Momentum continued for crypto ETFs last week, as both bitcoin and ether funds saw strong inflows that underscored deepening institutional confidence. From Sept. 15 to 19, bitcoin ETFs attracted $886.65 million while ether ETFs brought in $556.92 million.

Bitcoin ETFs

It was a green week for bitcoin ETFs, though not without turbulence. Blackrock’s IBIT powered ahead with $866.84 million in inflows, followed by Grayscale’s Bitcoin Mini Trust with $39.59 million and Fidelity’s FBTC at $34.62 million. Ark 21Shares’ ARKB secured $33.39 million, Vaneck’s HODL added $14.07 million, and Franklin’s EZBC brought in $10.14 million. Invesco’s BTCO rounded out with $3.51 million.

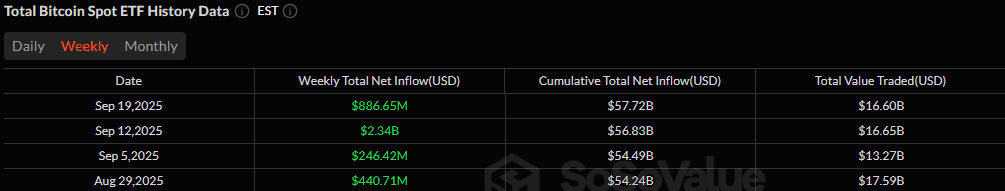

The drag came from Grayscale’s GBTC and Bitwise’s BITB, which saw a sharp -$86.14 million and -$29.39 million exits for the week. Even with that weight, the week’s total inflow for bitcoin ETFs stood at a robust $886.65 million for a fourth week of consecutive net gains. Value traded peaked at $4.24 billion midweek, while total net assets closed Friday at $152.31 billion.

Ether ETFs

Ether ETFs followed a bumpier path but still managed a strong showing. Blackrock’s ETHA stole the spotlight with a commanding $513.01 million inflow. Other funds added steady gains: Grayscale’s Ether Mini Trust ($17.99 million), Fidelity’s FETH ($15.18 million), Grayscale’s ETHE ($13.60 million), Bitwise’s ETHW ($7.52 million), and Franklin’s EZET ($3.49 million). Vaneck’s ETHV, however, offset momentum with an -$8.16 million outflow along with net weekly outflows for 21Shares’ TETH (-$3.99 million) and Invesco’s QETH (-$1.73 million)

That collective push brought ether ETFs to $556.92 million weekly inflow, despite multiple outflow days. Total value traded across the week was $8.9 billion, with assets rising to $29.64 billion.

Closing Take

This week’s flows make one trend clear: Blackrock’s ETF dominance is deepening. Both IBIT and ETHA consistently drew the lion’s share of institutional capital, overshadowing exits elsewhere. With consecutive weeks of rising trading activity, the ETF race is not just heating up; it is consolidating around a few clear leaders.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。