In the past two years, the Pendle protocol has made fixed income a standard feature in the DeFi industry through the PT/YT mechanism. This year, it's the turn of the new product Boros, which brings the funding rate from perpetual contracts—an often overlooked yet stable cash flow—on-chain. It is important to emphasize that Boros itself is not a decentralized trading platform for perpetual contracts, but rather elevates the largest "interest brick" in contract trading into the main hall of DeFi. In one sentence, Boros is about breaking down the funding fees that users pay/receive in perpetual contracts into a separately tradable and hedgable on-chain asset. Shortly after its launch, Boros has shown extremely impressive performance—the trading volume of Binance ETH funding rates in September exceeded $2.2 billion, BTC trading volume exceeded $600 million, and the cumulative nominal transaction volume has surpassed $2.8 billion; after connecting to the BTC/ETH funding rate market on Hyperliquid on September 12, it not only provided a large amount of liquidity and trading volume but also directly opened up cross-exchange hedging/arbitrage paths.

Just as PT has dominated the DeFi fixed income sector, achieving a TVL of over $10 billion, Boros is likely to establish consensus on this new track of funding rates, which is crucial to CeFi.

What is Boros: An On-Chain "Funding Rate Trading Platform"

Boros is an on-chain funding rate trading platform launched by the Pendle team on Arbitrum. Its core mechanism is to convert the cash flow of funding rate earnings from the perpetual contract market into tradable Yield Units (YU). Each YU represents the rights to funding rate earnings/expenses accumulated before maturity, calculated based on nominal principal; for example, 1 YU-ETH corresponds to "funding rate earnings calculated based on 1 ETH principal until maturity." Readers familiar with Pendle can think of YU as a YT specifically anchored to funding rates.

First, let's clarify what the funding rate is: perpetual contracts have no expiration date, and to keep the contract price close to the spot price, trading platforms periodically settle an "interest" between longs and shorts (commonly every 1/4/8 hours). When the contract price is higher than the spot price, the long pays the short; when the contract price is lower than the spot price, the short pays the long. The size of the rate is determined by market supply and demand and is usually annualized. For any holder, this represents a continuous cash flow that can directly consume or increase your strategy returns.

As for Boros's interest trading, it operates in an order book + margin format, providing an experience more akin to a futures trading platform, allowing users to go long or short on funding rates. Currently, Boros has launched on the Arbitrum mainnet, supporting funding rate trading for BTC/ETH perpetual contracts (connected to Binance and Hyperliquid's BTC/ETH markets), allowing users to place orders to trade YU on Boros and gain long or short exposure to the future funding rates of the corresponding assets.

Why It Matters: A Trillion-Dollar Market Gap and the Pendle Puzzle

The scale of perpetual contracts in the crypto market is enormous: daily trading volume reaches $150 to $200 billion (equivalent to annualized hundreds of trillions of dollars), with open interest (OI) often exceeding hundreds of billions. However, the funding rates (i.e., the interest paid by long and short positions) associated with this scale have long been an overlooked cash flow: the lack of standardized tools has prevented users from hedging or trading it. This has led to two problems: first, while the source of funding rates is stable (the perpetual contract market generates them 24/7), they are highly volatile and uncontrollable, making them an uncertain factor in many quantitative and arbitrage strategies; second, the lack of hedging means that some institutional funds and strategies cannot enter the market with peace of mind, limiting the depth of the DeFi interest rate market. The emergence of Boros fills this gap—it standardizes, tokenizes, and supports the clearing of traditionally off-chain funding rate earnings, incorporating this discrete revenue curve into the DeFi standard landscape, which is of great significance.

Historical data on funding rates (annualized returns) for ETH perpetual contracts across different trading platforms shows that not only do significant differences often exist between platforms, but there are also frequent violent fluctuations. In fact, there are players in the industry who arbitrage funding rates across perpetual contract platforms. However, for a long time, these differences and fluctuations could not be smoothed out or exploited through on-chain tools, and Boros provides a standardized solution for this: allowing arbitrageurs and risk managers to enter this market, promoting the rationalization of funding rates across platforms.

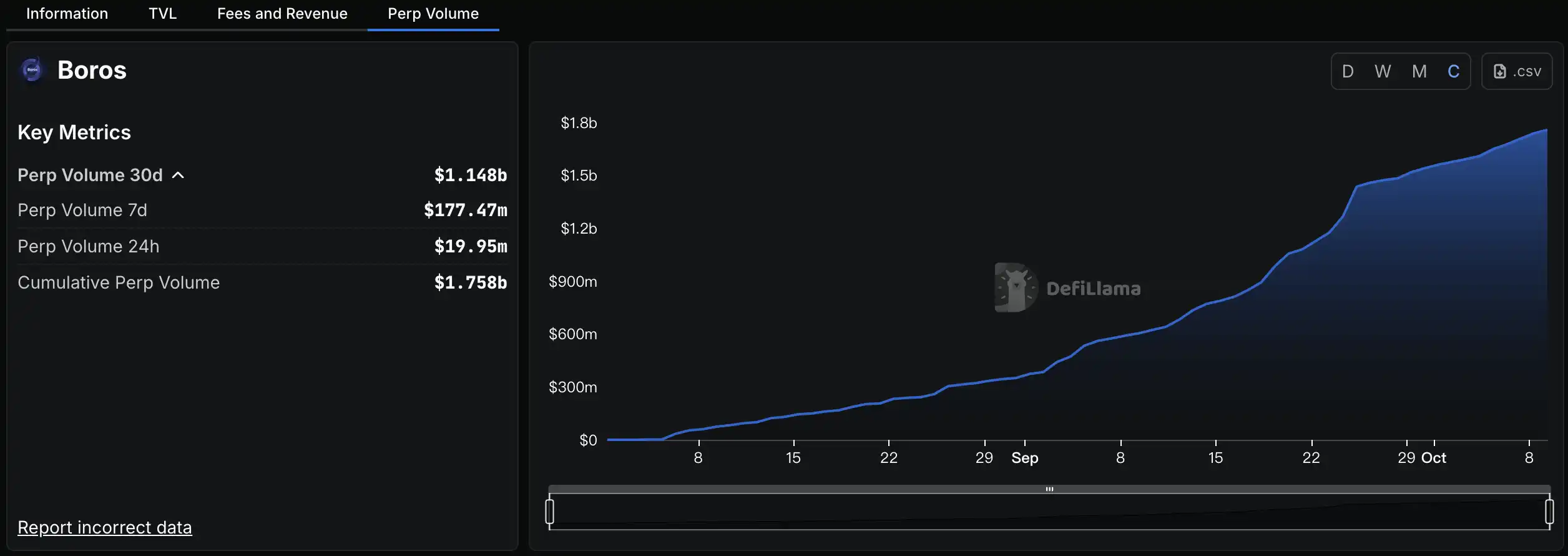

For Pendle itself, Boros is also an indispensable piece of the puzzle. Pendle has been committed to building a complete on-chain yield curve, previously covering the fixed-rate field through PT/YT products, while funding rates belong to highly volatile short-term rates. Boros introduces this floating rate into the Pendle family, extending its product line to a broader range of interest rate categories and filling a market gap. Boros has attracted a large number of users and funds for trading in a short time, with cumulative trading volume exceeding $700 million and nominal open interest exceeding 10,000 ETH. It can be said that the introduction of funding rate trading has brought Pendle a second growth curve, broadening its sources of income and influence.

More broadly, Boros takes the funding rates that could only be balanced within centralized trading platforms and brings them on-chain, attracting more types of funds to participate in DeFi. This is especially a "dream tool" for some strategies and institutions that rely on funding rate earnings, such as protocols like Ethena with delta-neutral strategies. Ethena issues a decentralized stablecoin, USDe, using volatile assets like BTC and ETH as collateral, holding spot assets while shorting perpetual contracts on trading platforms to achieve price neutrality and earn income through funding rates. Of course, this situation can also apply to many crypto hedge funds. Boros provides a key "shock absorber" for such protocols and institutions.

As summarized by Pendle's official statement, Boros can bring at least three aspects of value to such protocols: first, it allows protocols to actively adjust their funding rate exposure based on judgment (going long or short on funding rates); second, it can effectively hedge funding rate risks, avoiding extreme fluctuations impacting the yield curve; third, it makes earnings more predictable and stable, reducing uncertainty. With Boros, the funding rate exposure of Ethena, which is close to a $10 billion position, can finally be managed through on-chain tools, greatly enhancing the ability of protocols like Ethena to maintain stable returns in various market environments and further lowering the barriers for traditional financial institutions to enter the crypto industry.

What Can Be Done: Lock Costs, Earn Flexibility, Bet on Price Differences

Locking Funding Costs – By using Boros, you can lock the funding rate costs of perpetual contract positions into a fixed value, avoiding uncertain expenses caused by market fluctuations. For example, if you hold a long position in BTC/ETH perpetual contracts on a trading platform but are concerned about high positive funding rates eroding your returns, you can short the corresponding amount of YU on Boros to fix the future funding rate you will pay. Shorting YU is equivalent to borrowing the funding rate earnings at a fixed rate in advance, while the actual floating funding rate in the market will belong to you—this way, regardless of how the funding rate changes in the future, your total funding cost is fixed, effectively buying a rate insurance. This is particularly important for large institutions executing carry strategies (such as spot long + perpetual short to earn funding rates): they can lock in the earnings or costs of the "funding leg" of the carry strategy through Boros, eliminating interest rate volatility risks and holding positions until maturity. On the other hand, if you hold a short position in the perpetual market and continuously earn funding rates, you can also go long on YU in Boros to lock in earnings, avoiding a decrease in income due to future funding rate declines.

Pure Yield Betting – In addition to hedging, Boros also provides traders with a channel to speculate on funding rate trends. If you believe that the funding rate in a certain market will rise in the near future (for example, during a bull market when trading is hot, leading to higher funding rates), you can go long on YU in Boros, effectively buying a long position in that market's funding rate. As long as the actual funding rate trend aligns with your expectations, the floating earnings you gain from your YU position will exceed the fixed cost locked in at the time of purchase, resulting in a net profit from the spread. Conversely, if you expect the funding rate to decline or even turn negative (for example, if short-selling sentiment rises and long positions are insufficient), you can short YU, betting on a decline in rates and profiting from it. Since funding rates are often highly sensitive to market sentiment and capital demand, their fluctuations can sometimes exceed the price movements of the corresponding assets themselves. Therefore, effectively utilizing the long and short tools provided by Boros to trade purely around interest rate fluctuations may yield greater flexible returns than directly trading the underlying assets. This opens up new arbitrage opportunities for advanced traders and hedge funds.

Arbitrage and Spread Trading – Additionally, Boros has opened the door to cross-market rate trading. Users can trade multiple assets or funding rates from different sources on the platform simultaneously, taking advantage of the relative differences between them for arbitrage. For example, historical data shows that the funding rates for BTC and ETH perpetual contracts often exhibit a see-saw phenomenon, allowing traders to go long on one asset's YU while shorting another's YU on Boros, purely betting on the changes in the funding rate difference between the two without exposing themselves to any unilateral price risk. Similarly, the differences in funding rates between different trading platforms also create arbitrage opportunities— as Boros connects to more trading platforms' perpetual rates, users can even go long and short on the funding rates of the same asset from different sources on Boros to converge cross-platform price differences. This mechanism is expected to unify and stabilize interest rates in the crypto market, providing professional market-making and arbitrage teams with ample risk-free profit opportunities.

In summary, after Boros connects the previously fragmented funding rate market, various structured interest rate trading strategies can flourish: whether locking in basis, cross-market arbitrage, or building your own interest rate swap combinations, all can be realized in Boros.

Next Steps: Starting from Arbitrum, Making Funding Rates a Standard Product

Currently, the Boros protocol is successfully running and gaining momentum: in its first month, the platform's open interest (OI) surpassed $61.1 million, with cumulative nominal trading volume exceeding $1.3 billion, generating a net income of $730,000 for the protocol. The liquidity vaults are often emptied within minutes whenever new quotas are opened. Pendle co-founder TN Lee stated that the team will continuously monitor growth and gradually increase system capacity, introducing larger capital flows, including support for institutional hedging needs.

Looking ahead, Boros plans to gradually expand its coverage of the global perpetual funding rate market. The official roadmap indicates that in addition to the current BTC and ETH, it will support funding rates for more large-cap assets such as SOL and BNB, and plans to integrate with trading platforms like Bybit. In the future, users may be able to directly trade perpetual funding rates from multiple sources on Boros, achieving a true network-wide interest rate swap. With the expansion of market categories and the enhancement of trading depth, Boros is highly likely to become a standardized pricing venue for funding rates, introducing a new interest rate benchmark curve to DeFi.

It is worth mentioning that Boros has not issued new tokens but continues Pendle's consistent value capture model: 80% of the platform's generated fee revenue will be distributed to vePENDLE holders. This means that long-term participants in the Pendle ecosystem can directly share in the income generated by Boros's growth, providing more substantial value support and cash flow for the Pendle token.

In summary, the significance of Boros lies in standardizing the previously fragmented and difficult-to-manage funding fees across various trading platforms into on-chain tradable, hedgable, and liquid interest rate assets; it provides a unified pricing and liquidity venue for funding rates in DeFi, while also opening a transparent and auditable hedging channel for CeFi/TradFi institutions, allowing TradFi entities to manage volatility and duration in a familiar way and at a lower cost. As more assets and trading platforms are integrated, Boros is expected to grow into a pricing hub and industry benchmark for funding rates, turning this long-overlooked cash flow into a true public infrastructure for the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。