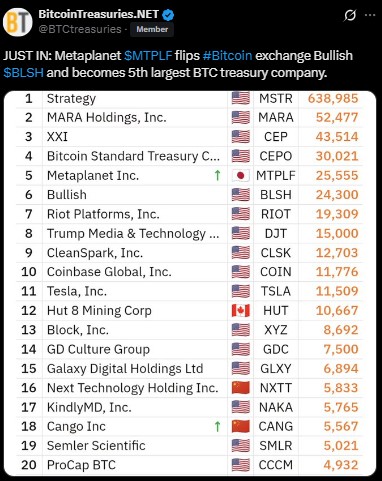

Metaplanet Bitcoin Surges, Overtakes Bullish to Rival MicroStrategy

On Monday, September 22, Metaplanet announced a new Bitcoin purchase worth $632 million, pushing Metaplanet Bitcoin holdings to an impressive 25,555 BTC. The Japan-listed company now stands as the fifth-largest corporate treasury, surpassing the exchange Bullish.

Source: X

Source: X

A Bold Move That Strengthens Treasury

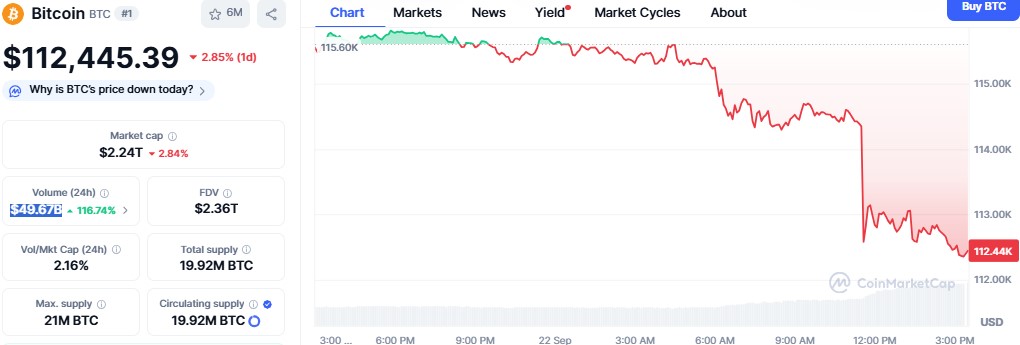

The latest acquisition—5,419 BTC at an average price of $116,724 per coin—marks one of the largest single purchases to date. With this move, the company’s treasury is now valued near $3 billion, even after Bitcoin’s 2% dip to $112,456.

Source: CoinMarketCap

Source: CoinMarketCap

Quarter-to-date, it has achieved a 10.3% yield, showcasing its aggressive accumulation strategy. The company’s average cost basis sits at $106,065 per BTC, giving it an unrealized profit of nearly $290 million.

CEO Simon Gerovich celebrated the milestone on X, stressing that the accelerated plan has already delivered a 395.1% year-to-date yield in 2025. This performance signals to both shareholders and institutions that Metaplanet is not slowing down.

How Far Is Metaplanet from the Top Holders?

Despite its rapid rise, the giant still trails four major players in the corporate race:

-

Bitcoin Standard Treasury (30,021): Needs 4,467 more BTC.

-

XXI (CEP Holdings) (43,514): Needs 17,960 more.

-

Marathon Digital (52,477): Needs 26,923 more.

-

MicroStrategy (638,985) : Needs a staggering 613,431 more.

To surpass MicroStrategy, Metaplanet would need to invest roughly $69 billion at current market prices. While ambitious, its aggressive buying pace hints that it’s building a reputation as the biggest challenger to MicroStrategy’s dominance.

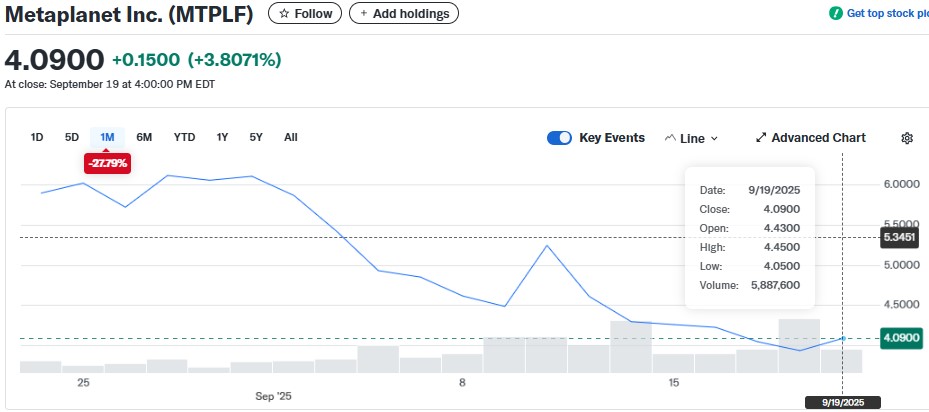

Stock Struggles as BTC Bet Expands

Ironically, the MTPLF stock has struggled even as the company’s treasury has grown. Shares fell 1.32% to 600 JPY during Monday’s session, marking a month-long slide of over 27%. Analysts point to institutional short positions from Morgan Stanley, Jefferies, and UBS as major pressure points.

Source: Yahoo Finance

Source: Yahoo Finance

Yet, momentum is still alive. Just days earlier, MTPLF stock closed at $4.09 in the U.S. OTC market, up 3.80%, extending its year-to-date gain to nearly 75%. Investors may be nervous, but the company’s bold strategy continues to capture headlines.

Conclusion

Metaplanet Bitcoin strategy is rewriting the corporate playbook. From a $2.71B total spend to nearly $3B in holdings, the platform has shown conviction few rivals dare match. While MicroStrategy remains untouchable for now, its relentless accumulation proves it is the biggest competitor in the making—one step closer to rewriting history.

Disclaimer: This is for educational purposes only. Always do your own research before any crypto investment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。