Can Lab Token Price Surge Hit $1 or Risks Ahead? $LAB Price Prediction

Crypto investors are excited today as LAB token price surged around 30% right after its launch. Even though the market is very unstable, with worries about the economy and possible rate cuts in October, $ LAB coin —a token used for spot, limit, and perpetual trading with an AI research engine—got a lot of attention.

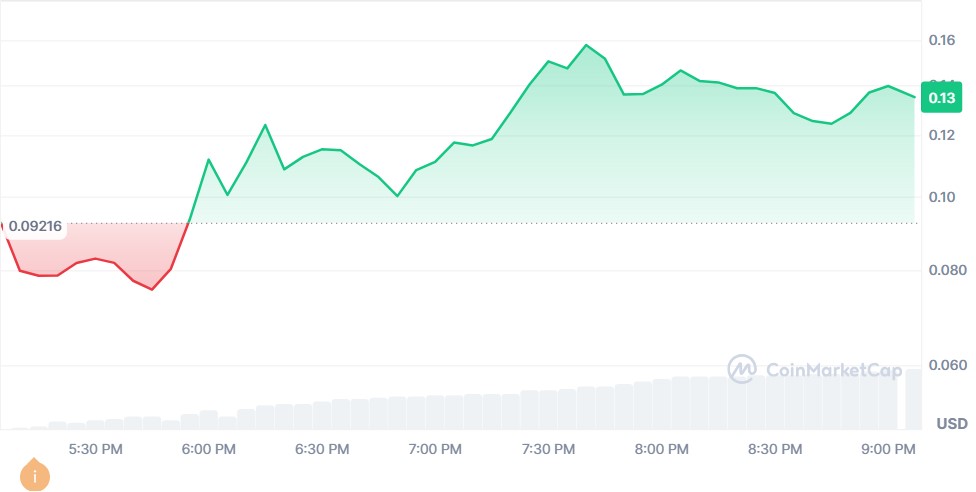

The token started trading on October 14 at 12:00 UTC on big exchanges like Binance Alpha, MEXC, BingX, KuCoin, Bitget, and Gate.io. From the first price of $0.09216, the asset jumped to $0.1380, a 30.76% increase as seen in the below chart.

People are now asking if it could follow the same price path as Yei Finance $CLO, which had a huge first-day rise. So let’s explore the surge reasons, potential threats, and Lab price prediciton 2025

Why $LAB Is Going Up Today Reasons and Risks Uncovered

It’s interesting that the asset’s price surged high even though the world markets are shaky, because it happens with very rare tokens. The possible threats that flip the surge are:

-

October Fed rate cut probability soars to 95% amid Powell speech today.

-

Trump-China tariff tension rising with no potential peace deals.

-

The crypto market is unstable as it has crashed around 4% today following the geopolitical tension.

All of these major economic tensions might trigger the flip button of the asset, but my analysis being an experienced crypto writer says that if it was about to happen then it would never have surged this high.

Post-Listing Surge Reasons:

- Strong Lab Listing Today Momentum : It appeared on many exchanges at once. This made $31.14M trade in 24 hours, a huge 6,173,051% increase.

-

AI-Powered Trading Edge: This platform helps with smart trading and fast execution. This makes it useful, not just hype.

-

Speculative FOMO: Traders saw $CLO rise and now want this asset too. This drives demand for both the token fueling altcoin rally.

This explains why the asset is going up today even when other cryptocurrencies are struggling.

$LAB vs Yei Finance: Comparing Price Increase Potential

Many are comparing both the assets because they have a total of 1 billion supply and both started trading today. Yei Finance price jumped 153.32% on its first day and moved close to $1. Could the current asset do something similar?

Experts say multi-exchange listing helps a lot. Being on many exchanges at the same time gives the asset more buyers and sellers everywhere. This is important for big first-day gains. People watching $LAB price prediction are already seeing positive signs.

Lab Token Price Prediction and Technical Analysis

Even with excitement, technical signals show some caution. As per TradingView price chart , Current RSI at 43.86 shows a neutral or slightly weak trend, and MACD is weakly bearish, meaning momentum is slowing.

Labs token surge analysis shows it went up to $0.15 and then dropped slightly. Now it’s stable between $0.12–$0.125, making a short-term support.

-

Short-Term Target: $0.115 – $0.135, expect sideways movement or small dips. A break above $0.135 could reach $0.14.

-

Mid-Term: If BTC is steady and the market improves, this altcoin could go to $0.18–$0.25.

-

Long-Term 2025 Forecast: If the asset grows its ecosystem and more exchanges join and or any positive news affects the overall market momentum, then it might target $0.45 - $1+ like $COL Yei Finance forecast.

Conclusion

Traders watching Lab Token price surge post listing should know there is both high potential and high risk. First-day gains are exciting, but unstable markets mean you should check volume and trend before buying a lot.

For long-term holders, the above price prediction depends on the asset being used more, exchanges supporting it, and more people joining the community.

Disclaimer: This article is for informational purposes only. Do your own research and manage your risks before investing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。