By Francisco Rodrigues (All times ET unless indicated otherwise)

Crypto markets are continuing their rise this week after weaker-than-expected U.S. labor data and amid a government shutdown that saw the market adopt the stance that a Federal Reserve rate cut next month is a near certainty.

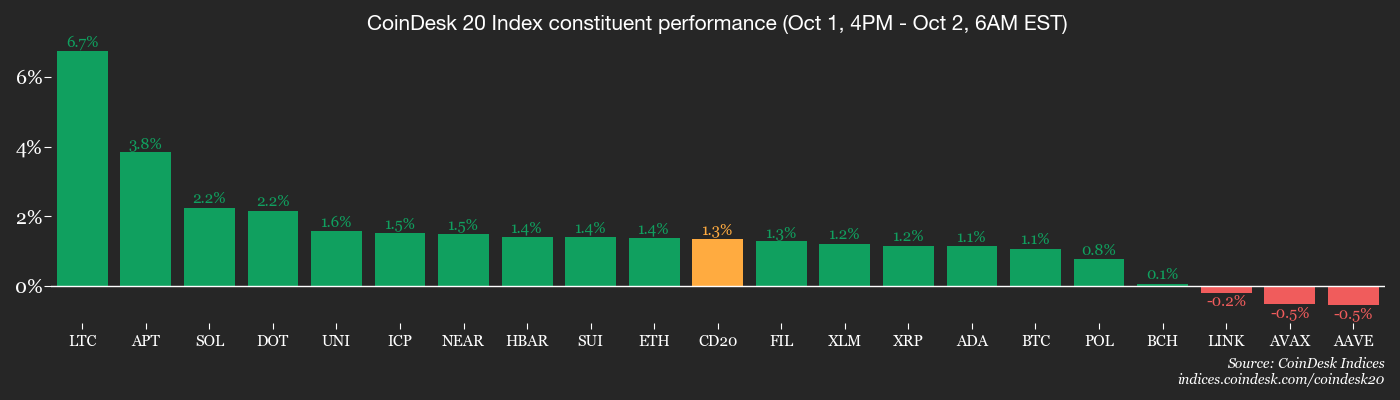

Bitcoin climbed an additional 2.15% in the last 24-hour period to $118,700, while the broader market, as measured by the CoinDesk 20 (CD20) index, rose 2.33% in the same period. The rally came despite, or because of, rising uncertainty in traditional markets.

The spark came from an unexpected drop in U.S. private payrolls. ADP data showed a 32,000 job decline in September, against forecasts for a 50,000 gain. With the government shutdown halting official labor data, traders are forced to lean on this miss for insights, leading to increased rate cut bets.

Data from Polymarket now shows traders weigh a 91% chance the Fed will cut rates by 25 bps later this month, while on the CME’s FedWatch tool, odds of such a rate cut stand at 99%.

“Markets appear to have responded with relative stability in the first 24 hours following the U.S. government shutdown,” Philipp Zentner, CEO and founder of LIFI Protocol, told CoinDesk. “It’s worth noting that during the last major shutdown in 2018–2019, which lasted 35 days, markets remained largely resilient, and we may see similar dynamics this time.”

That stability, coupled with a dovish macroeconomic environment, bodes well for risk assets like cryptocurrencies.

Derivatives markets also reflect this shift, with open interest rising nearly 4% to $216 billion according to CoinGlass data. Similarly, spot crypto ETFs have seen more than $2.3 billion in net inflows since the beginning of the week, according to SoSoValue.

Still, some warn of structural risks. “Strategies that rely on stock premiums to buy bitcoin are hitting limits,” Justin Wang, co-founder of Zeus Network, told CoinDesk. “Sustainable institutional Bitcoin adoption requires infrastructure that doesn't depend on market sentiment and stock premiums.”

As the shutdown drags on and economic signals grow murkier, investors appear to be turning toward alternative assets like gold and crypto. Speaking to CoinDesk, XYO co-founder Markus Levin pointed out BTC’s price structure is “showing a classic Elliott Wave completion within a rising wedge, a pattern that often signals consolidation before a decisive move.”

“Institutional flows and derivatives activity will be critical in determining whether this setup resolves with new highs or a deeper retracement. Either way, we’re entering one of Bitcoin’s historically most dynamic months, and market participants should be prepared for volatility,” he said.

Stay alert!

What to Watch

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead" note.

- Crypto

- Nothing scheduled.

- Macro

- Oct. 2, 8:30 a.m.: U.S. Jobless Claims initial (for week ended Sept. 27) Est. 223K, continuing (for week ended Sept. 20) Est. 1930K. The report has been delayed due to a federal government shutdown.

- Earnings (Estimates based on FactSet data)

- Nothing scheduled.

Token Events

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Governance votes & calls

- ENS DAO is voting to reimburse the eth.limo team 109,818.82 USDC from the treasury. These funds are to cover legal fees for operating their public gateway. Voting ends Oct. 2.

- Arbitrum DAO is voting to transfer 8,500 idle ETH to its treasury team to earn yield and support the ecosystem. The move is expected to generate ~204 ETH annually. Voting ends Oct. 2.

- Gitcoin DAO is holding a re-vote to approve a revised $1,175,000 matching fund and updated grant categories for its upcoming Grants Round 24 (GG24). Voting ends Oct. 2.

- Unlocks

- Oct. 2: Ethena (ENA) to unlock 0.62% of its circulating supply worth $23.65 million.

- Token Launches

- Oct. 2: DoubleZero (2Z) to be listed on Binance Alpha, Coinone, Kraken, Bithumb, OKX, and others.

Conferences

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Day 2 of 2: Northern FinTech Summit 2025 (London)

- Day 2 of 2: TOKEN2049 Singapore

- Oct. 2: Stablecoin Summit 2025 (Singapore)

- Day 1 of 3: Lightning Plus Plus Berlin

Token Talk

By Oliver Knight

- Plasma founder Paulie Punt has refuted claims that the recently issued XPL token had been sold by team members, despite on-chain data suggesting the contrary.

- Paul stated that no members of the Plasma team have sold their XPL holdings since launch. According to him, all investor and team allocations are subject to a three-year lock-up with a one-year cliff, meaning they cannot be accessed or sold within that timeframe. He emphasized that the circulating claims of insider unloading were unfounded.

- The Plasma founder also pushed back against characterizations that the team was primarily made up of “ex-Blast” employees. Of the roughly 50 team members, only three had prior stints at Blur or Blast, he said. He noted that the group also includes professionals with backgrounds at Google, Facebook, Square, Temasek, Goldman Sachs, and Nuvei, underscoring the project’s broader pedigree.

- Another point of contention has been Wintermute, a well-known crypto trading firm often engaged as a market maker for new projects. Paul denied that Plasma had a contract with Wintermute for market-making or other services, saying the company has no more information about Wintermute’s XPL holdings than the public.

- Pseudonymous researcher ManaMoon had initially claimed that over 600 million XPL tokens have been transferred from the project’s vault to exchanges since launch.

- XPL has performed relatively poorly since launch, sliding from a high of $1.68 to $0.97 while daily trading volume has remained steady at $2.6 billion.

Derivatives Positioning

- The BTC futures market is showing a strong and sustained bullish trend, with key metrics reaching new highs. Open interest has climbed to an all-time high of $32.6 billion, reflecting a significant increase in trader exposure, with Binance leading the way at $13.6 billion.

- This record-high interest is supported by a stable 3-month annualized basis, which has settled around 7%, indicating that the basis trade remains profitable and reinforcing the positive market sentiment. The combination of these two metrics suggests that recent price action is being driven by strong, conviction-based bullish positioning rather than short-term speculation.

- The BTC options market is presenting a complex and contradictory picture of sentiment. While the 25 Delta Skew for short-term options continues its downward trend, now at just 3.25%, suggesting that traders are willing to pay a premium for puts to hedge against downside risk, the 24-hour Put/Call Volume tells a different story.

- Calls are still dominating the volume at over 56%, indicating that a majority of traders are actively positioning for a rally rather than a decline.

- Meanwhile, BTC's funding rate on major exchanges is hovering between an annualized 9% to 10%, indicating healthy demand for leveraged long positions.

- However, a significant outlier is Deribit, where the funding rate has spiked dramatically to over 60%. This isolated but extreme spike suggests intense, concentrated demand for long positions on that platform, but the overall market, including altcoins, does not yet appear to be overheated with average funding for top 30 coins by market capitalization at around 10% annualized, as per Coinglass.

Market Movements

- BTC is up 1.12% from 4 p.m. ET Wednesday at $118,927.57 (24hrs: +2.23%)

- ETH is up 1.27% at $4,392.20 (24hrs: +2.59%)

- CoinDesk 20 is up 1.49% at 4,232.18 (24hrs: +2.41%)

- Ether CESR Composite Staking Rate is unchanged at 2.87%

- BTC funding rate is at 0.0135% (14.7825% annualized) on KuCoin

- DXY is down 0.18% at 97.53

- Gold futures are up 0.12% at $3,902.00

- Silver futures are down 0.2% at $47.58

- Nikkei 225 closed up 0.87% at 44,936.73

- Hang Seng closed up 1.61% at 27,287.12

- FTSE is unchanged at 9,449.86

- Euro Stoxx 50 is up 1.30% at 5,653.99

- DJIA closed on Wednesday unchanged at 46,441.10

- S&P 500 closed up 0.34% at 6,711.20

- Nasdaq Composite closed up 0.42% at 22,755.16

- S&P/TSX Composite closed up 0.28% at 30,107.67

- S&P 40 Latin America closed down 1.55% at 2,905.87

- U.S. 10-Year Treasury rate is down 1.2 bps at 4.094%

- E-mini S&P 500 futures are unchanged at 6,766.50

- E-mini Nasdaq-100 futures are up 0.25% at 25,081.00

- E-mini Dow Jones Industrial Average Index are down 0.11% at 46,672.00

Bitcoin Stats

- BTC Dominance: 58.84% (-0.36%)

- Ether to bitcoin ratio: 0.03691 (0.63%)

- Hashrate (seven-day moving average): 1,059 EH/s

- Hashprice (spot): $49.91

- Total Fees: 3.63 BTC / $423,349

- CME Futures Open Interest: 137,820 BTC

- BTC priced in gold: 30.6 oz

- BTC vs gold market cap: 8.66%

Technical Analysis

- Yesterday’s move saw bitcoin break past the bearish order block on the daily, now trading at $118,675. The daily close signals a shift in market structure, favouring the bulls.

- A retest of the order block — flipping it from resistance into support — would be a healthy retracement that could allow Bitcoin to test the all-time highs again. Bulls will want to see bitcoin establish acceptance above the order block.

Crypto Equities

- Coinbase Global (COIN): closed on Wednesday at $346.17 (+2.57%), +2% at $353.11 in pre-market

- Circle Internet (CRCL): closed at $129.03 (-2.68%), +3% at $132.90

- Galaxy Digital (GLXY): closed at $35.83 (+5.97%), +2.99% at $36.90

- Bullish (BLSH): closed at $60.81 (-4.4%), +2.22% at $62.16

- MARA Holdings (MARA): closed at $18.61 (+1.92%), +2.47% at $19.07

- Riot Platforms (RIOT): closed at $18.93 (-0.53%), +1.74% at $19.26

- Core Scientific (CORZ): closed at $17.97 (+0.17%), +1.22% at $18.19

- CleanSpark (CLSK): closed at $14.59 (+0.62%), +1.71% at $14.84

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $45.07 (+1.88%)

- Exodus Movement (EXOD): closed at $28.31 (+1.91%), +0.11% at $28.34

Crypto Treasury Companies

- Strategy (MSTR): closed at $338.41 (+5.03%), +2.29% at $346.15

- Semler Scientific (SMLR): closed at $31.03 (+3.43%)

- SharpLink Gaming (SBET): closed at $17.37 (+2.12%), +1.78% at $17.68

- Upexi (UPXI): closed at $6.53 (+13.17%), +2.6% at $6.70

- Lite Strategy (LITS): closed at $2.56 (+5.79%), +5.47% at $2.70

ETF Flows

Spot BTC ETFs

- Daily net flow: $675.8 million

- Cumulative net flows: $58.4 billion

- Total BTC holdings ~ 1.32 million

Spot ETH ETFs

- Daily net flow: $80.9 million

- Cumulative net flows: $13.9 billion

- Total ETH holdings ~ 6.61 million

Source: Farside Investors

While You Were Sleeping

- Bitcoin Surges Above $119K as U.S. Government Shutdown Takes Effect; BTC Options Look Cheap (CoinDesk): A delayed jobs report from the shutdown could push the Fed toward deeper cuts, and a 21Shares strategist says bitcoin's recent gains suggest an explosive rally could be in the cards.

- U.S. to Provide Ukraine With Intelligence for Missile Strikes Deep Inside Russia (The Wall Street Journal): Trump has authorized U.S. intelligence agencies and the War Department for the first time to provide Ukraine with targeting data for long-range missile strikes on Russian energy facilities.

- 'Tokenization is Going to Eat the Entire Financial System' Says Robinhood CEO (CoinDdesk): Robinhood is expanding tokenized stocks in Europe and eyeing real estate next. CEO Vlad Tenev says the U.S. needs to catch up with Europe in digital asset regulation.

- Thailand Crypto ETF Push Expands Beyond Bitcoin, Regulator Says (Bloomberg): Thailand’s Securities and Exchange Commission is drafting rules to let mutual funds offer ETFs tied to baskets of cryptocurrencies, aiming to attract younger investors amid a sluggish equity market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。