Author: J.A.E

On October 11, 2025, the cryptocurrency market experienced an unprecedented leverage liquidation, marking the most severe correction in this bull market cycle. The total market capitalization of the crypto industry evaporated by over $500 billion at one point, with total liquidations exceeding $19 billion in 24 hours. Industry insiders estimate that the actual liquidation scale could reach as high as $30-40 billion. This figure far surpasses any previous market crash liquidation records, with over 1.6 million traders' positions being forcibly closed. PANews will deeply analyze the reasons behind this market crash and its implications for the industry to help investors formulate their next response strategies.

Macro Shockwave: Trump's 100% Tariff Triggers Global Risk Asset Sell-off

A conspiracy theory circulating in the crypto market suggests that the recent crash was a targeted attack on Binance's pricing mechanism vulnerabilities. On October 6, Binance announced an adjustment to the WBETH and BNSOL price indices, effective October 14, raising suspicions that this was a deliberate preemptive strike.

However, according to a timeline compiled by crypto KOL Jiang Zhuoer, the transmission chain of the crash can actually be traced.

It appears that the trigger for this epic crash was likely the escalation of geopolitical risks. U.S. President Trump announced via Truth Social that, in retaliation for China's expansion of rare earth element export restrictions, the U.S. would impose an additional 100% tariff on all Chinese imports starting November 1. His hardline trade policy statement instantly ignited panic in global capital markets.

Various crypto assets suffered severe blows during this period. BTC plummeted to $102,000, a nearly 16% drop. ETH fell to $3,635, with a decline exceeding 20% at one point. Long-tail altcoins experienced an even harsher liquidity vacuum, with flash crashes ranging from 20% to 90%. The intense sell-off activity led to a 145% and 148% surge in 24-hour trading volumes for BTC and ETH, respectively, indicating a market-driven deleveraging process fueled by panic.

This crash demonstrates that the crypto market is deeply embedded in the global macro narrative, where geopolitical frictions are no longer distant external factors but can directly trigger massive sell-offs in the crypto derivatives market through traditional market risk aversion sentiments. The risk-off behavior of institutional investors first manifested in concentrated sell-offs of the most liquid assets (BTC/ETH), which then triggered the threshold for chain liquidations in the derivatives market. Macro uncertainty, through geopolitical factors, has for the first time penetrated and ignited a crisis in the crypto market with such immense energy.

CEX Pricing Mechanism Risks: Decoupling of Anchor Assets Triggers Chain Liquidations

Although the macro shock was the trigger, the key structural issue lies in the chain transmission risks of centralized exchanges (CEX).

In the previous bull market, the explosive growth of USDe was partly due to its acceptance as collateral for contract trading by mainstream CEXs, creating a massive liquidity influx and application scenarios. The full-margin collateral mechanism uses all available funds and collateral in the account to jointly maintain the positions established by traders, reducing the risk of early liquidation of a single position. However, under conditions of extreme market volatility, losses in positions can quickly consume the full margin, triggering a synchronized forced sale of all collateral by the CEX's liquidation mechanism.

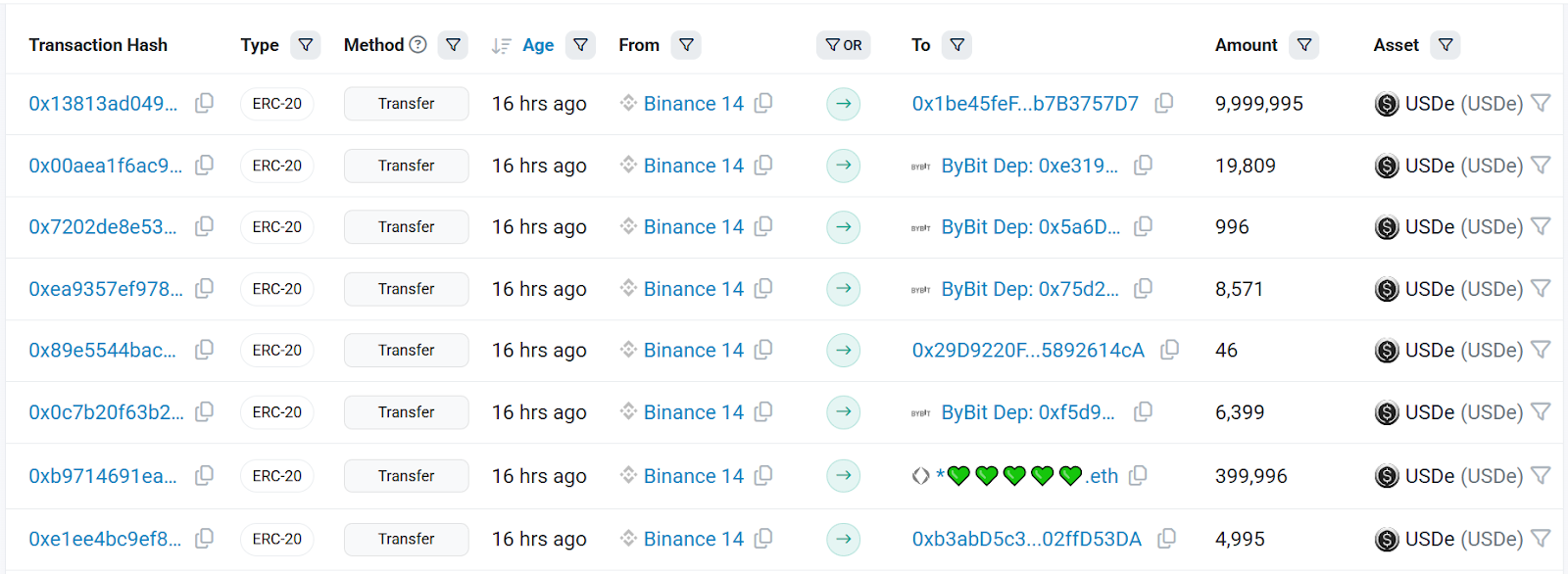

When the global market sell-off caused BTC/ETH derivative positions to trigger Binance's margin requirements, the automatic liquidation system was activated. To quickly repay debts, the system had to sell off collateral in traders' accounts on a large scale.

Since USDe was used as the primary collateral, the liquidation system became a massive sell pressure on USDe, as its scale far exceeded the market's real-time absorption capacity for USDe, causing USDe's trading price on Binance to decouple, plummeting to $0.65 at one point.

Guy Young, founder of Ethena Labs, stated on platform X that oracles attempted to identify two different scenarios: one where secondary market prices were temporarily misaligned, and another where collateral experienced permanent devaluation, the latter of which had never occurred with USDe. As he noted, the decoupling of USDe primarily occurred in the Binance spot market, while other CEXs and on-chain DEXs did not experience significant decoupling.

The reason for USDe's decoupling may be a result of the USDe reward products on Binance's financial services and the pricing mechanism working together. According to the announcement, the APY for USDe financial products on Binance was as high as 12%, originally set to last until October 21, but has now been removed.

It is evident that in pursuit of extreme yields, a large number of users (including professional institutions, market makers, and large holders) may have implemented high-leverage circular borrowing strategies by depositing USDe into Binance Loans, obtaining more USDe to deposit into Binance financial products, thereby amplifying annual returns.

However, the USDe price used by Binance is based on internal market quotes rather than the weighted average of the entire market. Therefore, once USDe decouples, all users executing circular borrowing strategies will have their leverage severed. Starting from the liquidation of high-leverage users, the degree of USDe's decoupling was continuously deepened until all leveraged users were completely cleared.

Users in the market also reported that when USDe plummeted, withdrawing assets from Binance took about an hour to complete. The absence of arbitrage opportunities may also be another reason why USDe failed to alleviate the degree of decoupling or quickly re-peg.

When USDe hit its lowest point, another risk chain was also ignited. WBETH and BNSOL, two types of liquid staking tokens (LSTs), are unique crypto assets within the Binance ecosystem. In addition to users executing circular borrowing strategies with USDe, many investors also staked their ETH/SOL to obtain WBETH/BNSOL, using LSTs to borrow stablecoins and exchange them for more USDe while earning staking rates to offset some borrowing costs.

WBETH and BNSOL, among other LSTs, should theoretically be closely tied to the value of their underlying assets (ETH and SOL), determined by the official staking exchange rates provided by CEX or underlying protocols. However, the liquidity of spot trading pairs like WBETH/USDT and BNSOL/USDT is typically in a "lowland" compared to their underlying asset trading pairs.

The announcement by Binance to adjust the WBETH and BNSOL price indices exposed flaws in the pricing mechanism. CEXs typically use an "index price" to calculate the "mark price" for perpetual contracts, which is the final valuation used to trigger margin calls and liquidations. Before the adjustment, 20% of WBETH's price index directly came from the WBETH/USDT spot price on Binance; BNSOL's price index also had 30% weight from the BNSOL/USDT spot price, meaning that even if the official staking exchange rate for LSTs remained unchanged, as long as the terminal asset USDe decoupled, it would lead to massive sell-offs of low-liquidity LSTs in the spot market, quickly driving down the index price in the CEX derivatives system, thereby affecting the mark price used for liquidation, resulting in large-scale liquidations in a short time.

"Post-Disaster Reconstruction": What Improvements Does the Industry Need?

After the crash, Binance, as the epicenter of this liquidation earthquake, took responsibility for its pricing mechanism errors and promised to compensate users who suffered losses due to three types of anchor assets. Additionally, Binance announced in the early hours of October 12 that it would adjust relevant parameters, including: adding redemption prices to the price index weights of BNSOL, WBETH, and USDe; introducing a minimum price limit for USDe's index to enhance price stability; and increasing the frequency of risk control parameter reviews to ensure dynamic adjustments based on market conditions.

OKX founder Star stated that the industry should take time to reflect on the deeper structural issues at play in this crash. The CEO of Crypto.com also called for regulatory agencies to investigate the largest exchanges by liquidation scale. However, rather than being investigated, self-examination may be more beneficial.

This crash was a high-intensity stress test of CEX's risk control capabilities, exposing the failure of CEXs to adequately isolate the structural risks of anchor assets used as collateral in full-margin systems while pursuing trading volume and user growth.

CEXs should implement stricter classification and haircut management for assets used as collateral. For non-fiat stablecoins, it should be mandatory to use isolated margins or raise the haircut rate to nearly zero to prevent the CEX pricing mechanism from becoming a source of market contagion again.

The market should demand higher transparency and mechanism resilience for all non-fiat fully collateralized stablecoins. Investors should repeatedly weigh high returns against structural risks, fundamentally abandoning the belief in "risk-free high returns." To optimize risk models, protocols like Ethena should also adjust their collateral allocation strategies, controlling collateral chains and increasing the allocation ratio of higher liquidity, lower risk assets when the market enters a bear phase or experiences negative funding rate trends.

This incident also exposed the pain points of the close coupling between CEX and DeFi. Although DeFi aims for decentralization, to achieve efficient, low-slippage derivative hedging, protocols must rely on CEX's liquidity and liquidation efficiency, leading to the security boundaries of DeFi protocols still being defined by CEX's pricing mechanisms. The future market must seek a decentralized derivatives infrastructure that can provide deep liquidity while fundamentally eliminating the risks of CEX pricing.

Crypto practitioners are also actively offering suggestions for the direction of industry construction after this crash.

Forgiven, co-founder of Conflux, suggested that the liquidation pricing of some anchor assets should be set with a hard floor, rather than directly adopting spot market prices. If USDe is used as collateral for a unified account, it would be more reasonable for CEX to flexibly constrain the maximum position size supported by margin based on market liquidity.

0xTodd, a partner at Nothing Research, believes that self-custodied LSTs like WBETH and BNSOL within the CEX ecosystem should directly anchor their underlying assets without any third-party risk, which would not only help their peg stability but also promote the use of LSTs.

Shen Yu, co-founder of F2Pool & Cobo, proposed three system design principles: 1) Do not design structures that are "critically reachable" at the system level; 2) Avoid collateral homogeneity; 3) Maintain physical diversity in negative feedback loops.

The "1011 crash" was not only a severe market clearing but also a profound inquiry into the infrastructure and risk logic of the crypto industry. When the pricing mechanism of CEX becomes an amplifier of systemic risk, and when high-yield products hide unrecognized structural vulnerabilities, the industry must confront a fundamental question: In the pursuit of efficiency and scale, have we truly built a system capable of withstanding chain reactions?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。