This article is written by Tiger Research, providing an in-depth analysis of the new regulations for cryptocurrency exchanges in Vietnam: under a minimum registered capital threshold of $380 million, international giants like Binance and Bybit are fiercely competing with local institutions for limited licenses.

Key Points Summary

- Vietnam's new regulatory framework sets extremely high entry barriers, with only large banks, securities companies, or global exchanges with strong partners likely to meet the requirements.

- Although seven local companies have made early preparations, most lack sufficient capital strength and institutional qualifications to meet regulatory demands.

- Binance and Bybit have already met with senior government officials in Vietnam, indicating that foreign exchanges will share the market pie with a few licensed local institutions.

1. A New Era of Regulation: Vietnam's Digital Asset Market Moves Towards Standardization

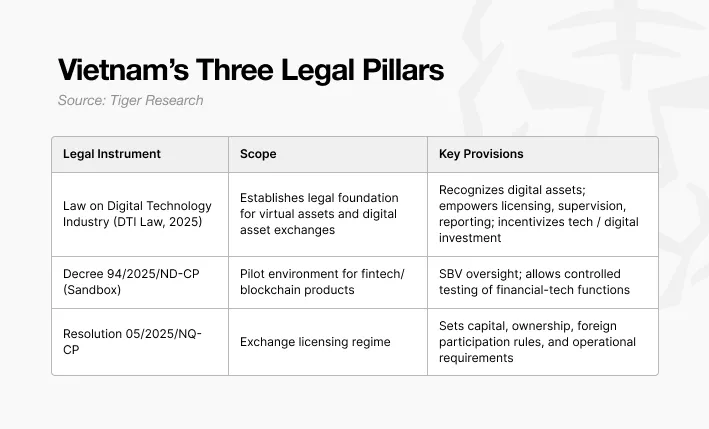

In 2025, Vietnam's digital asset market will undergo a decisive transformation. After years of regulatory ambiguity, the government has introduced three major policy frameworks, marking the country's official transition from a laissez-faire "gray area" to a new stage of comprehensive regulation and controllable taxation.

The primary cornerstone is the Law on Digital Technology Industry passed by the National Assembly in June 2025, set to take effect on January 1, 2026. This law clearly defines the independent status of digital assets for the first time at the legal level, distinguishing them from securities and fiat currency instruments, providing a legal basis for subsequent taxation, anti-money laundering regulation, and enforcement authority, with specific details to be further clarified through implementation regulations.

The second key measure is the Regulatory Sandbox Decree effective from July 1, 2025. Led by the State Bank of Vietnam, this sandbox mechanism provides a testing environment for financial innovation. Although not specifically designed for cryptocurrencies, it is expected to create regulatory linkages with the exchange licensing system through core requirements such as anti-money laundering, customer identity verification, and settlement. The most immediate impact comes from the Resolution No. 05/2025/NQ-CP issued on September 9, 2025, which officially launches a five-year pilot for the issuance and trading of virtual assets. This becomes the first practical framework for exchanges to operate legally in Vietnam. A key limitation is that during the pilot phase, only local Vietnamese companies can apply for operator licenses, while foreign exchanges must participate indirectly through joint ventures or by providing technology, compliance systems, and liquidity support.

This series of measures demonstrates the government's intention to gradually incorporate digital asset activities into the domestic system under strict regulation. The policy direction clearly favors local control, aligns with international anti-money laundering standards, and is deeply tied to the strategic goal of building Da Nang as a regional financial center.

For institutions, the core message is that Vietnam has bid farewell to the era of regulatory vacuum, which is a positive signal. However, the high licensing thresholds and restrictions on foreign capital indicate that the level of openness remains limited. The next 12-18 months will witness whether Vietnam can grow into a structured market or remain merely a policy testing ground.

2. High Barriers to Licensed Operations

The Resolution No. 05/2025/NQ-CP issued on September 9, 2025, establishes stringent entry conditions for Vietnam's five-year cryptocurrency pilot: only Vietnamese companies registered under the Enterprise Law are eligible to apply for operator licenses.

Licensed institutions must maintain a minimum legal capital of 100 trillion Vietnamese dong (approximately $380 million), all of which must be paid in Vietnamese dong. At least 65% of the capital must come from institutional shareholders, and more than 35% of that portion must be jointly funded by at least two of the following types of organizations: commercial banks, securities companies, fund management companies, insurance companies, or technology enterprises. Institutional shareholders must also have a record of profitability for the past two consecutive years, with audited financial statements receiving unqualified opinions.

The foreign ownership ratio is strictly limited to 49% of the legal capital, ensuring that operational control remains in local hands. Additionally, licensed institutions must meet strict human resource and infrastructure requirements: the CEO must have at least two years of experience in the financial industry, the CTO must have five years of relevant IT experience, and at least 10 employees must hold cybersecurity certifications and 10 must have securities qualifications. The technical system must achieve the highest national information security level four certification in the financial industry.

While this framework demonstrates the government's determination to regulate the market, its requirements pose challenges even for mature financial institutions. If the scope of application is expanded in the future to include wallet services, GameFi projects, or medium-sized exchanges, the vast majority of native crypto enterprises will struggle to meet the standards.

KyberSwap restricts access for Vietnamese users. Source: KyberSwap

Notably, local projects like KyberSwap and Coin98 have proactively suspended domestic operations. The most likely outcome in practice is a hybrid model: banks, brokerages, insurance companies, and tech giants form the licensed core, while Web3 projects participate as technology and service providers. In this dynamic, market dominance will shift towards licensed institutions, and startups and native crypto projects may be marginalized.

The scope of business is also strictly limited: only asset-backed token issuance and spot trading are allowed, and settlements must use Vietnamese dong. Cryptocurrency payment functions remain prohibited, and derivatives and leveraged trading are not open. Compared to pioneers like the U.S., Singapore, and Hong Kong, Vietnam's licensed business scope is significantly narrower.

3. Confrontation Between Local and International Forces

3.1 Local Participants' Layout

Several Vietnamese companies have taken proactive steps by registering "digital asset exchange" entities in anticipation of the new regulations. However, the current capital scale and equity structure of these institutions still fall far short of the hard requirements of Resolution No. 05/2025.

For institutional investors, there are three observations worth noting. First, the capital gap is decisive. The capitalization levels of all current participants range from 2 billion to 14.7 trillion Vietnamese dong, far below the 100 trillion Vietnamese dong legal minimum requirement. Without substantial injections from banks, securities companies, or insurance companies, most of these entities will not qualify for licenses.

Second, institutional anchoring will determine who can survive. The resolution requires at least 65% of institutional ownership, including a 35% share from at least two banks, securities companies, insurance companies, or technology enterprises. This clause clearly favors participants already connected with major financial institutions like SSI, VIX, Techcom, HD, and MB, while fintech-led entities like DNEX or CAEX are at a disadvantage unless they can attract stronger partners.

Finally, market expectations indicate that licenses will be limited. Rumors suggest that no more than five operators will be approved in the initial phase. With at least seven competitors positioning themselves, some will inevitably be excluded. For global exchanges assessing the Vietnamese market, this raises the importance of forming alliances with the most credible local partners as early as possible.

3.2 Global Players and Government Strategic Interaction

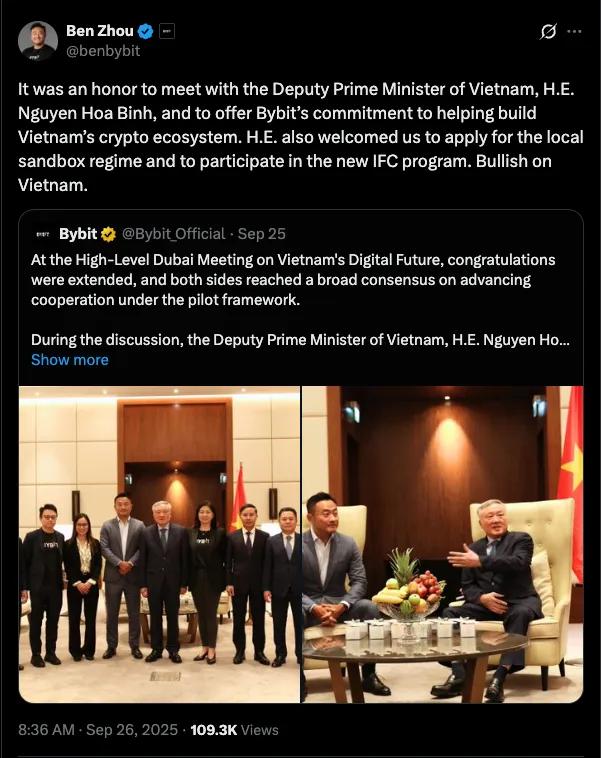

Bybit CEO Zhou Ben met with Vietnamese Deputy Prime Minister Nguyen Hoa Binh. Source: Bybit

Global exchanges are actively building communication bridges with the Vietnamese government. On September 24, 2025, during an official visit to the UAE, Deputy Prime Minister Nguyen Hoa Binh met with Binance CEO Richard Teng. The Deputy Prime Minister personally invited Binance to establish a regional headquarters in Da Nang and participate in the construction of a licensed digital asset exchange for Vietnam's international financial center. He also invited Teng, who previously led the Abu Dhabi Global Market, to serve as a senior advisor to Vietnam's financial center. This move was announced through official government channels, sending a clear policy signal.

Binance CEO Richard Teng meets with Vietnamese leadership in Da Nang. Source: Binance

At the same time, the Da Nang People's Committee signed a memorandum of cooperation with Binance, establishing a strategic partnership in the blockchain and digital asset fields. This means Binance has both high-level endorsement and a local government cooperation framework.

Bybit is also making aggressive moves. On September 17, 2025, it signed a tripartite memorandum of understanding with the Da Nang People's Committee, Abu Dhabi Blockchain Center, and Verichains, covering liquidity supply, infrastructure security, and ecological connectivity, precisely aligning with Vietnam's regulatory goals. Although it did not reach the high-level meeting level of Binance, it laid a practical foundation for its participation in the construction of the international financial center.

The current landscape shows that Binance and Bybit have already gained an advantage in the competition among global exchanges in Vietnam. If, as rumored, only five licenses are issued, with two seats reserved for international exchanges, then local companies will have only three remaining slots. Faced with at least seven competitors poised to enter, local institutions must accelerate their efforts to prove their strength and institutional background to secure the remaining positions.

This layout also raises a chain of thoughts: what will happen to global exchanges like BingX and MEXC that have already captured the mainstream retail market in Vietnam? These exchanges, which serve Vietnamese users through offshore platforms, may be marginalized in the licensed market if they fail to engage in timely government relations. Unless they quickly ally with approved local entities or receive special invitations, their operations will continue to operate outside regulation and may face regulatory risks once the licensed market matures.

4. Strategic Breakthrough: The Path of the Hypothetical "CEX Tiger" Case

Under the new system, what options do projects seeking to enter Vietnam have? Consider a hypothetical case, "CEX Tiger," a global exchange planning to expand into Vietnam, and what strategies would be most feasible.

The first and most important decision is to choose a partner. Foreign exchanges cannot directly obtain licenses and must ally with strong local institutions. It is crucial to identify which Vietnamese banks, securities companies, or insurance companies are most likely to secure one of the limited licenses. The choice of partner will determine market access, compliance status, and long-term scalability.

Once a partner is secured, the next step is to define the operational model. A hybrid structure is needed: the Vietnamese partner holds the license and regulatory responsibility, while CEX Tiger contributes technology, liquidity, and operational expertise. The joint venture becomes a formal entity, with the domestic institution serving as the legal and regulatory front, while the foreign exchange operates the underlying services.

Business expectations must also be calibrated. The framework limits activities to spot trading, settlements in Vietnamese dong, and limited investor participation. This is not a market designed for immediate trading volume or revenue driven by derivatives. Instead, the strategic goal should be to ensure an early presence, establish regulatory goodwill, and build legitimacy before potential future liberalization.

However, competition will be fierce. If two licenses are allocated to Binance and Bybit, only three will remain for domestic institutions. For latecomers, the real question is not whether Vietnam is attractive—the market's growth and user base make that clear—but whether they can secure a credible domestic partner and whether that partner is willing to collaborate. Missing the first round of licenses could delay entry until the framework expands.

For exchanges like CEX Tiger, Vietnam should be viewed as a long-term strategic foothold rather than a short-term profit source. The key to success lies in selecting the best local partners, being willing to take a minority equity position, and deeply engaging in Asia's most promising crypto market in advance.

From the user perspective, the challenges are even more complex. Vietnamese users are accustomed to global trading platforms. Even with a license, new entrants will still face multidimensional tests regarding security standards, asset types, and platform stability. Licenses bring compliance but do not automatically translate into user trust and market share.

The ultimate strategic choice facing exchanges like CEX Tiger is: to join hands with local partners in the license competition, or to maintain existing users on the regulatory periphery while closely tracking policy developments? This strategic game concerning the Vietnamese market has just begun.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。