运筹帷幄之中,决胜千里之外。大家好,我是林超,全球金融市场观察者,专注加密货币市场分析,为大家带来最有深度的交易资讯解析及技术教学。

林超最近都在度假中,之前的仓位基本都清掉了。算是幸运,也算是有准备,总之,躲过了这次1011的惨剧。很多粉丝私信过来催更,希望本人分析一下1011之后,后面的市场会向哪个方向行驶。

其实冰冻三尺非一日之寒,之前就有预感。当有些粉丝私信我的时候,私下我也告诉过大家,感觉牛市的态势即将进入缓和,可能行情进入一个周期性的向下轨道中。一直到4号的时候,林超还在劝部分跟单的用户让他们现货出掉,准备做对冲空单合约。但也会存在一些不死心的用户,觉得本人是在危言耸听,不信任导致的灰心,比市场本身更为可怕。

而市场就是这样,充满的了各种声音,多到让人无法分辨真伪。但是大家要记住,无论行情怎么走,是上涨还是下跌。不会有人一直赚钱,但一直会有人赚钱。即使像这样的黑天鹅事件发生,1011当天,也有人狂赚20亿,这就是这个市场的魅力。想在加密市场生存,就需要我们对这个市场有自己的判断和自己的一套交易规则。就如同林超一直强调的那样,你需要有自己的交易系统,而非人云亦云。

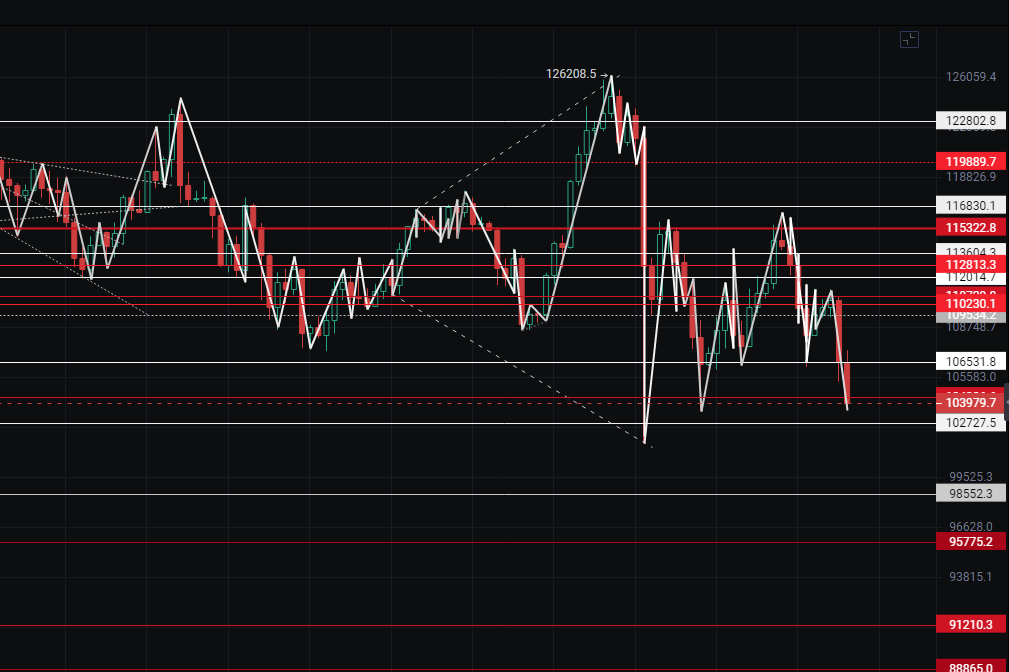

林超并没有在1011发生的第一时间发文,因为这市场需要冷静,而我需要观察市场。很多人分析市场,说这个黑天鹅事件是川普发推文导致的连锁反应,短时间发生的踩踏事件。但这种言论在林超眼中只是事后诸葛亮,没有任何意义,市场收割我们根本不需要理由,需要的只是一个借口而已。真正的原因从来不会公之于众,连续上涨4个多月,多头过热,杠杆持有成本很低,需要杀一波多头。让低成本的杠杆持仓者出场,仅此而已。至于说消息面方面,不管是川普的言论,还是鲍威尔的一句话,任何事件都可以引来这样的行情。

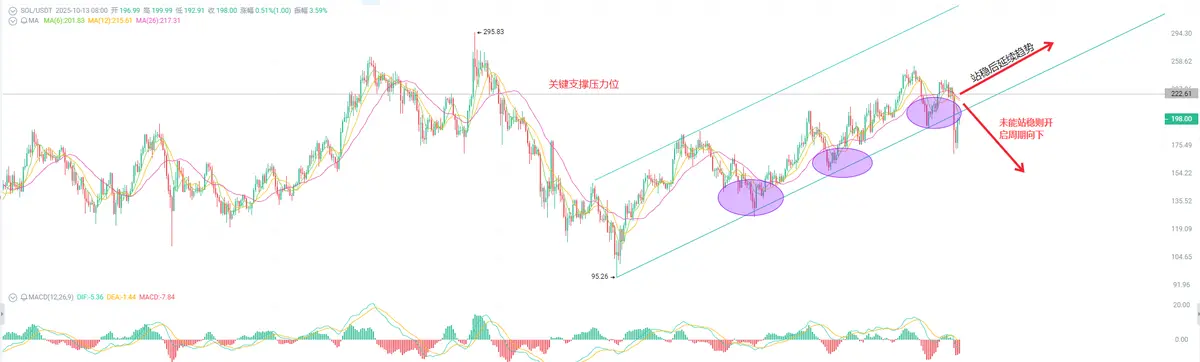

林超很多粉丝都是重仓持有SOL的,我们先从盘面详细解析一下SOL。目前我们能得到的已知信息是,首先多单的杠杆已全部清空,其次前期高点未破,高点越来越低,并且大家期待的SOL的ETF并没有落地,因此很多持有者就会怀疑SOL未来的前景。从指数来看,如果接下来的2周时间指数都走在30日均线以下,那么可以判断,短期内都会是一个周期性向下的态势,并且这个态势至少是以月线为调整目标的。所以关键信息就是指数能否站稳30日均线这个价位。林超本人并不会期待短期内SOL会有光芒四射的表现,因为它承载的散户太多了,即使是ETF叙事完成,市场中也不会有太多的资金投入这个链,建议对SOL还抱有新高期待的用户谨慎持仓,即使行情一路向上,在什么阶段完成套利止盈这也是一门高深的学问。接下来直到整个4季度结束,本人会减少现货持仓,留出仓位随时做好合约做空的准备。

说到合约,很多人谈虎色变,觉得玩合约就是天杀的收割者。林超只能说大家要么是被营销号洗脑了,要么就是在这市场中时间太短了。任何事物都有两面性,水能载舟亦能覆舟,但是存在即合理。林超强调过无数遍,合约只是我们手中的工具,一旦空头态势确定,请问大家要如何保全手中的利润?难道只是单纯的默默期待行情一定会有涨起来的那一天?大家有没有经历过庄家在底部反复拉扯,永远把持仓控制在你的成本之下?总之来到这个市场,就要接受这个市场,利用好一切能运用的手段,保护好自己的利益。当然,一切的前提就是保护好本金。

如果你正处于迷茫之中——不懂技术、不会看盘、不知何时进场、不会止损、不懂止盈、胡乱加仓、抄底被套、守不住利润、错过行情……这些都是散户常见的问题。林超可以帮助你建立正确的交易思维。千言万语不如一次盈利,屡战屡败不如找到正确的方向。与其频繁操作,不如精准出击,让每一单都更有价值。

投资的成功不仅仅取决于选择好的标的,更在于何时买入和卖出。保住本金做好资产配置,才能在投资的海洋中稳健前行。人生在世如长河入海,决定胜负的,从来都不是一关一隘的得失和一时一地的亏盈,谋定而后动,知止而有得。

全球市场瞬息万变,世界是一个整体,关注林超,带你拥有全球顶级金融视野

文章仅为个人观点,不具备任何买卖建议,币圈有风险,投资需谨慎!

实时咨询,欢迎关注公众号:林超论币

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。