The Decoupling Event in October 2025 and the Intersection with Hayek's Prophecy

On October 11, 2025, panic in the crypto market triggered an extreme shock to the synthetic stablecoin USDe — during an "epic crash" where Bitcoin plummeted from $117,000 to $105,900 (a single-day drop of 13.2%) and Ethereum fell 16% in one day, USDe briefly dropped to about $0.65 on October 11, 2025 (a decline of about 34% from its $1 peg), before recovering within a few hours. During the same period, the global crypto market saw a surge in liquidations, reaching $19.358 billion in 24 hours, with 1.66 million traders forced to close their positions, setting a record for the largest single-day liquidation in history.

From a micro market perspective, the liquidity pool depth of USDe-USDT on the decentralized exchange Uniswap was only $3.2 million at the peak of the event, shrinking by 89% compared to before the event, leading to a 25% discount on a sell order of 100,000 USDe due to slippage (the posted price was $0.70, but the actual transaction price was $0.62); at the same time, six leading market makers faced a liquidation risk due to a 40% drop in the value of their margin collateral, further exacerbating the market liquidity crisis.

However, this "crisis" saw a key reversal within 24 hours: the price of USDe gradually rose back to $0.98, and third-party reserve proofs disclosed by Ethena Labs showed that its collateralization ratio remained above 120%, with an over-collateralization scale of $66 million; more importantly, the user redemption function remained normal, allowing assets such as ETH and BTC in the collateral to be redeemed at any time, which became the core support for restoring market confidence.

The MSX Research Institute believes that this "drop - recovery" curve sharply contrasts with the complete collapse of LUNA-UST after its decoupling in 2022, allowing this event to transcend the ordinary "stablecoin volatility" category — it became the first extreme stress test of Hayek's theory of "The Denationalization of Money" in the digital age.

In 1976, Hayek proposed in "The Denationalization of Money" that "money, like other goods, is best provided by private issuers through competition rather than by government monopoly." He believed that the government's monopoly on money issuance was "the root of all the ills of the monetary system," and the biggest problem with the monopoly mechanism is that it hinders the discovery of better forms of money. Under the competitive framework he envisioned, privately issued money must maintain stable purchasing power, or it will be eliminated by the market due to loss of public trust; therefore, competitive money issuers "have a strong incentive to limit their quantity or lose their business."

Half a century later, the emergence of USDe precisely reflects this contemporary expression of thought. It does not rely on sovereign fiat currency reserves but is supported by consensus assets in the crypto market, maintaining stability through derivatives hedging, with its credibility and circulation entirely dependent on market choice and technological transparency. Regardless of the outcome of the decoupling and recovery in October 2025, the practice of this mechanism can be seen as a real-world experiment in Hayek's "competitive discovery of quality money" — validating the market's potential self-regulating power in monetary stability and revealing the institutional resilience and evolutionary direction of digital private money in complex environments.

The Mechanism Innovation of USDe

The "collateral - hedging - yield" trinity structure of USDe permeates the logic of spontaneous market adjustment rather than the coercive constraints of centralized design, which aligns closely with Hayek's emphasis that "market order arises from individual spontaneous actions."

Collateral System: The Value Base Built on Market Consensus

The choice of collateral for USDe fully follows the liquidity consensus of the crypto market — ETH and BTC together account for over 60%, and these two assets are not designated by any institution but have been recognized by global investors as "hard assets in the digital world" over more than a decade of trading. Auxiliary liquid staking derivatives (such as WBETH, BNSOL, etc.) are also products that the market has spontaneously created to enhance capital efficiency, allowing for staking yields while not sacrificing liquidity; the 10% share of USDT/USDC serves as a "transitional stable tool" chosen by the market, providing a buffer for USDe in extreme market conditions.

The entire collateral system consistently maintains an over-collateralized state, with a collateralization ratio still exceeding 120% at the time of the October 2025 incident, and real-time valuation and automatic liquidation are managed by smart contracts.

Stability Mechanism: Spontaneous Hedging in the Derivatives Market

The core difference between USDe and traditional fiat-collateralized stablecoins lies in its independence from "fiat reserves backed by national credit," instead achieving risk hedging through short positions in the derivatives market. The essence of this design is to leverage the liquidity of the global crypto derivatives market to allow the market itself to absorb price fluctuations — when the price of ETH rises, the profits from spot assets offset the losses from shorts; when the price of ETH falls, the profits from shorts compensate for the losses in spot assets, all without any centralized intervention, driven entirely by market price signals.

When ETH plummeted 16% in October 2025, this hedging mechanism experienced a brief lag due to the instantaneous depletion of liquidity, but it did not fail — the short positions held by Ethena Labs ultimately generated $120 million in unrealized gains, which did not come from administrative subsidies but from the voluntary trading between long and short positions in the derivatives market.

Yield Mechanism: Spontaneous Incentives to Attract Market Participation

The "staking yield + circular lending" model designed for USDe is not the "rigid high-interest repayment" found in traditional finance, but rather a reasonable compensation for market participants taking on risk. The basic 12% annualized subsidy comes from the spontaneous investment of ecological funds into "increasing the money circulation"; the mechanism that amplifies leverage to 3-6 times and achieves annualized returns of 40%-50% through circular lending essentially allows users to autonomously choose the matching of risk and return — users willing to take on higher leverage risks receive higher returns; users with lower risk preferences can opt for basic staking.

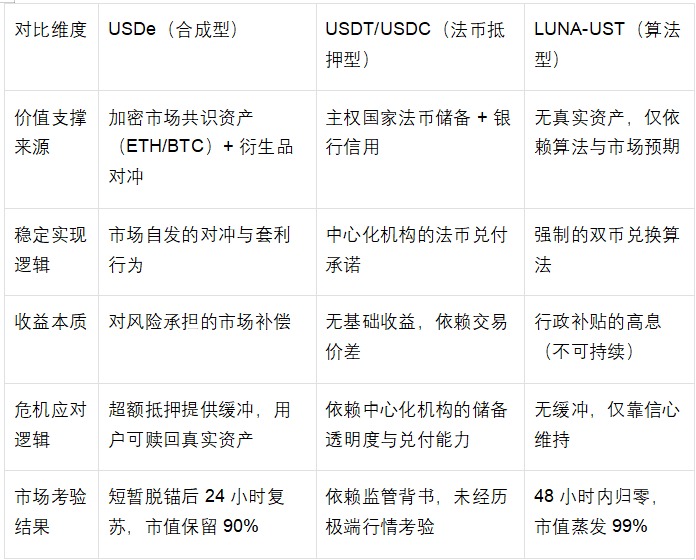

Comparison of Three Types of Stablecoin Mechanisms: The Divide Between Market Choice and Administrative Intervention

The Truth of Market Tests: Why USDe Can Distinguish Itself from LUNA-UST

The decoupling event in October 2025 is often misunderstood as a "similar risk exposure" between USDe and LUNA-UST, but from the perspective of the Austrian School, the essential differences between the two are thoroughly highlighted in this test — the recovery of USDe is a success of "non-nationalized money undergoing market testing," while the collapse of LUNA-UST is the inevitable outcome of "pseudo-innovation detached from real assets."

The Essential Difference in Value Anchors: Real Assets vs. Empty Expectations

The value anchor of USDe is real assets such as ETH and BTC that can be redeemed at any time; even in extreme market conditions, users can still obtain equivalent crypto assets through the redemption mechanism — during the decoupling in October 2025, the redemption function of USDe remained operational, and third-party reserve proofs showed over-collateralization of $66 million, which is the foundation of market confidence based on this "redeemable value commitment."

In contrast, LUNA-UST had no real asset backing; its value relied entirely on "user expectations of the price of LUNA." When market panic erupted, the redemption mechanism of UST required the issuance of more LUNA, and the infinite issuance of LUNA ultimately lost value, leading to the collapse of the entire system. This "currency without asset backing" violated Hayek's principle that "money must have a real value basis" from the very beginning, making its collapse inevitable.

The Logical Difference in Crisis Response: Market Spontaneous Repair vs. Administrative Intervention Failure

USDe's response after the decoupling fully adhered to market logic: Ethena Labs did not issue an "administrative command-style rescue plan," but instead conveyed signals of "mechanism transparency and asset safety" to the market through public reserve proofs, optimizing the collateral structure (reducing the proportion of liquid staking derivatives from 25% to 15%), and limiting leverage multiples, ultimately relying on users' spontaneous trust to achieve price recovery.

In contrast, LUNA-UST's response during the crisis was a typical case of "administrative intervention failure": the Luna Foundation Guard attempted to rescue the market by selling Bitcoin reserves, but this centralized operation could not withstand the market's spontaneous sell-off — Bitcoin itself also experienced a decline in extreme market conditions, and the risk of reserve assets was highly correlated with UST, leading to the failure of the rescue.

The Difference in Long-Term Viability: Market Adaptability vs. Mechanism Fragility

After the decoupling, USDe not only restored its price but also enhanced its long-term adaptability through mechanism optimization: limiting circular lending leverage to 2 times, introducing compliant treasury assets (USDtb) to enhance collateral stability, and diversifying hedging positions across exchanges — these adjustments did not come from administrative orders but were spontaneous responses to market feedback, making the mechanism more aligned with the market rules of "matching risk and return."

In contrast, LUNA-UST lacked market adaptability from the start: its core Anchor protocol's 20% high interest relied on continuous subsidies from ecological funds rather than real payment demand (the actual payment scenarios for UST accounted for less than 5%). When subsidies could not be sustained, the funding chain broke, and the entire system collapsed instantly. This model of "relying on unsustainable administrative subsidies" is doomed to fail in long-term market competition.

Mechanism Flaws and Critical Reflection: The Growth Dilemma of Non-Nationalized Money

The innovative value of USDe is undeniable, but the pressure test in October 2025 and its daily operations still reveal deviations from Hayek's idea of "complete market spontaneous adjustment," exposing risks that need to be heeded. These flaws are not essential defects that cannot be corrected, but rather obstacles that must be overcome for its evolution into a mature non-nationalized currency.

Concentration Risk in Collateral: Systemic Binding of Crypto Asset Cycles

Over 60% of USDe's collateral is concentrated in ETH and BTC, which, while aligning with the current liquidity consensus of the crypto market, falls into the dilemma of "binding to a single market cycle." The decoupling in October 2025 was essentially a chain reaction triggered by a unilateral decline in the crypto market — when ETH dropped 16% in a single day, even with derivatives hedging, the instantaneous shrinkage in the market value of collateral still triggered market panic.

What is even more concerning is that the current auxiliary collateral in the form of liquid staking derivatives (such as WBETH) has not detached from the Ethereum ecosystem, essentially representing "secondary derivatives of crypto assets," failing to achieve true risk diversification. This "internal circulation of crypto assets" in the collateral structure appears fragile compared to the logic of traditional currencies relying on the value of the real economy.

Limitations of the Hedging Mechanism: Implicit Dependence on Centralized Exchanges

The Derivatives Hedging of USDe Highly Relies on the Liquidity of Leading Centralized Exchanges, and the Brief Lag in the Hedging Mechanism in October 2025 Was Caused by a Liquidity Gap Due to a Leading Exchange Suspending Perpetual Contract Trading. Currently, About 70% of USDe's Short Positions Are Concentrated in Two Exchanges, and This Concentration Makes It Difficult to Completely Break Free from Passive Acceptance of Centralized Platform Rules.

Moreover, the Severe Fluctuations in Funding Rates Expose the Uniqueness of the Hedging Tools. USDe Currently Relies Solely on Perpetual Contracts for Risk Hedging, Lacking a Diverse Combination of Tools Such as Options and Futures, Making It Difficult to Quickly Adjust Hedging Strategies When Long and Short Forces Are Extremely Imbalanced. This Reflects That Its Mechanism Design Has Not Fully Utilized the Market's Diverse Risk Pricing Capabilities.

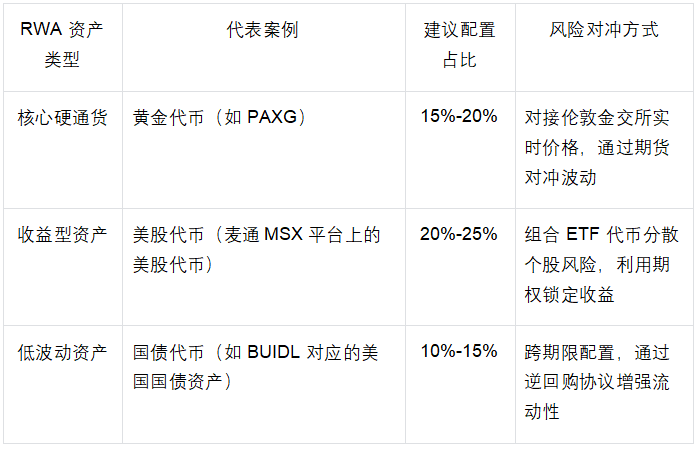

RWA Anchoring Upgrade: The Advancement Path of Non-Nationalized Currency

In Response to Existing Mechanism Flaws, Integrating RWA Assets Such as Gold Tokens and US Stock Tokens to Optimize the Anchoring System Is Not Only a Precise Correction of USDe's Deficiencies but Also an Inevitable Choice That Aligns with the Explosive Trend of the RWA Market (Projected to Reach $26.4 Billion in 2025, Growing 113% Year-on-Year). This Upgrade Does Not Deviate from the Core of Non-Nationalization but Rather Enhances the Vitality of Hayek's Ideas in the Digital Age by Connecting to the Value of the Real Economy.

The Underlying Logic of RWA Anchoring

The Value of Currency Should Stem from Real Assets with Broad Market Consensus, and RWA Assets Precisely Possess This Attribute — Gold, as a Millennia-Old Hard Currency, Has a Value Consensus That Transcends Countries and Eras; US Stock Tokens Correspond to the Real Economic Earnings of Listed Companies, Anchoring the Ability of Enterprises to Create Value; Treasury Tokens Rely on the Tax Capacity of Sovereign States, Providing a Low-Volatility Value Benchmark. The Value of These Assets Does Not Depend on the Cycles of the Crypto Market but Comes from Production and Trade in the Real World, Allowing USDe to Build a "Cross-Market Value Buffer."

The BUIDL Token Launched by BlackRock in 2024 (Anchoring Assets Such as US Treasuries) Has Verified the Feasibility of RWA Anchoring. The Core Difference Between It and USDe Is That BUIDL Relies on Centralized Institutions for Issuance, While USDe Can Achieve Decentralized Confirmation and Valuation of RWA Assets Through Smart Contracts, Truly Practicing the Logic of "Market Spontaneous Management."

Adaptation and Configuration Strategy of Diverse RWA Assets

The RWA Anchoring Upgrade of USDe Should Follow the Principles of "Market Consensus First, Risk Diversification Adaptation." Combining the Current Maturity of RWA Tokenization, a "Core - Auxiliary - Resilient" Three-Layer Configuration System Can Be Constructed, as Shown in the Table Below:

This Configuration Can Reduce the Proportion of Crypto Asset Collateral in USDe from the Current 80% to 40%-50%, Retaining the Liquidity Advantage of the Crypto Market While Achieving Cross-Market Risk Diversification Through RWA Assets. For Example, the Price Correlation Between Gold Tokens and ETH Is Only 0.2, Allowing Gold Tokens to Serve as a "Value Anchor" During a Downturn in the Crypto Market, Preventing the Panic of Concentrated Selling in October 2025.

Austrian School's Re-Insight: The Evolution Logic from Innovation to Maturity

The Flaws of USDe and the Path of RWA Upgrades Further Confirm the Profound Connotation of Hayek's "The Denationalization of Money": Non-Nationalized Currency Is Not a Static Mechanism Design but a Dynamic Market Evolution Process. Only Through Continuous Self-Correction and Innovation Can It Succeed in Currency Competition.

Evolution of the Value Foundation: From Single Market Consensus to Cross-Domain Value Anchoring

The Current Crypto Asset Collateral of USDe Represents the "Primary Form" of Non-Nationalized Currency in the Digital Age — Its Value Consensus Is Limited to Participants in the Crypto Market. By Integrating RWA Assets, the Essence Is to Expand the Value Consensus to Traditional Finance and the Real Economy, Upgrading the Value Foundation of USDe from "Digital Consensus" to "Cross-Domain Real Value." This Evolution Fully Aligns with Hayek's Assertion That "The Value of Money Should Stem from the Widest Market Trust." When USDe Anchors Diverse Assets Such as Crypto Assets, Gold, and US Stocks, Its Ability to Withstand Risks from a Single Market Will Significantly Increase, Truly Becoming a "Value Carrier That Transcends Sovereignty and Single Markets."

Improvement of the Adjustment Mechanism: From Single Tools to Multi-Market Synergy

Currently, USDe's Hedging Mechanism Relies on a Single Derivatives Market, Reflecting "Insufficient Utilization of Market Tools." Hayek's Emphasis on "Market Self-Repair" Should Be Based on Multi-Market Synergy — The Integration of RWA Assets Not Only Enriches the Collateral but Also Creates the Possibility of Synergistic Hedging Between the "Crypto Derivatives Market + Traditional Financial Market." For Example, the Volatility of US Stock Tokens Can Be Hedged Through Traditional Stock Options, While Gold Tokens Can Be Linked to Forward Contracts in the London Gold Market. This Cross-Market Synergy Makes the Hedging Mechanism More Resilient, Avoiding Dependence on the Liquidity of a Single Market.

Conclusion: The Leap from Innovation Benchmark to Evolution Model

The Market Test in October 2025 Not Only Validated the Value of USDe as an Innovation Benchmark for Non-Nationalized Currency but Also Revealed Its Inevitable Path from "Primary Innovation" to "Mature Currency." Its Essential Distinction from LUNA-UST Lies in Real Value Support and Market Adjustment Capability; Its Current Mechanism Flaws Are the Inevitable Growth Costs in the Innovation Process.

The MSX Research Institute Believes That the Upgrade Strategy Integrating RWA Assets Such as Gold Tokens and US Stock Tokens Provides a Clear Evolution Direction for USDe — This Is Not a Denial of Existing Innovations but a Deepening and Perfection Under the Guidance of Hayek's Ideas.

For Market Participants, the Evolutionary Journey of USDe Offers Deeper Insights: The Core Competitiveness of Non-Nationalized Currency Lies Not Only in the Courage to Break Sovereign Monopoly but Also in the Ability for Continuous Self-Correction; The Standards for Judging Its Value Should Not Only Be Based on Short-Term Stability Performance but Also on Long-Term Adaptation to Real Value and Market Evolution Resilience. When USDe Completes the RWA Upgrade, It Will No Longer Be Just an Innovative Experiment in the Crypto Market but a True "Cross-Domain Value Carrier" with the Potential to Challenge Traditional Currency Systems.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。