The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and refuse any market smoke screens!

Today, let's talk about a topic that everyone tends to avoid: when to cut losses. The trend in the analysis has always been correct, yet the coin friends who find the author are all stuck in short positions. This is a normal rhythm; users who have made profits will not seek out the author. My personal view on cutting losses is to clear positions and stop losses. Not cutting losses does not mean holding on until the end. For example, if the price falls below a certain moving average support level, one needs to reduce their position first and take over at a lower price. I rarely mention this step in my articles because inexperienced coin friends may face significant issues with this approach. Most users, after stopping losses, will have a certain fear, afraid of making mistakes, so they choose to accept their losses. Fear is a human instinct, but courage is also a human anthem. Therefore, unless absolutely necessary, I rarely let users choose to cut losses. I have reminded everyone every time it is time to stop losses.

Many friends think simply: is there a way to exit without cutting losses? Because not cutting means no immediate loss, this concept is now collectively referred to as the first principle. This requires resolving floating losses through long-term strategies, but what if the result is failure? For example, shorting Bitcoin at 60K, wasting a year without being able to exit, do you think this is a worthwhile trade? Usually, for such choices, the author would choose to cut losses directly. This tests the control over stop-loss points; typically, my stop-loss point is my profit portion. Suppose I short at 60K, aiming for a take profit at 30K, then my stop-loss point would be 60 + 30 = 90. Once the price reaches 90K, that is my cut loss point. In the author's view, taking profit and stopping losses are relative positions; I can accept a profit of 30K, but I must also accept a loss of 30K.

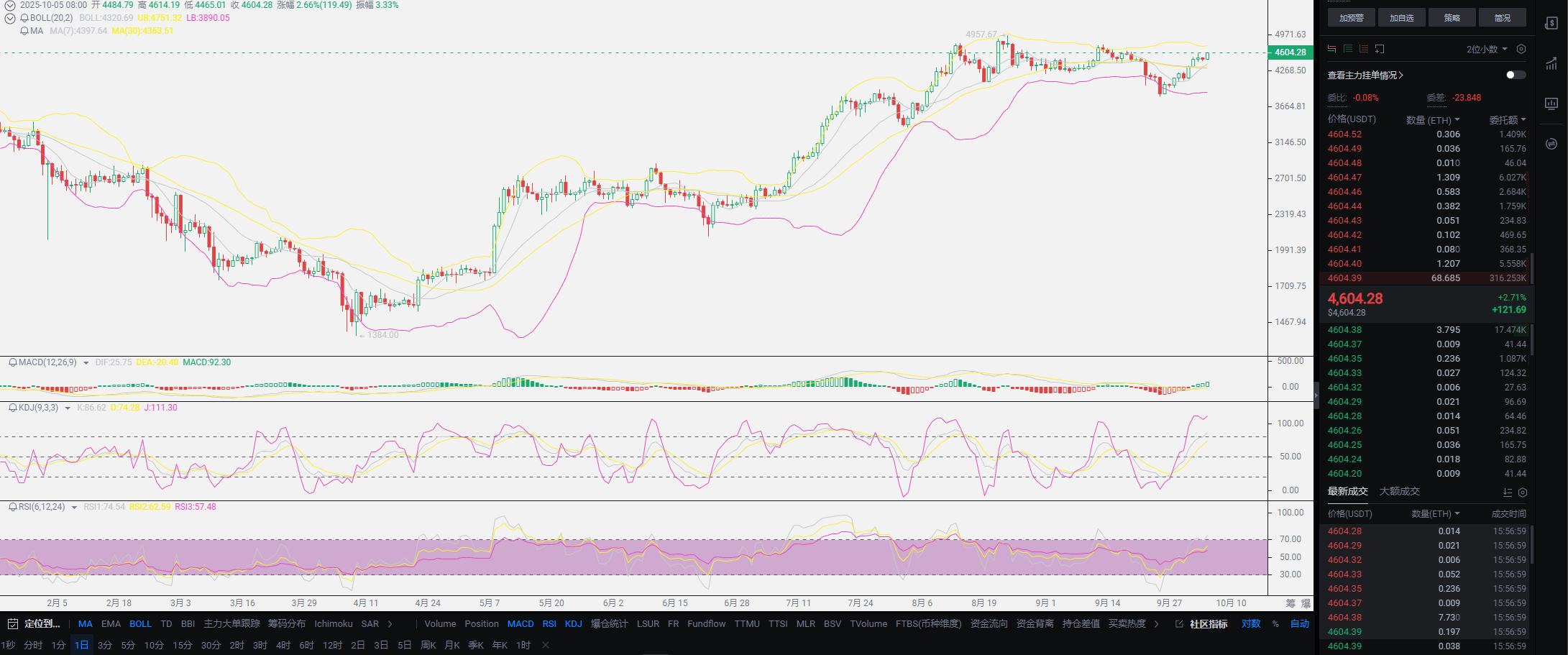

Once a loss is realized, the author will exit without hesitation and will not stubbornly continue to short, indicating that shorting is an extremely foolish choice. If a wrong choice is made, there is not much problem in terms of trend. This is also where most contract users encounter issues; most enter the market when the volatility is not large. Taking the current price as an example, going long at 123000 corresponds to letting profits run and allowing floating losses to remain. The key point is to maintain firm belief because everyone is certainly bullish at this stage. Being bullish is on the side of the trend; as long as the trend is still there, exiting is just a matter of time. This point is indeed a poor choice, as it is only 1,000 points away from the historical high of 124000, and the market is very likely to reverse at this position. If it goes down from here, everyone will need to add to their positions, provided they are in a light position.

So what if it's a heavy position? In the case of a heavy position without stopping losses, there is only one approach: lock in half of the position and wait for the market trend to rise, then resolve the position accordingly. If this position is not locked, it will definitely be impossible to sleep. The historical high is the time for shorting in the short term; this position can only be said to have a short-term decision-making problem, which is not worth stopping losses, but one must remember the feeling of making a mistake. Due to the peculiarities of the cryptocurrency market, combined with the nature of contracts, which do not settle for 24 hours, the biggest problem is that it does not give you time to think. If it were the US stock market or the old A shares, you could review after the market closes. In the cryptocurrency market, it is a choice of entering for profit or loss, which does not give you any time to react. Therefore, in most cases, if a position is entered and luck is not good, it will instantly generate losses, even approaching your take profit or stop-loss points, severely testing your experience in decision-making. Making a judgment is a matter of an instant; if emotional management is out of control for a moment, it can lead to a loss on a position.

This is also why the author prefers a trend-based approach and does not care about the gains or losses of a single position. At the same time, the author's position management, whether in spot or contracts, will respond in a way similar to Livermore's method of 10%-20%-30%-40%. In most cases, the final 40% will not be added before the market starts but will be added after the market has started. The recent SOL is a case in point; starting from 120, there was no opportunity to go down, and it was added all the way to 200, resulting in an average price maintained around 166, but the more it was added, the higher it went. The premise of being able to add is that the overall position remains profitable; if losses reach over 50%, I personally believe that the final addition will also lead to hesitation. The contract market never has the best choice, only relatively easier decisions. It does not mean that the author's method of adding positions is absolutely correct; many friends firmly believe in their trend and will go all in at 120. Looking back, the profits are far greater than those of the author.

In this market, the more you profit, the more correct your choices are. The financial market is a market that speaks in terms of returns; the greater your returns, the more you are in the truth. Looking at the current trend, especially the turning points mentioned earlier, once the market starts, it will not give too many entry opportunities. You can refer to the period last year when Bitcoin grew to the 100K mark; the overall surge and pullback depth was less than 15K, which is half of the growth. This year, although it may not surge as violently, the pullback depth will not be deeper than last year, and there will be almost no opportunities for you to enter during the process. Therefore, each wave of pullback depth is your entry opportunity. I have also told everyone before that acquiring SOL below 200 and OKB below 4000 is a profit. These statements are not hindsight; only this year has Bitcoin not allowed everyone to hold. To put it bluntly, missing Bitcoin below 100K has almost no investment value in spot.

Overall summary: In fact, the entire article revolves around the explanation of stopping losses, mainly because there are too many users making wrong decisions, and they are basically reluctant to cut losses. Some coin friends, after reading the article, think that since it will drop in 2026, why not short directly now? Or currently hold short positions waiting for the drop in early 2026. In my view, these practices are not wise choices. First, there is the cost of time, and second, there is the waste of energy. What if the depth of the decline next year is not too great? Wouldn't the result be the opposite? Knowing that this year is in a bull market, why not seize this growth opportunity? To take a step back, even if you are reluctant to stop losses, you should at least lock in positions, primarily focusing on making profits from long positions to balance overall losses, which is the best choice. Remember not to hold positions, especially this time with short positions, as I fear you will go further down the path of holding positions, even adding more. Short positions should be discarded; the bull market has already started to arrive! Going long at this stage is definitely much better than stubbornly holding short positions!

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on a single piece or territory, aiming for the final victory. The novice, on the other hand, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。