Author: 0xBrooker

Previously, the U.S. market was caught in the tension of interest rate cut expectations, the soft and hard landing of the U.S. economy, Q3 earnings reports, and the stock buyback season. During the U.S. government shutdown, the temporary absence of economic and employment data left the market in a precarious state as it continued to reach new heights.

This week, the long-simmering U.S.-China tariff war suddenly reignited, quickly becoming the most significant influencing factor, disrupting the established rhythm of almost all trading markets.

As a result, BTC, which reached an all-time high on October 6, retraced again, dropping as much as 15.28% from its peak. The Altcoin market, aside from BTC, experienced a nearly 30% "waterfall" decline in a single day due to almost exhausted liquidity support and black swan events. The crypto derivatives market saw over 1.6 million liquidations, marking the largest scale of clearing in history, exceeding $10 billion.

After six months, the U.S.-China tariff war once again became a core market factor determining the trends of BTC and the crypto market; as the cycle nears its end, the internal liquidity crisis in the crypto market continues to trouble the market.

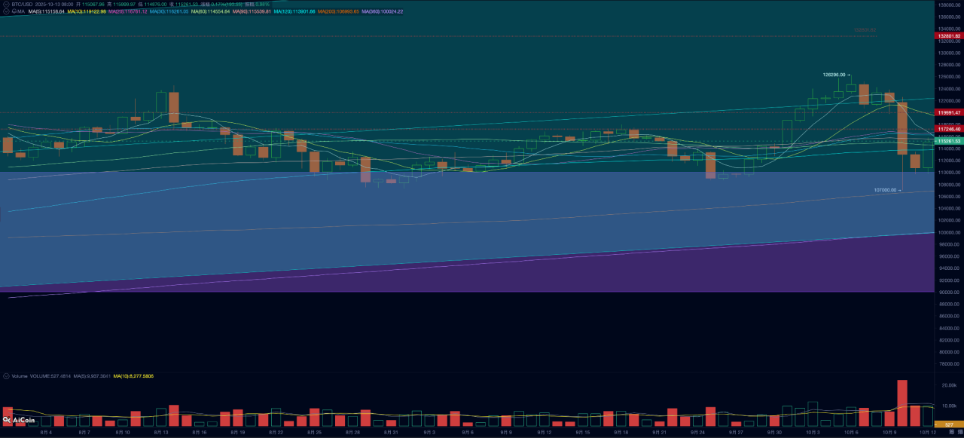

BTC Daily Chart

Policy, Macroeconomic Finance, and Economic Data

In the first half of the year, the U.S. declared a war on the world with reciprocal tariffs, and after months of negotiations, it seemed to be nearing an end, but an agreement with the most important trading partner, China, remained elusive. Subsequently, delegations from both sides met several times but failed to make real progress.

Entering October, this lack of progress quickly escalated into targeted sanctions from both sides.

On October 9, China's Ministry of Commerce tightened the export of rare earths and magnetic materials, announcing an expansion of export restrictions on key military and high-tech supply chain products. This move was seen as a counter to the U.S.'s long-term export controls and "entity list," directly impacting key industrial chains in the U.S. and its allies. On October 10, Trump announced on social media that starting November 1 (or earlier), a 100% tariff would be imposed on all imports from China, while also stating that new restrictions on key software/technology exports would be implemented; he emphasized that a meeting with China would depend on their response.

The market viewed this as a "new round of trade war escalation risk."

After the announcement of China's measures on the 9th, the A-shares rose, Hong Kong stocks fell, and the Nasdaq, after reaching a historic high, slightly dipped. Before Trump's announcement of the 100% tariff on the 10th, A-shares fell, Hong Kong stocks plummeted, and the Nasdaq, which had set a new historic high after the announcement, began to rapidly decline, ultimately dropping 3.56%, breaking the 30-day moving average, marking the largest single-day drop since June. BTC experienced a waterfall decline, with a volatility of 12.87, dropping 7.18%.

As conflicts reignited, the market entered a risk-averse state.

On that day, the U.S. dollar index fell by 0.57% to 98.843. Short-term and long-term U.S. Treasury yields quickly dropped by 1.89% and over 2%, respectively. London gold rose by 1.02%, returning to the $4,000 mark.

The renewed U.S.-China tariff conflict caused multiple markets to change their operational dynamics. Subsequently, Trump stated in a television interview that the November 1 implementation would reserve time for negotiations, while also indicating he would continue to South Korea (APEC summit), with the possibility of meeting with China depending on the situation. On the 12th, a spokesperson for China's Ministry of Commerce stated that China's export controls do not prohibit exports and that applications meeting the regulations would be permitted. Before the measures were announced, China had already informed relevant countries and regions through a bilateral export control dialogue mechanism. China is willing to strengthen dialogue and communication on export controls with all countries to better maintain the safety and stability of the global industrial and supply chains.

The media believes that both sides, after taking real actions, are also sending signals of de-escalation, and their actions can be seen as "promoting talks through confrontation," given the difficulties faced in previous negotiations.

Based on the current market data and information, the market risk has not yet accumulated to the extent of a major adjustment, but if subsequent conflicts escalate, the probability of a medium-sized adjustment in markets like U.S. stocks will increase.

Crypto Market

As for BTC, we believe it has initially completed the pricing adjustment triggered by the risk appetite decline due to the tariff conflict during the sharp drop.

BTC, especially Altcoins, reacted more violently than other markets; in addition to BTC being a high-risk asset, it is also at a critical "curse time" near the top of the old cycle, with the market already in a state of anxiety interwoven with selling pressure.

In the September monthly report, we pointed out that according to past "cyclical laws," BTC prices would peak in the fourth quarter. In this cycle, as retail investors "retreat," only the BTC Spot ETF channel and DATs remain as large sellers, while long-term holders continue to sell off significantly, severely impacting market liquidity. This week, long-term holders sold over 11,926 BTC, while short-term holders' losses reached 176,648 BTC, remaining at high selling levels for two consecutive weeks. After two weeks of significant outflows, the outflow scale from centralized exchanges slowed down significantly this week, forcing BTC prices to seek balance downward.

On the buying side, the funds in the BTC Spot ETF channel maintained a decent (but still lower than last week) inflow level in the first four trading days, but there was an outflow on Friday.

In summary, the current market shows a persistent threat of selling pressure, while buying power is insufficient, which is a typical scenario before a cycle peaks and warrants high vigilance.

Additionally, the internal structural weakness of the crypto derivatives market is also a significant reason for the overreaction.

After BTC prices reached a new high on the 6th, the open interest exceeded $94 billion, triggering a chain liquidation of long positions during the sharp price drop, amplifying the decline.

Long positions were severely slaughtered, with BTC open interest decreasing by nearly $25 billion.

Moreover, the stablecoin project Ethena's USDe became unpegged from USDT by over 35% on Binance, leading to liquidations of market makers using USDe, causing many Altcoin prices to experience sharp declines of over 30%.

According to media statistics, the number of liquidated accounts across the market exceeded 1.6 million, with total losses exceeding $19 billion. October 10 marked the largest loss day in the history of the crypto derivatives market.

From a technical indicator perspective, BTC prices stabilized above the 200-day bull-bear dividing line by the end of the weekend, remaining above the upper edge of the "Trump bottom" (between $90,000 and $110,000), and after the passionate release on Friday and Saturday, the trading volume returned to normal levels over the weekend.

We judge that the pricing related to the U.S.-China trade conflict has been initially completed, with future developments depending on whether the situation escalates further. However, the risks in the U.S. may not have been fully released, which could hinder the inflow of funds into the BTC ETF channel. Nevertheless, one should not be overly pessimistic; market risks have been sufficiently released, and the U.S.-China trade war is likely to return to rationality, with its impact expected to be far less than in April of this year. However, whether the mid-term can reach new highs mainly depends on whether funds can flow back, determined by the U.S.-China trade conflict and the performance of U.S. stocks, as well as whether long-term selling can be alleviated.

Cycle Indicators

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is at 0, indicating a peak period.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。