This week is definitely the most intense week for major projects this year. Tether's Plasma (XPL) is about to launch, DWF's Falcon Finance new project is nearing its deadline, and I've heard that the OTC market prices have been driven up to $120 through KYC accounts. Kraken also has a new project from the founder of Curve coming soon. The wealth effect of new coins, led by STBL and 0G, is quite considerable.

So, what other new project opportunities are there in the market? Rhythm BlockBeats has compiled several recently popular projects.

Upheaval

Upheaval is a decentralized trading platform built on HyperEVM, which previously airdropped Memecoin to users before its TGE, issuing PUP. Its spot trading volume on Hyperliquid even surpassed that of the previously issued Purr. The platform currently has five main functions, covering everything from token launches to user fund depth vaults.

First is JumpPad, officially positioned as an incubator for new tokens and communities based on UIP-3, addressing the difficulties in issuing tokens caused by Hyperliquid's auction mechanism, serving as another entry point for project launches on Hyperliquid. Although Hypurrfun had previously developed similar functional needs, Upheaval has taken a step further by building its own aggregator function to efficiently route trades within the platform, while also setting up a fiat entry. It mimics the Hyperliquid mechanism through governance mechanisms like veUPHL and veUP, binding users and the platform in a long-term relationship through locking and governance, strengthening supply-demand balance and expanding liquidity.

This relatively complete architecture makes Upheaval both a launchpad for new projects and a hub for funds and trading, giving a sense of a Hyperliquid model version of Pumpfun+Moonshot.

Moreover, Upheaval is the first project launched after the full-channel trading platform Based opened its Launchpad. Since this is its first launch, there are no historical performance records to reference, but its investor Ethena has provided some degree of endorsement for its expectations.

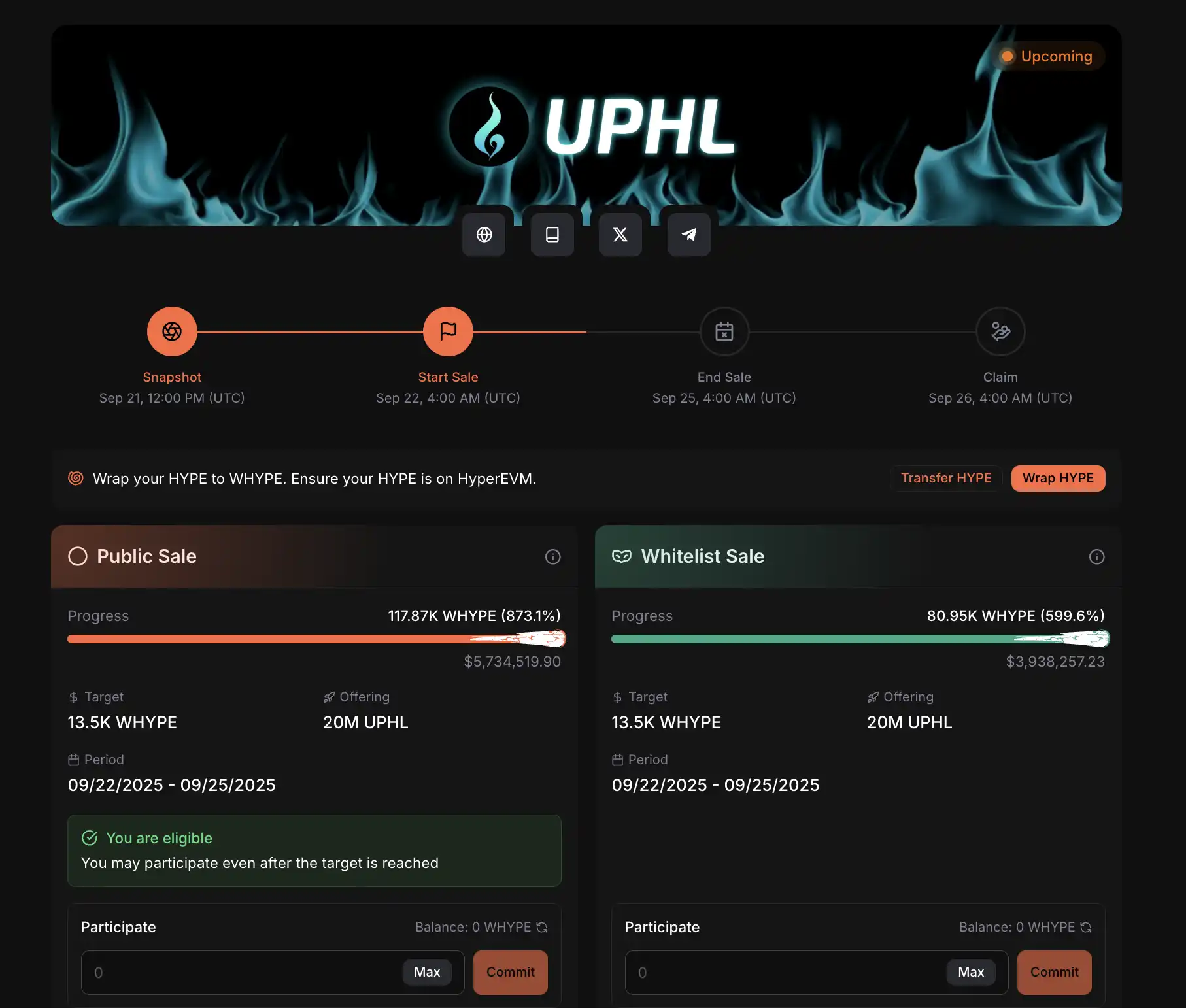

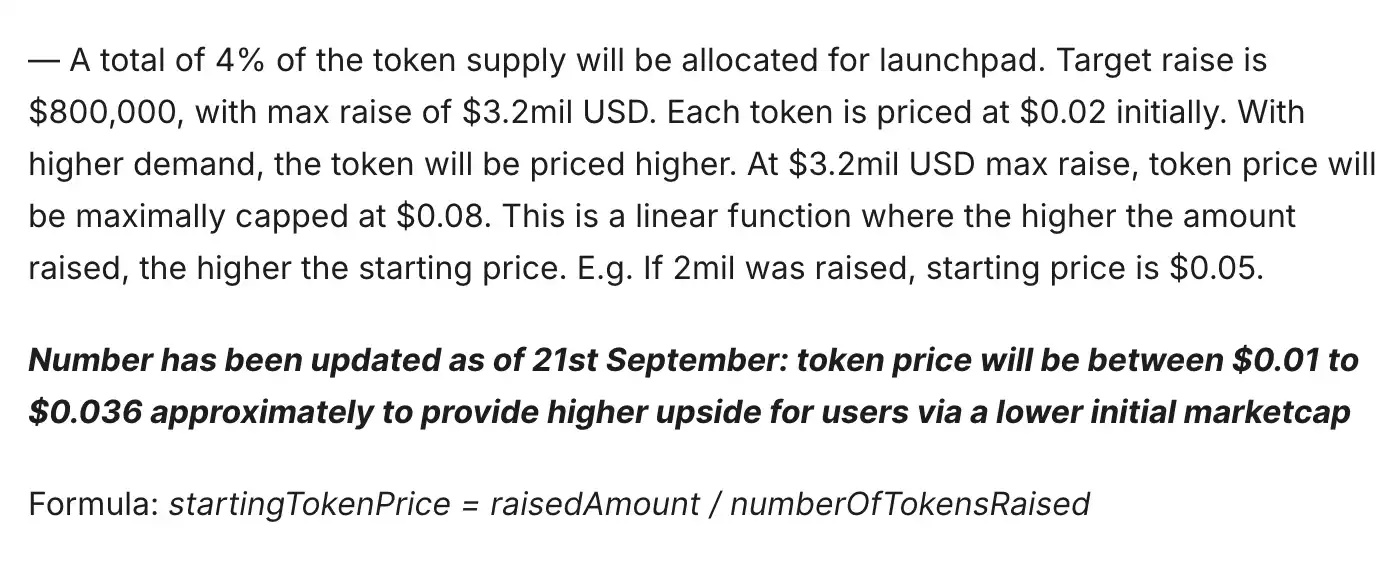

The current presale is ongoing, starting from September 22 at 4:00 UTC and lasting until September 25 at 4:00 UTC, but the public sale has already been oversubscribed by over 870%. Interestingly, the presale mechanism is divided into public sales and a whitelist phase for long-term supporters of Based and PuP holders. In fact, before the oversubscription, the price changed according to a "Bonding Curve" from the initial $0.01 to $0.036, and once the fundraising reached 13.5K WHYPE, the presale was conducted at a price of $0.036. The oversubscribed portion will distribute Upheaval tokens based on the proportion of individual contributions to the total contributions, with excess funds refunded. This means that the more participants and funds there are, the smaller the impact of the previous "Bonding Curve" price difference.

Upheaval's TGE tokens account for 4% of the total supply of 1 billion tokens, with an FDV of $33 million and an initial circulation of 26%. However, whether the market cap can increase later will depend on whether Upheaval's trading volume can sustain growth and whether the "JumpPad" under the UIP-3 mechanism can truly drive the entire ecosystem's Memecoin.

Yield Basis

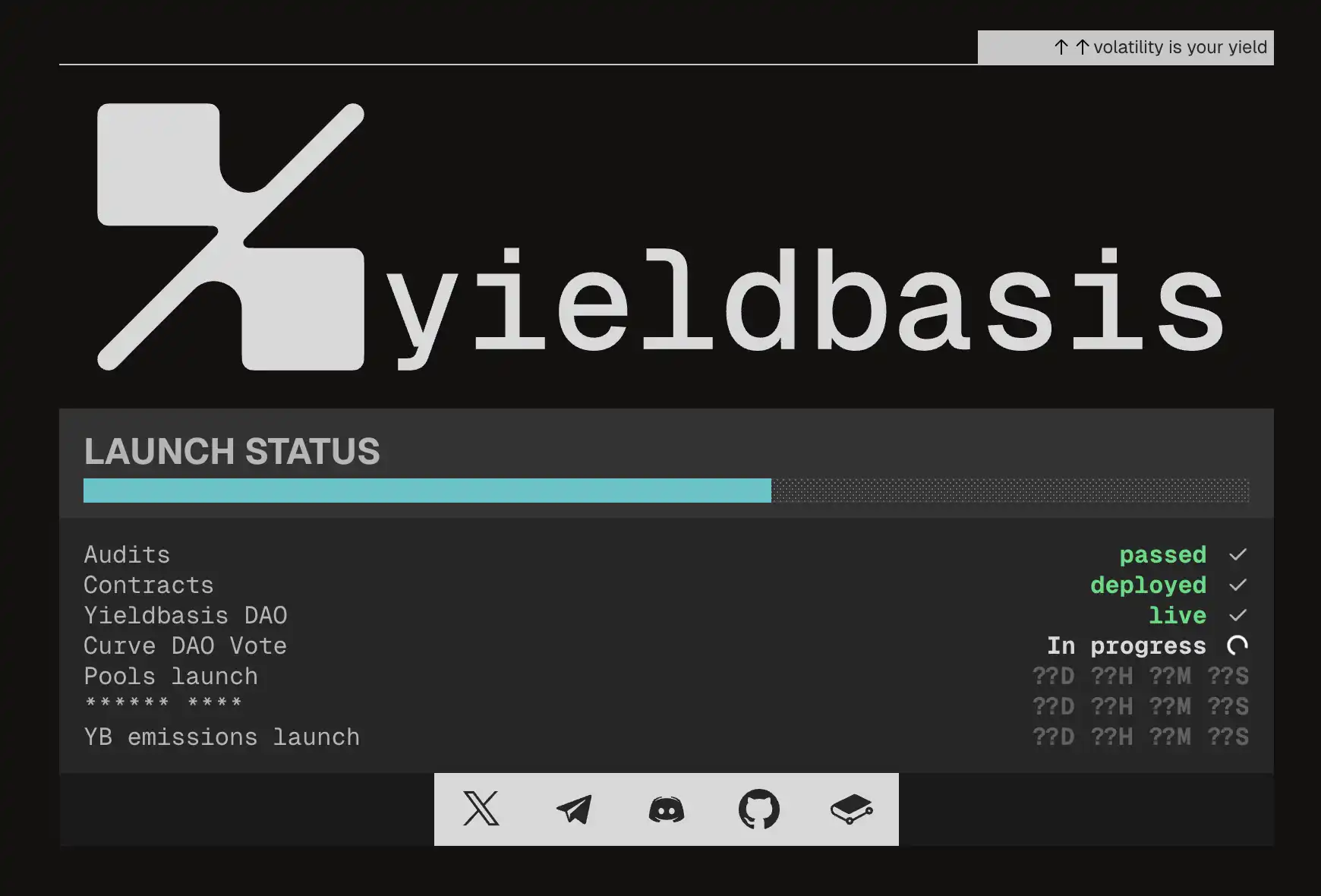

Yield Basis is a Bitcoin-native yield protocol launched by Curve founder Michael Egorov, which raised $5 million in funding at a $50 million valuation earlier this year.

Yield Basis utilizes an automatic re-leveraging mechanism to provide trading fee income for BTC liquidity providers while hedging against impermanent loss caused by AMM curvature risks. LPs can choose to receive BTC-denominated trading fees directly or forgo fees in exchange for YB token incentives, with locked veYB participating in governance and sharing protocol fees.

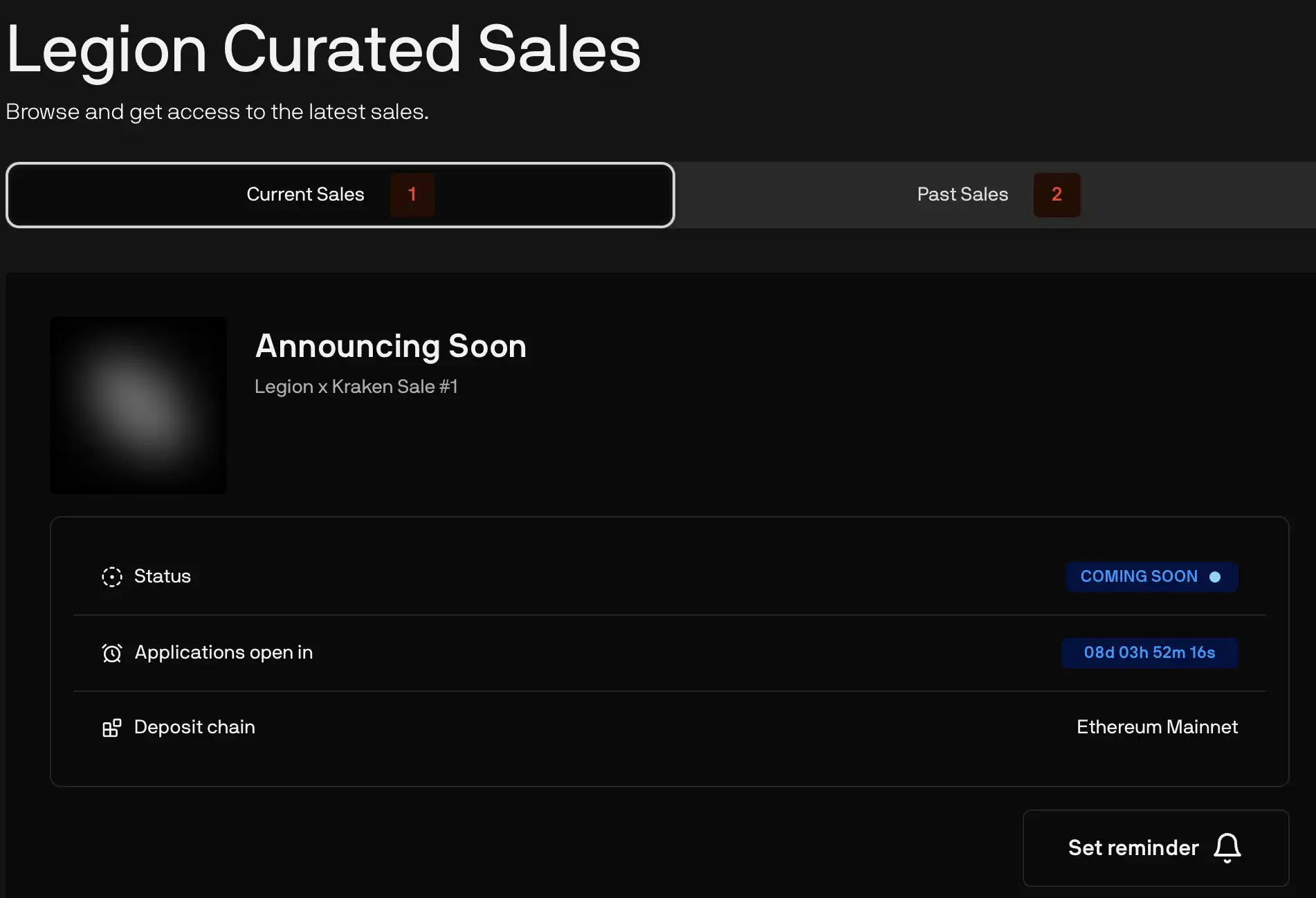

After a day's delay, Kraken announced that its first project in collaboration with Legoin for LaunchPad is Yield Basis. Due to Legion's "Legion Score" system, which allocates quotas based on on-chain behavior, social media activity, and developer contributions, it can filter out a large number of multi-account participants for the project, ensuring that true builders and core users get priority in subscription shares. Coupled with Kraken's listing channel effect, the market is paying close attention to this collaboration.

The presale model is currently understood to be divided into two phases, with 20% of tokens reserved for high-scoring Legion users, while the remaining 80% will be publicly sold on Kraken and Legion on a first-come, first-served basis. $YB will directly launch on Kraken after the sale ends. The total token supply is 1 billion, with 30% allocated for liquidity mining incentives, 25% for the team, 15% for ecological reserves, 12.1% for investors, 7.5% for Curve protocol licensing fees, 7.4% for developer reserves, and 3% for Curve governance incentive token distribution.

Although the financing valuation at the beginning of the year was only $50 million, considering the support from the Curve community (Curve DAO has already provided crvUSD credit support for YB through proposals) and Egorov's influence, the market expects YB's FDV at listing to potentially reach several hundred million dollars, significantly higher than the internal financing valuation. Further specific presale information, including the TGE rhythm and sales pricing for each share, will only be revealed during the public application in 8 days.

Tea

Tea is a decentralized open-source software platform that fairly rewards developers based on their contributions to the entire ecosystem. Founded by former Apple employee Max Howell, a supporter of the "open-source faction," he previously created open-source projects like HomeBrew and PromiseKit in Web2. These plugins have been used by major companies like Google and McDonald's, but he did not receive any compensation, which led him to want to create a sustainable open-source ecosystem-driven Layer2.

Previously, it raised a total of $16.9 million in funding from VCs such as Yzi Labs and Acuitas Group Holdings in Preseed and Seed rounds.

Tea has chosen the established IDO platform Coinlist for its presale, which will start on September 25 at 17:00 UTC, selling at an FDV of $50 million, with a total of 4 billion $TEA ($0.0005/$TEA). Coinlist will allocate tokens in a "bottom-up" manner after the purchase window closes (i.e., the smaller the amount participated, the earlier the allocation, and the larger the amount, the later the allocation or possibly no allocation).

Although 100% will be unlocked at TGE, many users who participated in the testnet did not receive airdrop promises, leading to some community backlash, and this has raised suspicions of the team potentially having "scam" tendencies.

Limitless

Limitless is a decentralized prediction market application on the Base blockchain, where users can create and trade prediction contracts on any topic (supporting a centralized order book interface) to bet on real-world or crypto events, similar to Polymarket.

Since its launch in 2024, Limitless has accumulated a trading volume of over $270 million, although it has previously been caught up in discussions about "trading volume manipulation." The project has completed two rounds of financing totaling $7 million in 2024-2025, with backing from well-known institutions such as Coinbase Ventures and 1confirmation. In July, it even brought in former BitMEX founder Arthur Hayes as an advisor.

Kaito recently launched the "Capital Launchpad" feature for project token presales. Although the market has been overwhelmed by mindless Yap armies flooding social media, leading to some community resistance against "Kaito," it still couldn't resist the fact that the Launchpad has launched some well-backed projects like Boundless, Rise, and Theoriq.

According to the project announcement, the Limitless token presale is scheduled to start on September 25. As a reward for early supporters, Limitless has previously launched a points airdrop program (Points Program), where users can earn points through trading and market-making, with the hope of receiving airdrop rewards after TGE.

Currently, Kaito has not disclosed specific subscription thresholds and limits, but according to convention, it may adopt a model that allows users to subscribe freely, with oversubscription allocated proportionally, and may require completing tasks on the platform to obtain whitelist qualifications, as well as passing Kaito's KYC verification to participate. Although the prediction market has been quite hot recently, whether it is worth participating will depend on further financing information.

Goated

Goated is a rapidly developing decentralized gaming platform within the Solana ecosystem. Since its launch in June 2024, Goated has processed over $1 billion in total bets, has more than 12,000 monthly active users, and generated over $2 million in net gaming revenue. The previous angel round received support from Polygon and Sentient founder SanDeep, Scimitar Capital founder Thiccy, and several former FTX team members.

Goated has chosen the launcher Metaplex, which launched a token issuance protocol on the Solana chain called Metaplex Genesis this year, and the projects issued have achieved good results. Recently, the $CARDS token, which became very popular, surged after a decline, reaching a market cap of $800 million, with presale participants earning nearly 20 times their investment. It has also launched projects like Portals with impressive funding lineups.

This time, Goated is conducting a token presale through Genesis, which is referred to as the largest token issuance in the GambleFi sector on Solana for 2025. Typically, such products do not have a need to issue tokens due to sufficient cash flow income.

The presale will adopt a fixed-price public sale model, opening on September 25 at 16:00 UTC. The first 2 hours will be reserved for the community allowlist, followed by public participation. A total of 10 million $GOATED tokens (1% of the total supply) will be issued at a price of 0.0004 SOL per token. The fundraising cap is set at 4,000 SOL (approximately $880,000), and subscriptions will stop once the cap is reached.

Allowlist eligibility is open to existing Goated users, requiring them to register on the platform, bind their Solana wallet, deposit and bet at least $1,000, and complete specified Twitter follow and retweet tasks to obtain whitelist status. However, the snapshot has already ended, and users who did not participate in the project previously will have to wait for the public sale round.

Based on the presale price, the initial FDV of $GOATED tokens is approximately 400,000 SOL (around $8.8 million). Given that Goated already has stable cash flow and a user base, the market expects its trading market cap to be significantly higher than the fundraising amount, with an initial circulating market cap potentially reaching tens of millions of dollars.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。