Good afternoon everyone, last night the thoughts went in the opposite direction. Bitcoin rebounded from around 111200 to around 116000. From eight o'clock yesterday morning to four o'clock this morning, there were six consecutive four-hour bullish candles, with a strong time point from ten o'clock last night to three consecutive one-hour bullish candles in the night session. Each of these candles pierced up by three thousand points, breaking the bears' confidence, and then it saw a tug-of-war of nearly two thousand points before facing resistance and retreating at ten o'clock in the morning.

Here we can see that at ten o'clock in the morning, the one-hour KDJ and RSI indicators both formed a double death cross, with four consecutive one-hour bearish candles. However, the two one-hour candles at twelve o'clock and one o'clock in the afternoon showed a narrowing decline. Around one o'clock in the afternoon, it was running at the upper band of the one-hour Bollinger Bands, touching the lower band of the fifteen-minute Bollinger Bands at that time, showing signs of resistance.

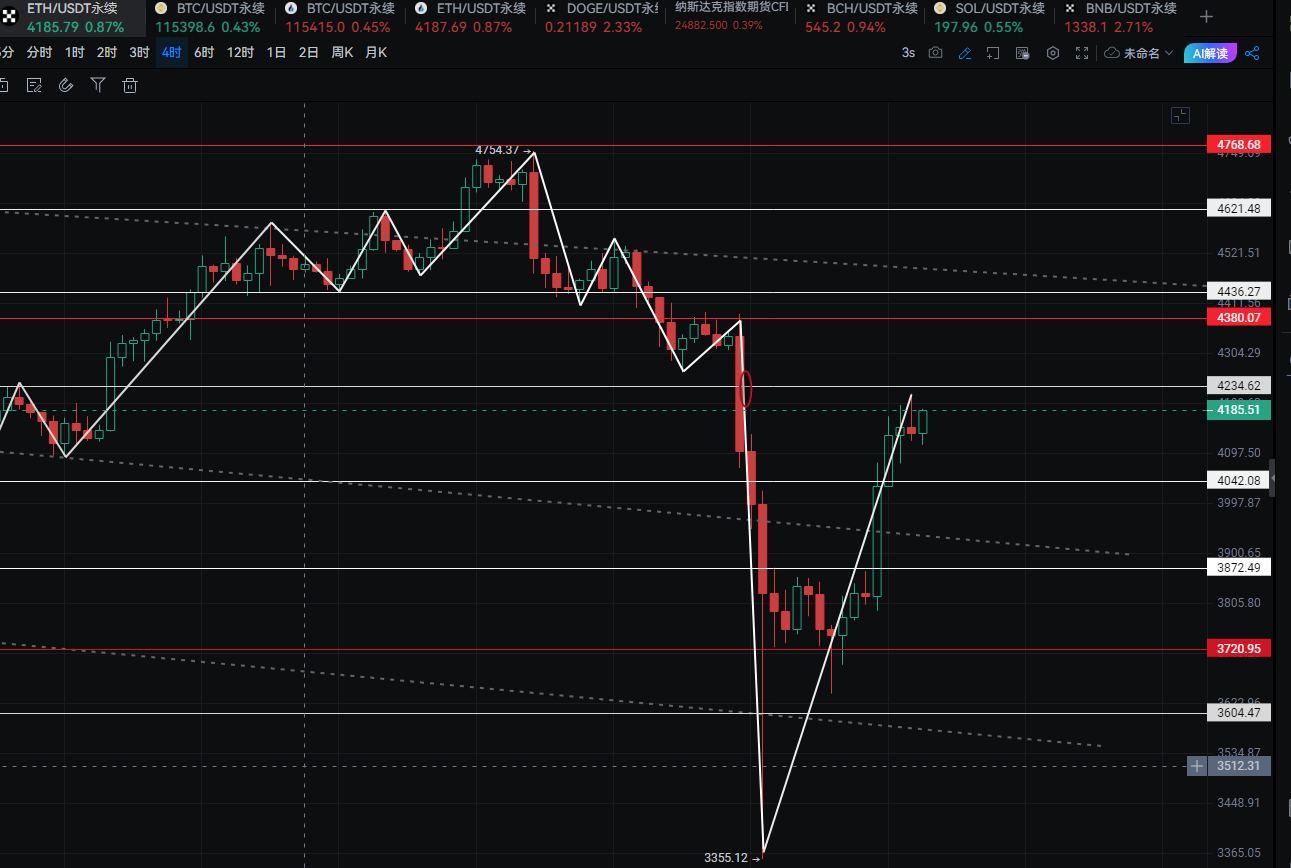

In the first half, Ethereum's performance was stronger than Bitcoin. The three one-hour candles at ten o'clock last night rose nearly three hundred points from around 3800, with trading volumes being quite similar. The last two candles showed a clear weakening, and the subsequent tug-of-war appeared slightly fatigued compared to Bitcoin. After a final peak at 4220 in the morning, it quickly regained ground. From one o'clock in the morning until now, it is evident that Ethereum's main divergence point is consolidating around 4135.

We can determine that Bitcoin's divergence point has reached around 114800-115200, while Ethereum's divergence point is around 4130-4150. For short-term trading today, we can refer to this range for consolidation.

Currently, a new round of medium-term short positions can be established. At the current price of 115500, one can short, and at 116500, add to the position, aiming for around 108800 by mid-October. For Ethereum, short at the current price of 4180, targeting the starting point at around 3850. If it continues to weaken, it can reach a minimum of 3650.

For Bitcoin, it is recommended to short around 115800, initially targeting 113800, with a stop loss at 116850. For Ethereum, short in the range of 4180-4200, add at 4220, with a stop loss at 4255, aiming to reclaim the divergence point around 4135. In the short term, reference the range of 4080-4220 for back-and-forth trading. The main focus is on the 4120-4180 range, and if it breaks below 4120, further observation is needed. If there is a rebound, one can initially enter around 4088 with a stop loss, but it should not be held for long.

The benefit of not holding positions is the ability to withdraw and replan at any time, and to make rebounds in between. In the short term, the downside is that the cost is weakened, which tests short-term trading and the profit-loss ratio. There have been two consecutive losses, but it’s not a big deal.

Yesterday was the first time I posted here and faced setbacks, but the losses compared to the volatility are quite small now. The road ahead is long and winding, so let's take it slow.

Public account: Jiang Xin Lun Chan

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。