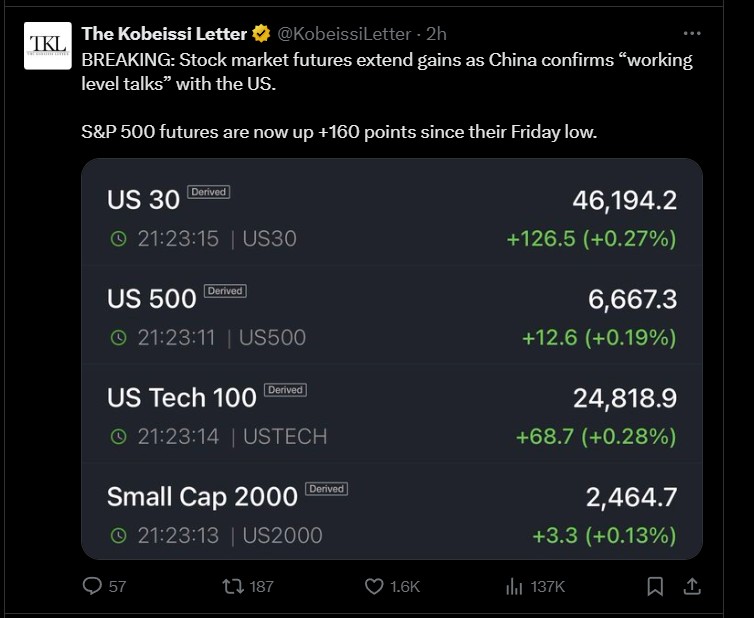

Stock Futures Jump After China Confirms Discussions on Trump Tariffs

According to the recent news, Stock futures surged sharply after China confirmed “working-level talks” with the US concerning Trump Tariffs and export controls.

Investors are keeping a close eye on the developments, and most investors are seeing some signs of improvement in the trade talks that may stabilize global markets and may open the path to a new US-China trade agreement.

Source: The Kobeissi Letter X

Futures Extend Gains on Trade Talks

S&P 500 futures climbed by 160 points from their Friday low following China’s confirmation of discussions with the US. The market rally shows the hope that the current negotiations are likely to calm tensions caused by tariff actions.

Investors and traders are increasingly using historical patterns from past trade disputes to anticipate market movements. The recent surge mirrors earlier market responses during US-China tariff confrontations, suggesting that futures are reacting to the hope of progress rather than finalized agreements.

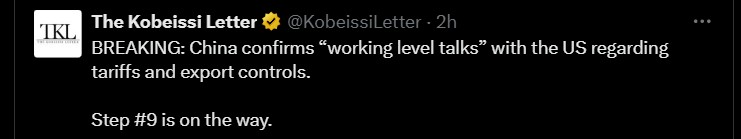

China Confirms Working-Level Talks

China formally recognized the current negotiations, terming them as working-level talks about tariffs and export controls. The development shows that both parties are actively seeking solutions to the trade friction that has been experienced in the global markets.

Source: X

Analysts observe that this is the sixth step in a playbook that many investors have been following in order to maneuver between the US and China tariff tensions. Traders have been traditionally led to the playbook since they first enter the market during a downturn, only to later rise when negotiations are making progress.

Trump Tariffs on China

During the last 10 months, analysts have followed all the key tariff developments and discovered a certain predictable market trend:

-

The first cryptic messages regarding future tariffs led to crashes in the market.

-

High tariffs (usually 50% or higher) announcements result in severe falls.

-

Dip buyers come in, and this will bring a short-term recovery, and new lows may be seen.

-

Further urging by the US leadership statements throughout the weekend increases volatility.

-

The targeted nation reacts, and more adjustments to the market are made.

-

By Sunday, there are clues of a possible solution, which preconditions a futures rally.

-

Monday starts with the momentum that can be slowly eroded.

-

U.S. Treasury officials give assurance to investors.

-

Within 2-4 weeks, there are indications of a trade agreement.

-

Formalization of a deal usually propels markets to new heights.

The US is currently in step number 6, and futures are already showing an upward trend in the hope of good things.

China's Strong Response

Even with the current negotiations, China also gave a strong warning about the 100% tariff of President Trump . The quote highlighted the necessity to rectify the wrongs and promised to struggle to the last. This reflects on the words of April 2025, implying that China remained the same.

Source: X

Observers take this statement to be an indication that the negotiations are complicated but still on track to step #9, where allusions to a trade deal are usually seen.

Investor Sentiment and Market Outlook.

Shareholders are optimistically cautious. The historical playbook shows that the volatility of the industry is usually followed by future gains after trade deals are announced.

Analysts recommend following future utterances by both the US and Chinese officials because a minor event may have a huge impact on futures and the general industry trend.

Conclusion

Although China is making strong assertions that highlight the future, the trends of the past indicate that a systematic way to an agreement could be taking shape. Shareholders are on the alert, and there are more trends to be experienced in the next few weeks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。