Compiled & Organized by: Yuliya, PANews

Arthur Hayes, Chief Investment Officer of Maelstrom, once again threw out shocking views at the TOKEN2049 conference. In his speech titled "Bastille Day: Celebrating France's Exit from the Eurozone," he boldly predicted that due to irreconcilable internal economic pressures and continuous capital flight, France would ultimately exit the euro system, potentially triggering a global banking crisis. PANews has compiled and organized the text of this speech, and below is the full text:

Since Donald Trump ascended to the throne of "American Hegemony" in 2016, his core policy has always revolved around "America First." What does this mean? It means reversing the surplus and deficit patterns between countries.

For a long time, the Trump administration has grown weary of the model where the United States is financed by other countries, which in turn hold assets in the U.S. He believes that American companies should be able to export products and profit in competition with countries like Germany and Japan. Therefore, the implementation of the "America First" policy is essentially closing off the vast export market of the United States.

This shift has forced traditional export-oriented countries like Germany and Japan to adopt corresponding "Germany First" and "Japan First" policies in response. They need to repatriate overseas savings and capital to cope with the closure of the U.S. market. The direct consequence of this move is that these countries can no longer finance deficit countries like France and even the U.S. as they did in the past.

France's Crisis: The Truth of Capital Flight

In the European financial system, there is a key indicator—Target Balances. The European Central Bank publishes the net balances of the Target system monthly, reflecting the flow of capital within the eurozone. Taking France as an example, at the beginning of 2021, France still had a surplus, indicating capital inflow. However, comparing the changes from 2021 to now reveals that capital is flowing out of the French banking system on a large scale. Data shows that France's capital outflow situation is the most severe in the entire eurozone. French savers and capital holders have clearly lost confidence in their domestic financial system, unwilling to keep their funds in French banks, and instead transferring euros to Germany, Luxembourg, and other places. As this situation worsens, France may have to resort to capital controls and other measures to address the imbalance in the future.

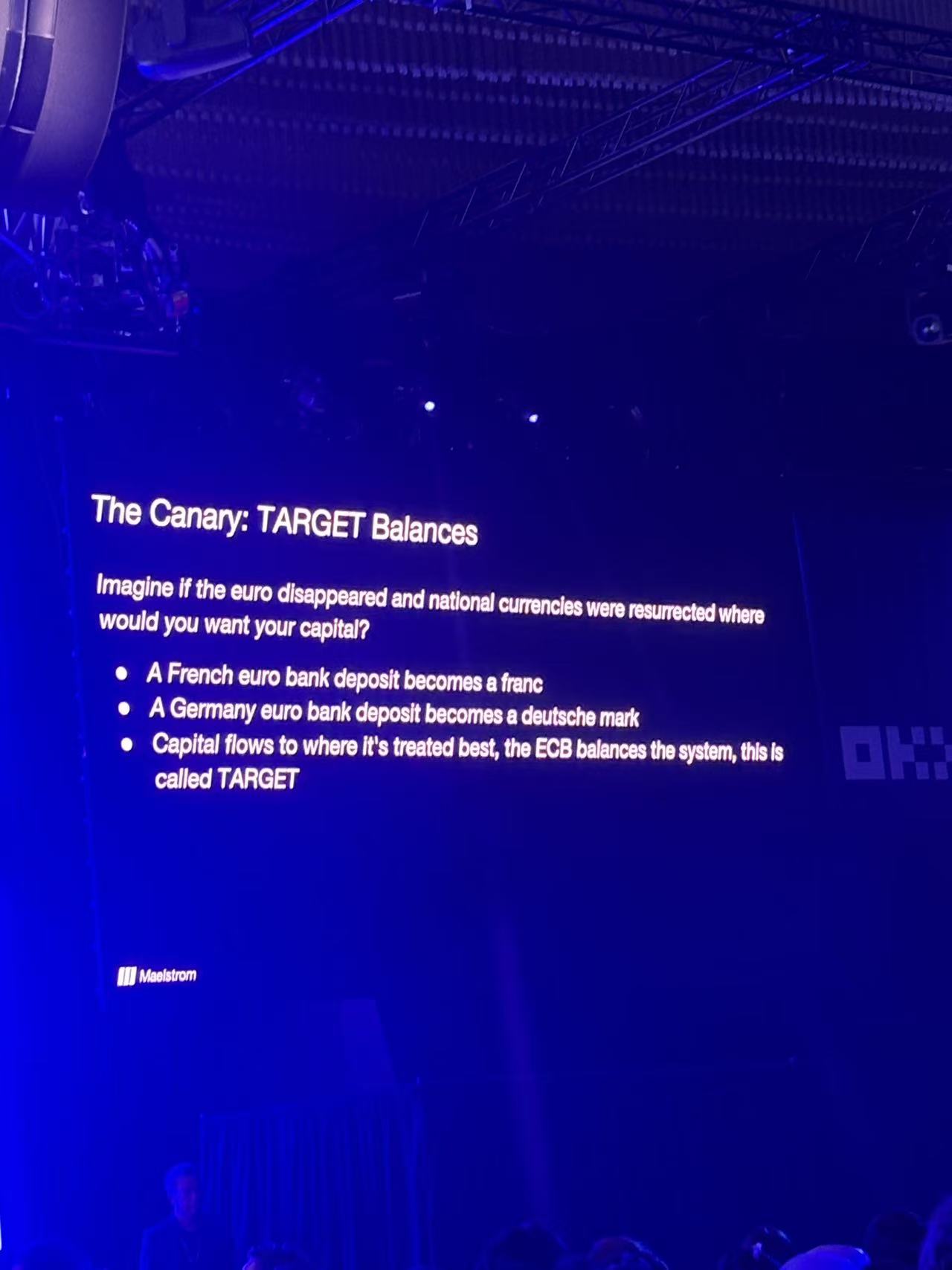

So, what exactly are Target Balances? Essentially, it is a centralized clearing system operated by the European Central Bank, designed to allow the eurozone, which has about 17-18 different central banks, to operate smoothly. Through this system, countries like Germany and France can generate surpluses and deficits with each other without each country's central bank needing to establish bilateral accounts with all other central banks.

To understand the essence of the Target system, consider this: if a eurozone country exits the eurozone and revalues its currency to its national currency, such as the franc or the deutsche mark, would investors be willing to hold that currency? If a country has a deficit and gradually loses its financing ability, it may resort to capital controls. Rational capital would choose to transfer funds to strong countries like Germany while the euro is still freely circulating, as Germany is the wealthiest and most stable country in the eurozone. The deterioration of Target balances is like the "canary in the coal mine," indicating domestic capital's unease with the system. The French public has expressed their distrust in the most direct way by transferring funds.

*Note: Target Balances specifically refer to the credit or debt balances formed in cross-border payments within the euro system through the pan-European real-time gross settlement system (TARGET2) among the central banks of eurozone countries.

The Dilemma of the European Central Bank and Lagarde's Role

Christine Lagarde, President of the European Central Bank, is humorously referred to as the "Crocodile Countess." She is a lawyer from France who ultimately holds the highest position at the European Central Bank. Her responsibility is not to respect the will of the people of eurozone countries but to maintain the European Central Bank's control over its member states.

Looking back at the Greek debt crisis from 2011 to 2012 and the elections in other eurozone countries, we can see the European Central Bank's consistent style of operation: it issues ultimatums to governments—"If you do not do as we say, we will stop printing money to buy your bonds." This will directly lead to government bankruptcies, currency devaluation, and an inability to purchase oil, food, and medicine. The underlying message is: "Shut up, vote for the obedient party, and we will continue to provide financing."

Lagarde achieves this control by managing the money printing press. Since the COVID-19 pandemic, the European Central Bank has maintained a relatively tight monetary policy. They have set rules such as "the fiscal deficit must not exceed 3% of GDP." If a country's spending exceeds this limit, the European Central Bank threatens to stop supporting its bond market until the country passes an "acceptable" budget. This has posed a significant dilemma for domestic politicians in various countries, especially for Macron in France.

Macron's Predicament and the Government's Inevitable Choice

French President Macron finds himself in a dilemma. On one hand, the French people expect more social welfare and demand increased government spending. On the other hand, the European Central Bank firmly opposes this, demanding fiscal tightening or else it will cut off funding support.

This contradiction has evolved into a constitutional crisis. In the past year, two French prime ministers have resigned due to their failure to pass budget proposals. Whenever the government hints at implementing austerity measures or cutting government spending, it immediately triggers large-scale street protests and strikes. The public's message is clear: "We do not want austerity; we want to print money for France and for ourselves. We do not care what the European Central Bank or Brussels says."

This has left Macron in an unsolvable predicament. When a government faces pressure to fill a fiscal gap, what is the first thing it will do? The answer is: seize foreign assets.

This is not alarmist rhetoric. Although France prides itself on being a capitalist country that respects property rights, when the country's solvency is threatened, plundering foreign wealth is always the first choice. Data shows that 53% of French stocks and bonds are held by foreigners. As a Communist leader in the French parliament said a few months ago: "Don't worry about us raising taxes on the French people; all our debt is owed to foreigners, and we just need to take their money first."

This behavior will trigger a chain reaction. First, plundering foreign assets will scare away domestic capital, forcing the government to implement stricter domestic capital controls. Ultimately, the private capital that remains in France will be forced to buy government bonds at rates that the government can afford, which is not the optimal choice for capital holders.

Systemic Risk and the Future of Global Money Printing

France's actions to seize foreign assets or implement capital controls will have catastrophic consequences.

First, this will directly lead to the bankruptcy of the entire EU banking system. Since EU banks hold a large amount of French assets, a default by France will trigger a systemic collapse. It is estimated that the European Central Bank will need to provide about 5 trillion euros in massive funds for rescue to ensure the solvency of the EU banking system.

Second, the crisis will quickly spread globally. When Japan finds that its hundreds of billions of dollars in investments are trapped in France, what will the Bank of Japan do? When the U.S. faces the same situation, what will the Federal Reserve do? They will all be forced to print money to rescue their financial institutions that have lent to France. Therefore, this localized crisis in Europe will become the fuse for a new round of large-scale money printing globally.

To understand how all this will happen, we must continue to monitor changes in the Target2 system. Once France sets a precedent for capital controls, all investors will ask, "Who is next?" Capital will flee madly from all other vulnerable eurozone countries. No country’s people will accept a mere 3% fiscal deficit limit when they desire more, not less, government spending.

Ultimately, the question falls to Germany. What choice will they make? Will they continue to stay in the eurozone and pay for all this, or will they choose to exit? This is a politically uncertain decision, and investors detest this kind of binary political game.

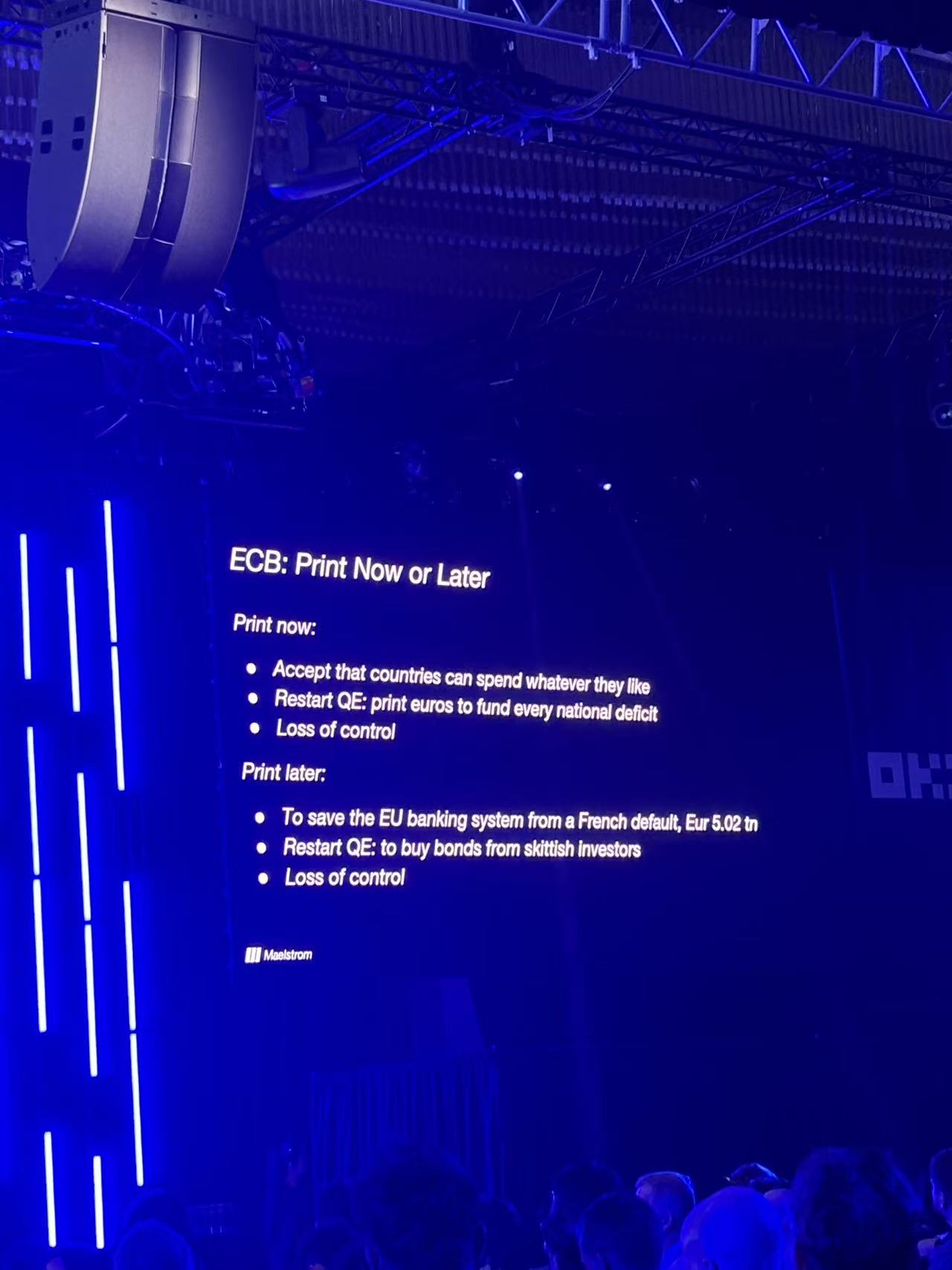

For the European Central Bank, the so-called "choices" it faces are actually false dilemmas:

Print money now: Accept fiscal expansion from various countries, restart quantitative easing (QE), and buy bonds from various countries. This means handing power back to national politicians, and the European Central Bank loses control.

Print money later: Wait for France to threaten to exit the euro and seize foreign assets, then be forced to print 5 trillion euros for rescue and restart QE for the remaining countries. The result is still a loss of control.

The conclusion is obvious: the euro is fundamentally a failure; it has just taken us 30 years to recognize this fact. The European Central Bank has no choice; they will ultimately print money. Because without printing money, the euro is doomed to die; and by printing money, Lagarde and her successors may still maintain their dominance over Europe.

Investment Insights: Escape Europe, Embrace Real Assets

From an investment perspective, historical data clearly indicates the plight of European assets. Since the COVID-19 pandemic, the performance of the Euro Stoxx index has not only lagged behind the MSCI Global Stock Index but has also performed poorly compared to real hard assets like gold and Bitcoin.

Seeing this information, combined with the fact of capital flight from France, it is hard to find a reason to continue holding European assets. The conclusion is very clear: leave as soon as possible while there is still a chance to exit.

The most important observation tool remains the balance of the Target system. It is the core indicator for judging when the European Central Bank will be forced to print money. By simply checking the Target balances of various countries on the European Central Bank's website or Bloomberg system each month, one can gain insight into the most genuine flow of funds. As France's funding gap continues to widen, the European Central Bank has no way out.

In fact, the European Central Bank has exhausted all options. France is too large to be "rescued" and too big to "not rescue." Once capital flight from France reaches a critical point, it will be impossible to maintain stability through localized measures; the only response will be large-scale money printing. Whether or not France actually exits the euro, the outcome will be the same: trillions of euros will be created out of thin air.

This is particularly important for cryptocurrency investors. Because the U.S. is changing the global order, reversing the patterns of surplus and deficit. Deficit countries will turn into surplus, and surplus countries will turn into deficit. Countries like France do not control reserve currencies; their bonds lack buyers and can only rely on central banks to print money. For investors, this means that European assets will lack attractiveness for a long time, while the importance of Bitcoin and other decentralized assets will further increase.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。