I never expected that the seemingly ordinary day of October 11, 2025, would become a historic one.

At 8 AM on the 11th, data showed that the cryptocurrency industry experienced over $19.1 billion in liquidations within 24 hours, affecting more than 1.6 million people, with each figure setting a record in the 10-year history of cryptocurrency contract trading.

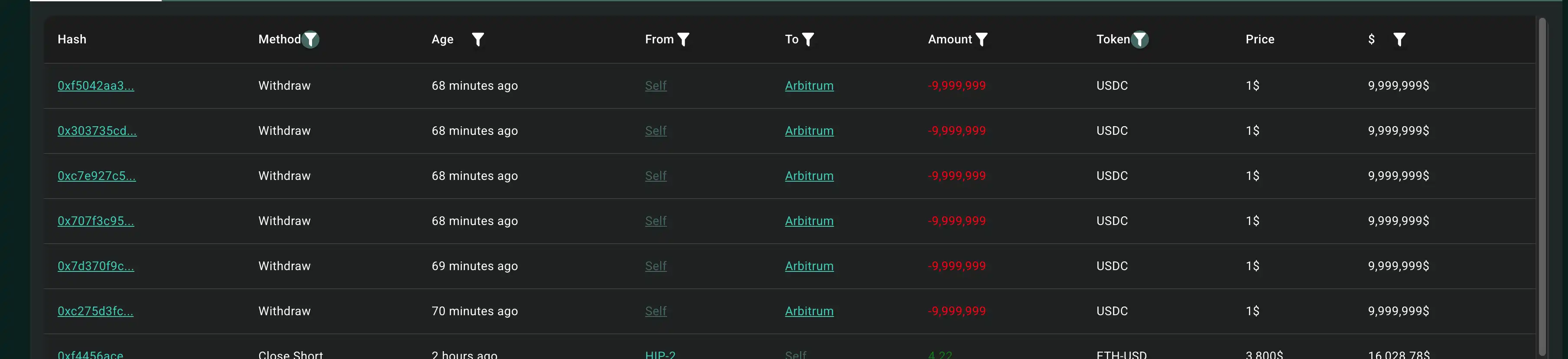

Looking back at the K-line, Bitcoin actually began its downward trend at 10:11 PM on October 10, when it was at $117,000. However, no one paid attention; there were no negative news reports, only an unnamed whale on Hyperliquid who opened short positions on Bitcoin and Ethereum with $1.1 billion.

Whales leveraging hundreds of millions of dollars to trade cryptocurrencies has become a common occurrence; we've seen several whales go to zero, so what could this "1.1 billion" do?

A few hours later, around 5 AM on the 11th, the epic "1011" crash officially began. If you happened to wake up at that time and opened the 1-minute K-line for Bitcoin, you would see Bitcoin drop continuously without resistance, averaging nearly 1% per minute over 30 minutes. The most extreme moment occurred at 5:19 AM, when Bitcoin plummeted over 4% in that minute, dropping nearly $5,000, ultimately hitting a low of $102,000.

Bitcoin, a global commodity with a total market value exceeding $2 trillion, fell 12% in one night.

Finally, the culprit emerged in the news: the trade war between Trump and China has restarted, with the U.S. President announcing that the U.S. would impose a 100% tariff on China starting November 1.

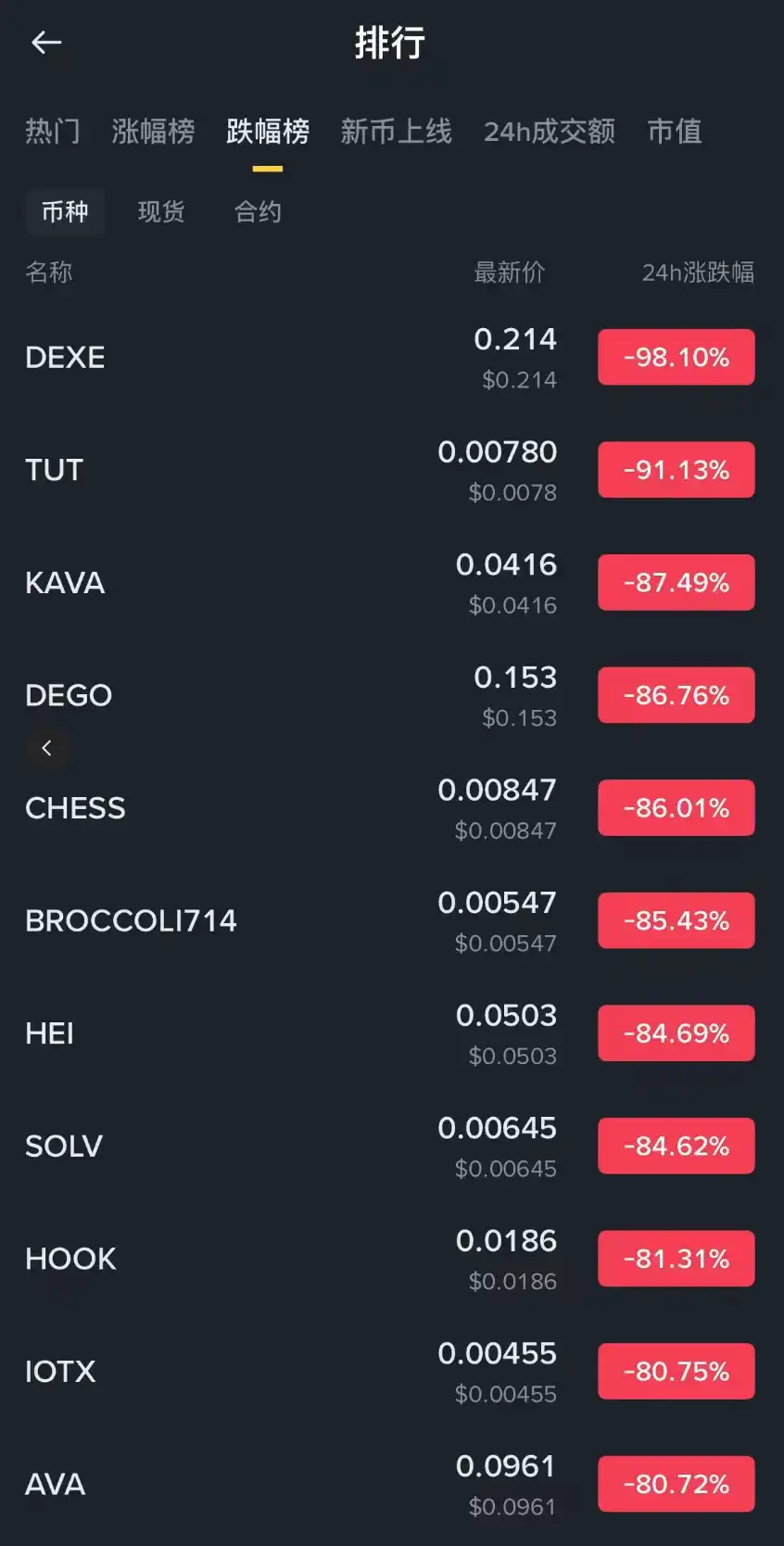

It no longer mattered how late the news was; altcoins were already in a bloodbath. Just to name a few mainstream large-cap altcoins: SUI, which had been at $3.5 just days ago, dropped to $0.55; WLD, the AI leader, fell from $1.4 to $0.26; even Dogecoin, among the top ten by market cap, saw a 50% drop. This is still among large-cap altcoins; small-cap ones are basically going to zero.

Perhaps no one could calmly end this night, except for that $1.1 billion whale, who opened a short position of $1.1 billion with $30 million before the crash, taking profits at the peak of this disaster. In less than 20 hours, he doubled his capital, earning $30 million in profit, and quickly exited with $60 million in just a few minutes. We don’t even know who he is, given such precise operations.

In fact, it wasn't just cryptocurrencies; a horizontal comparison with global capital markets showed it was a day of black swans everywhere. The S&P 500 index closed down 182.61 points on October 10, a drop of 2.71%, marking the largest weekly decline since May. The Nasdaq index fell 3.5%, the largest single-day drop since April 10. Hang Seng index futures closed down 5% overnight. FTSE A50 index futures also fell 4.26% in consecutive overnight trading, all experiencing cliff-like declines.

Only gold did not fall.

In hindsight, the recent surge in precious metals was actually a warning to the market. The sustained rise in gold, with a market value of hundreds of trillions of dollars, was a reminder that large funds on Earth are seeking safety, but unfortunately, we did not foresee it.

Respect the market; after such a disaster, we can only remind everyone to respect the market. No matter how big the bull market is, not everyone can return home with a full load. Always remind yourself to have risk control. Capital is the foundation for survival in the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。