At the end of last month, we firmly took a bullish stance, and the market moved as we expected, experiencing a significant rally, rising about 10 points since October 1st. Let's all thank the market makers for their holiday bonuses.

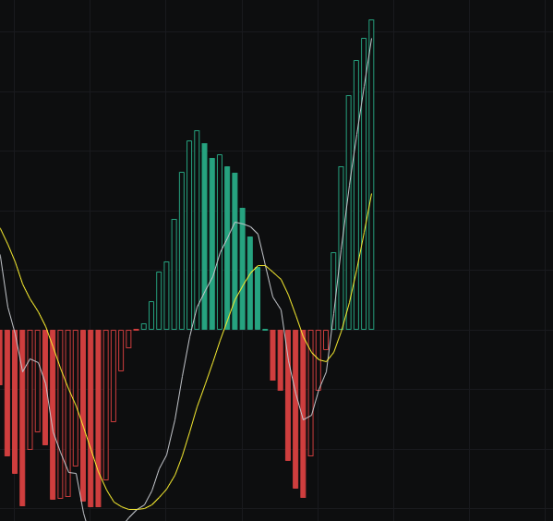

Weekly Level

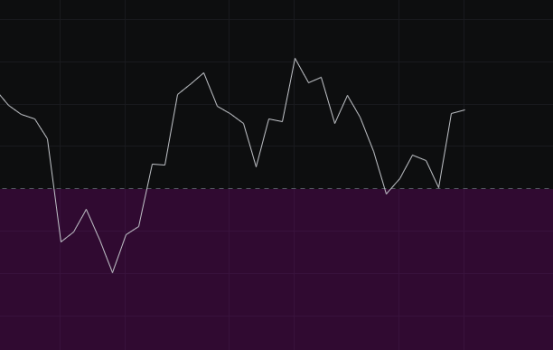

From the MACD perspective, the energy bars are above the zero line, and the fast line and slow line have formed a golden cross at a high position. Here, both risks and opportunities coexist; it ultimately depends on the market makers' choice.

From the CCI perspective, the CCI has tested 100 twice and has been pulled back by the bulls, indicating strong bullish momentum that does not want to start declining here, so there is still potential for further increases.

From the OBV perspective, the trading volume is still consolidating at a high level, and the slow line continues to rise without any significant outflow signals, so the OBV is bullish.

From the KDJ perspective, last week the KDJ formed a golden cross below 50, and we expect it to continue rising.

From the MFI and RSI perspectives, both indicators are in the neutral zone, with potential for both upward and downward movements; we will continue to observe the trend.

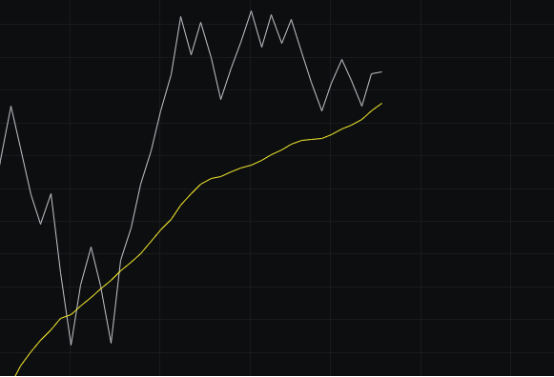

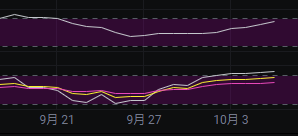

From the moving averages perspective, several moving averages are rising, and the price is above the moving averages, indicating a bullish trend in the larger time frame.

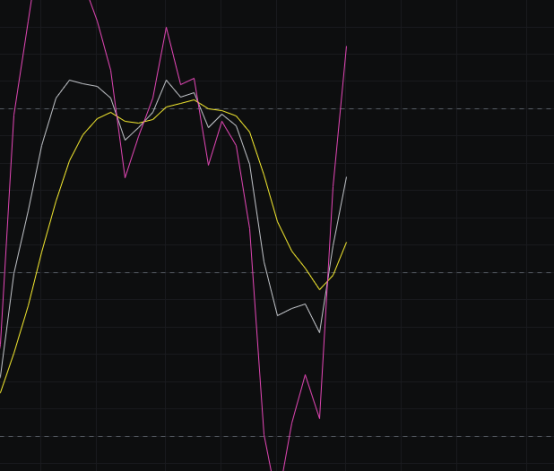

From the Bollinger Bands perspective, the upper band has opened, while the lower band has not opened significantly. For the upper and lower bands to synchronize, we need to continue rising this week. The middle band is rising, indicating a bullish outlook as well.

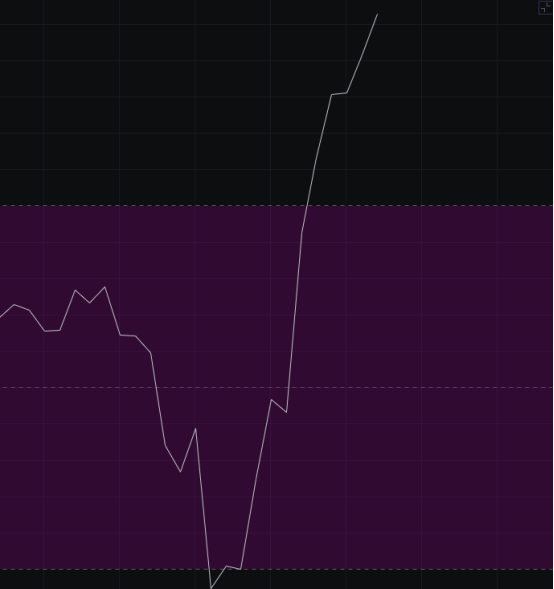

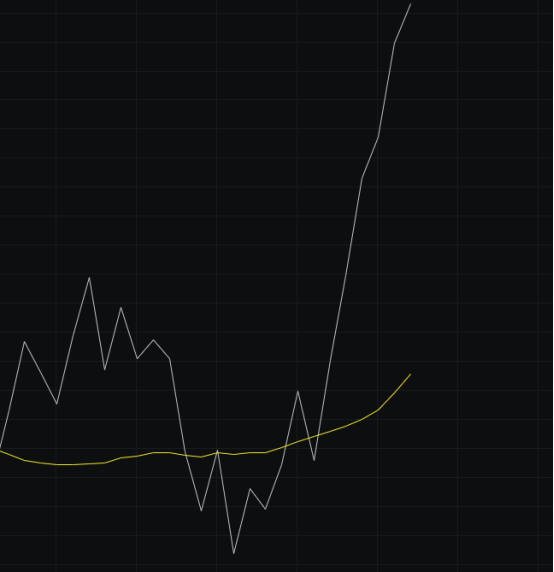

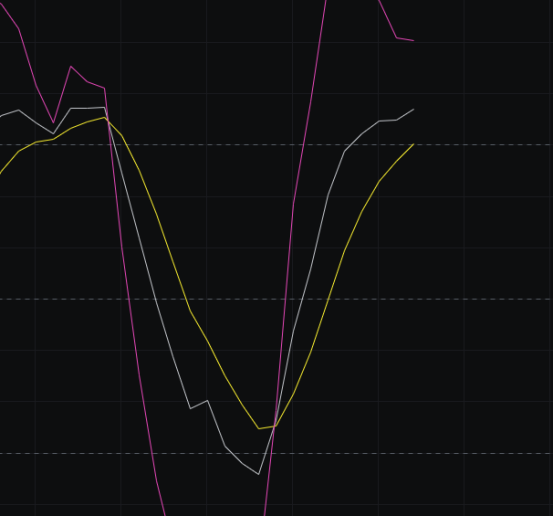

Daily Level

From the MACD perspective, the energy bars continue to increase, and both the fast line and slow line are pushing upward, indicating a bullish trend.

From the CCI perspective, the CCI is currently above 200, showing strong bullish momentum, so we continue to be bullish.

From the OBV perspective, the bulls are clearly advancing, with strong energy, and the slow line continues to rise, so we remain bullish on the OBV.

From the KDJ perspective, the KDJ is currently in a strong zone, and the bulls are still attacking, so we continue to be bullish.

From the MFI and RSI perspectives, both indicators have reached the overbought area, indicating a bullish sentiment.

From the moving averages perspective, the price is above several moving averages, and the moving averages are also trending upward, indicating a bullish formation.

From the Bollinger Bands perspective, the upper and lower bands are moving in sync, the middle band continues to rise, and the price is running close to the upper band, indicating a bullish formation.

In summary: Since October 1st, Bitcoin has risen about 10 points, and we believe the market makers' holiday bonuses are quite supportive. Today's target for the bulls is to continue closing with bullish candles, ideally with relatively low trading volume. Support is seen at 122,000-120,000, and resistance is at 126,000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。