Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $3.73 trillion, with BTC accounting for 59.9%, which is $2.23 trillion. The market cap of stablecoins is $304.6 billion, with a 7-day increase of 0.69%, and the data continues to rise, with USDT accounting for 58.88%.

Among the top 200 projects on CoinMarketCap, most have declined while a few have risen, including: ZEC with a 7-day increase of 67.77%, IP with a 7-day decrease of 55.79%, MYX with a 7-day decrease of 55.08%, DEXE with a 7-day decrease of 50.97%, and KAVA with a 7-day decrease of 49.35%.

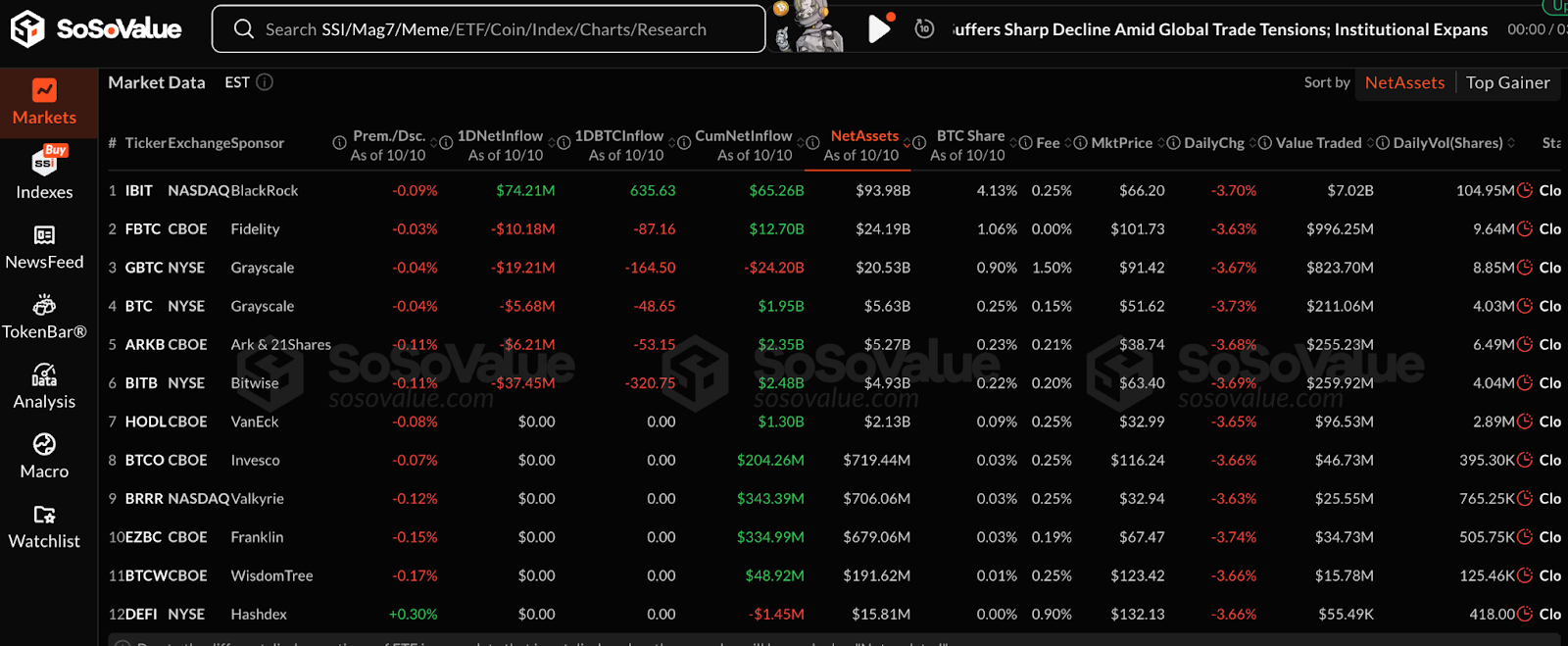

This week, the net inflow for Bitcoin spot ETFs in the U.S. was $2.7005 billion; the net inflow for Ethereum spot ETFs in the U.S. was $484.3 million.

Market Forecast (October 13 - October 17) :

The current RSI index is 29.37 (oversold zone), and the fear and greed index is 28 (fear zone), with the altcoin season index at 45.

BTC core range: $110,000 - $115,000

ETH core range: $3,700 - $4,100

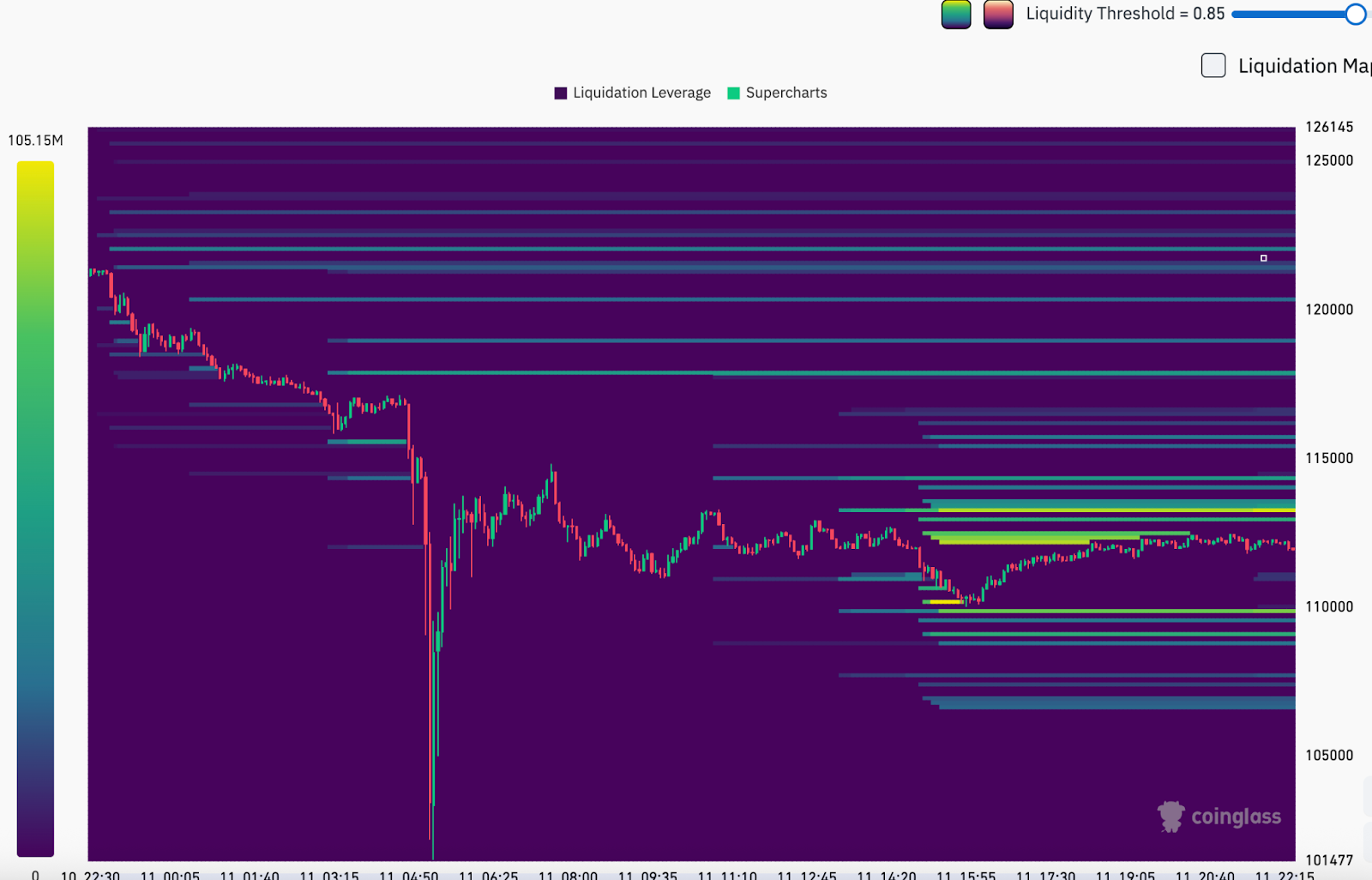

On October 11, the market experienced an epic crash. According to Coinglass data, the total liquidation across the network reached $19.1 billion within 24 hours, with over 1.62 million people liquidated. Both the amount and the number of liquidations set historical records for cryptocurrency contract trading over the past decade. This crash was primarily triggered by the Trump administration's announcement of increased tariffs on China, which was amplified by market liquidity withdrawal and high leverage. Currently, there is a significant divergence in the market between bulls and bears, but regardless, this is not a good time to sell at low prices; it is better to wait until the situation stabilizes. After all, in two weeks, on October 30, the probability of a Federal Reserve interest rate cut has reached 98%. The winter of the crypto market has not yet arrived, but it is necessary to maintain respect for the market.

Short-term Traders:

Pay close attention to whether BTC can form support and rebound around $111,050. If it can break through $113,290, the short-term rebound momentum may continue; if it falls below $111,050, it may further test $109,560 or even lower. Market volatility will be very intense, suitable for quick in-and-out trades.

Medium to Long-term Investors:

If you are a dollar-cost averaging investor or a coin holder who believes in the long-term value of cryptocurrencies, this crash may provide an opportunity to "buy quality assets at reasonable prices." Consider adopting a staggered investment strategy, prioritizing core assets with solid fundamentals like BTC and ETH.

Understanding Now

Review of Major Events of the Week

On October 6, the U.S. federal government continued its shutdown into a new week, causing delays in the release of key economic data and halting approval activities by regulatory agencies like the SEC, increasing market uncertainty;

On October 8, the Federal Reserve released the minutes from the September FOMC meeting, with the market carefully analyzing any signals regarding inflation control and future interest rate cuts to gauge the direction of monetary policy;

On October 8, the SEC postponed its decision on Bitcoin and Ethereum mixed ETFs, delaying the approval of the first spot ETF combining BTC and ETH, which negatively impacted short-term market sentiment;

On October 9, concerns about quantum computing threats arose, as the Nobel Prize in Physics was awarded in the field of quantum computing, with several analysts warning that this technology could pose a long-term threat to blockchain security, causing market anxiety;

On October 10, the SEC delayed its decision on Solana and Litecoin ETFs, and the highly anticipated altcoin spot ETFs failed to gain approval, putting pressure on the prices of related assets like SOL;

On October 10, Trump announced a 100% tariff on China, a significant geopolitical event that became a turning point for the market, directly triggering panic selling of global risk assets. The cryptocurrency market began an epic crash, with Bitcoin plummeting from a high of about $122,000 that day, followed by mainstream coins like Ethereum and Solana, which saw declines of over 20%-30%. A record wave of leveraged liquidations erupted during the market crash, with the total liquidation amount across the network quickly rising to $19.1 billion, affecting approximately 1.6 million traders;

On October 11, the stablecoin USDe experienced a severe decoupling, as a series of liquidations and pressure on mechanisms caused the synthetic dollar stablecoin USDe to briefly unpeg to $0.65, triggering panic in the DeFi ecosystem.

Macroeconomics

On October 10, according to CNBC, after a series of rigorous interviews, U.S. Treasury Secretary Basant narrowed the list of candidates for Federal Reserve Chair from 11 to 5, with the final nominee possibly being announced in January next year, but may not necessarily assume the chair position;

On October 10, the Nasdaq fell by 1%, following Trump's threat to "significantly increase" tariffs on China.

On October 11, according to the Federal Reserve rate observer, the probability of a 25 basis point rate cut in October is 98.1%.

ETF

According to statistics, from October 6 to October 10, the net inflow for Bitcoin spot ETFs in the U.S. was $2.7005 billion; as of October 10, GBTC (Grayscale) had a total outflow of $24.154 billion, currently holding $20.538 billion, while IBIT (BlackRock) currently holds $93.567 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $158.938 billion.

The net inflow for Ethereum spot ETFs in the U.S. was $484.3 million.

Envisioning the Future

Event Preview

The Aptos Summit, The Aptos Experience, will be held in New York from October 15 to 16;

Blockchain Life 2025 will take place in Dubai, UAE, from October 28 to 29, 2025;

Bitcoin MENA will be held at the Abu Dhabi National Exhibition Centre (ADNEC) from December 8 to 9;

Solana Breakpoint 2025 will take place in Abu Dhabi from December 11 to 13.

Project Progress

Fleek (FLK) will conduct its TGE on October 14;

Intuition (TRUST) will conduct its TGE on October 15;

Novastro (XNL) will conduct its TGE on October 15.

Important Events

On October 14 at 23:30, Federal Reserve Chair Powell will speak at an event hosted by the National Association for Business Economics;

On October 16 at 20:30, the U.S. will release the monthly retail sales rate for September.

Token Unlocking

Aethir (ATH) will unlock 1.26 billion tokens on October 12, valued at approximately $57.86 million, accounting for 16.08% of the circulating supply;

Starknet (STRK) will unlock 127 million tokens on October 15, valued at approximately $16.19 million, accounting for 5.64% of the circulating supply;

Sei (SEI) will unlock 55.56 million tokens on October 15, valued at approximately $12.6 million, accounting for 1.15% of the circulating supply;

Arbitrum (ARB) will unlock 92.65 million tokens on October 16, valued at approximately $29.98 million, accounting for 1.99% of the circulating supply;

ZKsync (ZK) will unlock 172 million tokens on October 17, valued at approximately $7.42 million, accounting for 3.49% of the circulating supply;

Fasttoken (FTN) will unlock 20 million tokens on October 18, valued at approximately $39.6 million, accounting for 2.04% of the circulating supply.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. Through our "Weekly Insights" and "In-depth Reports," we analyze market trends for you; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening), we help you identify potential assets and reduce trial-and-error costs. Every week, our researchers will also interact with you through live broadcasts, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize value opportunities in Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。