Written by: A1 Research

Translated by: Saoirse, Foresight News

Editor’s Note: CLOB DEX (Central Limit Order Book Decentralized Exchange) is the mainstream technical architecture of Perp DEX (Perpetual Contract Decentralized Exchange), supporting over 92% of its market share. This report focuses on the CLOB DEX ecosystem, analyzing its dominant position in the derivatives market, opportunities for spot expansion, and industry challenges, providing a reference for grasping decentralized trading trends.

Key Points

- Zero-fee competition has compressed the profit margins across the entire CLOB DEX (Central Limit Order Book Decentralized Exchange) sector. Market leader Hyperliquid, despite stable trading volume, saw its September revenue drop by 39% to $68.93 million. Meanwhile, Lighter processes $133 billion in trading volume monthly and implements a zero-fee policy for retail users, further intensifying industry competition.

- In addition to standard trading fees, various new profit models have gradually emerged. Among them, Paradex achieves profitability through a Payment for Order Flow (PFOF) mechanism (charging market makers 0.5 to 3 basis points) and user deposit earnings; while ADEN.io (developed by Bugscoin) obtains infrastructure-related fees through a backend revenue-sharing model.

- Although application chains currently dominate, new high-performance monolithic L1 public chains are rapidly rising. These public chains, leveraging their parallel processing technology and efficient virtual machines (VM), are expected to become the next frontier in decentralized trading infrastructure.

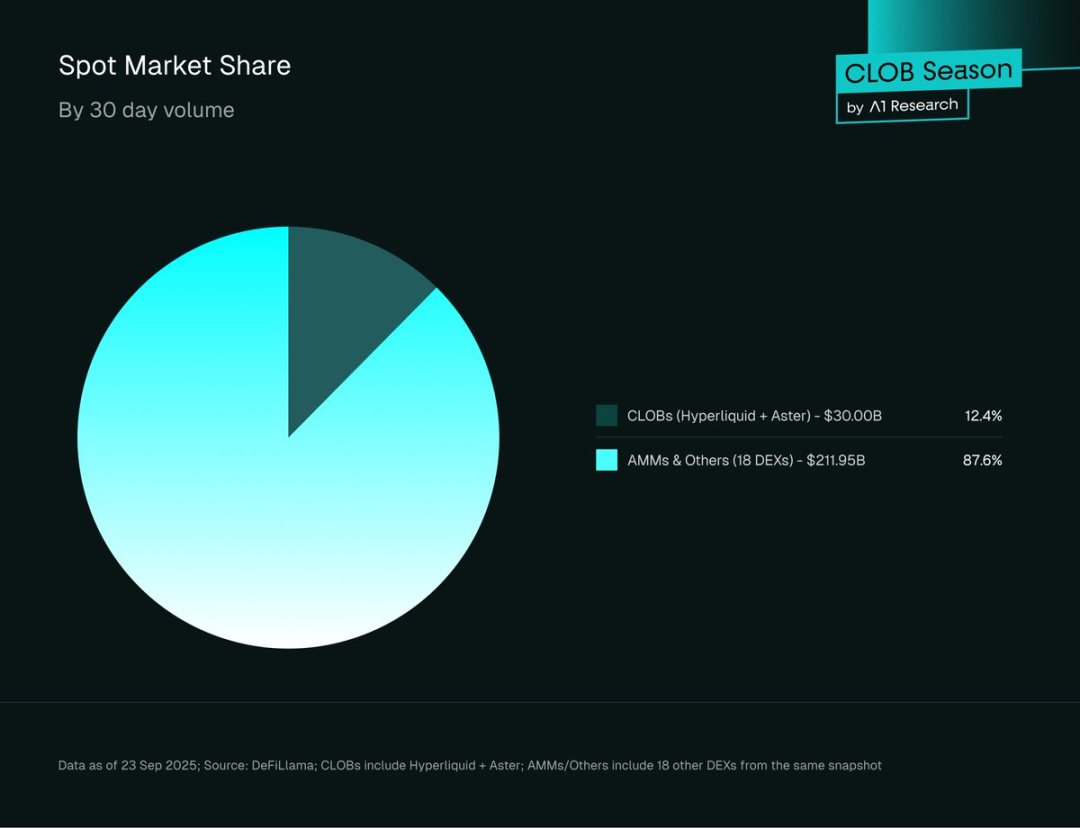

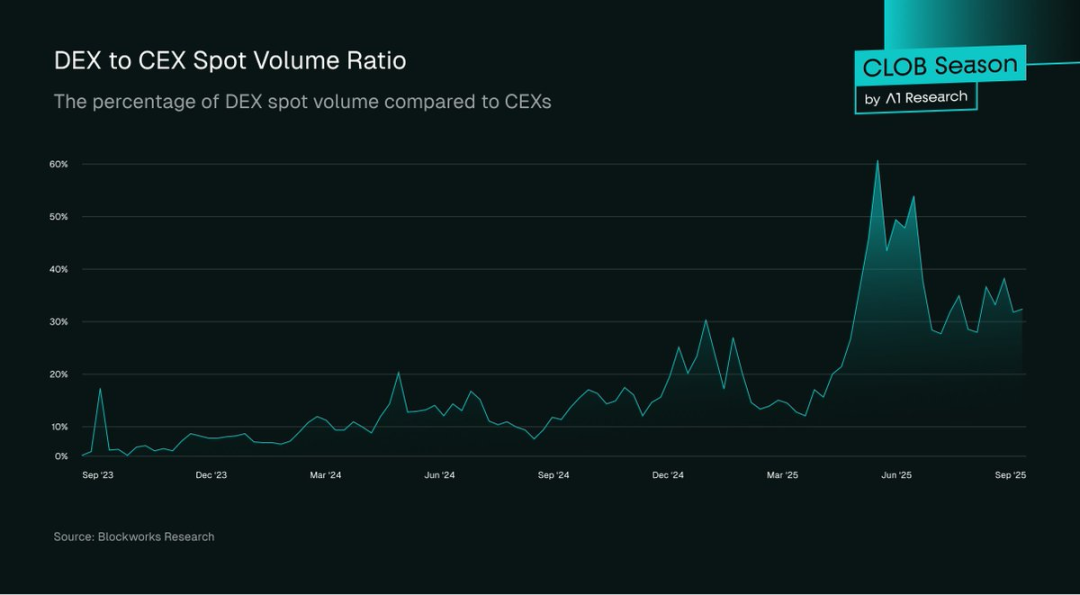

- The spot penetration rate of CLOB (Central Limit Order Book) is only 12.4%, indicating significant expansion opportunities. Monthly data shows that automated market makers (AMMs) have a spot trading volume of $212 billion, while CLOB's spot trading volume is only $26.4 billion, highlighting a substantial scale gap and confirming the growth potential of CLOB in the spot market.

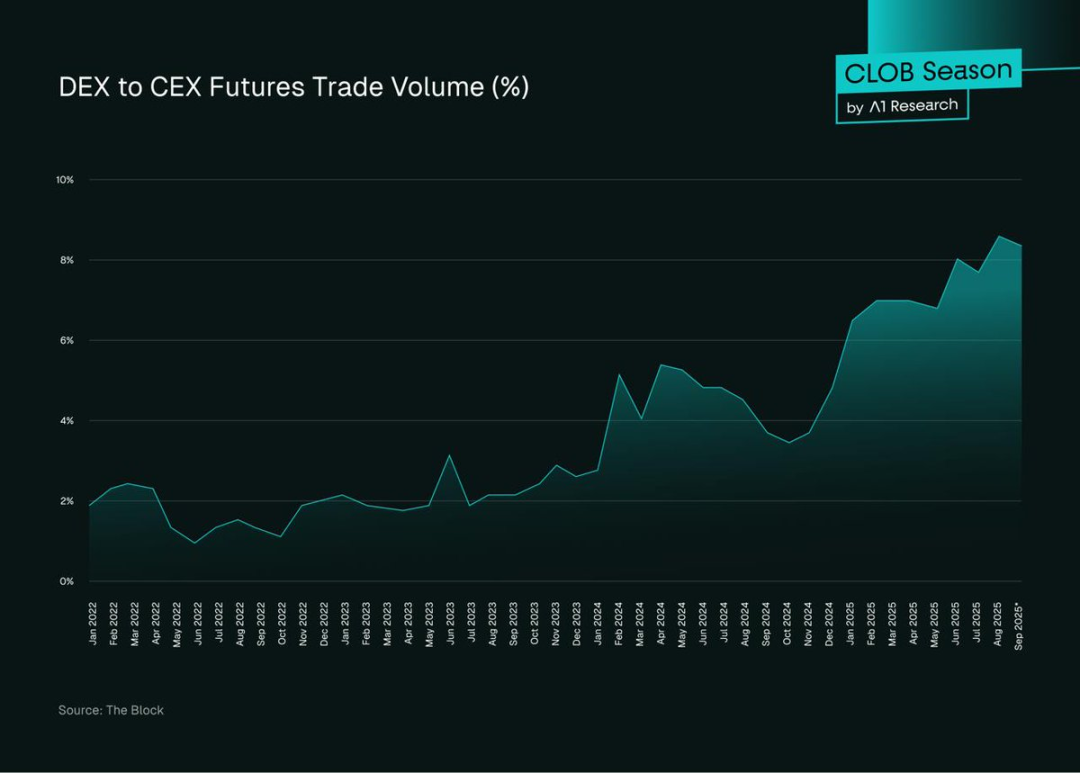

- From 2022 to 2025, the proportion of decentralized exchange (DEX) futures trading volume to centralized exchange (CEX) futures trading volume increased from less than 2% to 8%. This significant growth strongly indicates that DEX (especially CLOB-type DEX using the central limit order book mechanism) is continuously gaining user favor.

This report employs a data-driven analytical approach, focusing on CLOB platforms that are live on the mainnet and have observable metrics; projects that are either in the testing phase or have not yet launched on the mainnet will be separately marked and excluded from the core comparison.

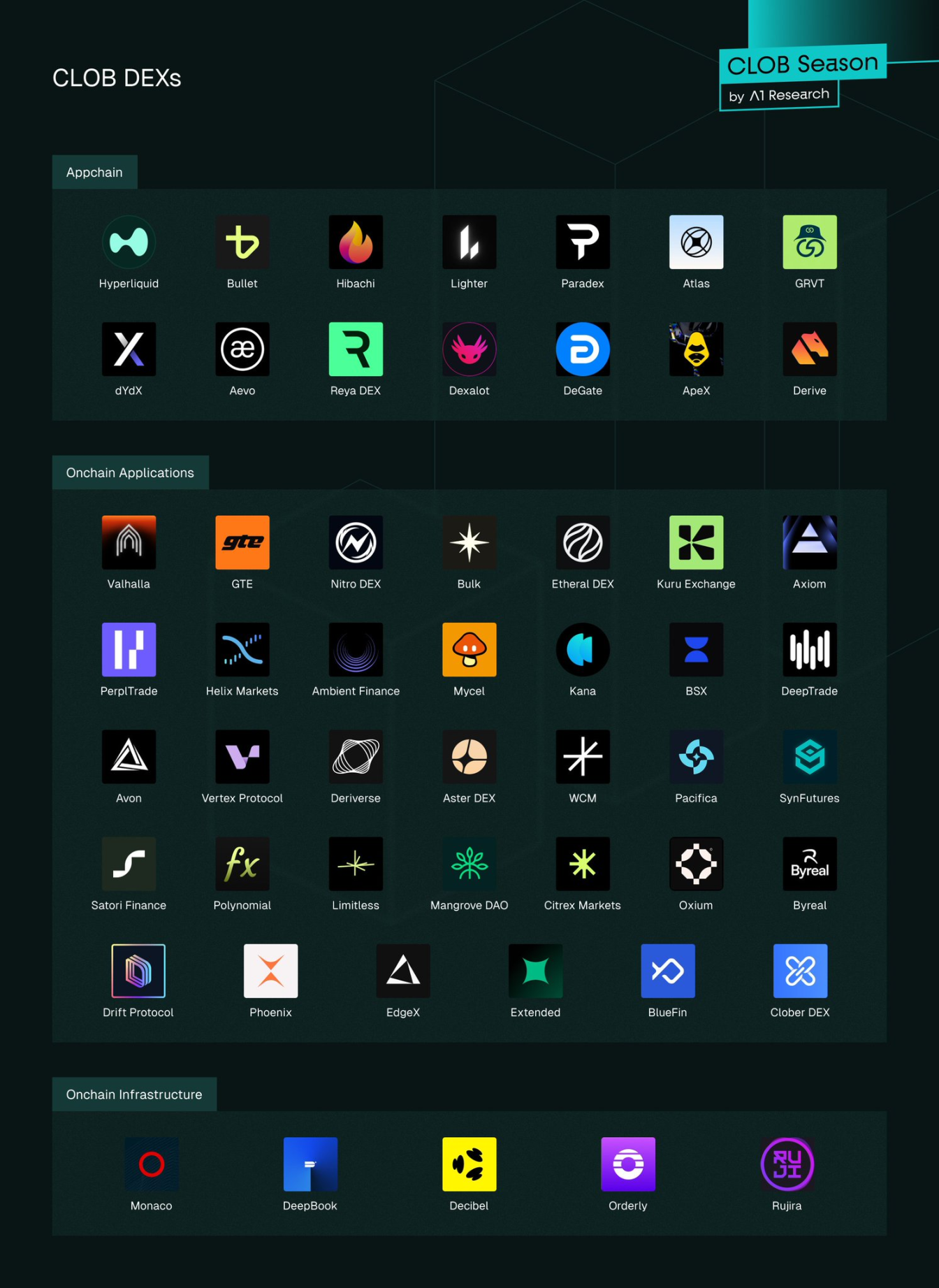

Competitive Landscape

In just two months, a decentralized exchange (DEX) has broken its monthly trading volume record twice: in July 2025, it became the first DEX to surpass approximately $31.9 billion in perpetual contract (Perp) trading volume in a single month; by August, its perpetual contract trading volume further climbed to nearly $39.8 billion, breaking the record again and setting a new high for all on-chain trading platforms. This exchange is Hyperliquid — a fully on-chain central limit order book (CLOB) built on its own Layer 1, designed for low-latency matching and centralized exchange-level throughput.

Despite these achievements, industry competition is becoming increasingly fierce. September trading volume data shows that emerging CLOB DEX are exerting greater pressure — they not only provide comparable latency performance but also offer lower fees and substantial incentive policies. The core of this competitive landscape is that CLOB model DEX can leverage deep liquidity combined with a transparent and efficient price discovery mechanism to pose a real challenge to centralized exchanges (CEX).

In 2025, advancements in infrastructure (continuously improving L1, more advanced Rollup SDKs, zero-knowledge proof (ZK) infrastructure, and high-throughput data availability (DA) solutions), coupled with the growing institutional demand for self-custodied derivatives, are driving CLOB from a promising experimental project in the DeFi space to a core trading infrastructure. However, early entrants like dYdX v4 and Dexalot are no longer market leaders, raising the question: what truly determines market dominance in this rapidly evolving field?

This report outlines the competitive landscape of central limit order books (CLOB) across five dimensions: trading volume, open interest, user growth, fee economics, and infrastructure choices, and conducts a comprehensive analysis of the top 10 protocols based on data from DeFiLlama, Token Terminal, Artemis, and Flipside Crypto as of September 2025.

Market Metrics Deep Dive

The core part of this analysis focuses on the current top 10 largest on-chain central limit order book (CLOB) platforms, with data covering the past 30 days up to the date of extraction. These protocols have been selected for analysis due to their significant market share and open interest scale.

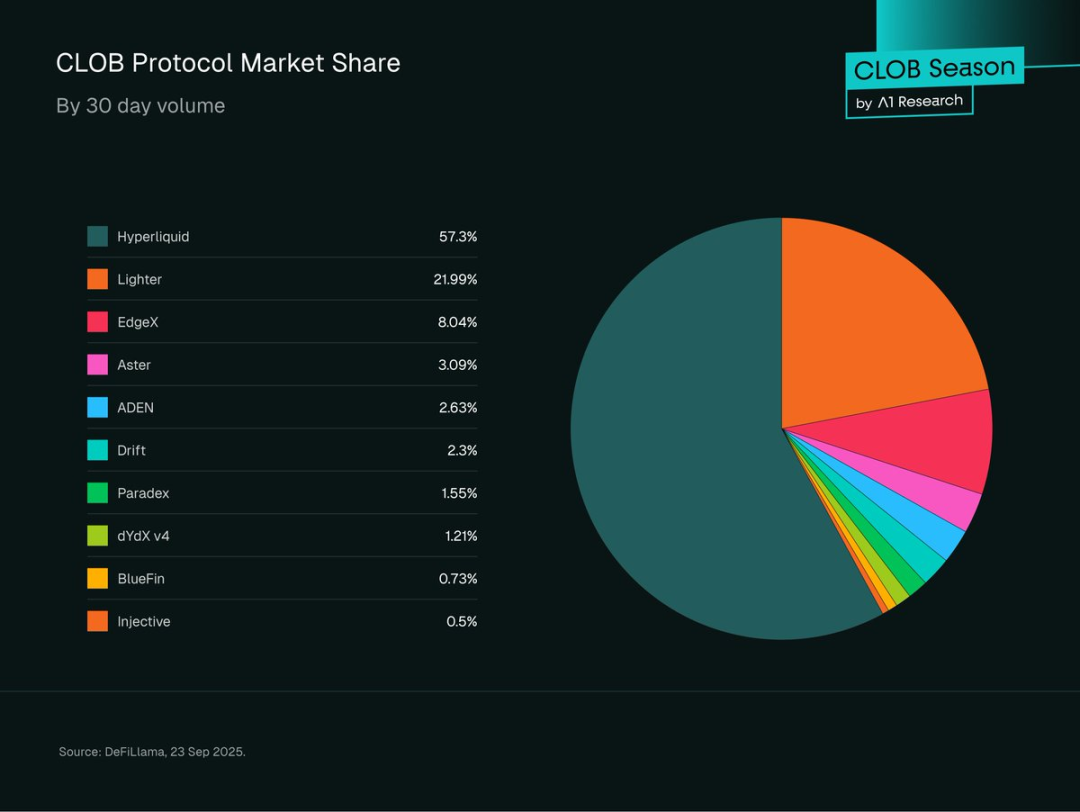

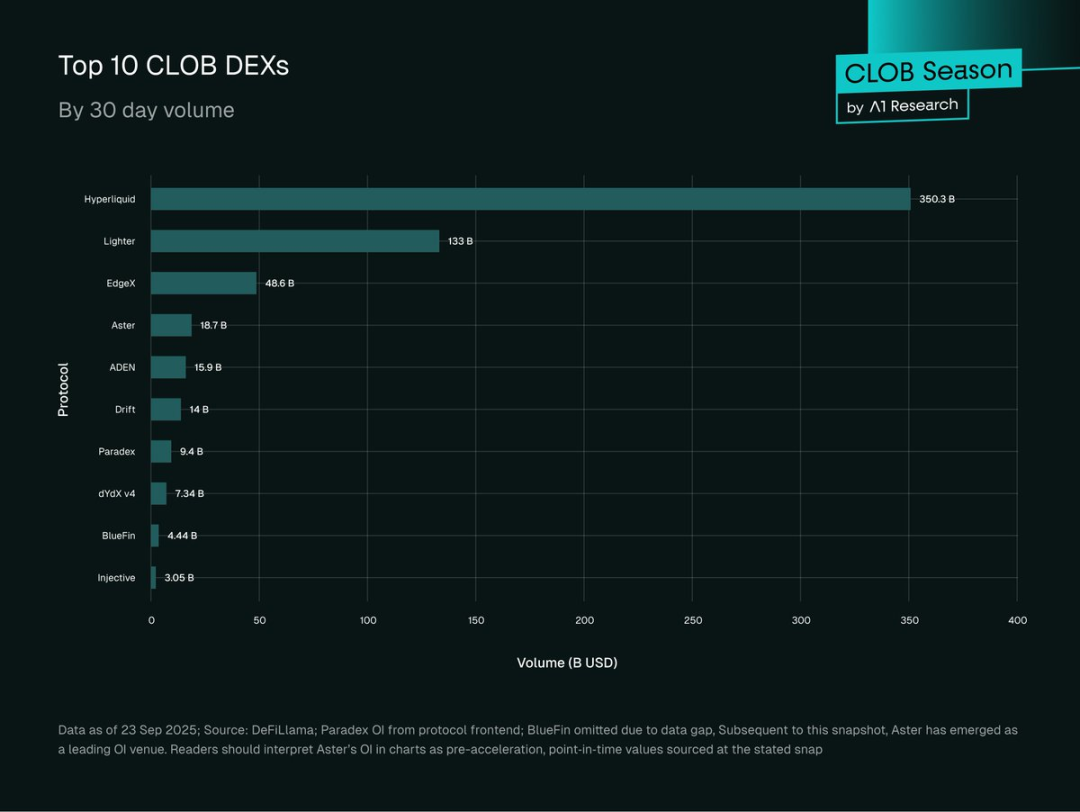

Figure 1: Market share pie chart based on 30-day trading volume (10 protocols: Hyperliquid, Lighter, EdgeX, Aster, ADEN, Drift, Paradex, dYdX v4, BlueFin, Injective). Source: DeFiLlama, September 23, 2025.

Overall Market Analysis

In 2025, on-chain derivatives trading underwent significant transformation: CLOB DEX (Central Limit Order Book Decentralized Exchange) not only established an unprecedented dominant position in the perpetual futures market but also occupied a specific niche in the spot trading sector.

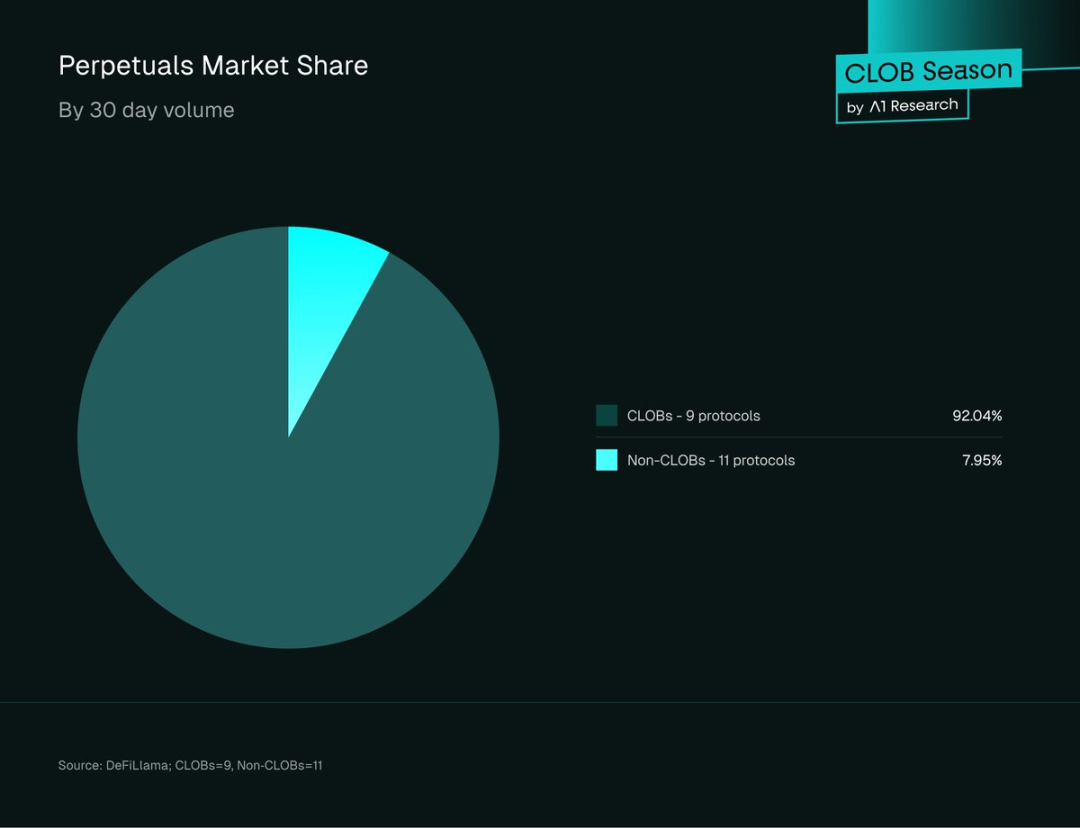

Among the top 20 decentralized perpetual contract protocols, CLOB DEX has a market penetration rate of 92.04%, with a 30-day trading volume of $607 billion; in contrast, non-CLOB protocols have a 30-day trading volume of only $48.37 billion.

Figure 2: Market share of the top 20 Perp DEX based on 30-day trading volume — Data as of September 23, 2025; Source: DeFiLlama; including 11 CLOB protocols and 9 non-CLOB protocols.

This stands in stark contrast to the early DeFi era — during that phase, automated market makers (AMMs) dominated all trading activities.

Conversely, the spot trading market remains absolutely dominated by AMMs: the spot trading volume share of CLOB protocols is only 12.4% ($26.4 billion), while AMMs and other protocols account for 87.6% ($212 billion).

Figure 3: Spot trading volume market share (CLOB vs. AMM) — Data as of September 23, 2025; Source: DeFiLlama; CLOB includes Hyperliquid and Aster; AMM/other categories include 18 other DEX from the same period.

This significant disparity highlights the specialization of the CLOB architecture: it excels in derivatives trading but faces structural challenges when competing for liquidity supply in the spot market against AMMs. This also presents a substantial untapped opportunity for the industry ecosystem — if CLOB can capture a significant share of the cryptocurrency spot market, its target market size and revenue potential will expand dramatically.

Open Interest Trends

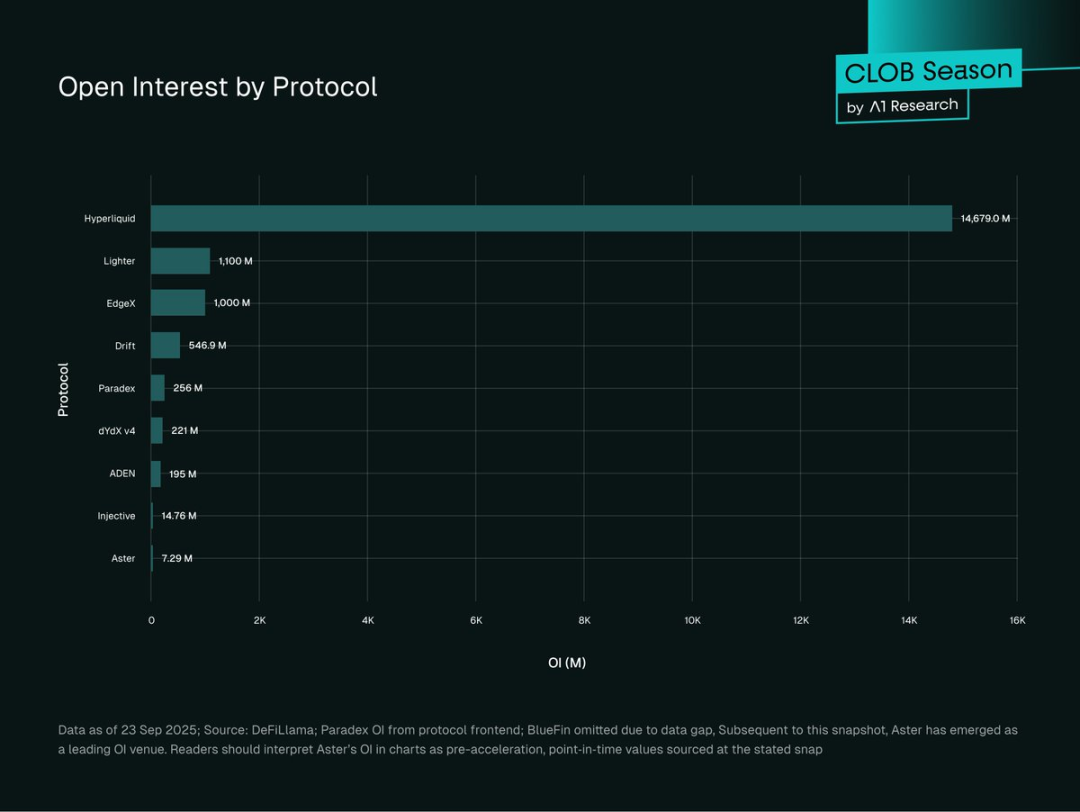

Figure 4: Open interest scale of various CLOB DEX protocols (in millions of dollars) — Data as of September 23, 2025; Source: DeFiLlama; Paradex's open interest data comes from the protocol's frontend; BlueFin is excluded from statistics due to data gaps. After this data collection, Aster has emerged as the leading platform in open interest scale. Therefore, readers should note that the open interest data for Aster in the chart reflects a specific time point before accelerated growth.

Hyperliquid dominates the on-chain CLOB open interest scale, approximately $14.77 billion, accounting for 81.56% of the total; followed by Lighter ($1.1 billion, 6.07%), EdgeX ($1 billion, 5.52%), and Drift ($546.9 million, 3.02%). Paradex's open interest is gradually growing, reaching $255 million (1.41%); dYdX v4 is at $221 million (1.22%); and ADEN is at $195 million (1.08%). Injective and Aster have the smallest shares, approximately $15 million (0.08%) and $7 million (0.04%), respectively.

Open interest (OI) is not merely a "vanity metric"; it measures not only trading volume but also reflects the actual capital invested and risk exposure. When high open interest coexists with high trading volume, it often indicates deep market liquidity, large positions, and institutional participation. Conversely, low open interest and low trading volume typically correspond to retail or other entities' short-term activities (such as obtaining airdrop rewards through mining, speculative capital flows), or emerging protocols still accumulating liquidity.

Hyperliquid holds 77% of the open interest share (Note: According to context and online data analysis, the previously mentioned 81.56% refers to the share among the 9 statistically recorded CLOB DEX open interests, while 77% should refer to the share across the entire CLOB DEX open interests), reflecting its deep liquidity "moat" and strong network effects — liquidity attracts more liquidity, and large capital traders prefer platforms with tight spreads and low slippage.

However, it is important to note that this highly concentrated pattern may also pose systemic risks: if Hyperliquid experiences a failure or security issue, the entire on-chain derivatives market could be impacted.

The ideal market structure should achieve a more balanced distribution of open interest across multiple CLOB platforms to enhance the overall risk resilience of the market in adverse conditions. Historical events in the cryptocurrency space (such as the collapses of FTX, Mt. Gox, Terra, etc.) have proven that excessive concentration can exacerbate systemic risks and potentially trigger broader market crises.

User Growth Metrics

- Hyperliquid: As of September 2025, monthly active users reached 361,300 (data source: Token Terminal); user growth in the first half of 2025 was 78%, with the number of wallet addresses increasing from 291,000 to 518,000.

- Lighter: As of 2025, the number of deposit users exceeded 171,000; daily new wallet registrations have significantly increased since the beginning of the year, peaking at around 6,000 by the end of September (data source: Dune Analytics).

- Aster: Within 24 hours of the token issuance, the number of wallets created reached 330,000; cumulative claims exceeded 2 million (some of which may be overestimated due to airdrops and support from Zhao Changpeng); trading volume in the past week reached 545,529 transactions; daily trading volume peaked at $3.67 billion in September (data source: Dune Analytics).

- dYdX v4: The monthly active user base remains stable at around 19,900; for over two years, the number of weekly traders has consistently stayed above 15,000 (data source: Token Terminal).

- Drift: Monthly active users reached 18,600, with this growth closely related to the development of cross-margin perpetual contracts based on Solana and the expansion of DeFi integration (data source: Token Terminal).

- Paradex: On-chain data shows that the number of deposit users continues to rise, with accelerated deposit growth since mid-2025, supported by Paradigm (data source: Dune Analytics).

Hyperliquid's user growth shows a mature and sustained upward trend, gaining recognition from institutions. The surge in Aster's users may benefit from the influence of Zhao Changpeng (founder of Binance, who has recently joined as an advisor) and generous layered incentive measures, but its long-term user activity remains to be observed.

As early entrants, dYdX v4 and Drift have smaller user bases but maintain stability and high user retention rates — likely due to their early market positioning.

Fee Revenue Analysis

Monthly fee performance reveals significant differences in profitability efficiency and competitive positioning among different platforms within the CLOB ecosystem. An analysis of the profit and loss statements of six protocols shows varying trends in absolute revenue scale and fee acquisition rates.

September 2025 monthly performance:

- Hyperliquid: $68.93 million (down from $113.73 million in August).

- Aster: $21.28 million (up from $16.57 million in August).

- Drift: $4.10 million (down from $4.87 million in August).

- BlueFin: $2.56 million (down from $3.24 million in August).

- dYdX v4: $940,987 (relatively stable).

- ADEN: Infrastructure fees of $396,919 (up from $303,556 in August).

September 2025 fee acquisition efficiency:

- dYdX v4: Monthly fee rate of 1.28% ($940,987 ÷ $7.34 billion trading volume).

- Aster: Monthly fee rate of 1.14% ($21.28 million ÷ $1.87 billion trading volume).

- Drift: Monthly fee rate of 0.29% ($4.10 million ÷ $140 million trading volume).

- ADEN: Monthly fee rate of 0.25% ($400,000 ÷ $1.59 billion trading volume)*.

- Hyperliquid: Monthly fee rate of 0.20% ($68.93 million ÷ $350.3 billion trading volume).

- BlueFin: Monthly fee rate of 0.06% ($2.56 million ÷ $440 million trading volume).

Note: ADEN's fees are infrastructure/developer fees, not direct trading fees.

Six-month revenue trend analysis:

- Hyperliquid: Revenue dropped significantly from $113.73 million in August to $68.93 million in September, indicating that while it still leads in trading volume, it faces increasing competitive pressure.

- dYdX v4: Monthly revenue remains stable at around $1 million, indicating a stable but limited user base.

- Aster: Revenue surged from $789,000 in July to $21.28 million in September, demonstrating rapid market penetration capability.

- Drift: Revenue has slightly decreased from its peak, facing competitive pressure within the Solana ecosystem.

- ADEN: The infrastructure revenue model continues to grow, achieving a month-on-month increase of 30% through backend profitability.

- BlueFin: Revenue performance is volatile, with a recent decline, struggling to maintain stable fee acquisition capabilities within the Sui ecosystem.

Fee Model Classification

Efficient Fee Models:

These models have a relatively high fee-to-volume ratio, showcasing outstanding profitability efficiency. dYdX v4 and Aster have the highest fee acquisition rates (1.28% and 1.14%, respectively), which may reflect their positioning to serve high-end users or facing less competitive pressure in specific niche markets.

Notably, Aster's higher fee acquisition rate may benefit from attracting "incentive-driven users" through generous reward programs — allowing it to maintain a high fee level amid intensifying competition. In contrast, dYdX has achieved stable fee acquisition by leveraging its long-established brand advantage, serving loyal users who value platform reliability and execution quality. If future rewards diminish, Aster's fee levels may decline; however, dYdX's higher fees may be sustained due to strong trader loyalty and brand trust.

Scale-Driven Models:

These models rely on high trading volumes and competitive fee rates to achieve substantial absolute revenue through scale advantages. Hyperliquid's 0.20% fee rate reflects its competitive pricing strategy to maintain its leading trading volume, yet its absolute revenue ($68.93 million) still far exceeds that of other competitors due to its scale advantage.

Infrastructure Revenue Models:

These models primarily profit through backend services or partner services, focusing on enterprise-level (B2B) infrastructure monetization rather than directly charging users trading fees. ADEN's continuously growing backend profitability (from developer fees from partners) is a typical example — it has opted not to pursue a consumer-facing (B2C) trading fee model but instead derives value from B2B infrastructure services.

Competitive Pressure Metrics

All mature protocols have experienced a general decline in fee acquisition rates (especially Hyperliquid, which saw a month-on-month decline of 39%), reflecting the pressure from zero-fee competitors (such as Lighter, with a monthly trading volume of $133 billion and zero fees), leading to a compression of profit margins across the industry. However, Lighter still charges fees to market makers and high-frequency traders. This trend may be temporary until potential adjustments in fee strategies occur; if the total costs across platforms converge, it is expected that some incentive-driven trading volumes will flow back to platforms with higher execution efficiency.

Protocols without profit and loss data:

- Lighter: Does not charge fees for retail trading but does charge market makers and high-frequency traders. The platform has a monthly trading volume of $133 billion, posing a significant competitive threat to fee-based DEX models.

- Paradex: Adopts a Payment for Order Flow (PFOF) model, charging institutional market makers a small fee (0.5-3 basis points) to acquire selected retail order flow, thus achieving zero trading fees for users. Additionally, the platform profits through user deposit earnings sharing, performance commissions from asset management vaults, and spread profits from integrated money markets.

- Injective Orderbook: Implements a flexible fee structure governed by the community, including negative maker fees (e.g., -0.005% to incentivize liquidity) and positive taker fees (approximately 0.05%), while providing VIP discounts through INJ token staking and trading volume rewards to encourage long-term user participation.

- EdgeX: Charges maker fees (0.015%) and taker fees (0.038%), and has launched an "ambassador program" offering fee reductions and rebate points. Its revenue sources include trading fees, market-making fees, and clearing fees, while rewards are distributed based on users' trading activities and community contributions through edgeX points.

Detailed Analysis of Each Platform

Figure 5: Top 10 CLOB platforms ranked by 30-day perpetual contract trading volume — Horizontal bar chart (10 protocols: Hyperliquid, Lighter, EdgeX, Aster, ADEN, Drift, Paradex, dYdX v4, BlueFin, Injective). Source: DeFiLlama, data snapshot as of September 23, 2025.

Tiered by 30-day perpetual contract trading volume:

Tier 1: Monthly trading volume over $10 billion

The CLOB ecosystem exhibits a clear concentration characteristic, with two protocols accounting for nearly 80% of the total trading volume.

Hyperliquid ranks first with a 30-day trading volume of $350.3 billion, capturing 57.9% of the market share while controlling 77% of open interest ($13 billion). Its customized HyperBFT Layer1 architecture achieves performance levels that other platforms find hard to match: zero gas fees for transactions and final confirmation times under one second. The protocol embeds "nano sorters" within its validating nodes, enabling end-to-end latency of less than 50 milliseconds while maintaining a degree of decentralization.

This infrastructural advantage directly translates into narrower spreads and deeper order books, creating a self-reinforcing moat of "liquidity attracting liquidity." Professional traders are more inclined to choose Hyperliquid as it minimizes adverse selection costs and ensures trade execution certainty even during market volatility or congestion on other platforms.

Lighter follows closely with a trading volume of $133 billion (22.0% market share), but its open interest does not match its trading volume. The platform has built a custom low-latency architecture on Ethereum Layer 2, achieving verifiable order matching and settlement through customized zero-knowledge (ZK) proof circuits. Lighter's zero-fee model (for retail users) and 5-millisecond latency achieved through recursive SNARKs create a highly attractive value proposition for retail users. It utilizes ZK proofs to batch process trade executions, achieving settlement speeds of under 1 second while inheriting Ethereum's security.

It is important to note the sustainability of Lighter's zero-fee model for retail users: although it currently charges market makers (MM) and high-frequency traders (HFT), it may adjust its fee strategy in the future.

Tier 2: Monthly Trading Volume of $15 Billion - $50 Billion

Competitors in this tier have established their market positions through unique technological paths, forming the "challenger tier" of the CLOB ecosystem.

EdgeX leads this tier with a monthly trading volume of $48.6 billion and fee revenue of $52.6 million. It combines an off-chain Rust matching engine (processing over 200,000 operations per second with a 10-millisecond latency) verified by zero-knowledge proofs with on-chain settlement based on StarkEX technology. This design strikes a balance between scalability and credibility: achieving centralized exchange-level speed through off-chain matching while ensuring transaction integrity via ZK proofs in on-chain smart contracts.

Aster follows closely with a monthly trading volume of $18.7 billion, but its cumulative fee revenue for 2025 has reached $39.8 million, showing rapid growth. The platform operates on BNB Chain, focusing on crypto dark pools and yield-generating collateral, supporting up to 1001x leverage. The approximately 3-second on-chain final confirmation time on BNB Chain (with upgraded block confirmation times under 1 second) allows for quick on-chain settlements, primarily targeting active retail users; however, its performance does not currently support true high-frequency trading (HFT), and its actual competitive advantage may stem from acquiring native liquidity from BNB.

Aster has received support from Zhao Changpeng and the Binance ecosystem, giving it an advantage in user outreach, but it should be noted that such high leverage levels may raise sustainability concerns during market pressures.

ADEN has a monthly trading volume of $15.9 billion and is built on the Orderly Layer 2 infrastructure (utilizing the Celestia data availability solution) as a white-label DEX. It routes orders to the unified CLOB of the Orderly network — this order book is shared among over 50 integrated DEX frontends, effectively avoiding liquidity fragmentation and achieving deeper capital pool sharing. ADEN's revenue comes from ecosystem revenue sharing rather than directly charging users fees; its technical architecture supports a 1-second final confirmation time and a throughput of 5,000 transactions per second (TPS).

Drift rounds out this tier with a monthly trading volume of $14 billion and cumulative fee revenue of $24.8 million. It leverages Solana's 400-millisecond fast final confirmation feature to introduce an innovative "liquidity triple mechanism" — integrating on-chain CLOB (DLOB), virtual AMM, and just-in-time (JIT) auctions to ensure sufficient liquidity even during market fluctuations. Drift reduces matching latency to below 10 milliseconds through GPU-accelerated "guardians," while its on-chain risk engine supports a multi-asset cross-margin model.

The key to the protocol's success lies in solving the liquidity initiation challenge: when CLOB liquidity is insufficient, the AMM can provide backup liquidity depth, while JIT auctions can attract additional trading flow.

Tier 3: Monthly Trading Volume of $3 Billion - $15 Billion

Paradex has a monthly trading volume of $9.4 billion and is built on Ethereum using a Layer 2 application chain with a SN stack (CairoVM), focusing on retail-friendly strategies and implementing zero trading fees for retail users across over 250 trading markets.

Its innovation lies in abandoning the easily abused "cancel priority" mechanism and adopting a dual-market structure: "Request for Price Improvement" (RPI) auctions protect retail traders' interests, while "Request for Quote" (RFQ) supports institutional private trading, achieving a high-quality zero-fee trading experience within a fully integrated, high capital efficiency on-chain prime brokerage system.

The platform features zero-knowledge proof (ZK) encrypted account functionality, which can hide users' positions, entry and exit points, and profit and loss (PnL), attracting privacy-conscious institutional funds; with a final confirmation time of 200 milliseconds and a unified interface integrating options, pre-market trading, spot, and treasury, it builds a comprehensive trading ecosystem.

Although Paradex currently does not match Hyperliquid in scale (with open interest of approximately $255 million), its growth potential is significant: trading volume and deposit amounts continue to rise, indicating an expansion in activity scale. However, its sustainability still needs to be observed (especially the impact of incentive programs like "Second Quarter XP Points"); it is worth noting that its retail-oriented design creates a fair trading environment — something many DEXs limited by the "cancel priority" mechanism lack, laying the foundation for long-term user retention.

dYdX v4 has a monthly trading volume of $7.34 billion and is the first-generation independent application chain built on the Cosmos SDK, with an order book maintained by a distributed network of validating nodes. Although it has achieved complete decentralization, its architectural features (1-second block time, approximately 10,000 TPS throughput) have fallen behind newer high-performance platforms.

Despite its high brand recognition, dYdX v4's market share continues to decline, highlighting the critical role of technical performance in a highly competitive market. Additionally, as an independent Cosmos SDK application chain, it faces extra friction in attracting users: successful ecosystems are typically built on foundational layers that can provide broader liquidity and user networks, and this "isolation" may limit its user acquisition scale and ecosystem expansion potential.

BlueFin has a monthly trading volume of $4.4 billion, achieving gas-free trading through Sui's Move smart contracts and supporting parallel block generation via the Narwhal+Tusk consensus mechanism.

Sui's directed acyclic graph (DAG) architecture theoretically supports a throughput of 297,000 TPS, providing BlueFin with significant scalability potential, although its current trading volume has not fully utilized this performance. The platform targets high-frequency trading (HFT) level latency performance and is expected to attract institutional users as the Sui ecosystem matures.

Injective has a monthly trading volume of $3.05 billion and is an application chain built on the Cosmos SDK, reducing frontrunning through a frequent batch auction (FBA) mechanism. Its financially optimized Layer 1 supports permissionless validating nodes and cross-chain IBC interoperability, capable of handling complex derivatives business.

Performance and Functionality Comparison

Figure 6: Performance and Functionality Comparison Table

Latency Benchmark

Latency performance highlights the significant advantages of different architectures:

- Lighter (ZK Layer 2): Optimized through Layer 3 ZK Rollup, achieving an actual latency of 5 milliseconds

- EdgeX (StarkEx): Adopts a hybrid model of off-chain matching and on-chain settlement, with a latency of 10 milliseconds

- Hyperliquid (Custom Layer 1): Based on HyperBFT consensus, with a latency of 70 milliseconds, but zero gas fees for transactions

- Drift (Solana): Relies on Solana's high throughput, with a latency of 400-480 milliseconds

- dYdX v4 (Cosmos): Utilizes a distributed validating node order book, with a latency of 1000 milliseconds (1 second)

- Paradex: Optimized through Cairo VM, with a latency of 200 milliseconds (Cairo VM supports efficient computation and rapid proof generation, aiding low-latency trade execution)

- Bullet: Testnet observed latency of approximately 1 millisecond

- Monaco: Testnet reports latency below 1 millisecond

Throughput Metrics

The theoretical maximum throughput differences among different architectures are significant:

- Hyperliquid: Custom Layer 1 architecture, with an actual throughput of 200,000 TPS

- BlueFin: Leveraging Sui's parallel execution capabilities, peak throughput of 297,000 TPS

- Injective: Depending on configuration, hybrid throughput of 25,000-400,000 TPS

- Lighter: Layer 3 infrastructure, with an actual throughput of 10,000 TPS

- Paradex: Layer 2 ZK application chain infrastructure, with an actual throughput of 7,000 TPS

- Bullet: Testnet throughput of 7,840,000 TPS

- Monaco: Testnet throughput of 12,500 TPS

Order Types and Advanced Features

The richness of order types is highly correlated with the maturity of the protocol and its target user group:

- Most Comprehensive Features: Hyperliquid (supports market orders, limit orders, stop market orders, stop limit orders, gradient orders, time-weighted average price orders (TWAP))

- Standard Features: Most protocols support market orders, limit orders, and stop orders

- Basic Features: Emerging protocols typically only support market orders/limit orders (simplified functionality during initial launch)

Margin System and Cross-Margin Capability

Cross-margin support has become a "basic threshold" for CLOB protocols, and all analyzed protocols possess this functionality; however, Hyperliquid, Drift, and ADEN stand out with more advanced margin designs:

- Hyperliquid employs a fixed margin rate system, maintaining consistent margin requirements regardless of position size, helping to better manage leverage and reduce the risk of forced liquidation during market volatility.

- Drift operates on Solana, leveraging its fast final confirmation features and native multi-asset support to achieve a multi-asset, multi-position cross-margin model, providing more efficient capital allocation for complex trading strategies.

- ADEN relies on the Orderly Network — this network utilizes the LayerZero cross-chain messaging protocol to achieve unified margin and liquidity management across multiple chains.

Liquidation Mechanism

Each protocol employs three different liquidation mechanisms, optimizing for price discovery, speed, or throughput:

1. On-Chain Auctions (Hyperliquid, EdgeX, Aster, ADEN, Drift, BlueFin, Injective)

- Mechanism: When collateral for a position is insufficient, an auction is triggered; liquidators repay the debt through bidding to acquire the position.

- Advantages: Competitive pricing, decentralized execution, providing users with a fairer exit opportunity.

- Trade-offs: Relies on active bidders' participation; during market pressure, auctions may be delayed or only partially filled.

2. Based on Leeper Mechanism (dYdX v4)

- Mechanism: Designated bots automatically execute liquidations on the order book at "executable" prices set by the protocol.

- Advantages: Fast execution speed, predictable outcomes; flexible adjustment of liquidation penalty ratios and insurance mechanisms.

- Trade-offs: Relies on specific infrastructure, presenting certain centralization risk points.

3. Zero-Knowledge Proof Verification (Paradex)

- Mechanism: The liquidation process is executed off-chain, ultimately confirmed on-chain through validity proofs (usually processed in batches).

- Advantages: High throughput, low gas costs, with strong integrity guarantees.

- Trade-offs: Increased architectural complexity, relying on proof generators and data availability (DA) systems.

4. On-Chain Auctions with Zero-Knowledge Proof Verification (Lighter)

- Mechanism: Liquidation is fully executed on-chain within the ZK Rollup, utilizing a zero-knowledge proof encrypted verification auction model.

- Advantages: The liquidation process is transparent, fair, and resistant to manipulation, combining the speed of centralized exchanges with the security of DeFi.

- Trade-offs: High complexity of the ZK Rollup system, relying on the maturity of zero-knowledge proof technology.

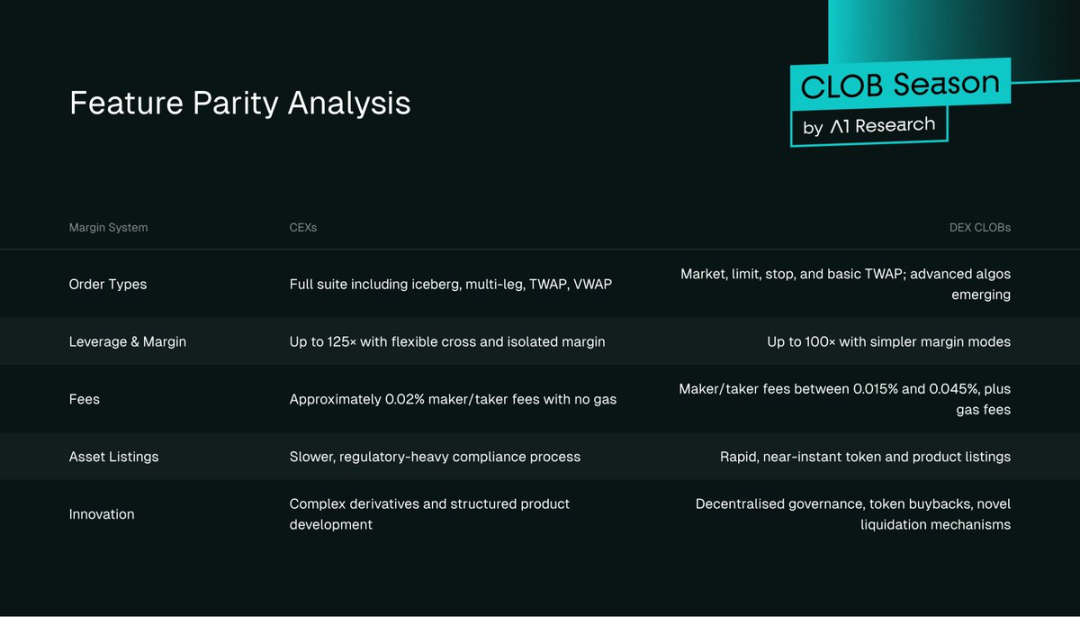

Comparison of CEX and DEX CLOB

Although CEX still holds an absolute dominance in spot and derivatives trading volume, the competitive landscape between the two markets is gradually changing as DEX gains more recognition from institutional and retail users.

Figure 7: Changes in DEX and CEX Futures Trading Volume Share (%), Source: The Block

Figure 7 shows a clear upward trend in the market share of DEX futures (including perpetual contracts): it accounted for less than 2% at the beginning of 2022, rising to about 8% by September 2025. The period from 2024 to 2025 is the fastest-growing phase, with DEX futures trading volume capturing a "meaningful" share of the total derivatives market for the first time.

This trend is highly correlated with the maturity of the underlying infrastructure, and CLOB data (30-day trading volume) further confirms its core driving role: CLOB DEX accounts for 92.04% of on-chain perpetual contract trading volume ($607 billion), far exceeding the $48.37 billion of non-CLOB protocols. Platforms like Hyperliquid and Lighter have achieved final confirmation times of under 1 second, with execution quality comparable to CEX, meeting the performance requirements of institutional traders.

Figure 8: Changes in DEX and CEX Spot Trading Volume Share, Source: Blockworks Research

Figure 8 shows that while DEX spot trading volume fluctuates significantly, its adoption level is notable: during the active trading period in 2025, on-chain trading volume could reach 30%-60% of CEX. These peaks typically occur during market pressures (such as when CEX withdrawal restrictions become apparent), reflecting the increasing acceptance of DEX alternatives by retail users — typical cases include events where the collapse of CEXs like FTX led to significant losses for retail users, driving them towards more transparent DEXs.

Currently, CLOB DEX only accounts for about 12.4% of on-chain spot trading volume ($26.4 billion), while AMM DEX reaches $212 billion, reflecting the positioning differences between the two trading models. The reasons for this include: the simpler swap interface and aggregator operations of AMM, which attract retail users migrating from CEX; additionally, many CLOBs operate on Layer 1 or Layer 2, requiring users to transfer assets from highly composable ecosystems across chains, increasing entry complexity and potentially limiting growth.

Although CLOB DEX performs strongly in perpetual contract trading ($607 billion), the spot market is much larger than the derivatives market, providing significant growth opportunities for order book model platforms — they have yet to fully tap into this potential.

User Experience Gap

CEX still leads in interface smoothness, sub-second execution speed, and comprehensive service support, offering a richer variety of advanced order types (such as iceberg orders, multi-leg options, conditional orders) compared to most CLOB DEX.

However, DEX CLOB has significantly narrowed the gap: platforms represented by Hyperliquid have matched CEX applications in speed and usability — with stable latency below 1 second, core order types such as market orders, limit orders, stop orders, and TWAP orders are widely supported.

In the short term, gas fees, wallet operation friction, and insufficient coverage of complex order types may still pose barriers to the large-scale adoption of DEX CLOB.

Regulatory Advantages and Disadvantages Comparison

CEX typically benefits from mature regulatory frameworks in key jurisdictions (such as the US SEC and UK FCA), which help establish institutional trust and provide investor protection; however, it should be noted that many CEXs operate offshore or are not bound by the aforementioned frameworks, and not all centralized exchanges possess the same level of regulatory transparency and coverage.

In contrast, CLOB DEX offers permissionless, borderless access, ensuring asset security through self-custody, and does not require KYC (Know Your Customer), providing users with greater autonomy; however, it faces a rapidly evolving legal and regulatory environment with many gray areas. For example, new regulations such as the EU's Markets in Crypto-Assets Regulation (MiCA) and the latest guidance from the US SEC introduce uncertainties regarding validator responsibilities and protocol enforcement — this poses major concerns for institutions that prioritize legal certainty.

For institutions considering "centralized vs decentralized" trading, trust and regulatory transparency remain important but "context-dependent" factors: both models have trade-offs in regulatory oversight, accessibility, and user protection, requiring a balance based on specific needs.

Differences in Trust Assumptions

The trust models of CEX and DEX are fundamentally different: CEX users must trust the solvency of the centralized custodian and the effectiveness of the insurance fund, accepting a certain degree of counterparty risk; whereas DEX users rely on the security of smart contracts, the accuracy of oracle data, and governance transparency — however, the audit quality and governance practices of different DEXs vary significantly, leading to differing risk profiles.

Functionality Equivalence Analysis

Figure 9: Functionality Equivalence Analysis Table

Challenges in Spot Trading

Although CLOB holds a dominant share of 92.63% in the perpetual contract market, it only accounts for 12.4% in the spot market, revealing the structural challenges CLOB architecture faces in competing with AMM liquidity provision.

Why is CLOB Spot Trading Lagging Behind AMM?

- Difficulty in Liquidity Initiation: Establishing an active order book liquidity pool across hundreds of trading pairs requires significantly more capital and expertise than AMM passive liquidity mining (LP).

- User Experience Friction: Placing orders incurs higher operational cognitive costs (compared to simple swaps), and gas fees further increase trading costs.

- Fragmented Routing: The lack of a shared order book leads to liquidity being dispersed across different CLOB interfaces, limiting overall depth.

- Market Maker Economic Model: Professional market makers tend to focus on high-volume trading pairs (where fees are sufficient to cover capital costs), resulting in insufficient liquidity for long-tail assets.

This creates a "self-reinforcing cycle": retail users default to AMM swaps for convenience, while market makers focus on the derivatives market (where complex order types are easier to realize value).

Ecosystem Map

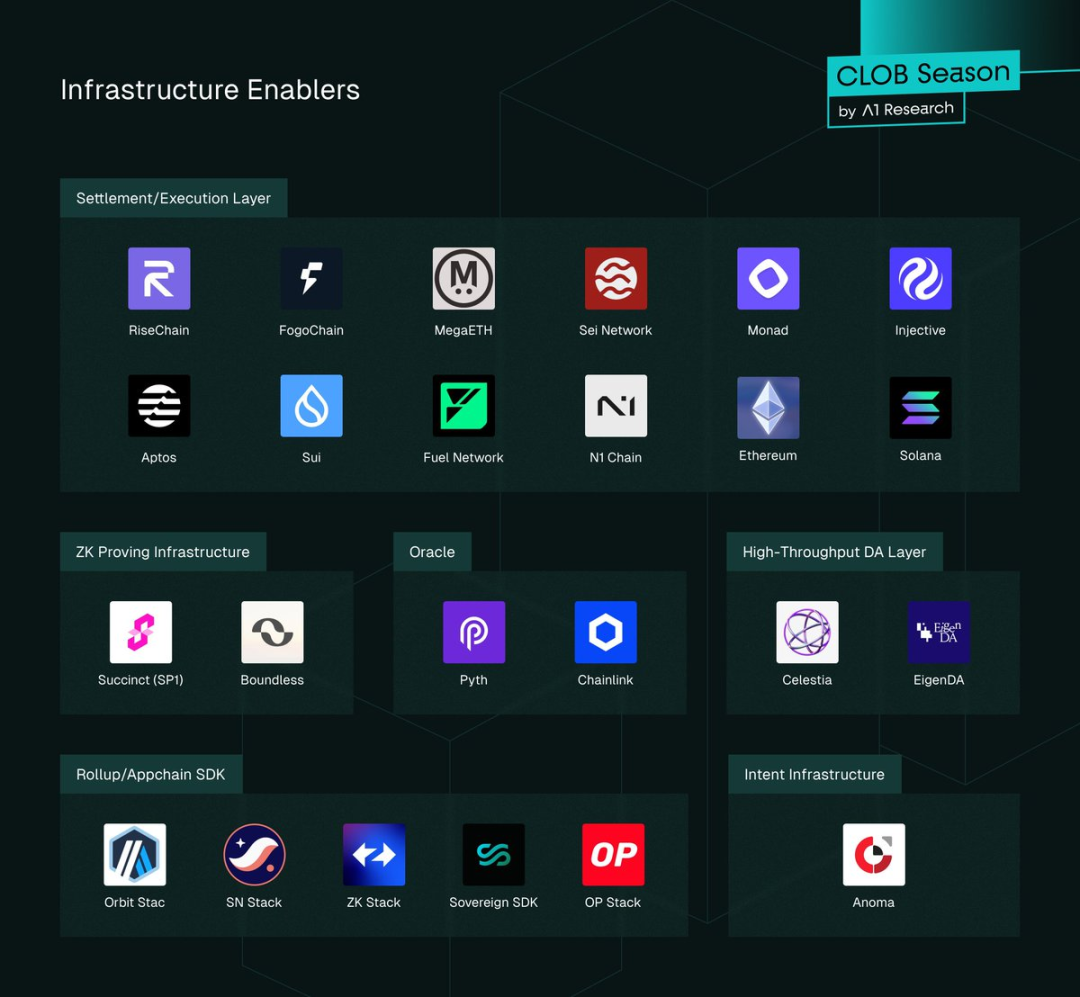

Figure 10: CLOB Infrastructure Supporters

Infrastructure Levels and Supporters

Data Availability (DA) Infrastructure Usage of 10 CLOBs

- Lighter: Inherits Ethereum's data availability (DA)

- ADEN: Obtains DA through Orderly Network

- Other Protocols: Most rely on the data availability (DA) layer of their underlying chains (e.g., Hyperliquid uses a custom Layer 1, Drift is based on Solana, Aster relies on BNB Chain)

ZK Infrastructure Deployment:

- Lighter: A fully zero-knowledge rollup (ZK Rollup) Layer 2 architecture that utilizes recursive succinct non-interactive arguments of knowledge (SNARKs) technology to achieve batch proof verification, efficiently handling the validity verification of multiple transactions while balancing security and throughput.

- EdgeX: Built on StarkEx validity proofs, it implements an off-chain matching mechanism for zero-knowledge verification, completing order matching off-chain to enhance speed while ensuring transaction integrity through StarkEx proofs, achieving a balance of "off-chain efficiency + on-chain security."

- Paradex: Constructs zero-knowledge encrypted accounts using the SN technology stack, relying on Starknet's shared proof infrastructure (SHARP), and the underlying blockchain is developed using Cairo language (a programming language optimized for zero-knowledge proofs), ensuring transaction privacy while maintaining verifiability, suitable for high-privacy trading scenarios.

- Non-Zero-Knowledge Protocols:

- Hyperliquid: Utilizes a custom consensus mechanism that does not rely on zero-knowledge proof technology, ensuring trading efficiency and security through its self-developed HyperBFT consensus;

- Drift: Natively deployed in the Solana ecosystem, leveraging Solana's high throughput and low latency characteristics without the need for an additional zero-knowledge layer;

- ADEN: Based on the Orderly Network architecture, it adopts a "execute first, verify later" aggregation logic, rather than the zero-knowledge proof's "verify first, execute later" model;

- dYdX v4: Developed based on the Cosmos SDK, utilizing the modular architecture of the Cosmos ecosystem to achieve functionality, without integrating zero-knowledge infrastructure;

- Aster: Natively deployed on the BNB Chain, directly utilizing the underlying performance of the BNB Chain to support trading, without relying on zero-knowledge technology;

- BlueFin: Natively deployed in the Sui ecosystem, leveraging Sui's parallel execution and gasless trading features, without the need for additional zero-knowledge layer optimization;

- Injective: Built on the Cosmos SDK to create an application chain, utilizing cross-chain communication (IBC) and a native order book module from the Cosmos ecosystem to achieve functionality, without adopting zero-knowledge proof solutions.

Shared Liquidity Backend Model:

- ADEN: Achieves fully shared liquidity through the Orderly Network, which provides unified liquidity support for over 50 front-end interfaces, avoiding liquidity fragmentation on a single platform and enhancing order execution efficiency;

- Injective: Built-in native exchange module that provides protocol-level shared order books, allowing different applications or front-ends within the ecosystem to share the same liquidity pool, reducing market maker costs;

- BlueFin: Constructs native shared order book infrastructure based on the DeepBook protocol of the Sui ecosystem, optimizing order matching speed and liquidity aggregation effects through Sui's parallel processing capabilities;

- Independent Model: Hyperliquid, Lighter, EdgeX, Aster, Drift, Paradex, and dYdX v4 all adopt independent order book architectures, with each platform's liquidity stored and managed independently, not shared with other platforms. While this ensures operational autonomy, it may lead to liquidity dispersion issues.

Oracles and Real-Time Market Data:

Chainlink and Pyth, the two major oracle protocols, provide low-latency data push for all CLOB platforms, which is essential for ensuring accurate price marking and the normal operation of the liquidation engine. Most protocols utilize PythLazer technology to achieve sub-second price updates, ensuring that market prices can reflect external conditions in real-time, avoiding liquidation deviations or trading risks caused by price delays.

Cross-Chain Routing:

- Inter-blockchain communication protocols support cross-chain margin trading for dYdX v4 and Injective within the Cosmos ecosystem, allowing users to flexibly allocate margin assets across different chains in the Cosmos ecosystem;

- LayerZero and Wormhole, two major cross-chain protocols, provide cross-chain messaging and liquidity routing services, supporting asset cross-chain transfers and cross-chain order routing for platforms like EdgeX and ADEN (via Orderly Network), addressing asset interoperability issues between different chains;

- Hyperlane's modular cross-chain messaging protocol enables secure and fast communication between multiple chains. Currently, Paradex has adopted this protocol, and projects like Bullet plan to integrate it upon launch to support low-latency, low-trust assumption scalable multi-chain operations.

It should be noted that the above interoperability systems currently mainly support asset and message transfers between chains and have not yet achieved true atomic multi-platform settlement — meaning that atomic operations for "settling a transaction simultaneously across multiple trading platforms" are not possible. Native multi-chain order book synchronization and settlement technology is still in active development and has not yet been widely implemented in the industry.

Application Chains and General Integration:

- Layer 1 Application Chains

Designed for performance and control, typical cases include:

- Hyperliquid's HyperBFT Layer 1: Optimizes trading throughput and latency through a custom Layer 1 architecture, meeting high-frequency trading needs;

- Injective's Cosmos SDK Layer 1: Built on the Cosmos SDK to create a native Layer 1, with a built-in exchange module that supports shared liquidity and MEV-aware ordering, reducing the impact of maximum extractable value (MEV) on trading fairness.

- Layer 2/Layer 3 Application Chains

Rollups that embed CLOB logic on top of a general Layer 1, typical cases include:

- Lighter's custom ZK Layer 2: Builds CLOB functionality on its own zero-knowledge Layer 2, optimizing trading verification efficiency through zero-knowledge proofs;

- EdgeX's StarkEx Layer 2: Implements off-chain matching based on StarkEx Layer 2, balancing low-latency matching with broader DeFi liquidity and proofs-based integrity.

- General Layer 1

General Layer 1 with parallel processing and low-latency characteristics, capable of directly supporting high-performance CLOB, typical cases include:

- Sui: Provides a native shared order book through the DeepBook protocol, supporting high-frequency trading scenarios;

- Sei Network: Utilizes an exchange-optimized technology stack, specifically optimizing performance for order book trading scenarios;

- Monad: Supports Ethereum Virtual Machine (EVM) compatible parallel execution, balancing ecosystem compatibility and trading efficiency.

The above general Layer 1s aim to achieve narrow spreads and rapid final confirmation of order book markets, intending to provide more efficient underlying support for CLOB trading. Subsequent articles will delve into various architectural designs, focusing on application chain architecture and the technical paths for building CLOB on high-performance chains in a composable general environment.

Leaders, Laggards, Winners, and Losers

Current Market Leaders

Hyperliquid leads the industry with its customized high-performance Layer 1, achieving sub-second order execution speed and deep order books. In 2025, this technological advantage translated into record monthly trading volumes and substantial fee revenues, with no other platform currently able to come close.

Emerging Winners

- EdgeX: Adopts a hybrid off-chain matching mechanism on the StarkEx protocol, capturing market share with its fast trading speed and rapid token listings.

- Lighter: Built on a self-developed customized zero-knowledge proof second-layer network (ZK L2), it employs a zero-knowledge verifiable execution architecture and actively attracts retail traders through a zero-fee strategy, driving continuous growth in monthly active users and open contract sizes.

- Paradex: Its zero-knowledge proof second-layer network (ZK L2) employs a unique revenue model, with a design philosophy similar to diversified financial institutions. The platform's core operational engine is a payment for order flow (PFOF) system — charging institutional market makers a small fee (0.5-3 basis points) to access selected retail order flows, allowing the platform to offer zero trading fees to users. In addition to trading operations, Paradex creates value through multiple synergistic channels, including taking a share of the revenue generated from user deposits, charging performance fees on asset management vaults, and earning interest from integrated money markets.

- Aster: Despite higher fees, the platform is experiencing rapid growth driven by incentives, KOL marketing, support from Zhao Changpeng (CZ), and the rapid listing of new tokens.

- Orderly Network: Its launch of a "no-code Perp DEX (perpetual contract decentralized exchange) launcher" provides technical support for ADEN, integrating multiple front-end interfaces into a single unified order book. Compared to traditional single venue operating models, this approach can more quickly expand liquidity scale and user coverage.

Emerging Key Participants Worth Watching

- Bullet: A zero-knowledge rollup application chain (ZK rollup appchain) built on Solana, aiming to replicate Hyperliquid-style native order book trading models to meet the scalability and low-latency needs of perpetual contract trading within the ecosystem.

- Monaco: Developing a permissionless, low-latency central limit order book (CLOB) infrastructure on the Sei network, focusing on ecosystem composability and microsecond-level trading latency, aiming to create a unified modular ecosystem rather than isolated application chains.

Strategically Lagging Platforms

- The first generation of application chains is facing increasingly severe challenges. Taking dYdX v4 as an example: the platform's monthly trading volume reaches $7.34 billion, but the open contracts amount to only $221 million (accounting for 1.22%), indicating limited confidence from large traders. Compared to newer platform solutions, dYdX v4's 1-second trade finality and inter-blockchain communication (IBC) bridging mechanism may present operational obstacles; at the same time, its "governance voting determines token listings" model has slowed market expansion — while competitors are rapidly capturing market share by quickly listing new tokens. Although the protocol still maintains a high fee capture rate (1.28%), indicating that loyal users recognize its trade execution quality, it remains to be seen whether this advantage can be sustained in the face of zero-fee competitors.

- Platforms lacking clear differentiation. BlueFin ($4.4 billion in trading volume) and Injective ($3.05 billion in trading volume) operate on reliable infrastructure but have yet to establish a clear competitive moat. BlueFin leverages Sui's parallel execution technology, while Injective offers batch auction-style MEV (maximum extractable value) protection; however, neither has driven large-scale user adoption. As the market matures, these protocols may find defensible niches but may continue to face dual pressure from larger scale-leading platforms and lower-tier specialized competitors.

- Some application chains (such as Injective and dYdX) are facing issuance challenges due to the continuous performance improvements of general-purpose Layer 1s. The operational requirements of cross-chain bridging have increased the user onboarding steps, while native deployment models can completely avoid this issue. Nowadays, general-purpose Layer 1s like Sui, Solana, and BNB Chain can provide performance comparable to existing ecosystems and liquidity, making it increasingly difficult for some application chains' issuance costs (e.g., [certain types of application chains]) to find reasonable justification. If application chains can achieve technically valuable breakthroughs or if cross-chain infrastructure is significantly improved, this situation may reverse. However, current trends indicate that composable ecosystem environments are more favored by the market.

Current Winning Strategies

- Achieve narrow bid-ask spreads and low, predictable latency

- Enable liquidity sharing among multiple front-ends

- Expand distribution through white-label liquidity technology stacks

- Establish fair and risk-matched fee structures for market makers

- Implement order matching mechanisms with MEV (maximum extractable value) awareness to reduce predatory trading flow

Outstanding performance is the foundation for success. Narrow bid-ask spreads and sub-second order execution speeds can attract liquidity providers as well as traders. For example, Hyperliquid's practices demonstrate that a consistently stable low-latency matching mechanism can effectively drive trading volume growth and improve market maker retention rates.

The shared liquidity model aims to address the issue of fragmented liquidity. Platforms like Injective and Sui allow multiple front-ends to access a unified order book depth, significantly enhancing pricing efficiency compared to isolated liquidity pools.

White-label infrastructure (such as Orderly Network's Layer 2 solution) enables decentralized exchanges (DEXs) like ADEN to allocate liquidity across multiple interfaces while achieving centralized back-end matching. This design separates infrastructure competition from user acquisition, allowing the front-end to focus on interface design and user experience optimization.

The zero-fee model is an effective market entry strategy, especially when challenging mature chain-based CLOB (central limit order book) platforms like Hyperliquid. For instance, Lighter initially achieved rapid growth by eliminating trading fees, forcing mature platforms to compete not just on liquidity advantages but also on execution quality and pricing. Although long-term sustainability depends on eventual profitability, aggressive pricing strategies can capture more market share by disrupting existing market structures.

As trading volume grows, the importance of anti-MEV mechanisms becomes increasingly prominent. Injective's fair batch auction mechanism effectively reduces front-running and harmful trading flow, but as new MEV extraction methods continue to emerge, such mechanisms will need ongoing adjustments and optimizations.

Failed Approaches and Risks

- Slow execution speeds and high costs of Layer 1 blockchains lead to trading delays and high fees

- Complex user onboarding processes, while automated market maker (AMM) operations are simpler, currently hinder user adoption of CLOB platforms

- Centralized orderers create trust crises and front-running risks

- Excessive market maker rebates foster manipulative "harmful" liquidity

- Governance mechanisms slow down the launch of new markets, harming token diversity

- Concentrated liquidity creates systemic risks

Taking dYdX as a case study, it is evident that large-scale on-chain trading often migrates to architectures with lower latency and better cost efficiency. If projects remain on technology stacks with slow finality and high fees, they will gradually lose competitiveness, prompting teams to shift towards faster rollups and application chains.

However, the user onboarding experience of most CLOB platforms still lags behind that of AMMs. Centralized orderers always carry the risk of single points of failure, which can be used to manipulate markets or implement censorship. Although dYdX has shifted to a decentralized validator-hosted order book, enhancing trust and censorship resistance, it has also introduced operational complexity and new scalability limitations.

Designing incentive mechanisms is another significant challenge. High market maker rebates often lead to order cancellation abuse and speculative behavior, affecting price discovery efficiency; thus, each protocol needs to continuously adjust fee schedules to optimize the balance of interests between market makers and takers.

The governance-led asset listing model is far slower than the near-instantaneous listings of AMMs, limiting long-tail liquidity and user choice. Additionally, concentrating liquidity on a single platform amplifies downtime risks; therefore, to achieve market robustness, multiple deep liquidity platforms with reliable failover capabilities need to be developed.

Future Market Structure Predictions

- Consolidation into 3-5 core platforms, becoming liquidity hubs

- Gradual growth of embedded liquidity within wallets and applications

- Rise of modular architectures, achieving separation of execution and settlement

- Maturation of Layer 1 blockchains, becoming reliable CLOB hosting platforms

- Increasing compliance requirements for orderers, trade builders, and interfaces

- Evolution of order matching towards a hybrid model balancing fairness and speed

- Active expansion of the spot market, breaking through the current 11% share

Under the trend of industry consolidation, leading decentralized exchanges (DEXs) are expected to gain advantages, while smaller specialized platforms will focus on niche areas such as privacy trading, special assets, or regional compliance. Gaining market leadership depends not only on execution quality (which must consider fees, slippage, and latency) but also crucially on the ability to attract and retain market makers and active traders through sufficient and active liquidity.

Liquidity has a self-reinforcing characteristic: deeper and more active pools attract market makers, while the narrow spreads and high trading volumes provided by market makers further enhance platform competitiveness. This virtuous cycle is central to achieving sustainable growth and maintaining competitiveness.

Future liquidity acquisition will increasingly rely on wallet and application integration rather than single exchanges. For example, Phantom provides perpetual contract services through Hyperliquid, and MetaMask plans to launch related integration features, indicating that CLOBs will gradually evolve into a "liquidity-as-a-service" layer. At that time, the importance of developer experience and distribution partnerships will be on par with original execution speed.

Leveraging increasingly mature zero-knowledge proof infrastructure stacks and dedicated data availability solutions will enable modular designs with ZK Rollup capabilities. Each layer will achieve separation of execution and settlement, thereby enhancing transaction speed, strengthening privacy protection, and optimizing fault recovery capabilities.

General-purpose Layer 1 blockchains like Monad, Sei, Aptos, Sui, as well as MegaETH, Rise, and Fogo, are gradually becoming quality CLOB hosting platforms, thanks to their smooth user onboarding experiences, market maker integration capabilities, and aggregator access channels at launch.

Compliance focus will center on key infrastructure nodes such as orderers and trade builders. It is expected that while maintaining core decentralized settlement functions, hybrid permission management and audit tracking mechanisms will gradually be implemented.

Order matching will evolve towards a hybrid model, integrating continuous order books with batch auctions or dual-stream designs to balance speed and fairness. For example, Injective's fair batch auction and dYdX v4's hybrid off-chain/on-chain matching mechanisms effectively reduce front-running and improve trading outcomes.

CLOB platforms will actively expand the spot market through various means: leveraging Injective's exchange module, Orderly's cross-chain aggregation, and other shared liquidity infrastructure to achieve hybrid wallet integration of AMMs and CLOBs, as well as implementing gasless transactions through account abstraction technology. Given that the spot market size is 2-4 times that of the perpetual contract market, capturing a significant share could potentially expand the market size from $26.4 billion to over $200 billion.

Finally, on-chain CLOB platforms have significant potential to capture more spot market share from AMMs: by sharing liquidity across multiple applications, routing trades within wallets for seamless integration of AMM and CLOB pricing, utilizing Layer 2 technology to reduce trading costs, and focusing incentives on mainstream blue-chip tokens. Although AMMs still dominate in long-tail and small-cap tokens, the growth of CLOBs in popular trading pairs is expected to significantly enhance platform revenues.

Conclusion

With the advent of new advanced designs, decentralized exchanges (DEXs) have entered a new era. Leading CLOB-type DEXs now achieve monthly trading volumes in the hundreds of billions of dollars, with execution levels comparable to centralized exchanges (CEXs); however, market competition is forcing these platforms to make critical strategic choices that will determine their survival prospects.

The zero-fee model is reshaping the pricing system across the industry. Lighter and Paradex are forcing traditional exchanges to either match their pricing or prove the justification for their premiums by improving execution quality, accelerating asset listings, or increasing incentives. However, the sustainability of this model remains in question, as the current economic model still relies on token incentives and other revenue sources.

Architectural advantages are shifting. In the past, application chains held advantages in areas where general-purpose Layer 1 blockchains could not compete due to latency optimization; however, the increasing user activity and experimental projects on platforms like Sui, Solana, and BNB Chain indicate that single chains may provide comparable performance while offering better distributed characteristics and composability. This raises the question: do protocols need full-stack control, or do they benefit more from existing ecosystems? These two models may coexist in the long term, optimized for different use cases.

The gap in the spot market presents a structural challenge. CLOBs dominate the derivatives space but hold a very low share in the spot market; AMMs still retain advantages in passive liquidity provision and user experience simplicity. To achieve breakthroughs, fundamental design limitations must be addressed, aligning with the real needs of specific market areas.

As liquidity concentration self-reinforces, the market is expected to consolidate into 3-5 core platforms. Mid-tier protocols face pressure from the scale advantages of upper-tier platforms while also contending with challenges from lower-tier specialized competitors. The practices of first-generation platforms demonstrate that merely having technical feasibility without distribution capabilities and sustained user retention is insufficient for market viability.

This report establishes benchmark indicators for tracking market competition dynamics. Subsequent analyses will delve deeper into the architectural trade-offs of CLOBs, the economics of modular infrastructure, and strategies for expanding the spot market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。