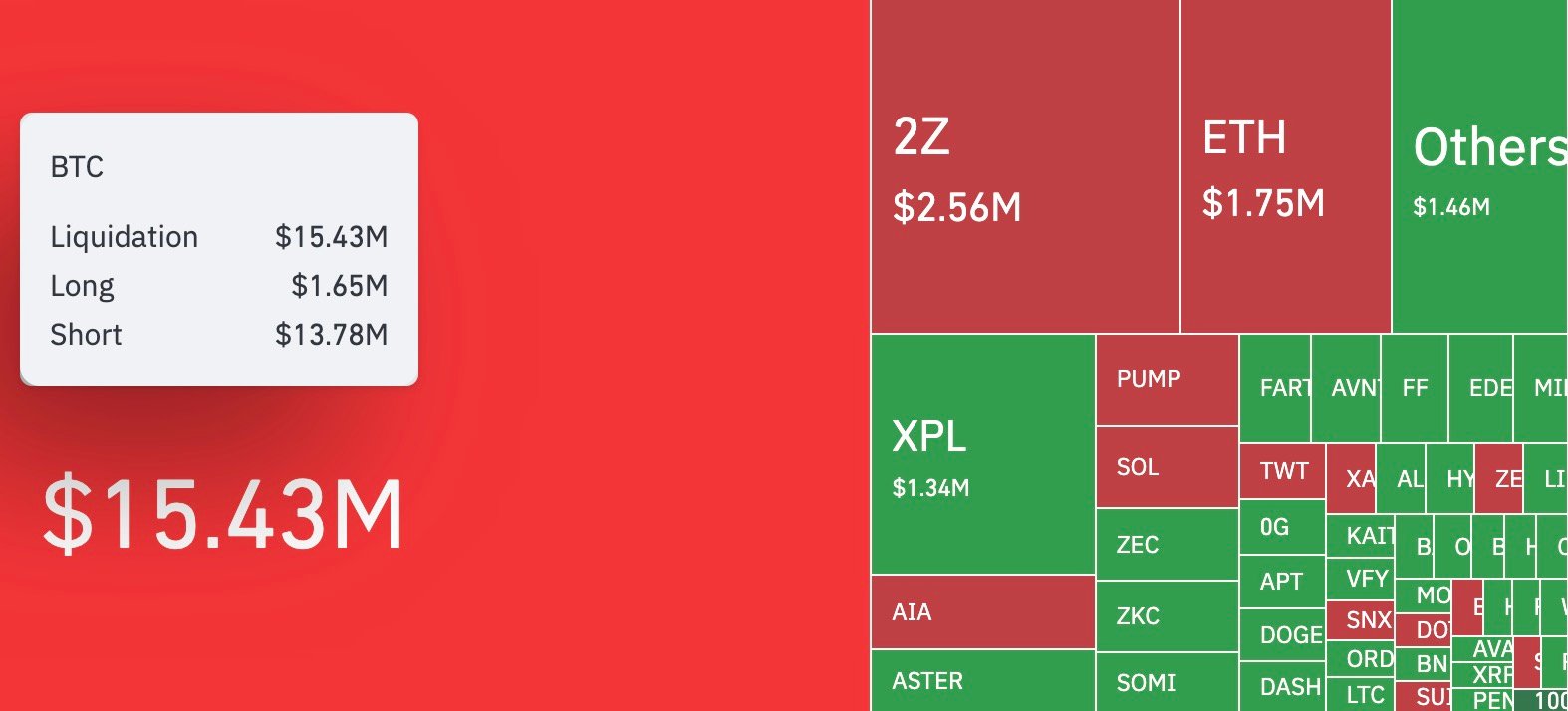

Bitcoin’s derivatives market just delivered a rare setup as an hourly liquidation heatmap by CoinGlass showed massive skewing against short positions. Within a 60-minute window, $15.43 million in BTC positions were wiped out, of which $13.78 million came from shorts and just $1.65 million from longs. The numbers mark an 835.15% imbalance.

Bitcoin was dominating the session, but the largest single liquidation came through an ETH/USD position on Hyperliquid worth $11.62 million.

Across the past 24 hours, $364.32 million in liquidations were recorded on crypto markets. Shorts accounted for $266.99 million, while longs absorbed $97.33 million. Bitcoin remained the core driver, carrying over $114 million in liquidations of so-called bears. Funding rates normalized too, showing less appetite for aggressive shorting.

HOT Stories 1.3 Billion XRP in 8 Hours: Whales Go Crazy, Dogecoin (DOGE) Price in Breakout Mode, 99% Crash in Shibarium Transactions Puts Shiba Inu (SHIB) on Verge — Crypto News DigestBREAKING: Bitcoin Reclaims $120K. Is ATH Next?BREAKING: CME Group to Offer 24/7 Trading for XRP, SOL, BTC, and Other Crypto FuturesMorning Crypto Report: XRP ETF Mania Sparks After $19,000,000 Raised, New Bitcoin Price All-Time High May Be Imminent, Dogecoin Bulls Load $3.96 Billion Futures

Source: CoinGlass

As always, the price is the driver, and BTC made it back quickly after the squeeze, stabilizing just below $120,000. With shorts heavily reduced, for many market participants, the biggest question right now is whether the market can sustain a run at the round-number level during the U.S. session.

Implications

What is for sure is that today’s imbalance leaves the market tilted in favor of bulls, at least in the short term, with forced liquidations affecting positioning across exchanges big time.

If BTC holds above $119,500, it may be suggested that the move could extend toward $120,500-$121,000. This would ensure the imbalance’s impact and be the logical outcome of today's concentrated liquidation waves' influence on intraday crypto market structure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。