TL;DR

- Brief Decoupling, Quick Recovery: On October 11, 2025, USDe briefly dropped to $0.65 on the Binance spot market, but this lasted only a few minutes. The overall decoupling lasted about 90 minutes ($0.75-$0.98), with a trading volume exceeding 780 million. The price fully stabilized around $0.99 before 06:45 Beijing time.

- Localized Liquidity Imbalance: The volatility was mainly concentrated on Binance. Prices on other major exchanges and DEXs (Bybit, Curve, Uniswap) deviated by less than 0.3%, indicating a single-point liquidity imbalance rather than a systemic issue.

- Not a Market Crash Trigger: BTC, ETH, and SOL began to decline at 04:45 Beijing time, triggering a chain reaction of liquidations. The price deviation of USDe appeared more like a release of secondary liquidity rather than a triggering event for the decline.

- Protocol Robustness Verified: Ethena successfully processed over $2 billion in redemptions within 24 hours without downtime or delays. Aave's oracle prices remained in the $0.99–$1.00 range, with no signs of forced liquidations, defaults, or liquidity squeezes in the system.

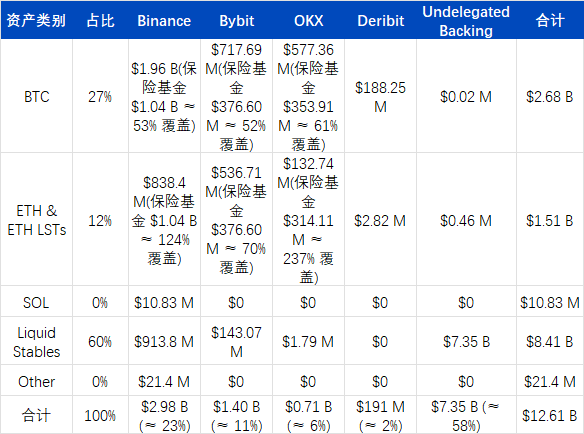

- Systemic Risk Controllable: The three major exchanges (Binance, Bybit, OKX) collectively hold about $2 billion in risk funds, theoretically capable of withstanding liquidation shocks of around $200 billion under similar market conditions, significantly reducing the risk of ADL (automatic liquidation) triggers.

On October 11, 2025, USDe briefly decoupled to $0.65 on Binance, lasting only a few minutes. The overall decoupling lasted about 90 minutes ($0.75-$0.98), with a trading volume exceeding 780 million. During the same period, prices on other major exchanges and on-chain markets remained stable in the $0.99–$1.00 range, with limited fluctuations. Overall, this was a localized liquidity imbalance rather than a systemic risk event—amplified by a chain of liquidations triggered by a sharp drop in BTC in trading venues with weak local depth. The Ethena protocol maintained a stable hedging structure, smooth redemption path, and robust oracle system in a high-volatility environment, successfully passing the real-world stress test and verifying its stability mechanism's good shock resistance and self-repair capability.

Ethena's USDe Stability Mechanism Under Real-World Test

Brief Price Dislocation of USDe on Binance

On October 11, 2025, USDe experienced a brief decoupling on Binance, with a minimum price reaching $0.65, lasting about 90 minutes, during which the trading volume exceeded 780 million.

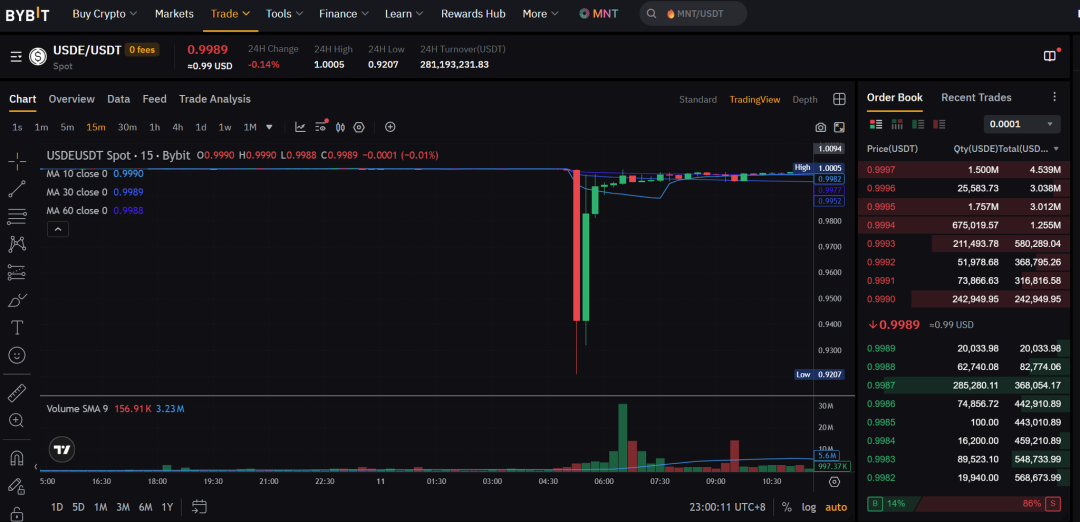

During the same period, Bybit, the second-largest exchange in the spot market, also experienced a slight deviation in its USDe/USDT trading pair, but the extent was limited, and the trading volume was low, making its impact on the overall market negligible.

Overall, the USDe decoupling on Binance lasted about 45 minutes, with a maximum decoupling extent of about -35% (instantaneous), during which the total trading volume exceeded 780 million USDe. The nature of the event is closer to a liquidity flash crash rather than a structural risk of the protocol.

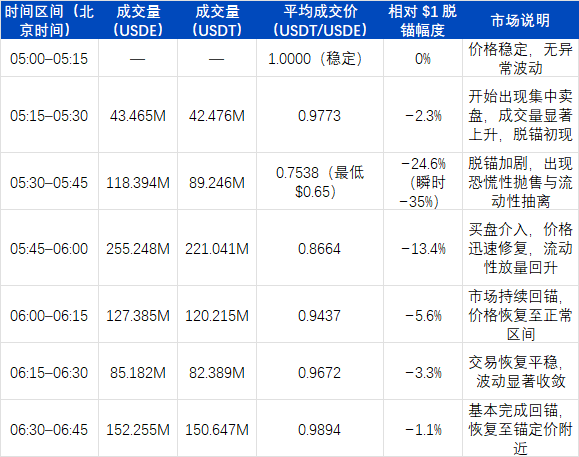

USDe Decoupling and Re-stabilization Process on Binance Spot (USDE/USDT)

USDE/USDT Price Chart on Binance

USDE/USDT Price Chart on Bybit

No Systemic Deviation of USDe on DEXs (Uniswap / Curve)

Compared to the deep decoupling on Binance, on-chain DEXs (such as Curve and Uniswap) only experienced slight and delayed price fluctuations, with a minimum around $0.995, remaining overall stable with almost no decoupling.

USDe/USDT Price Chart on Uniswap

USDe/USDC Price Chart on Curve

USDe on Binance: Growth Trajectory and Post-Event Adjustments

Since September 22, 2025, Binance officially launched the USDe reward program, offering users up to 12% annualized returns. The platform records users' minimum USDe holdings in spot, funding, and margin accounts (including collateral assets) through daily random snapshots, calculating returns based on annualized rates, and distributing them to spot accounts every Monday. The activity period is from September 22 to October 22, 2025, and users with holdings of at least 0.01 USDe and holding time exceeding 24 hours can participate.

Driven by this incentive program, the USDe supply on the Binance platform once exceeded $5 billion.

Currently, the lending and contract collateral functions for USDe on Binance appear to be temporarily closed, and verification on the front end is not possible; related leverage and lending data have also not been disclosed.

Based on subsequent announcements and parameter adjustments, it is speculated that Binance may have directly used the USDe price index as the core pricing reference during the decoupling event, with the lowest transaction price around $0.66.

After the October 11 event, to enhance system robustness, Binance promptly adjusted the risk control parameters for USDe, including incorporating the redemption price into the price index, setting minimum transaction price limits, and increasing the frequency of parameter reviews to respond to potential market fluctuations.

Additionally, according to Binance's latest announcement, the platform has initiated a compensation plan of approximately $283 million for users affected by this event (including USDe, BNSOL, and WBETH decoupling-related assets).

Binance's USDE Index Price

USDe Lending Market on Aave Remains Stable, No Chain Liquidations Occurred

When analyzing the relevant market on Aave, the focus is primarily on the USDe lending pool and sUSDe. Other assets related to USDe (such as pt-sUSDe) do exist on Aave, but due to the high correlation with USDe itself, the Pendle protocol's USDe principal funds are also considered.

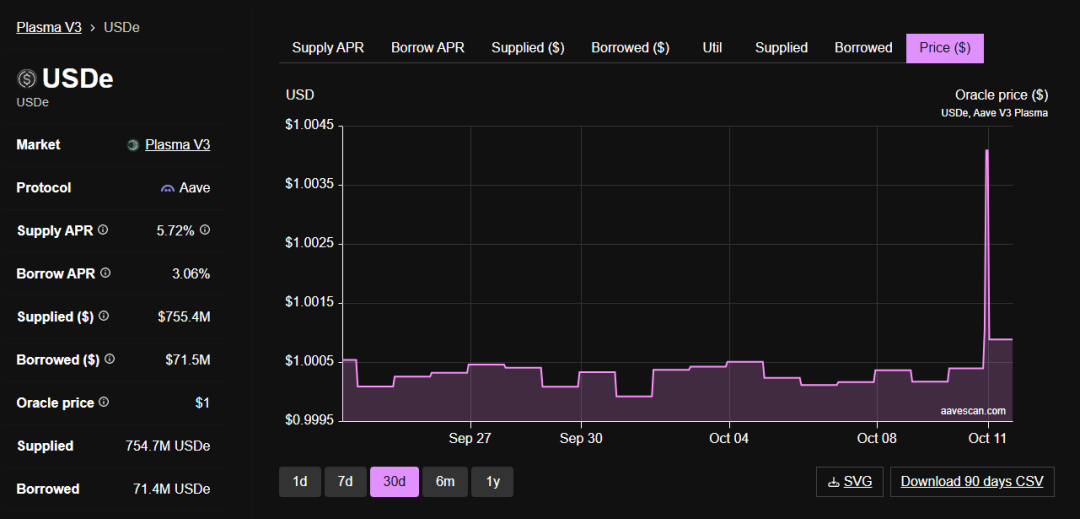

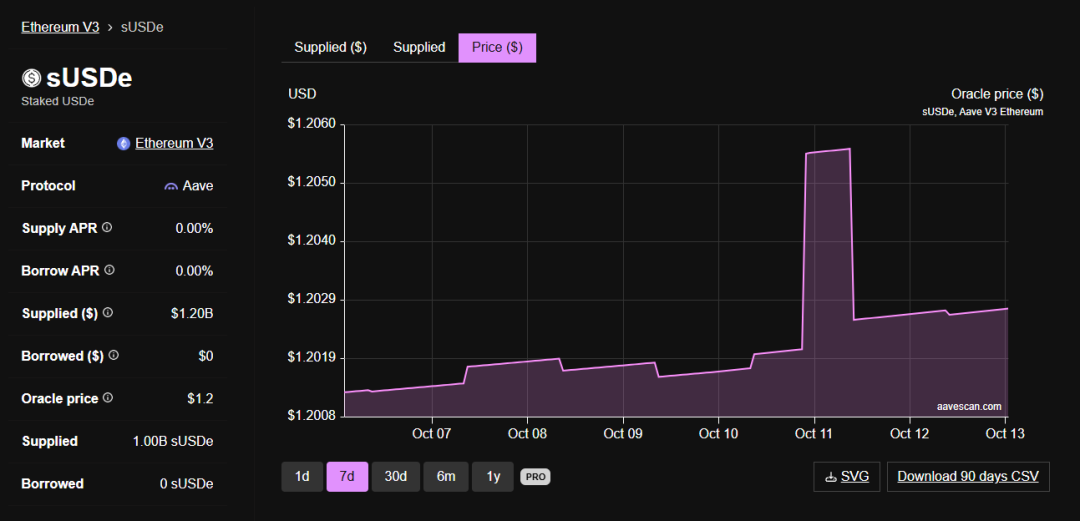

Currently, the USDe lending pool is mainly distributed across Ethereum (approximately $1.1 billion) and Plasma (approximately $750 million). Meanwhile, the deposit scale of sUSDe on Ethereum is about $1 billion.

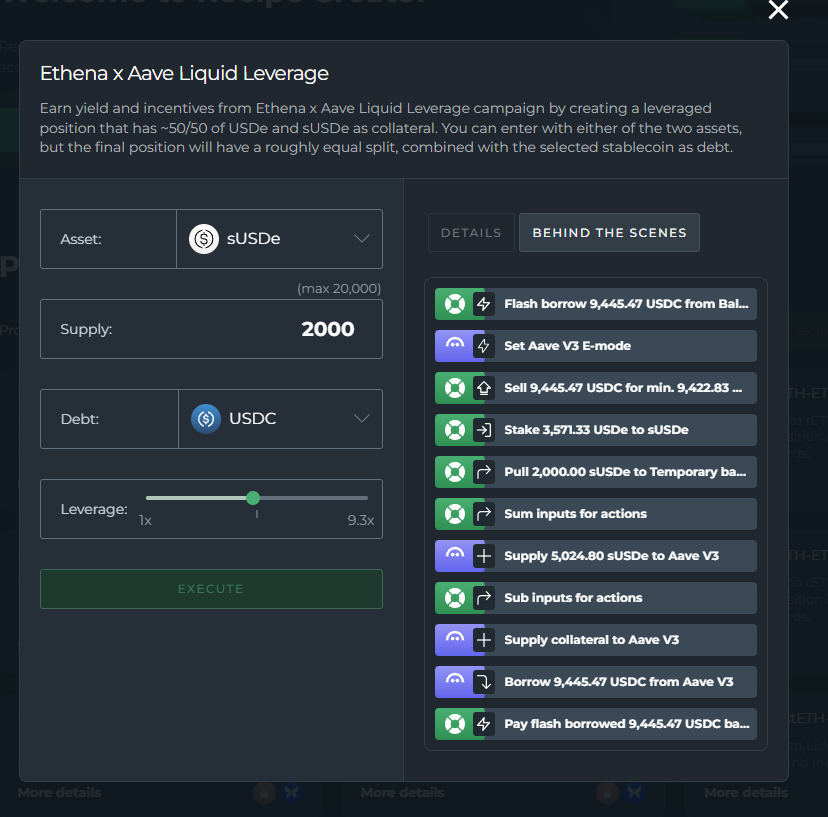

Due to the existence of a circular lending model on-chain, some users will use USDe and sUSDe as collateral to borrow other stablecoins, then re-exchange the funds obtained and re-collateralize as USDe and sUSDe, thereby implementing a leveraged USDe yield amplification strategy.

Aave's USDe and sUSDe Circular Lending Process

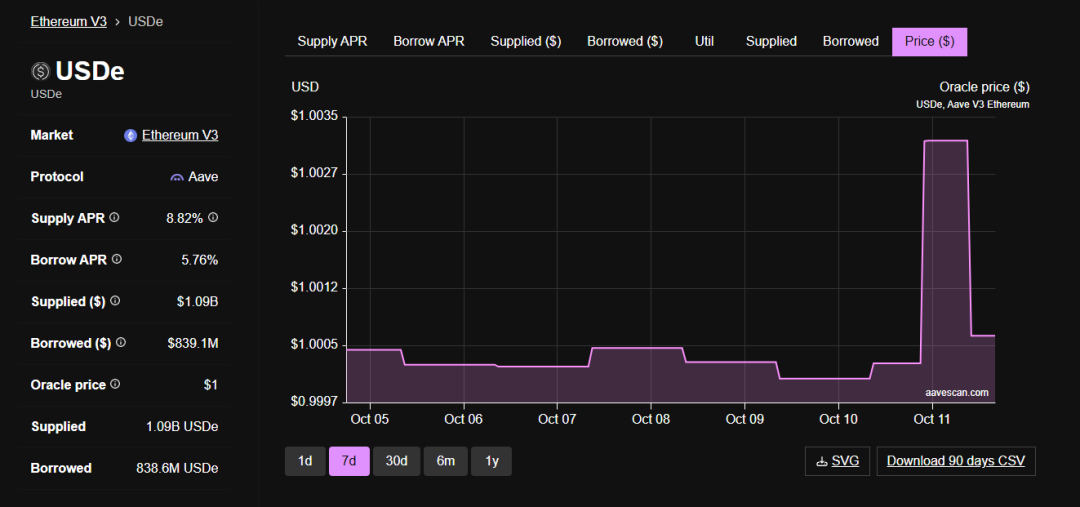

From Aave's pricing data, the oracle price of USDe on the platform has consistently maintained around $1, even slightly above $1. Meanwhile, the oracle price of sUSDe remains around 1.2, indicating that users borrowing USDe and sUSDe on Aave were not practically affected by the decoupling of USDe spot on Binance.

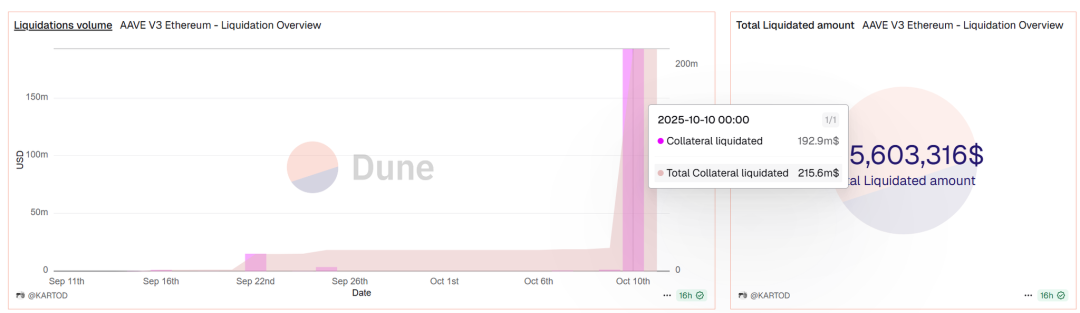

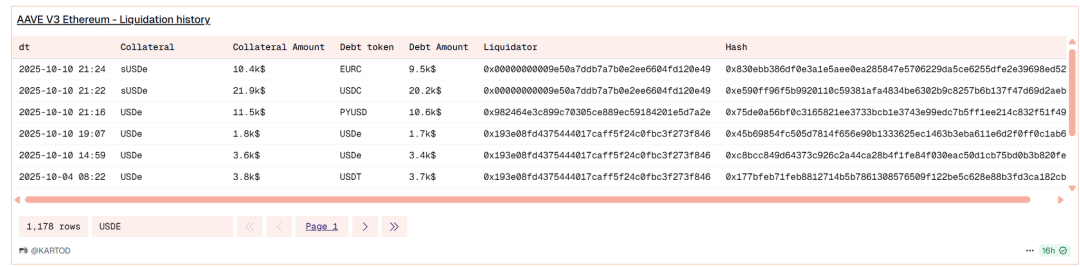

Note: This analysis focuses on the circular lending and stability performance related to USDe and sUSDe; other liquidation actions using mainstream assets such as BTC and ETH as collateral are not within the scope of discussion.

Aave Ethereum's USDe Oracle Price

Aave Plasma's USDe Oracle Price

Aave Ethereum's sUSDe Oracle Price

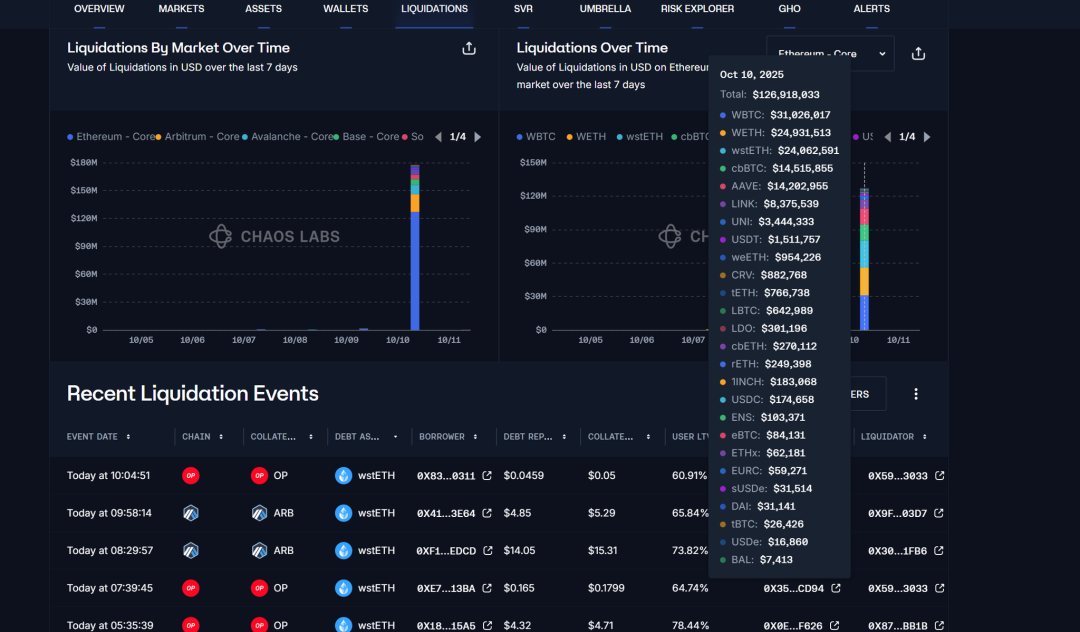

We also tracked Aave's liquidation situation through a third-party data analysis platform. The data shows that although the overall liquidation amount on Aave reached $192 million during the market crash period (October 10 to 11, 2025), the liquidation events related to USDe and sUSDe were extremely few and almost negligible.

Aave's Liquidation Dune Panel

In the monitoring data from another risk analysis platform, Chaos Labs, Aave's liquidation activities can also be observed, but there are no direct liquidation records related to USDe and sUSDe.

Aave Liquidation Data Provided by Chaos Labs

Aave's Oracle Pricing and Pricing Logic for USDe

Aave's pricing for USDe is not fixed at $1 but uses a composite oracle mechanism:

USDe Price = Chainlink USDe/USD Oracle Price × sUSDe/USDe Internal Exchange Rate × CAPO (Price Adjustment) Coefficient

This pricing logic has been clearly stated in Aave's official governance proposal "sUSDe and USDe Price Feed Update" and its risk analysis documents.

Currently, although some community proposals hope to "hard code" the USDe price to $1 (i.e., directly align it with USDT), the related proposals have not yet been approved or deployed.

Therefore, Aave still calculates the reference price of USDe based on Chainlink's real-time oracle prices and the internal exchange rate of sUSDe.

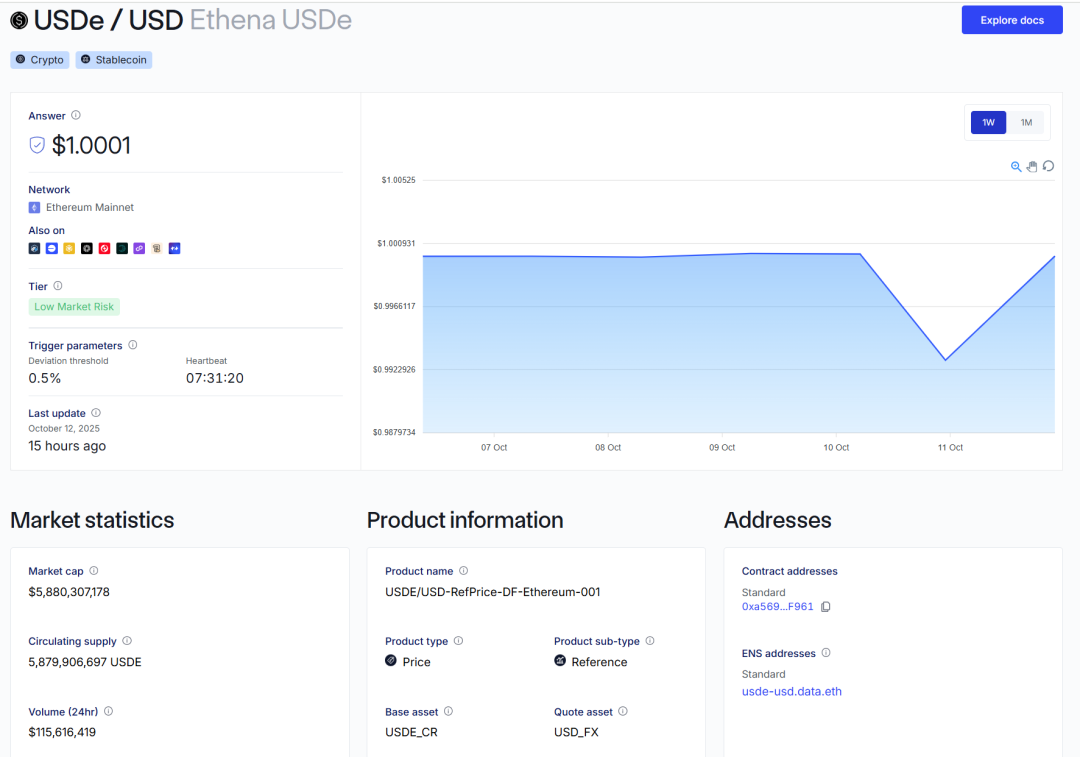

During the period from October 11 to 12, 2025, the USDe/USD oracle price provided by Chainlink remained in the range of $0.992–$1.000, with overall fluctuations being minimal and no significant decoupling occurring.

Chainlink's USDe oracle price uses a multi-source aggregation and noise-weighting mechanism: it does not directly take data from a single exchange but aggregates transaction data from multiple centralized and decentralized markets through a node network, filtering out anomalies to calculate a verified weighted average price (Reference Price).

This oracle price is typically updated every few minutes and is widely used for collateral and liquidation calculations in protocols like Aave.

Thanks to this mechanism, the pricing of USDe on Aave can effectively reflect its fair market value, thereby avoiding price deviations caused by short-term fluctuations or liquidity imbalances on individual exchanges.

Chainlink's USDe Oracle Price

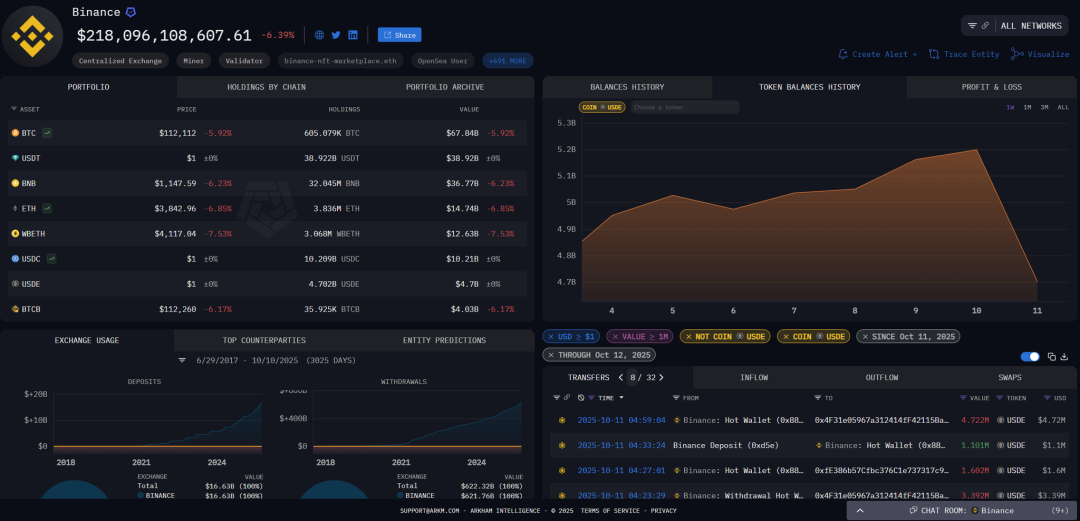

No Abnormal USDe Fund Flows Observed on Binance During Decoupling

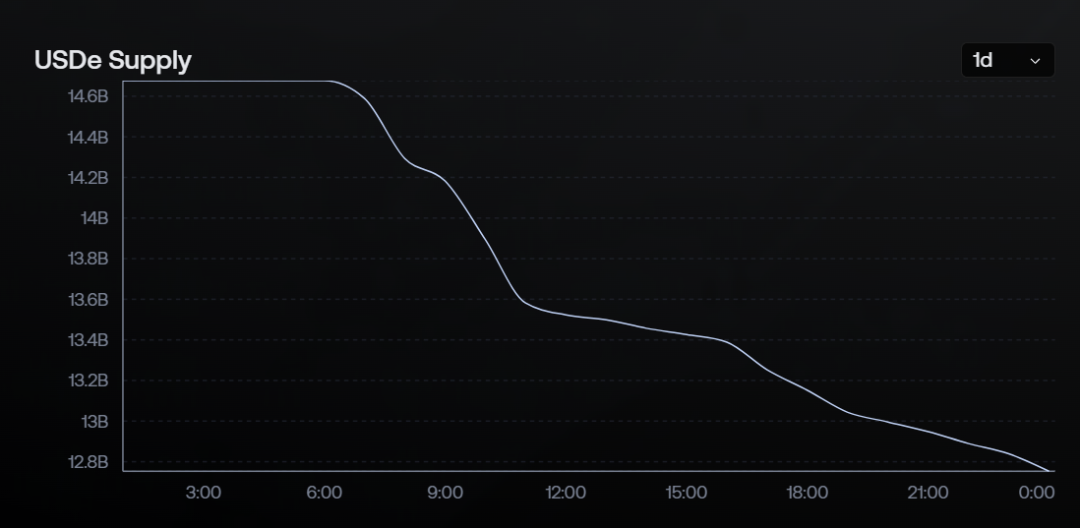

No significant abnormal fund inflows were observed. The USDe supply on Binance was approximately $4.7 billion, which significantly decreased from the previous $5.2 billion after the event, a drop of about $500 million. This change is consistent with the overall trend of USDe's total supply decreasing from $14.6 billion to $12.8 billion.

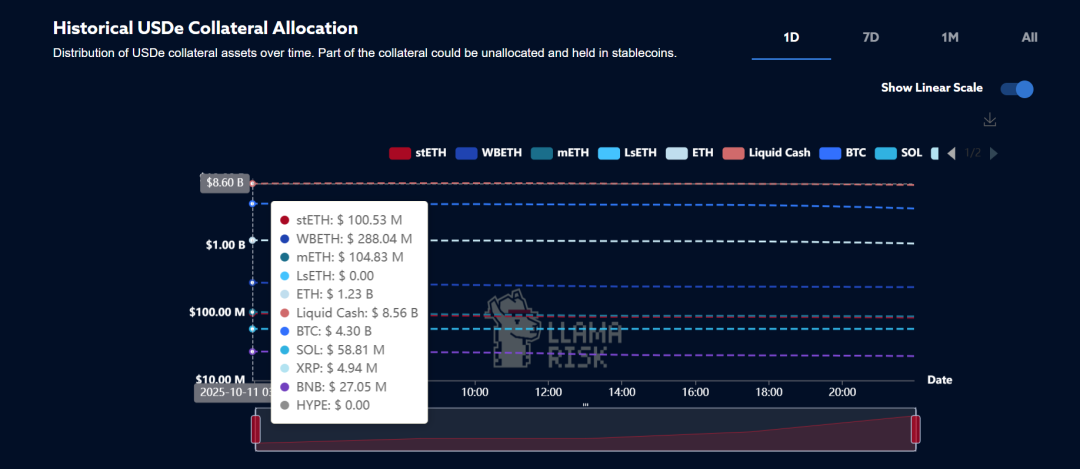

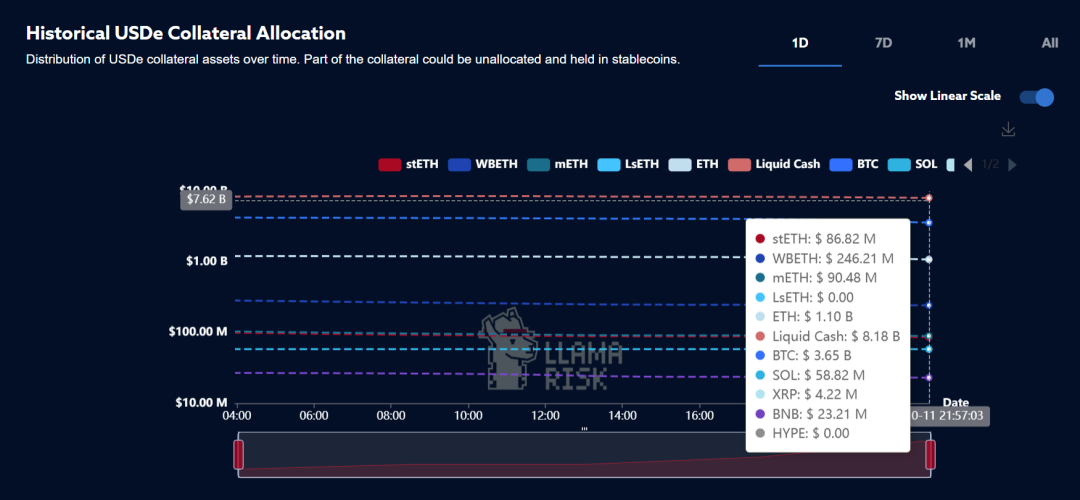

From the collateral structure perspective, BTC positions decreased by about $650 million, ETH decreased by about $130 million, and stablecoin assets decreased by about $400 million. Overall, it can be judged that the decline in USDe issuance mainly resulted from long liquidations and a contraction in the funding capacity of the derivatives market, rather than a stability attack or run on a single exchange.

Arkm's Asset Situation on Binance

Changes in USDe Supply

Changes in USDe Underlying Assets

Changes in USDe Underlying Assets

Sequence of Overall Market Decline and USDe Decoupling

In fact, BTC began to decline at 4:45, and major assets like ETH and SOL also experienced pullbacks during the same time frame. The market saw a spike at 5:15, but at that time, USDe had not yet shown significant decoupling.

Therefore, it can be inferred that the decoupling of USDe was not directly triggered by the overall market decline but was more likely due to users holding circular lending positions on Binance selling USDe in bulk to cope with margin pressure, leading to a short-term liquidity squeeze and price decoupling.

It remains unclear whether any market makers used USDe as collateral to participate in market liquidity provision. According to actual tests, Binance currently only allows USDe to be deposited into margin accounts and has not opened the function for it to be used as contract collateral, so its market-making use may be limited.

BTC Price Decline Chart

ENA Systemic Risk and USDe Stability Analysis

ENA System Risk Resistance Structure

The total issuance of USDe under the current ENA ecosystem is estimated at $14 billion.

Among them:

- About 60% (≈$8.4 billion) is the "liquidity stablecoin" portion, mainly used for internal deployment and circular collateral;

- About 40% (≈$5.6 billion) is the stablecoin liabilities formed by the hedging structure, of which:

- BTC spot + short positions account for about 28% (corresponding to about $3.9 billion in issuance);

- ETH spot + short positions account for about 11% (corresponding to about $1.54 billion in issuance).

This means that the stability of the BTC and ETH hedging positions directly determines the entire system's risk resistance capability.

Core Systemic Risks

The main systemic risk of USDe lies in the effectiveness and sustainability of its short positions:

- If the short positions of BTC/ETH are forcibly liquidated due to sharp market fluctuations or ADL (automatic liquidation) triggers, the ENA protocol will lose the corresponding neutral hedging structure.

- At this point, the protocol will hold not a hedging portfolio but an exposure of about $3.9 billion in BTC long positions.

- If the market further declines by 10%–20%, the asset side of USDe will incur actual losses, and the stablecoin will face real decoupling pressure.

Additionally, in extreme market conditions, the contraction of funding rates and delays in liquidations may also lead to expanded losses on the asset side, which can be evidenced by the data showing the decrease in BTC's proportion during this event.

Possibility of Further Decoupling and Monitoring Points

The market anchoring of USDe is mainly determined by the exchange order books, so if a large sell-off occurs (e.g., concentrated selling by whales), even if the asset side remains healthy, it may still cause short-term decoupling.

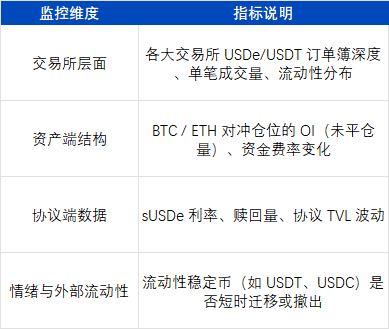

Key indicators to continuously monitor include:

Potential Impact on Overall Liquidity

If USDe experiences substantial decoupling, the market impact could resemble a localized liquidity crisis:

- The BTC hedging positions at the protocol level become ineffective → asset side risk exposure is revealed;

- Liquidity providers (LPs) and borrowers in the stablecoin pool will prioritize withdrawing funds → accelerated outflow of liquidity stablecoins;

- If a feedback loop forms, the extent of decoupling will be positively correlated with the extent of BTC's decline.

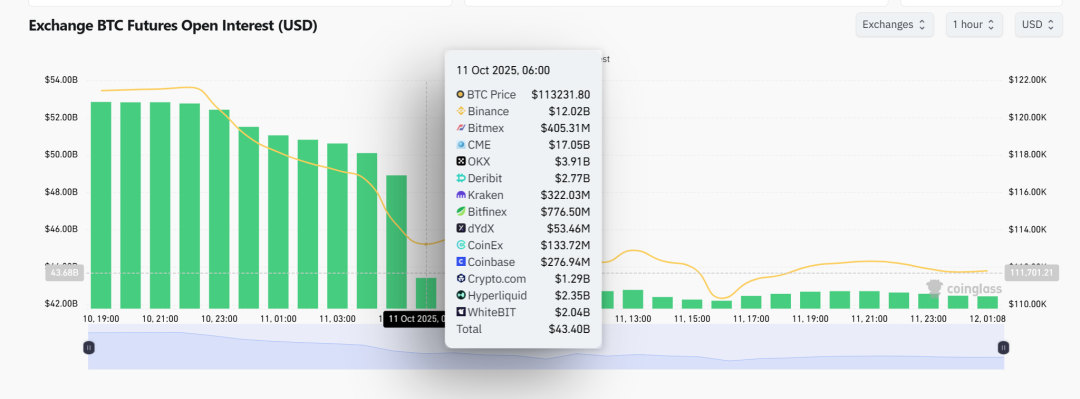

BTC Contract OI Data

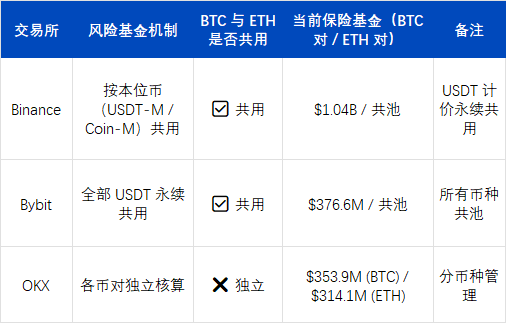

Ethena's Response Mechanism to ADL and Exchange Risks

The Ethena team has long had contingency plans for potential ADL (automatic liquidation) and exchange system risks, which have been clearly stated in official documents.

This section mainly addresses two types of scenarios:

- Auto Deleveraging (ADL) Risk;

- Exchange Failure Risk (exchange downtime or bankruptcy risk).

The automatic deleveraging mechanism (ADL) is the "last line of defense" used by major derivatives exchanges to prevent systemic risks in extreme situations. When the insurance fund is exhausted and cannot cover liquidation losses, the exchange will forcibly close the positions of profitable parties to eliminate risk exposure.

Ethena points out in its documentation that, although theoretically ADL may lead to some hedging positions being passively liquidated, the probability of this occurring in current mainstream exchanges (such as Binance, Bybit, OKX, etc.) is extremely low due to:

- Sufficient scale of the insurance fund;

- The liquidation system has multiple layers of risk buffers and self-healing mechanisms;

- During market volatility, exchanges will prioritize resolving risks through internal matching and position-by-position allocation.

Even if ADL is triggered in individual venues, Ethena can quickly restore market neutrality by immediately rebuilding hedging positions and actively realizing unrealized profits and losses (realize PnL).

Overall, the impact of ADL on Ethena is limited to the risk of temporary position interruptions and does not pose a systemic threat to the price anchoring or asset safety of USDe.

Multi-Exchange Risk Fund Capacity Assessment

Based on the distribution of Ethena's hedging positions and the scale of risk reserves at major exchanges, the following calculations can be made:

As of October 11, 2025, the total daily liquidation amount across the market is approximately $20 billion.

Among them, the risk fund balance disclosed by Binance has decreased by about $200 million, estimating its risk absorption rate under extreme market conditions to be about 10%.

If we calculate based on the current risk fund scale of Binance, which is about $1 billion, its theoretical maximum liquidation capacity under similar market conditions is approximately:

≈ $100 billion in daily liquidation volume (corresponding to a 10% risk absorption rate)

Ethena's hedging positions are distributed across multiple major exchanges (Binance, Bybit, OKX, etc.), providing significant risk diversification effects.

According to publicly available data estimates:

- Binance: approximately $1.04 billion

- Bybit: approximately $380 million

- OKX: approximately $320 million

Totaling approximately $2 billion.

Under the same assumptions (approximately 10% risk absorption rate), the combined risk fund scale of the three major platforms can theoretically withstand about $200 billion in daily liquidation shocks without triggering systemic risk.

This result indicates that Ethena's multi-exchange hedging strategy possesses sufficient elasticity and defensive depth in risk distribution, ensuring that even in extreme volatility, the risk of systemic deleveraging (ADL) remains within a controllable range.

Reference Links

https://app.ethena.fi/dashboards/transparency

https://www.binance.com/en/trade/USDE_USDT?type=spot

https://www.bybit.com/en/trade/spot/USDE/USDT

https://aavescan.com/ethereum-v3/usde

https://dune.com/KARTOD/AAVE-Liquidations

https://community.chaoslabs.xyz/aave/risk/liquidations

https://intel.arkm.com/explorer/entity/binance

https://portal.llamarisk.com/ethena/overview

https://www.binance.com/en/futures/funding-history/perpetual/insurance-fund-history

https://www.bybit.com/en/announcement-info/insurance-fund/

https://www.okx.com/zh-hans/trade-market/risk/swap

https://help.defisaver.com/protocols/aave/ethena-liquid-leveraging-on-aave-in-one-transaction

https://governance.aave.com/t/arfc-susde-and-usde-price-feed-update/20495

https://data.chain.link/feeds/ethereum/mainnet/usde-usd

https://www.binance.com/zh-CN/support/announcement/detail/9eb104f497044e259ad9bd8f259f265c?utm_source=chatgpt.com

https://www.binance.com/zh-CN/support/announcement/detail/f3d5d97ed12c4f639019419bd891705e?utm_source=chatgpt.com

https://www.binance.com/zh-CN/support/announcement/detail/0989d6c7f32545bfb019e3249eaabc3f

https://www.binance.com/en/margin/interest-history

https://www.coinglass.com/BitcoinOpenInterest

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。