Why Is Crypto Rising Today? 5 Drivers Fueling the $4.27T Rally

Have you noticed the sudden excitement across the crypto market this week? The total market cap touched a fresh record high of $4.27 trillion on Sunday, sparking a wave of optimism. Even after a slight retreat to $4.24 trillion on Monday, the market still posted a solid 1.4% daily gain. So, why is crypto rising today? Let’s break it down through five powerful market drivers that are shaping this bullish momentum — and what it could mean for investors next.

Why Is Crypto Rising Today? 5 Reasons

Bitcoin All Time High : Bitcoin has once again validated the fact that "Uptober" is a historically bullish time. Largely enabled by a confluence of macroeconomic changes and investor sentiment, BTC reached a peak all-time price of $125,559.21 on October 5, notching over 10% increases within just seven days. As of writing, BTC is priced at around $124,013.46, boasting a market capitalization of $2.47 trillion and 24-hour volume of $53.78 billion.

Source: CoinMarketCap

Source: CoinMarketCap

Interestingly enough, the BNB token too made history as it touched $1,220.51 on October 6 and continued to cement the rally further. Seasonal October strength combined with new capital inflows has created a classic breakout situation.

Stephen Miran Exacts Fed Cut : One of the prime reasons behind this boom is U.S. Federal Reserve dynamics. Fed Governor Stephen Miran publicly advocated for a firm 50 basis point cut in interest rates, citing that money policy is currently "too tight" for the U.S. economy. His view, revealed in recent Reuters reports, contrasts with other Fed policymakers who advocate for a cautious approach policy due to ongoing inflation risks. Miran voted last month for a half-point cut as the FOMC approved only 25 bps. Even as U.S. government shutdown holds up employment data, Miran remains convinced there is room to act before the late October policy meeting. Markets have already priced in this likelihood, supporting risk assets such as Bitcoin.

Spot Bitcoin and Ethereum ETF Flows: October started with robust ETF inflows, reinforcing institutional commitment. Ethereum ETFs saw $233.55M net inflows today, bringing total net inflows to $14.42B with $2.28B total traded value. At the same time, Spot Bitcoin ETFs added a whopping $985.08M, taking them to $60.05B with $7.52B in daily trade. These numbers indicate the way in which Wall Street is flooding crypto with money at scale — a structural change that likes to precede long-term bull ramps.

Liquidation Wave: Over the past 24 hours alone, 126,884 traders got liquidated, a total of $233.75 million in liquidations. The largest single order on Hyperliquid's BTC-USD pair was $4 million. $41.31 million in longs of BTC were wiped out, and $23.67 million in new longs appeared in the market.

Source: CoinGlass

Source: CoinGlass

Such liquidation waves tend to wash out overleveraged positions, setting stage for healthier bottoming-up price continuation as market structure gets re-set.

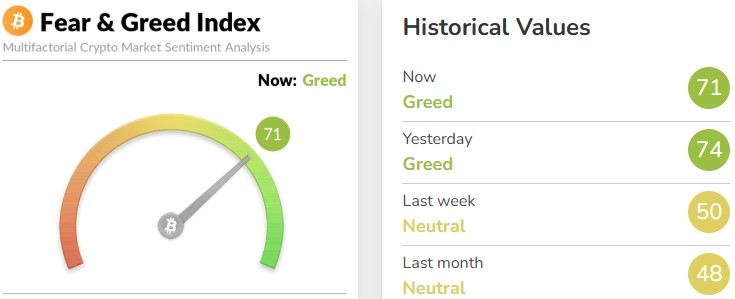

Fear and Greed Index Sentiment : Lastly, sentiment has strongly shifted bullish. The Fear and Greed Index is at 71 (Greed) today — well higher than 50 last week and 48 a month ago, when markets were even keel.

Source: Fear and Greed Index

Source: Fear and Greed Index

Historically, October greed spikes have resulted in Bitcoin rallies and general altcoin season rotations. Although extreme greed may create corrections, it also signifies extremely high investor confidence that usually yields short-term momentum.

Why Crypto Is Rising Today: What Investors Need to Do Now

The rally is currently being driven by macro tailwinds, ETF inflows, and seasonality, but sudden moves also carry greater volatility. To investors, this is the period to be on guard, avoid unnecessary leverages, and monitor significant support levels since greed rules the emotions. If the Fed does accelerate rate cuts and ETF inflows continue, the $4.27T breakout may well be an extended bull phase.

Conclusion

The response to why is crypto up today is found in the perfect storm of all-time high Bitcoins, Fed policy shifts, ETF hope, liquidation resets, and bullishness. Although the market sentiment is certainly positive, prudent positioning and strategic accumulation are still the monarchs in Uptober.

Disclaimer: This is for educational purposes only. Always do your own research before any crypto investment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。