Five Straight Days of Green: Bitcoin and Ether ETFs Roar Into October

It was a blockbuster week for crypto ETFs as both bitcoin and ether funds closed every single day in the green. The surge, powered by institutional accumulation and renewed risk appetite, pushed combined inflows to over $4.5 billion for the week. Not a single ETF recorded an outflow over the five trading sessions, a rare and powerful show of market strength.

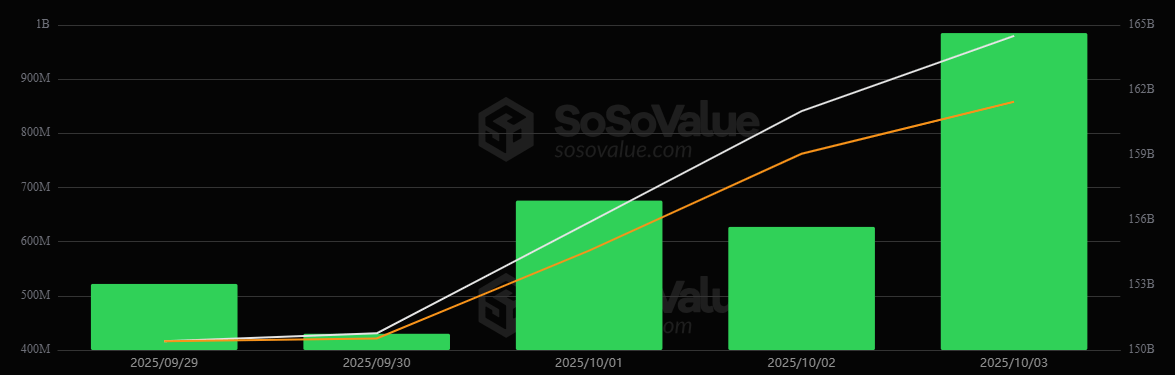

Bitcoin ETFs: $3.24 Billion Inflows

Bitcoin ETFs led the charge, pulling in $3.24 billion across ten issuers, marking the second-highest weekly inflow in history. Blackrock’s IBIT was the week’s clear winner, amassing $1.82 billion in inflows and showing why it remains the favorite ETF among institutional players. Fidelity’s FBTC followed with $691.92 million, maintaining consistent daily momentum.

Ark 21Shares’ ARKB secured $254.43 million, while Bitwise’s BITB drew $211.86 million. Grayscale’s Bitcoin Mini Trust brought in $87.25 million, and Grayscale’s GBTC added $57.27 million. Vaneck’s HODL recorded $65.06 million, while Invesco’s BTCO ($35.34 million), Franklin’s EZBC ($16.51 million), and Valkyrie’s BRRR ($4.03 million) contributed smaller sums, rounding out the week.

5 Days of Green for BTC ETFs

Trading activity was equally robust, with total bitcoin ETF volume topping $26 billion for the week. Net assets jumped to $164.50 billion, up nearly 10% from the prior week’s close, a strong reflection of both price appreciation and capital inflows.

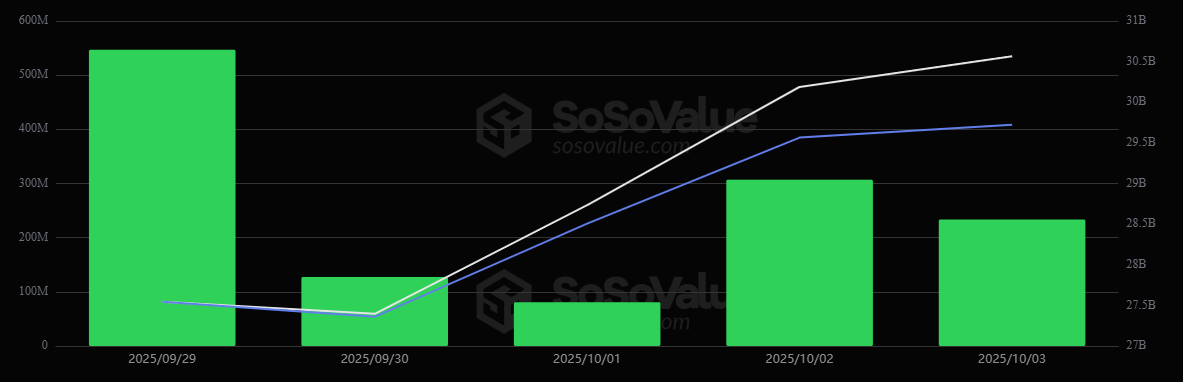

Ether ETFs: $1.30 Billion Inflows

Ether ETFs also enjoyed one of their strongest weeks in recent months, posting $1.30 billion in inflows over five straight days of gains. Blackrock’s ETHA dominated with a staggering $691.66 million. Fidelity’s FETH followed with $305.30 million, bolstered by consistent inflows in the latter half of the week.

Grayscale’s Ether Mini Trust pulled in $144.70 million, and Bitwise’s ETHW added $82.99 million. Grayscale’s ETHE ($30.41 million), Vaneck’s ETHV ($21.90 million), Invesco’s QETH ($6.69 million), Franklin’s EZET ($6.34 million), and 21Shares’ TETH ($5.83 million) contributed the remainder with steady inflows throughout the week.

5 Days of Green for Ether ETFs

Trading volumes for Ether ETFs reached $9.9 billion, while net assets climbed to $30.57 billion, up from $27.54 billion at the start of the week.

The Big Picture

The week of Sept. 29–Oct. 3 will be remembered as a turning point. Institutional liquidity roared back, and sentiment turned decisively bullish across the board. With bitcoin ETF net assets now well above $160 billion and ether ETF holdings breaching $30 billion, both markets appear to be entering a renewed accumulation phase, one fueled by long-term capital, rather than short-term speculation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。