President Trump announced a 100% tariff on China from November 1, 2025, after Beijing tightened rare-earth export controls, sparking sharp crypto and stock market drops and heavy investor selloffs today.

Trump’s Shock Move And How Markets Reacted

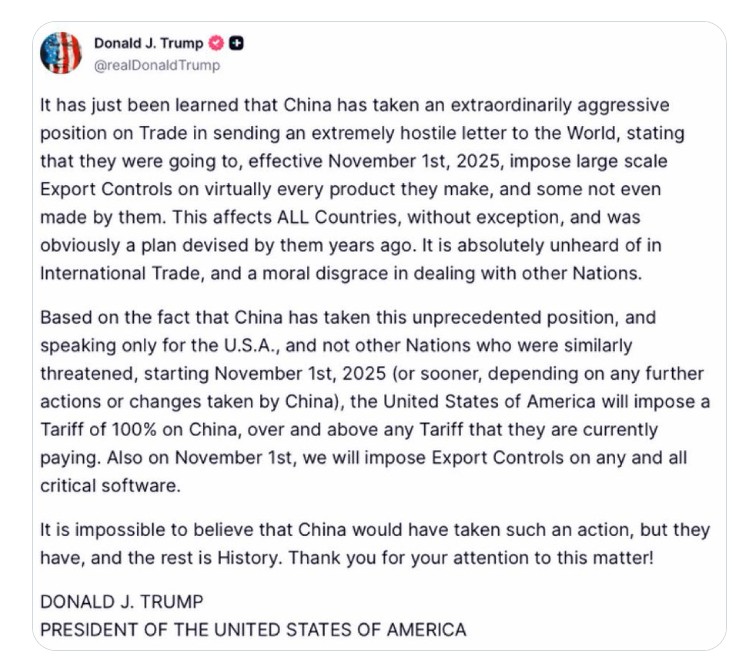

President Donald Trump said the United States will add an extra 100% tariff on China starting November 1, 2025, and put export limits on “any and all critical software.” He posted the move on Truth Social and framed it as a response to China’s new export rules on rare earths and related technology. This escalation sent shockwaves through risk markets within hours.

Source : Truth Social

Crypto Market Records Largest Single-Day Liquidation Event In History.

Crypto prices tumbled after the announcement . Major trackers and exchanges recorded mass selloffs, with the market cap down by well over $100 billion in the immediate reaction and hundreds of millions to billions wiped from leveraged positions.

The Kobeissi Letter showed more than $9 billion liquidated within the past 24 hours, and many traders faced forced exits on long positions. Crypto-focused outlets put the total market cap decline in the low hundreds of billions as traders fled to stablecoins and cash.

Source : The Kobeissi Letter

Stocks Follow — Risk-Off Hits Equities

US equities also moved sharply lower as investors priced higher trade costs and supply shocks in advanced tech supply chains. As per market report over $1.65 trillion wiped out from the US stock market today.

The S&P 500 and major indexes fell several percent during the session as traders digested the implications for growth, supply chains, and corporate margins. Bond and commodity markets reacted too, with traders reassessing inflation and manufacturing risks.

Source : X

Why China’s Export Controls Matter

Beijing’s new rules tighten exports of rare-earth minerals and some high-end processing equipment. Rare earths are vital for chips, defense, EVs, and advanced manufacturing; China controls a large share of global processing capacity. The controls restrict foreign use tied to military or sensitive tech and require extra licensing — a lever Beijing used now to push back in trade and strategic competition. That step prompted the US response.

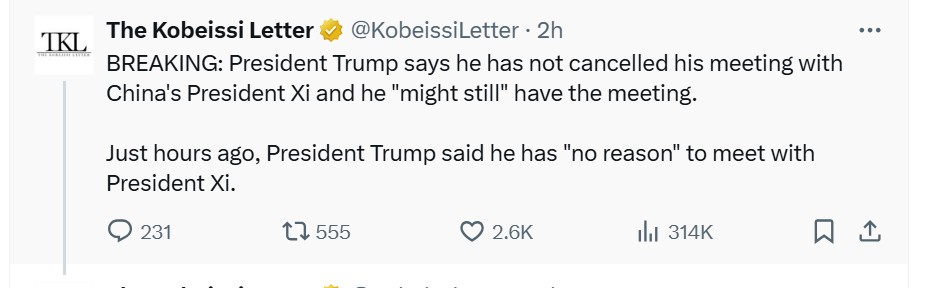

Diplomacy On Edge — Meeting With Xi Uncertain

Mr. Trump said he “might still” meet Chinese President Xi Jinping, while earlier suggesting there was “no reason” to go ahead with talks — language that underlined how quickly ties can swing from diplomacy to confrontation. Officials and markets will watch whether talks proceed: a cancellation could deepen the selloff, while a meeting might calm markets.

Source : The Kobeissi Letter

Source : The Kobeissi Letter

What Crypto Traders Should Watch Next

Short term: expect volatility, more liquidation risk, and flows into safe-haven assets and stablecoins.

Mid Term: watch for formal US policy steps (executive orders, customs guidance) and China’s enforcement moves — both could change market timing. If tariffs or export rules are formalized, tech supply chains (and tokens tied to Web3 infrastructure) could face lasting headwinds.

Long Term : If the President does what he says then how will the 100% tariff on China affect crypto prices in November 2025, be ready for high volatility.

Bottom Line

Today’s headlines mark a sharp re-escalation of trade tensions that briefly tipped markets into a risk-off panic. Traders reacted fast: crypto lost significant value and saw large forced liquidations, while equities and commodities also priced in greater disruption. Investors now wait for official paperwork, enforcement details, and any diplomatic conversations that might ease the shock.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。